- Home

- »

- Clinical Diagnostics

- »

-

Southeast Asia Blood Gas And Electrolyte Analyzers Market, Report, 2030GVR Report cover

![Southeast Asia Blood Gas And Electrolyte Analyzers Market Size, Share & Trends Report]()

Southeast Asia Blood Gas And Electrolyte Analyzers Market Size, Share & Trends Analysis Report By Product (Instruments, Consumables), By Brand (I-STAT, epoc, GEM Premier), By End -use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-325-2

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

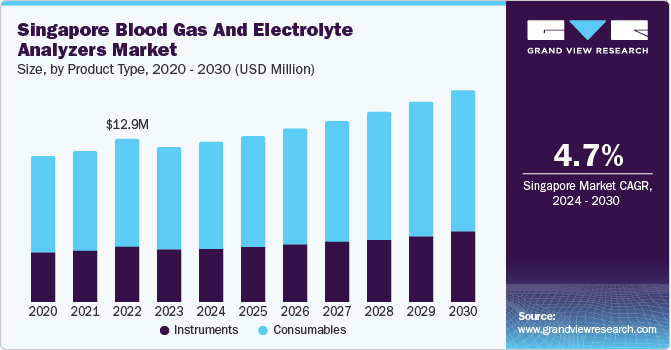

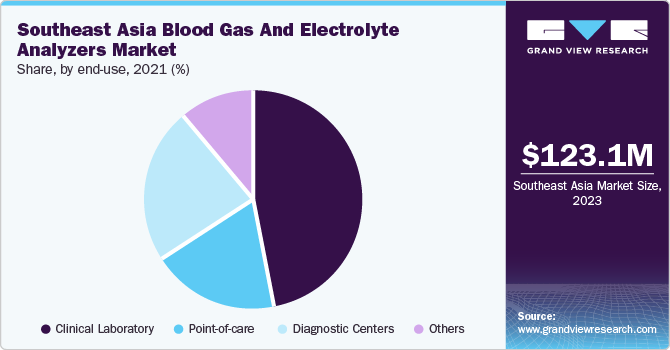

The Southeast Asia blood gas and electrolyte analyzers market size was estimated at USD 123.08 million in 2023 and is projected to grow at a CAGR of 4.52% from 2024 to 2030. The growth of the market is attributed to the rising prevalence of chronic diseases, the growing geriatric population, and increasing regulatory support and funding for the development of novel blood gas analyzers in the market.

The growing prevalence of chronic diseases in Southeast Asia is significantly driving the demand for blood gas and electrolyte analyzers in the region. Chronic diseases such as diabetes, cardiovascular diseases, and chronic respiratory conditions are becoming common due to various factors, including lifestyle changes and urbanization. These conditions require continuous monitoring and management. Chronic diseases lead to complications that require blood gas and electrolyte analysis. For instance, diabetes can lead to diabetic ketoacidosis, a condition that necessitates the monitoring of blood pH and electrolyte levels. Similarly, cardiovascular diseases can result in heart failure, demanding regular checks of blood oxygen levels and electrolyte balance. As the prevalence of these diseases rises, the demand for blood gas and electrolyte analyzers is growing. According to IDF, the number of people suffering from diabetes in the Southeast Asia region is expected to increase by 68% and reach 152 million by 2045, with the prevalence of diabetes expected to increase by 30%, reaching 11.3% in 2045.

Furthermore, chronic diseases need continuous and rapid monitoring, which can be effectively achieved through Point-Of-Care Testing (POCT). Blood gas and electrolyte analyzers are used in POCT settings due to their ability to provide quick and accurate results. This shift toward decentralized testing supports better disease management and reduces the burden on central laboratories.

Regulatory support and funding are crucial factors driving the Southeast Asia blood gas and electrolyte analyzer industry. These analyzers are essential for critical care, emergency departments, and clinical laboratories, providing vital information about patients' respiratory and metabolic status. Governments across Southeast Asia have been focusing on improving healthcare infrastructure and quality. Regulatory bodies have implemented stringent guidelines and standards for medical devices, ensuring the reliability, accuracy, and safety of blood gas & electrolyte analyzers. This regulatory environment helps in building trust among healthcare providers and patients, promoting the adoption of these devices. Several Southeast Asian countries have increased their healthcare budgets, with a significant portion allocated to upgrading medical facilities and technologies. For instance, in 2023, the Malaysian government allocated USD 7.9 billion in funds to the Ministry of Health (MOH), which is higher by USD 0.8 billion as compared to 2022. Such financial support and initiatives encourage hospitals & clinics to invest in advanced diagnostics equipment, including blood gas and electrolyte analyzers.

However, the high cost of advanced analyzers is one of the key factors restraining the growth of the market. These advanced analyzers integrate advanced technology and features that offer precise & rapid results, which are crucial for critical care. However, their high cost makes them less accessible to many healthcare facilities, especially in the developing countries of Southeast Asia, where budget constraints are a significant concern. This limitation affects the adoption of advanced blood gas and electrolyte analyzers across the region, impacting the overall market growth. Healthcare providers in these countries rely on older and less sophisticated equipment, which provides a different level of accuracy and efficiency. Blood gas and electrolyte analyzer methods emphasize the need for more affordable solutions that maintain the quality of care to ensure broader access & improve healthcare outcomes in Southeast Asia.

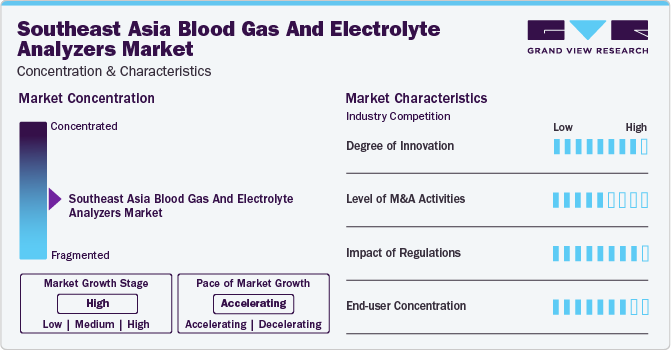

Market Concentration & Characteristics

The degree of innovation is high in the market, particularly in the development of innovations such as the miniaturization of components and robust software algorithms, which are enhancing the performance of these instruments. In addition, the growing focus on personalized medicine and precision healthcare is pushing the adoption of benchtop blood gas & electrolyte analyzers, ensuring that patients receive timely & accurate diagnoses.

Several players engage in mergers & acquisitions to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve competency.

Regulatory support and funding are crucial factors driving the Southeast Asia blood gas and electrolyte analyzer market growth. These analyzers are essential for critical care, emergency departments, and clinical laboratories, providing vital information about patients' respiratory and metabolic status.

The market shows a high end use concentration, with a significant portion of revenue generated from a limited number of key customers, primarily in the clinical laboratories sectors. This concentration is driven by the dominance of a few major players and the reliance on government-funded programs and regulations.

Product Insights

The consumables segment led the market in 2023 and accounted for 66.28% of the revenue share. It is also anticipated to grow at the fastest CAGR over the forecast period. Consumables for blood gas and electrolyte analyzers, including cartridges, sensors, electrodes, and calibration solutions, are essential for the continuous and accurate functioning of these diagnostic instruments. The demand for these consumables is driven by several factors, especially the rising prevalence of chronic diseases such as diabetes, cardiovascular diseases, and respiratory conditions that necessitate regular monitoring of blood gases and electrolytes. The increasing number of ICUs, emergency departments, and diagnostic laboratories in Southeast Asia also boosts the demand for these consumables. For instance, in 2021, Malaysia had a total of 1,388 ICU beds across 78 government and teaching hospitals, with 850 of these beds, or about 61%, allocated for COVID-19 patients.

Instruments held the second-largest market share in 2023. These instruments, essential for measuring pH, blood gases (such as oxygen and carbon dioxide), and electrolytes (including sodium, potassium, and chloride), are critical in managing patients in critical care, emergency medicine, and neonatal care. The market includes various instruments, from benchtop models to portable, handheld devices, with leading manufacturers like Siemens Healthineers, Radiometer, Abbott, and Roche Diagnostics offering advanced solutions tailored to diverse clinical settings.

Brand Insights

Epoc brand led the market in 2023 with a market share of 22.48%. The epoc system includes test cards with sensors, a wireless card reader, and a Personal Data Assistant (PDA) for data analysis. The test cards employ selective electrode potentiometry to measure pH, pCO2, sodium, potassium, and ionized calcium, while glucose, pO2, and lactate are measured by amperometry. Hematocrit is determined using conductometry, and bicarbonate, total carbon dioxide, base excess, oxygen saturation, and hemoglobin are calculated. Market driving factors for the epoc system include rising demand for rapid, accurate POC testing, particularly in emergency and critical care settings, and the growing need for portable, user-friendly diagnostic devices. The system’s advanced connectivity features and efficient data management capabilities further enhance its appeal in modern healthcare environments.

ABL Flex (90 and 800) is anticipated to grow at the fastest CAGR over the forecast period. It is designed to meet fluctuating blood gas testing demands with its individual and replaceable consumables. It is highly adaptable, allowing customization to specific parameters and configuration needs. The ABL90 FLEX PLUS provides test results in 35 seconds for up to 19 vital parameters, including urea and creatinine, from a single blood sample of only 65 µL. With a high uptime of more than 23.5 hours per day and only 60 seconds between each sample measurement, the analyzer is quickly ready for the next test. It delivers lab-quality results at the POC, enhancing treatment decision confidence.

End-use Insights

Clinical laboratory led the market with a revenue share of 46.98% in 2023. In the rapidly advancing landscape of healthcare technology, Blood Gas Analyzers (BGAs) have become indispensable for clinical laboratories, offering real-time insights into a patient's respiratory and metabolic status. The increasing demand for accurate and efficient diagnostic tools has propelled the development of innovative BGAs tailored to meet the specific needs of healthcare professionals. These advancements include enhanced accuracy, faster turnaround times, and integration with hospital information systems. The clinical laboratory market for BGAs continues to expand, driven by the need for precise monitoring in critical care settings, management of chronic diseases, and overall push for improved patient outcomes.

The point-of-care segment is projected to witness the fastest CAGR over the forecast period. The market for Point-of-Care (POC) blood gas and electrolyte analyzers is growing rapidly due to the increasing demand for quick and accurate diagnostic tools in critical care settings. These analyzers provide real-time insights into a patient's respiratory and metabolic status, which is essential for immediate clinical decision-making. Key drivers include the rising prevalence of chronic diseases, the need for rapid diagnostics in emergency and ICUs, and technological advancements that enhance portability, accuracy, and ease of use. Prominent products in this market, such as the Seamaty SG1, Radiometer ABL90 FLEX PLUS, and Siemens RAPIDPoint 500, offer comprehensive testing panels and user-friendly interfaces, ensuring swift results and improved patient outcomes at the POC.

Regional Insights

Indonesia blood gas and electrolyte analyzers market accounted for 24.49% share in 2023. The increasing prevalence of chronic diseases, such as diabetes, cardiovascular diseases, renal disorders, and respiratory diseases, is one of the major factors expected to drive the Indonesia market growth. According to the World Heart Federation, Indonesia reported around 651,481 deaths from cardiovascular disease in 2019. In addition, Indonesia has a high and rising prevalence of diabetes. Managing diabetes requires regular monitoring of blood electrolytes & gases, especially in diabetic ketoacidosis cases, a serious complication that can occur in patients with diabetes. Conditions such as Chronic Obstructive Pulmonary Disease (COPD) and asthma are common in Indonesia, partly due to high smoking rates and air pollution. Blood gas analysis is vital for assessing respiratory function and guiding treatment for these diseases.

Thailand blood gas and electrolyte analyzers market is anticipated to witness the fastest CAGR over the forecast period. Thailand is experiencing a demographic shift, with an increasing proportion of the elderly population more prone to chronic diseases that require blood gas & electrolyte analysis for diagnosis and monitoring. As per the Economic Research Institute for ASEAN and East Asia (ERIA) in 2021, Thailand has the world’s third-fastest aging population. The number of people aged 60 years & above in the country accounts for around 13 million, i.e., 20% of the population. As aging is a risk factor for cancer, cardiovascular diseases, diabetes, and other disorders, it is contributing significantly to the country’s disease burden, improving market demand.

Key Southeast Asia Blood Gas And Electrolyte Analyzers Insights

Some of the leading players operating in the Southeast Asia blood gas and electrolyte analyzers industry include Abbott, Siemens Healthcare Private Limited, Radiometer Medical ApS, and F. Hoffmann-La Roche Ltd. Key players are using existing customer bases in the region to prioritize maintaining high-quality standards and gain high market size access. This strategy is useful for brands that have already built trust in the market. These players are heavily investing in advanced technology and infrastructure, allowing them to process and analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

Nova Biomedical, OPTI Medical Systems Inc., Convergent Technologies, AFFORD MEDICAL TECHNOLOGIES PVT. LTD. are some of the emerging market participants in the market. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Southeast Asia Blood Gas And Electrolyte Analyzers Companies:

- Abbott

- Siemens Healthcare Private Limited

- Werfen

- Medica Corporation

- F. Hoffmann-La Roche Ltd.

- Quest Diagnostics Incorporated

- Nova Biomedical

- Radiometer Medical ApS

- EDAN Instruments, Inc.

- OPTI Medical Systems Inc.

- Convergent Technologies

- AFFORD MEDICAL TECHNOLOGIES PVT. LTD.

- Accurex, LLC

Recent Developments

-

In July 2023, Siemens Healthineers launched the Atellica CI Analyser for clinical chemistry and immunoassay testing, which was granted FDA clearance. The 1.9 m² device is ideal for smaller labs and offers consistent sample turnaround times with microvolume aspiration, independent sampling, and autonomous maintenance & quality control scheduling. It is currently accessible in many countries worldwide.

-

In September 2023, EDAN Instruments, Inc., a healthcare company and medical device manufacturer, officially inaugurated its Bangkok branch, marking the central operational hub for Asia Pacific. The office aims to provide comprehensive assistance to clients, particularly in Southeast Asia.

-

In June 2023, B&E DIAGNOSTIC INC. launched the i-Check handheld blood gas electrolyte analyzer at a product launching conference in Yantai. The analyzer uses microfluidic and electrochemical detection technology & features a single-use cartridge with a plastic substrate, multi-biosensor array, calibrator pouch, sample injection port, and waste chamber. Officials from various city government departments attended the event.

Southeast Asia Blood Gas And Electrolyte Analyzers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 126.84 million

Revenue forecast in 2030

USD 165.34 million

Growth rate

CAGR of 4.52% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, Volume/Number of Units in Thousands, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, brand, end-use, region

Country scope

Singapore; Malaysia; Indonesia; Thailand; Vietnam; Philippines

Key companies profiled

Abbott; Siemens Healthcare Private Limited; Werfen; Medica Corporation; F. Hoffmann-La Roche Ltd.; Quest Diagnostics Incorporated; Nova Biomedical; Radiometer Medical ApS; EDAN Instruments, Inc.; OPTI Medical Systems Inc.; Convergent Technologies; AFFORD MEDICAL TECHNOLOGIES PVT. LTD.; Accurex, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Southeast Asia Blood Gas And Electrolyte Analyzers Market Report Segmentation

This report forecasts revenue & volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Southeast Asia blood gas and electrolyte analyzers market report based on product, brand, end-use, and region:

-

Product Outlook (Number of Units, Thousands; Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Bench Top

-

Portable

-

-

Consumables

-

-

Brand Outlook (Number of Units, Thousands; Revenue, USD Million, 2018 - 2030)

-

I-STAT

-

epoc

-

GEM Premier (3500& 5000)

-

ABL Flex (90 and 800)

-

Cobas

-

RAPID Series

-

Others

-

-

End Use Outlook (Number of Units, Thousands; Revenue, USD Million, 2018 - 2030)

-

Clinical Laboratory

-

Point-of-care

-

Diagnostic Centers

-

Others

-

-

Regional Outlook (Number of Units, Thousands; Revenue, USD Million, 2018 - 2030)

-

Singapore

-

Malaysia

-

Indonesia

-

Thailand

-

Vietnam

-

Philippines

-

Frequently Asked Questions About This Report

b. The global Southeast Asia blood gas and electrolyte analyzers market size was estimated at USD 123.28 million in 2023 and is expected to reach USD 126.84 million in 2024.

b. The global Southeast Asia blood gas and electrolyte analyzers market is expected to grow at a compound annual growth rate of 4.52% from 2024 to 2030 to reach USD 165.34 billion by 2030.

b. Indonesia dominated the Southeast Asia blood gas and electrolyte analyzers market with a share of 24.49% in 2023. This is attributable to increasing prevalence of chronic diseases, such as diabetes, cardiovascular diseases, renal disorders, and respiratory diseases.

b. Some key players operating in the Southeast Asia blood gas and electrolyte analyzers market include Abbott, Siemens Healthcare Private Limited, Werfen, Medica Corporation, F. Hoffmann-La Roche Ltd., Quest Diagnostics Incorporated, Nova Biomedical, Radiometer Medical ApS, EDAN Instruments, Inc., OPTI Medical Systems Inc., Convergent Technologies, AFFORD MEDICAL TECHNOLOGIES PVT. LTD., Accurex, LLC

b. Key factors that are driving the market growth include rising prevalence of chronic diseases, growing geriatric population, and an increasing regulatory support and funding for development of novel blood gas analyzers in the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."