Southeast Asia Continuous Glucose Monitoring Market Size, Share & Trends Analysis Report By Component (Sensors, Transmitters, Receivers), By Connectivity (Bluetooth, 4G), By End-use (Hospitals, Home Care), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-415-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

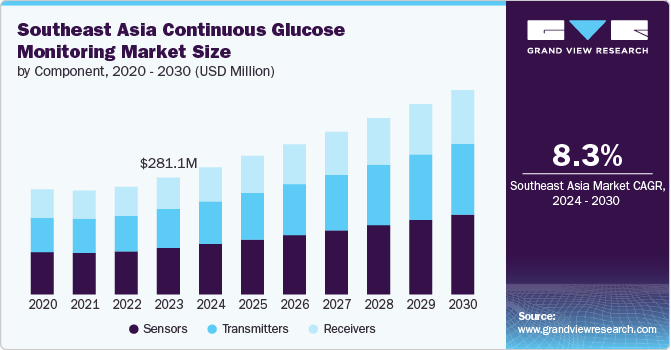

The Southeast Asia continuous glucose monitoring market size was estimated at USD 281.06 million in 2023 and is projected to grow at a CAGR of 8.26% from 2024 to 2030. Several critical factors, including the rising prevalence of diabetes, increasing awareness and adoption of advanced diabetes management technologies, supportive government initiatives and healthcare policies, and the rising demand for personalized healthcare solutions, drive the market growth. According to a study, in Thailand, 9.6% of adults have diabetes (2.4 million), with half previously diagnosed and half newly identified; additionally, 5.4% (1.4 million) experience impaired fasting glucose.

One of SEA's most significant market drivers is the alarming rise in diabetes cases across the region. The global prevalence of diabetes is rising rapidly, with projections indicating that by 2045, approximately 700 million individuals will be living with the condition. Indonesia is among the 20 countries and territories in the IDF Western Pacific region, where 537 million people have diabetes, with 206 million in the Western Pacific region; this number is projected to increase to 260 million by 2045. The growing diabetic population necessitates effective management solutions such as CGM systems that provide real-time glucose monitoring, enabling better glycemic control and reducing complications associated with diabetes.

Technological advancements and product innovation also play a vital role in propelling the market forward. Companies are continuously developing new and improved CGM devices that are less invasive, more accurate, and equipped with advanced features such as smartphone integration and real-time data sharing. For instance, introducing devices that provide alerts for high or low glucose levels enhances patient safety and encourages adherence to monitoring regimens. As these innovations become more accessible, they are most likely to drive further market growth.

The growing emphasis on personalized healthcare solutions is influencing the market growth in Southeast Asia. Healthcare providers recognize the importance of tailored diabetes management plans considering individual patient needs and lifestyles. CGM technology facilitates this personalized approach by providing continuous data on glucose levels, allowing for more informed decisions regarding diet, exercise, and medication. This shift toward customized care is expected further to boost the adoption of CGM devices across the region, ultimately improving diabetes management and patient outcomes.

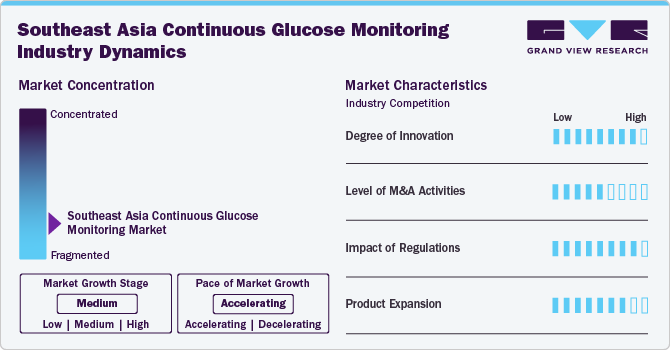

Market Concentration & Characteristics

The degree of innovation in the market is high. Companies are increasingly investing in R&D to enhance the accuracy, usability, and integration of CGM devices with digital health platforms. For instance, Dexcom's G6 CGM system was widely adopted due to its innovative features, such as real-time glucose monitoring and smartphone connectivity. The focus on user-friendly designs and advanced algorithms for predictive analytics further emphasizes this sector's high level of innovation.

The level of merger and acquisition activities in the market is medium. Notable acquisitions aim at consolidating technology and expanding market reach; the pace is not as aggressive as witnessed in other healthcare sectors. For example, in August 2024, Abbott and Medtronic partnered to develop an integrated CGM system using Abbott's FreeStyle Libre technology, which will connect with Medtronic's AID and innovative insulin pen systems. Such strategic moves indicate a growing interest among major players in diversifying their product lines through M&A; however, the overall frequency remains moderate compared to other regions, such as Europe.

The impact of regulations on market is high. Regulatory bodies across countries such as Singapore, Malaysia, and Thailand impose stringent guidelines for medical devices, which can affect the speed at which new products enter the market. For instance, Singapore’s Health Sciences Authority (HSA) requires comprehensive clinical data before approving any new CGM device for public use. This regulatory environment ensures safety and efficacy but can delay product launches and increase costs for manufacturers seeking compliance. As a result, companies must navigate complex regulatory landscapes while striving to innovate.

Product expansion within the market is high, driven by increasing diabetes prevalence and rising consumer awareness about diabetes management technologies. Expansion is a critical trend in the market as companies strive to diversify their offerings and cater to patients' varying needs. This includes developing different CGM models, such as those designed for specific age groups or lifestyle needs, and enhancements in existing products. For instance, in October 2022, Dexcom launched the Dexcom G7, a next-generation continuous glucose monitor (CGM) suitable for people with diabetes aged two and older. The G7 features a 60.0% smaller, all-in-one Connectivity and offers the fastest sensor warm-up time of any CGM, taking just 30 minutes.

Component Insights

Based on component, the sensors segment led the market with the largest revenue share of 39.9% in 2023. Technological advancements played a significant role; innovations such as miniaturization and improved accuracy of sensors made them more user-friendly and reliable, thus attracting both healthcare providers and patients. The sensor is equipped with chemical layers above the glucose oxidase, which helps maintain its functionality even in challenging conditions within the human body.

The transmitter segment is expected to witness at the fastest CAGR of 8.87% during the forecast period. Transmitters are positioned on the skin and wirelessly communicate with a sensor inserted beneath the skin. This sensor is involved in analyzing glucose levels in the interstitial fluid. The transmitter then relays this data to a receiver or a smartphone app that further allows users to monitor their glucose levels & receive high or low blood sugar alerts. CGM devices typically use radiofrequency transmitters, which utilize radio waves to transmit data from the sensor to the receiver or app. Some CGM devices also incorporate Near-field Communication (NFC) and Bluetooth transmitters.

Connectivity Insights

Based on connectivity, the bluetooth segment led the market in 2023 with the largest revenue share of 58.34%. As the patient brings the recording device close to the sensor, detailed blood glucose level information is transmitted via Bluetooth to the device. This technology enables smooth data transfer between glucose monitoring devices and smartphones or other digital platforms, allowing for real-time tracking and management of blood glucose levels. This convenience is especially beneficial for patients needing continuous monitoring, as it provides instant access to their health data without manual logging.

The 4G network segment is anticipated to grow at the fastest CAGR of 8.26% during the forecast period. The 4G network facilitates data transmission from the receiving unit to the central monitoring database and the provider's systems while storing multiple data points within specific CGM mobile end users. This data transfer is essential for establishing an appropriate treatment plan, enabling monitoring alerts, and triggering insulin delivery. Various apps on the market store patient data, helping users easily track glucose fluctuations.

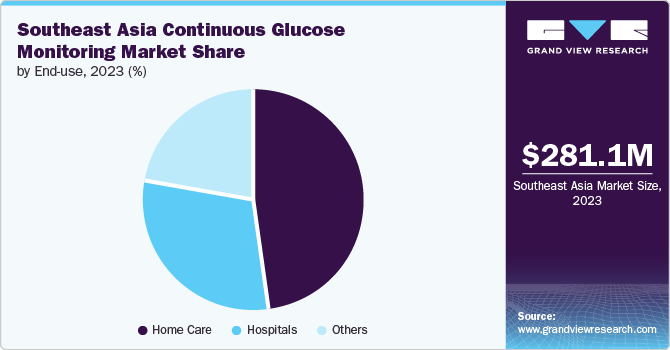

End-use Insights

Based on end use, the homecare segment led this market with the largest revenue share of 48.10% in 2023 and is anticipated to witness at the fastest CAGR of 8.50% during the forecast period. The rise of telehealth services supports this growth by enabling healthcare providers to monitor patient data remotely and offer timely interventions. Government initiatives promoting diabetes awareness and management programs also contribute to the development of this segment. For instance, in July 2022, Novo Nordisk Indonesia partnered with the West Java provincial government by signing a memorandum of understanding (MoU) for the Affordability Project. This initiative aims to enhance access to diabetes care for vulnerable populations in remote and very remote areas by transforming primary healthcare facilities.

The hospital segment represented a significant share of the market in 2023, driven by an increase in hospital visits for diabetes treatment and the urgent complications associated with diabetes, such as retinopathy, nephropathy, and neuropathic conditions, which necessitate immediate medical attention and hospital admissions. Many healthcare facilities adopted continuous glucose monitoring devices to track blood sugar levels in diabetes mellitus patients effectively.

Country Insights

The continuous glucose monitoring market in Singapore accounted for the largest revenue share of 24.17% in 2023, due to its advanced healthcare infrastructure, high prevalence of diabetes, and strong government support for health technology innovation. The country established itself as a hub for medical technology, attracting significant investments and fostering research and development in diabetes management solutions. The Ministry of Health (MOH), in partnership with the Institute of Policy Studies (IPS), initiated the Citizens’ Jury (CJ) as part of the War on Diabetes campaign. This initiative aims to involve citizens in increasing awareness about diabetes and develop community-based recommendations for enhancing the prevention and management of this disease across the country.

The Indonesia continuous glucose monitoring market represented a significant share of the market in 2023. The increasing prevalence of diabetes, especially type 2 diabetes, among the Indonesian population is an essential driver. According to the International Diabetes Federation (IDF), Indonesia's national diabetes prevalence was estimated at 6.2% in 2019 and rose to 10.8% in 2021, positioning the country among the top 10 with the highest rates of Type 2 Diabetes Mellitus (T2DM) and the most significant increase. This alarming statistic prompted governmental and non-governmental organizations to prioritize diabetes management and prevention strategies.

Key Southeast Asia Continuous Glucose Monitoring Company Insights

Key companies established a significant market position through innovative product offerings, strategic partnerships, and robust distribution network. The market is witnessing a growing trend towards technological advancements, such as integrating mobile health users and enhanced data analytics capabilities, which drive user adoption and engagement. Furthermore, the increasing prevalence of diabetes in the region has prompted healthcare providers to adopt CGM systems more widely, expanding the overall market.

Key Southeast Asia Continuous Glucose Monitoring Companies:

- Dexcom, Inc.

- Abbott

- Medtronic

- F. Hoffmann-La Roche Ltd

- Senseonics

- Ascensia Diabetes Care Holdings AG.

Recent Developments

-

In January 2023, Pacific Prime Thailand announced a partnership with HelpDeliver, a task-based home healthcare service that connects to the Internet. This collaboration focuses on Telehealth and provides solutions such as RESMED Sleep Apnea Testing, GLUNOVO Continuous Glucose Monitoring for diabetes, and premium home healthcare services

-

In February 2023, Dexcom, Inc. launched its Dexcom G6 CGM System in Singapore for individuals aged two and older, including pregnant women

Southeast Asia Continuous Glucose Monitoring Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 305.78 million |

|

Revenue forecast in 2030 |

USD 492.37 million |

|

Growth rate |

CAGR of 8.26% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, connectivity, end-use, country |

|

Regional scope |

South East Asia |

|

Country scope |

Singapore; Philippines; Thailand; Malaysia; Indonesia; Rest of South East Asia |

|

Key companies profiled |

Dexcom, Inc.; Abbott; Medtronic; F. Hoffmann-La Roche Ltd; Senseonics; Ascensia Diabetes Care Holdings AG. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Southeast Asia Continuous Glucose Monitoring Market Report Segmentation

This report forecasts revenue growth in South East Asia and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Southeast Asia continuous glucose monitoring market report based on component, connectivity, end use, and country:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Sensors

-

Transmitters

-

Receivers

-

-

Connectivity Outlook (Revenue, USD Million, 2018 - 2030)

-

Bluetooth

-

4G

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Home Care

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

South East Asia

-

Singapore

-

Philippines

-

Thailand

-

Malaysia

-

Indonesia

-

Rest of South East Asia

-

-

Frequently Asked Questions About This Report

b. The Southeast Asia continuous glucose monitoring market size was valued at USD 281.06 million in 2023 and is projected to reach USD 305.78 million in 2024.

b. The Southeast Asia continuous glucose monitoring market projected to grow at a compound annual growth rate (CAGR) of 8.26% from 2024 to 2030 to reach USD 492.37 million in 2030.

b. Sensors led this market with the largest revenue share of 39.9% in 2023. Technological advancements played a significant role; innovations such as miniaturization and improved accuracy of sensors made them more user-friendly and reliable, thus attracting both healthcare providers and patients.

b. Some of the key players in the SEA CGM market include Dexcom, Inc., Abbott, Medtronic, F. Hoffmann-La Roche Ltd, Senseonics, Ascensia Diabetes Care Holdings AG.

b. Several critical factors, including the rising prevalence of diabetes, increasing awareness and adoption of advanced diabetes management technologies, supportive government initiatives and healthcare policies, and the rising demand for personalized healthcare solutions, drive the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."