Southeast Asia Human Resource BPO Market Size, Share, & Trends Analysis Report By Service (RPO, Payroll Outsourcing), By Enterprise Size (Large Enterprises, SMEs), By Outsourcing Type, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-528-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

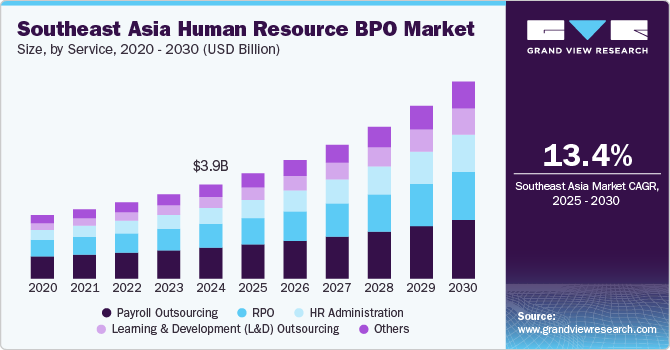

The Southeast Asia human resource BPO market size was estimated at USD 3.86 billion in 2024 and is anticipated to grow at a CAGR of 13.4% from 2025 to 2030.The rapid digital transformation across Southeast Asia is a significant growth driver of the market. Companies are increasingly adopting cloud-based HR solutions, AI-driven analytics, and automation to enhance efficiency and reduce costs. The growing reliance on digital tools for payroll management, recruitment, and employee engagement is pushing businesses to outsource HR functions to specialized providers that offer advanced technology-driven solutions.

Southeast Asia presents an attractive outsourcing destination due to its relatively low labor costs compared to Western markets. Many multinational corporations (MNCs) and regional enterprises are leveraging HR BPO services to streamline operations while maintaining cost efficiency. In addition, the region's strong outsourcing infrastructure, particularly in countries such as the Philippines, Malaysia, and Indonesia, is making it a preferred hub for HR BPO services.

The increasing complexity of labor laws and compliance requirements in Southeast Asia is also contributing to the demand for HR BPO services. With diverse regulations across different countries, businesses face challenges in managing payroll, benefits administration, and legal compliance. HR BPO providers help companies navigate these complexities by ensuring adherence to local labor laws, reducing legal risks, and enhancing workforce management. For instance, Republic Act 11927, also known as the Philippine Rightsizing Act of 2022, aims to streamline government operations and improve public sector efficiency, indirectly benefiting the HR BPO market in the Philippines. By reducing the number of redundant government positions and encouraging the adoption of more efficient processes, the law creates opportunities for outsourcing services, including human resources, to private BPO firms.

The surge in foreign direct investments (FDI) in Southeast Asia is significantly driving the HR BPO market. As multinational companies expand their presence in the region, the demand for professional HR services, including talent acquisition, payroll management, and compliance handling, is rising. These businesses often prefer outsourcing HR functions to navigate the diverse labor laws and cultural differences across multiple Southeast Asian countries efficiently. The increasing number of global enterprises setting up operations in economic hubs such as Singapore, Malaysia, and Vietnam further fuels the need for sophisticated HR BPO solutions.

Service Insights

The recruitment process outsourcing (RPO) segment dominated the market and accounted for the revenue share of over 25.0% in 2024. The rapid expansion of industries such as technology, e-commerce, healthcare, and financial services in Southeast Asia is a significant driver of the segment. As businesses scale operations, the demand for skilled talent continues to rise, making RPO an attractive solution for companies seeking efficient, cost-effective hiring processes.

The learning and development (L&D) outsourcing segment is expected to grow at a significant CAGR of 15.9% over the forecast period. The growth of remote and hybrid work culture is fueling demand for outsourced L&D services. With employees working from multiple locations, businesses require virtual training programs that can be effectively managed and delivered by external providers.

Enterprise Size Insights

The large enterprises segment accounted for a largest revenue share of nearly 54.0% in 2024. Large enterprises in Southeast Asia are increasingly turning to L&D outsourcing to enhance workforce capabilities and stay competitive in a rapidly evolving business environment. One of the key drivers is the need for large-scale digital transformation. As organizations integrate advanced technologies such as artificial intelligence, automation, and cloud computing, employees require continuous upskilling and reskilling.

The SMEs segment is expected to grow at a significant CAGR over the forecast period, driven by the rising need for digital upskilling among SME employees. With Southeast Asia’s rapid digital transformation, businesses are increasingly adopting e-commerce, automation, and AI-driven processes. To stay competitive, SMEs must equip their workforce with digital skills such as data analytics, cybersecurity, and digital marketing.

Outsourcing Type Insights

The onshore segment accounted for a largest revenue share of nearly 49.0% in 2024. The growing emphasis on data security and regulatory compliance is a major driver of the onshore outsourcing segment in Southeast Asia’s HR BPO market. With increasing government regulations on data protection, such as Thailand’s Personal Data Protection Act (PDPA) and Indonesia’s Personal Data Protection Act, businesses are prioritizing local outsourcing partners to ensure compliance with national laws.

The nearshore segment is expected to grow at a significant CAGR over the forecast period. The growing demand for digital HR solutions and automation is accelerating nearshore outsourcing adoption. Many Southeast Asian HR BPO providers specialize in cloud-based payroll processing, AI-driven talent acquisition, and automated compliance management. Businesses are increasingly partnering with nearshore vendors that offer advanced technological capabilities at competitive costs, ensuring seamless HR operations without the need for in-house investment in expensive HR technology.

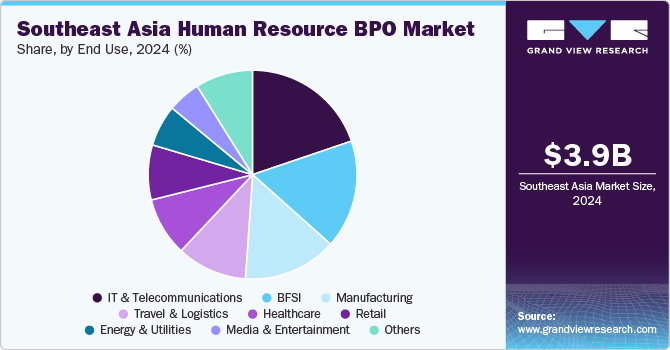

End Use Insights

The IT & telecommunications segment accounted for a largest revenue share of nearly 20.0% in 2024. The increasing focus on employer branding and employee experience in the IT and telecommunications sector is accelerating the adoption of HR BPO services in the Southeast Asia human resource BPO industry. With intense competition for top talent, companies must offer a seamless and engaging employee experience, from recruitment to career development. HR BPO providers help enhance employer branding by streamlining onboarding, optimizing HR processes, and implementing AI-powered employee engagement solutions. As IT and telecom firms strive to attract and retain top talent in a highly competitive market, HR BPO services play a crucial role in strengthening workforce management and driving business growth.

The BFSI segment is expected to grow at a significant CAGR over the forecast period. As financial institutions integrate advanced technologies such as AI, blockchain, and digital banking solutions, there is a growing demand for specialized talent in areas such as fintech, cybersecurity, risk management, and regulatory compliance. HR BPO providers help BFSI firms address talent shortages by streamlining recruitment, workforce planning, and onboarding processes, enabling them to attract highly skilled professionals while reducing hiring costs and time-to-fill positions.

Country Insights

Philippines Human Resource BPO Market Trends

The human resource BPO market in Philippines held a largest share of over 24.0% in 2024 in the Southeast Asia human resource BPO market. The adoption of automation and Artificial Intelligence (AI) is transforming HR functions in the BPO sector. Automation streamlines repetitive tasks such as payroll processing and leave management, allowing HR professionals to focus on strategic activities. AI-powered tools enhance recruitment by efficiently scanning resumes to identify ideal candidates, thereby improving job matches and reducing time-to-hire. In addition, cloud-based HR platforms offer secure, remote access to employee data, facilitating seamless operations in hybrid work environments.

Singapore Human Resource BPO Market Trends

The human resource BPO market in Singapore held is anticipated to register a considerable growth from 2025 to 2030. There is a growing demand for specialized HR roles, particularly in areas such as Compensation and Benefits, HR Information Systems (HRIS), Talent Management, and HR Business Partnerships. Companies are focusing on upskilling their HR teams to align with strategic business objectives and to navigate the complexities of modern workforce management.

Malaysia Human Resource BPO Market Trends

The human resource BPO market in Malaysia is anticipated to register a considerable growth from 2025 to 2030. The Malaysian government is actively promoting the BPO sector through initiatives aimed at economic diversification and digital transformation. The Madani Budget 2025 introduces tax incentives for advanced sectors, including AI and sustainable technologies, to create high-value job opportunities. In addition, investments from global tech giants are expected to generate substantial employment, with Google's new data center in Selangor projected to create 26,500 jobs by 2030.

Key Southeast Asia Human Resource BPO Company Insights

Key players operating in the Southeast Asia human resource BPO industry are Accenture, TTEC, Concentrix Cooperation, and Connext Global Solutions. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In February 2025, TTEC expanded its presence in Egypt with the opening of a new facility in Cairo. This growth comes just a year after TTEC's initial launch in the country, driven by increasing client demand. The investment underscores the company's commitment to utilizing Egypt's skilled workforce to enhance CX services for its global clientele. The expansion also coincides with the addition of a major on-demand pay solutions provider to TTEC Egypt's client portfolio, further strengthening its market position.

-

In June 2024, Cognizant expanded its partnership with Cengage Group, an edtech company based in the U.S. The new 7-year agreement envisaged Cognizant delivering advanced technology services to boost operational efficiency, lower the total cost of ownership, and support Cengage Group's ongoing digital transformation. The expanded agreement also envisaged Cognizant providing operations services for Cengage Group, focusing on critical corporate functions, such as global finance and human resources

Key Southeast Asia Human Resource BPO Companies:

- Accenture

- Alorica, Inc.

- Booth & Partners

- Cognizant

- Concentrix Cooperation

- ConnectOS

- Connext Global Solutions

- Genpact

- Offshore MVP

- Sourcefit

- Teleperformance

- TTEC

- WNS Global Service

Southeast Asia Human Resource BPO Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.31 billion |

|

Revenue forecast in 2030 |

USD 8.08 billion |

|

Growth rate |

CAGR of 13.4% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Base year for estimation |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report services |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Service, enterprise size, outsourcing type, end use, and region |

|

Country scope |

Singapore; Malaysia; Philippines; Indonesia; Thailand; Vietnam; Cambodia; Myanmar |

|

Key companies profiled |

Accenture; Alorica, Inc.; Booth & Partners; Cognizant, Concentrix Cooperation; ConnectOS; Connext Global Solutions; Genpact; Offshore MVP; Sourcefit; Teleperformance; TTEC; WNS Global Service |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Southeast Asia Human Resource BPO Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Southeast Asia human resource BPO market report based on service, enterprise size, outsourcing type, end use, and country.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Recruitment Process Outsourcing (RPO)

-

Payroll Outsourcing

-

Learning and Development (L&D) Outsourcing

-

HR Administration

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- SMEs

-

Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Onshore

-

Offshore

-

Nearshore

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

Manufacturing

-

Energy & Utilities

-

Travel & Logistics

-

IT & Telecommunications

-

Media & Entertainment

-

Retail

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Singapore

-

Malaysia

-

Philippines

-

Indonesia

-

Thailand

-

Vietnam

-

Cambodia

-

Myanmar

-

Frequently Asked Questions About This Report

b. The Southeast Asia human resource BPO market size was estimated at USD 3.86 billion in 2024 and is expected to reach USD 4.31 billion in 2025.

b. The Southeast Asia human resource BPO market is expected to grow at a compound annual growth rate of 13.4% from 2025 to 2030 to reach USD 8.08 billion by 2030.

b. The recruitment process outsourcing (RPO) segment dominated the market and accounted for a revenue share of over 25.0% in 2024. The rapid expansion of industries such as technology, e-commerce, healthcare, and financial services in Southeast Asia is a significant driver of the segment.

b. The key market players in the Southeast Asia human resource BPO market include Accenture, Alorica, Inc., Booth & Partners, Cognizant, Concentrix Cooperation, ConnectOS, Connext Global Solutions, Genpact, Offshore MVP, Sourcefit, Teleperformance, TTEC, WNS Global Service

b. The rapid digital transformation across Southeast Asia is a significant market growth driver. Companies are increasingly adopting cloud-based HR solutions, AI-driven analytics, and automation to enhance efficiency and reduce costs. The growing reliance on digital tools for payroll management, recruitment, and employee engagement is pushing businesses to outsource HR functions to specialized providers that offer advanced technology-driven solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."