- Home

- »

- Medical Devices

- »

-

Southeast Asia Diabetes Devices Market Size, Report, 2030GVR Report cover

![Southeast Asia Diabetes Devices Market Size, Share & Trends Report]()

Southeast Asia Diabetes Devices Market Size, Share & Trends Analysis Report By Type (BGM Devices, Insulin Delivery Devices), By Distribution Channel (Diabetes Clinics/Centers), By End Use (Diagnostic Centers, Homecare), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-343-9

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

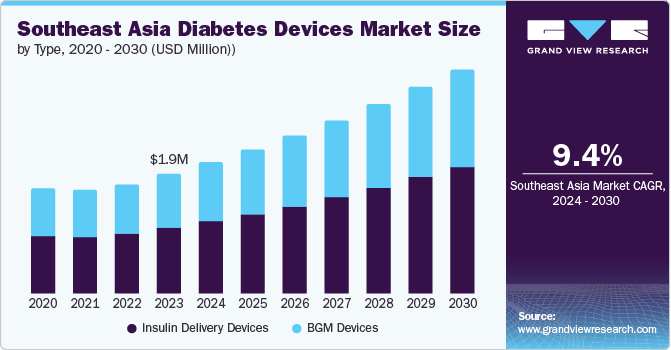

The Southeast Asia diabetes devices market size was estimated at USD 1.90 million in 2023 and is projected to grow at a CAGR of 9.36% from 2024 to 2030. The region is witnessing a rapid increase in diabetes prevalence, primarily due to lifestyle changes, including urbanization, sedentary lifestyles, and unhealthy diets. This surge in diabetes cases drives the demand for diabetes devices to manage the condition effectively. The International Diabetes Federation (IDF) projects that the number of people with diabetes in the Southeast Asia (SEA) region will increase by 68% reaching 152 million by 2045. Moreover, the prevalence of diabetes in the SEA region will also increase by 30% reaching 11.3% in 2045.

The introduction of advanced diabetes care devices, such as continuous glucose monitoring systems and smart insulin pens, is driving adoption in the Southeast Asia market. For instance, in February 2023, Dexcom, Inc., a global leader in real-time continuous glucose monitoring (CGM) for people with diabetes, announced its Dexcom G6 CGM System in Singapore. The Dexcom G6 is approved for use in people with diabetes ages two years and older, including pregnant women, providing them with a powerful tool to manage their condition better. The Dexcom G6 CGM System is a real-time continuous glucose monitoring (CGM) device that helps people with diabetes manage their blood sugar levels. It is a small, wearable sensor inserted under the skin and transmits glucose readings wirelessly to a receiver. The receiver displays the readings in real time, allowing users to see their blood sugar levels and trends.

Initiatives by governments and non-profit organizations to increase access to diabetes screening, diagnosis, and treatment are contributing to the market growth. For instance, in 2023, Action4Diabetes (A4D), a non-profit organization dedicated to bridging the gap in type 1 diabetes care in Southeast Asia, announced its partnership with Direct Relief, a U.S. humanitarian relief agency, to supply diabetes medicines in Laos. Direct Relief is known for distributing medication to public and non-governmental organizations in countries affected by disasters, ensuring access to essential medicines. The sponsorship funding received by A4D will support the expansion of its HelloType1 program across eight Southeast Asian countries. These factors, combined with the rising awareness about effective diabetes management, are expected to drive the market growth in the coming years. Manufacturers and distributors are well-positioned to capitalize on this growth opportunity by introducing innovative, affordable, and accessible diabetes care solutions tailored to the region's needs.

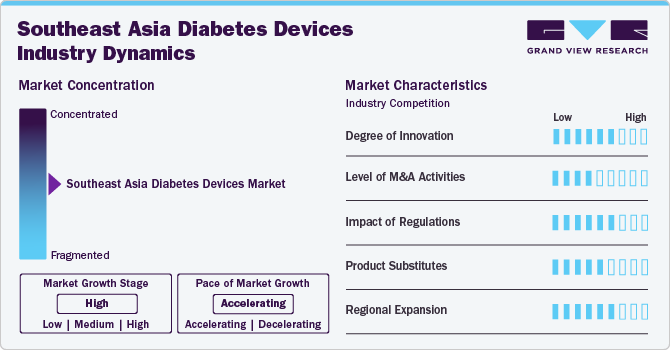

Industry Dynamics

The market growth stage is high, and the pace of its growth is accelerating. This rapid expansion is fueled by a combination of factors, including technological breakthroughs that have driven innovation in the market, leading to the development of advanced and more effective devices. Increased awareness among the population about the importance of proper diabetes management has also been driving the adoption of these devices. In addition, the enhanced effectiveness of the devices has further contributed to their widespread acceptance and usage.

The diabetes devices market in Southeast Asia is witnessing significant advancements due to the rising prevalence of diabetes and the growing demand for more efficient and accessible solutions. For instance, in January 2024, Medtronic Diabetes introduced the MiniMed 780G System, approved as the world’s first integrated with the Simplera Sync disposable continuous glucose monitoring (CGM) sensor. This development marks a groundbreaking milestone in the CGM market, particularly with the introduction of the Simplera Sync sensor, designed to enhance the user experience by offering a disposable, all-in-one solution that eliminates the need for fingersticks or overtape. This feature improves convenience and enhances comfort for individuals using this technology

The Southeast Asia diabetes devices market is experiencing a moderate level of merger and acquisition (M&A) activities among the market players. For instance, in May 2022, ALR Technologies, a diabetes management company, agreed to undergo a reincorporation merger that will change its jurisdiction of incorporation from Nevada to Singapore. ALRT USA (the current Nevada-incorporated entity) has signed a Reincorporation Merger Agreement with its Singapore subsidiary ALRT Singapore and its Delaware subsidiary ALRT Delaware

The regulatory frameworks across the region heavily shape the Southeast Asia diabetes devices market. Regulatory bodies, such as Indonesia's BPOM, Thailand's FDA, the Philippines FDA, Malaysia's MDA, and Vietnam's MOH, play a critical role in ensuring the safety, efficacy, and quality of products available to patients. A crucial element involves the strict authorization procedure, in which manufacturers must provide extensive information on clinical studies, production, and after-sale monitoring to these authorities. The time and costs of obtaining these approvals can impact how quickly new devices enter the market and reach patients.

The market has various product substitutes that can offer alternative solutions for managing diabetes. These substitutes encompass a range of options, including medications, such as metformin, sulfonylureas, and DPP-4 inhibitors, to help manage blood sugar levels, behavioral and lifestyle interventions, such as stress &weight management, technological alternatives, such as wearable smart devices, that can track overall fitness, and lastly alternative monitoring methods, such as A1C testing & urine glucose testing

The diabetes devices market in Southeast Asia is experiencing significant regional expansion, driven by the rising prevalence of diabetes across diverse countries in this dynamic economic region. Countries, such as Indonesia, Thailand, the Philippines, Malaysia, and Vietnam, all have large and growing diabetic populations, fueling increasing demand for a wide range of diabetes monitoring and treatment devices

Type Insights

The insulin delivery devices segment, which includes insulin pens, pumps, syringes, and jet injectors, held the largest share of 54.70% in 2023 and is anticipated to grow rapidly over the forecast period. These devices offer significant benefits that are driving their adoption, such as accurate and convenient dosing from insulin pens, continuous and adjustable insulin delivery from pumps to improve glycemic control and allow for more flexible lifestyles, cost-effective options from syringes, and needle-free delivery from jet injectors to reduce pain and improve patient compliance. The ease of use and enhanced adherence associated with insulin pens compared to traditional vials and syringes is a key factor contributing to their widespread acceptance and preference among healthcare providers and patients in Southeast Asia.

The growing demand for these advanced insulin delivery technologies is driven by factors, such as the high prevalence of diabetes, aging populations, rapid urbanization, sedentary lifestyles, and government initiatives to improve healthcare access as seen with Sanofi's insulin pen recycling program in Thailand. This innovative initiative aims to recycle used insulin pens and give them a new life while promoting sustainability and environmental responsibility among people with diabetes. The rapid expansion of this segment is expected to continue, driven by the significant benefits these insulin delivery devices offer in managing diabetes effectively.

The blood glucose monitoring (BGM) devices segment is expected to witness a substantial CAGR during the forecast period. The growth of this segment, comprising self-monitoring blood glucose (SMBG) and continuous glucose monitoring (CGM) systems, is driven by the increasing adoption of advanced glucose monitoring technologies, such as CGM sensors that provide real-time data and eliminate the need for frequent finger sticks. In addition, the growing availability of affordable SMBG devices, like glucometers and test strips, makes BGM devices more accessible to a broader diabetic population across the region, further accelerating segment growth.

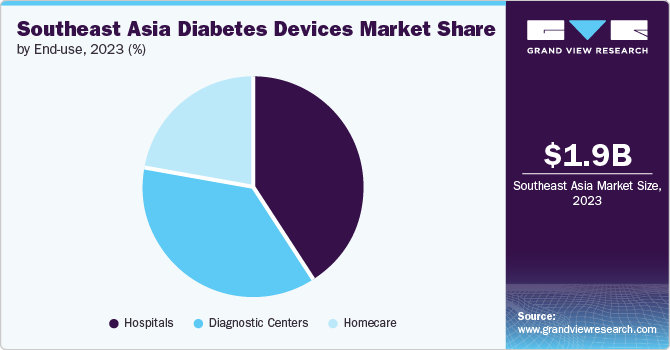

End Use Insights

The hospital segment held the largest share of 40.65% in 2023 due to the high number of diabetic patients being admitted to hospitals, particularly those with type 1 diabetes requiring insulin to prevent complications, such as ketoacidosis, and have higher rates of hyperglycemia. The growing adoption of CGM devices in hospitals to better manage glucose levels and reduce the need for fingersticks is also a contributing factor. In addition, the rising prevalence of diabetes in Southeast Asia, with countries, such as Indonesia, Malaysia, Philippines, Thailand, and Vietnam, seeing a surge in diabetic populations, is driving demand for diabetic devices in hospital settings. According to the National Library of Medicine, the prevalence of diabetes in Indonesia was 9.19% in 2020, affecting around 18.69 million individuals. However, this figure is projected to increase dramatically over the next 25 years.

The diagnostic centers segment is expected to grow at the fastest CAGR during the forecast period. Patients increasingly opt for glucose testing at these specialized facilities due to their ability to provide quick and accurate results, eliminating the need for lengthy waiting periods. Self-monitoring blood glucose (SMBG) devices are extensively utilized in regional diagnostic centers. This rising preference for diabetes testing at diagnostic centers, driven by their efficiency and convenience, is anticipated to be a key factor accelerating the growth of this segment in the Southeast Asia diabetic devices market.

Distribution Channel Insights

The hospital pharmacies segment dominated the market and accounted for a share of 53.79% in 2023. This is driven by patients' increasing preference to obtain their diabetic care products directly from in-hospital pharmacies. The growing adoption of advanced diabetic technologies, such as CGM devices and insulin pumps in hospitals, boosts the demand through the hospital pharmacy channel. This trend is expected to continue as improving healthcare infrastructure and rising healthcare spending in Southeast Asia make hospital-based diabetic care more accessible and convenient for patients across the region.

The retail pharmacies segment is projected to grow significantly over the forecast period. The increasing penetration of private-label diabetic products in retail pharmacy stores, often at lower prices than branded options, makes these devices more accessible and affordable for patients. In addition, the growing network of retail pharmacies across the region and improving healthcare infrastructure are making it more convenient for diabetic patients to obtain their necessary monitoring and treatment devices through this channel.

Country Insights

Indonesia Diabetes Devices Market Trends

The Indonesia diabetes devices market dominated the market and accounted for a share of 28.31% in 2023. The country has a large patient population that creates significant demand for glucose monitoring systems, insulin pens, and insulin pumps. Increasing awareness of the importance of diabetes management is boosting the adoption of these devices. The launch of the Changing Diabetes in Children (CDiC) partnership in Indonesia in September 2021 is a significant driver for the country's diabetes devices market. This global initiative, involving the Indonesian Ministry of Health, Indonesian Pediatrician Association (IDAI), Novo Nordisk, and other partners, aims to support children and adolescents with type 1 diabetes (T1DM) in low-resource settings. This collaborative effort between the government and private sector is expected to increase access to essential diabetes care services, including insulin and supplies, for the vulnerable pediatric population in Indonesia.

Thailand Diabetes Devices Market Trends

The diabetes devices market in Thailand will witness significant growth over the coming years. The country's high diabetes prevalence, with an estimated 2.4 million people affected, creates significant demand for diabetes devices. According to the WHO, Thailand's elderly population is among the fastest growing globally. Out of its 67 million population, 12 million Thais are considered elderly, per the most recent national statistics. In addition, the Thai government's efforts to improve healthcare access through the Universal Coverage Scheme have increased insurance coverage for diabetes devices. However, the high cost of advanced devices like continuous glucose monitors and insulin pumps remains challenging, as many patients need more insurance coverage.

Philippines Diabetes Devices Market Trends

The Philippines diabetes devices market is expected to grow over the forecast period. The financial burden of diabetes in the Philippines is on the rise, fueled by increasing healthcare costs. According to the International Diabetes Federation (IDF), the average diabetes-related expenditure per person with diabetes in the Philippines has seen a significant surge from US$61 in 2010 to US$234 in 2017. This escalation in costs can be attributed to the growing prevalence of diabetes and its associated complications, necessitating more intensive management and treatment. As expenses related to medications, hospitalizations, and long-term care for diabetic individuals continue to climb, there is a pressing demand for cost-effective and efficient solutions for managing diabetes.

Malaysia Diabetes Devices Market Trends

The diabetes devices market in Malaysia will witness significant growth over the coming years. Factors, such as population growth, aging demographics, and increasing prevalence of chronic diseases like diabetes, drive the country's rising healthcare expenditures. The International Trade Association forecasts that 2028 personal healthcare spending in Malaysia will reach $2.8 billion, marking a twofold increase. This increased spending on healthcare is likely to boost the demand for diabetes devices in the country.

Vietnam Diabetes Devices Market Trends

The Vietnam diabetes devices market is expected to grow as diabetes affects approximately 5 million individuals in Vietnam, making it a major global health issue. With a rise in diabetes cases, a heightened need exists for devices to help manage this condition. The aging population in Vietnam is likely to increase the number of diabetes cases further, boosting the demand for such devices. To improve diabetes management, the Vietnamese government has taken significant steps to improve diabetes management in the country, such as a multi-sectoral approach spanning 2015 to 2025, which aims to strengthen the country's healthcare system and empower individuals to take control of their health.

Myanmar Diabetes Devices Market Trends

The diabetes devices market in Myanmar will have considerable growth. The country experiences rapid urbanization, with more people adopting sedentary lifestyles and unhealthy diets. This trend contributes to diabetes cases, especially in urban areas. The Myanmar government is investing in improving healthcare infrastructure and access to medical services to address this challenge. These efforts are expected to increase diagnosis rates and drive the adoption of diabetes devices, as better access to healthcare will enable more people to be screened and receive the necessary treatment and management tools for their condition.

Singapore Diabetes Devices Market Trends

The Singapore diabetes devices market was identified as a lucrative region in this industry. Singapore's position as a global medical tourism hub attracts patients seeking high-quality healthcare. Moreover, the government's substantial investments in the sector drive the country's diabetes devices market. The government is investing heavily in the healthcare sector, with plans to quadruple healthcare spending from $13.2 billion in 2020 to $36 billion by 2029. This increased funding is expected to improve access to diabetes devices and support the adoption of new technologies.

Key Southeast Asia Diabetes Devices Company Insights

The key players in the market include Medtronic plc, Abbott Laboratories, F. Hoffmann - La - Ltd., and Bayer AG. These companies are actively working to enhance their product portfolios and expand their market presence in the region. By focusing on innovation, collaboration, and market expansion, these leading companies aim to capture a larger share of this rapidly growing market and improve access to quality diabetes management solutions for patients in the region.

Key Southeast Asia Diabetes Devices Companies:

- Abbott Laboratories

- Arkray, Inc.

- B Braun Melsungen AG

- Bayer AG

- Companion Medical

- Dexcom Inc.

- F.Hoffmann-La-Ltd.

- Insulet Corporation

- Lifescan, Inc.

- Medtronic plc

- Novo Nordisk

- Sanofi

- Valeritas Holding Inc.

- Ypsomed Holdings

Recent Developments

-

In February 2024, Duopharma Biotech Berhad partnered with Owen Mumford Sdn Bhd, a UK-based medical device manufacturer Owen Mumford subsidiary, to distribute a range of diabetes care products in Brunei, Malaysia, and Singapore. The partnership aims to provide better access to medical devices for needy patients, particularly those with diabetes

-

In April 2022, Gan & Lee Pharmaceuticals, a leading pharmaceutical company, announced the approval of its insulin pen in Thailand. This approval marks a significant milestone for the company as it expands its presence in the Southeast Asian market. The insulin pen is a crucial medical device for individuals with diabetes, allowing for convenient and accurate insulin delivery

-

In April 2021, Dexcom, a prominent U.S.-based diabetes care technology provider, planned to establish a significant manufacturing presence in Malaysia. The company intends to construct a sprawling 1.8 million square feet manufacturing facility in the country, marking its first foray into establishing a production site in Asia. Dexcom’s decision to expand its operations into Malaysia underscores its strategic vision to enhance its global footprint and cater to the growing demand for innovative diabetes management solutions in the region

Southeast Asia Diabetes Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.09 billion

Revenue forecast in 2030

USD 3.58 billion

Growth rate

CAGR of 9.36% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel and end use

Regional scope

Southeast Asia

Country scope

Indonesia; Thailand; Philippines; Malaysia; Vietnam; Myanmar; Singapore; Rest of SEA

Key companies profiled

Abbott Laboratories; Arkray, Inc.; B Braun Melsungen AG; Bayer AG; Companion Medical; Dexcom Inc.; F.Hoffmann-La-Ltd.; Insulet Corporation; Lifescan, Inc.; Medtronic plc; Novo Nordisk; Sanofi; Valeritas Holding Inc.; Ypsomed Holdings

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Southeast Asia Diabetes Devices Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Southeast Asia diabetes devices market report based on type, distribution channel, end use, and country:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

BGM Devices

-

Self-Monitoring Devices

-

Blood Glucose Meter

-

Testing Strips

-

Lancets

-

-

Continuous Glucose Monitoring Devices

-

Sensors

-

Transmitter

-

Receiver

-

-

-

Insulin Delivery Devices

-

Pens

-

Pumps

-

Syringes

-

Jet Injector

-

-

-

Distribution Channel (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Diabetes Clinics/ Centers

-

Online Pharmacies

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Homecare

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Indonesia

-

Thailand

-

Philippines

-

Malaysia

-

Vietnam

-

Myanmar

-

Singapore

-

Rest of SEA

-

Frequently Asked Questions About This Report

b. The Southeast Asia diabetes devices market size was estimated at USD 1.90 billion in 2023 and is expected to reach USD 2.09 billion in 2020.

b. The Southeast Asia diabetes devices market is expected to grow at a compound annual growth rate of 9.36 from 2024 to 2030 to reach USD 3.58 billion by 2030.

b. The Indonesia diabetes devices market dominated the Southeast Asia diabetes devices market and accounted for a share of 28.31 % share in 2023. The country has a large patient population that creates significant demand for glucose monitoring systems, insulin pens, and insulin pumps.

b. Some key players operating in the Southeast Asia diabetes devices market include Abbott Laboratories; Arkray, Inc.; B Braun Melsungen AG; Bayer AG; Companion Medical; Dexcom Inc.; F.Hoffmann-La-Ltd.; Insulet Corporation; Lifescan, Inc.; Medtronic plc; Novo Nordisk; Sanofi; Valeritas Holding Inc.; Ypsomed Holdings

b. Key factors that are driving the market growth include rapid increase in diabetes prevalence, primarily due to lifestyle changes, including urbanization, sedentary lifestyles, and unhealthy diets. This surge in diabetes cases is driving the demand for diabetes devices to manage the condition effectively.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."