Southeast Asia Biomass Market Size, Share & Trends Analysis Report By Feedstock (Wood Pallets, Palm Kernel Shells), By Technology (Thermal, Combustion, Pyrolysis), By Application, By Product, By End-Use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-305-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Southeast Asia Biomass Market Trends

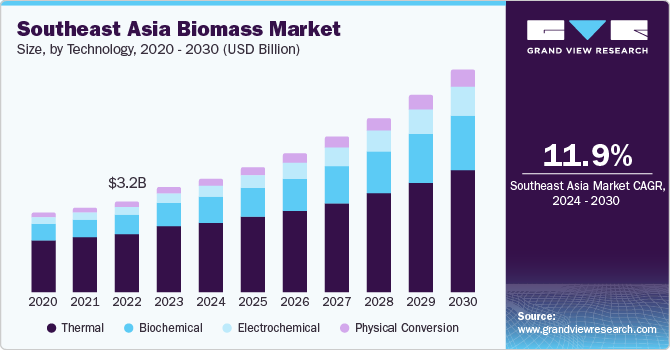

The Southeast Asia biomass market size was estimated at USD 3.68 billion in 2023 and is expected to grow at a CAGR of 11.9% from 2024 to 2030. This robust growth reflects the region's increasing commitment to renewable energy sources, driven by a combination of rising energy demands, environmental sustainability goals, and supportive governmental policies. As Southeast Asia grapples with the challenges of climate change and seeks to reduce its carbon footprint, biomass energy emerges as a critical component of its sustainable energy strategy.

One of the key factors driving the growth of the market in Southeast Asia is the escalating energy demand associated with rapid industrialization and urbanization. As the region continues to develop, the need for reliable and sustainable energy sources becomes more pressing. Biomass energy, derived from organic materials such as agricultural residues, wood pellets, and other biodegradable waste, offers a renewable and eco-friendly alternative to fossil fuels. This not only helps in reducing greenhouse gas emissions but also addresses waste management issues by converting waste materials into valuable energy resources. The dual benefits of energy production and waste reduction make biomass an attractive option for policymakers and businesses alike.

Government support plays a crucial role in fostering the growth of the market. Many Southeast Asian countries have implemented favorable policies and incentives to encourage the adoption of renewable energy sources, including biomass. These measures include feed-in tariffs, tax incentives, and subsidies for biomass energy projects. Such policies create a conducive environment for investment and innovation in the biomass sector. Furthermore, international collaboration and funding from global environmental organizations enhance the capacity of Southeast Asian nations to develop and implement biomass technologies. These efforts are instrumental in overcoming financial and technical barriers, thereby accelerating the deployment of biomass energy solutions across the region.

Technological advancements in biomass processing and utilization are also pivotal to the market's expansion. Innovations in areas such as gasification, pyrolysis, and anaerobic digestion have significantly improved the efficiency and feasibility of converting biomass into energy. These technologies enhance the energy yield from biomass materials and reduce the environmental impact of biomass energy production. As these technologies become more sophisticated and cost-effective, they are likely to see wider adoption, further driving market growth.

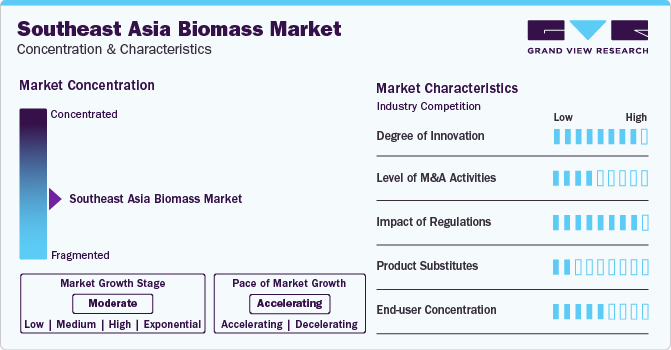

Market Concentration & Characteristics

The Southeast Asia biomass market is a dynamic landscape fueled by abundant agricultural residues, forestry resources, and growing demand for renewable energy. While promising, the market remains fragmented with a mix of established players like Singapore BioEnergy and Drax alongside numerous smaller producers. Biomass producers like QLD Resources and Golden Agri-Resources utilize agricultural waste from palm trees, while others like Real Thailand process wood chips, rice husk, and palm kernel shells.

Despite this diversity, a key challenge lies in ensuring sustainable feedstock production and responsible waste management practices. On the other hand, government initiatives and industry bodies like POREC in Malaysia promote the development of the sector. Furthermore, domestic power generation companies like Malakoff Corporation Berhad and Vietnam Electricity (EVN) are increasingly incorporating biomass into their energy mix, creating a market for biomass-based power solutions. Technology providers like BE Green and Green Enertech are also playing a crucial role by offering innovative technologies for biomass conversion and power generation. Overall, the market presents significant potential for clean energy generation, but requires focused efforts to address sustainability concerns and fragmentation for a robust and responsible future.

Feedstock Insights

Palm kernel shells (PKS) emerged as the largest feedstock segment with a market share of 69.0% in 2023. This dominance highlights the growing recognition of PKS as a valuable resource in various industries, particularly in energy production and manufacturing. The extensive availability of PKS, especially in palm oil-producing regions, combined with its cost-effectiveness and high calorific value, has made it an attractive alternative to traditional fossil fuels. Furthermore, the environmental benefits of utilizing PKS, such as reducing waste and lowering greenhouse gas emissions, have contributed to its increasing adoption. Companies and industries are increasingly incorporating PKS into their operations to enhance sustainability and improve their carbon footprint.

Furthermore, PKS is expected to witness robust growth over the forecast period. This anticipated growth is driven by the continued emphasis on renewable energy sources and the global shift towards more sustainable practices. Governments and regulatory bodies are also playing a crucial role by implementing policies and incentives that promote the use of biomass feedstocks like PKS. Advances in technology are further enhancing the efficiency and applications of PKS, making it even more versatile and appealing. As industries seek to diversify their energy sources and reduce dependence on non-renewable resources, the demand for PKS is likely to soar, solidifying its position as a key player in the feedstock market.

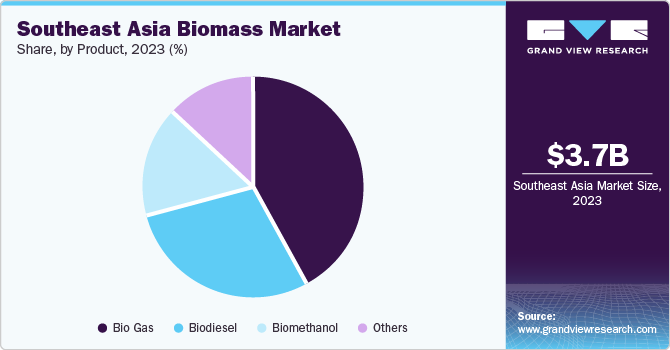

Product Insights

Bio gas emerged as the largest product segment with a market share of 42.1% in 2023. This dominance can be attributed to several key factors driving its widespread adoption and success. One primary reason is the versatility and efficiency of bio gas as an energy source. Produced through the anaerobic digestion of organic matter such as agricultural waste, manure, and municipal waste, bio gas provides a renewable and sustainable alternative to conventional fossil fuels. It can be used for various applications, including electricity generation, heating, and as a vehicle fuel, making it highly valuable across different sectors. Additionally, the production of bio gas helps in waste management by reducing the volume of organic waste and mitigating greenhouse gas emissions, which aligns with global environmental and sustainability goals.

The expected robust growth of the bio gas segment over the forecast period is further fueled by supportive government policies and increasing investments in renewable energy infrastructure. Many countries are implementing regulatory frameworks and financial incentives, such as subsidies, tax breaks, and feed-in tariffs, to encourage the development and utilization of bio gas. Technological advancements are also playing a crucial role in enhancing the efficiency and scalability of bio gas production. Innovations in anaerobic digestion processes and the development of integrated bio refineries are making bio gas production more economically viable and environmentally friendly. As the world continues to shift towards cleaner energy sources to combat climate change, the demand for bio gas is anticipated to rise, solidifying its position as a leading product segment in the renewable energy market.

Technology Insights

Thermal emerged as the largest technology segment with a market share of 63.0% in 2023. This dominance can be attributed to several key factors that underscore its widespread adoption and efficiency. Primarily, thermal technology, which includes processes such as combustion, gasification, and pyrolysis, is highly effective in converting biomass into energy. These processes are well-suited to the abundant biomass resources in Southeast Asia, such as agricultural residues and wood waste, providing a reliable and sustainable energy source. Additionally, thermal technology is relatively mature and well-established, ensuring a higher level of operational reliability and lower risk compared to emerging technologies.

The robust growth forecasted for thermal technology in the market over the coming years is driven by ongoing advancements and investments in this sector. Governments and private entities are increasingly recognizing the importance of renewable energy in meeting both environmental goals and energy security. Incentives, subsidies, and supportive regulatory frameworks are fostering the expansion of thermal biomass projects. Moreover, the scalability and adaptability of thermal technology make it an attractive option for a variety of applications, from small-scale rural energy solutions to large-scale industrial power generation. As the demand for clean, renewable energy sources continues to rise, thermal technology's proven track record and adaptability position it to maintain and potentially expand its market leadership.

Application Insights

Power generation emerged as the largest application segment with a market share of 58.0% in 2023 and is expected to witness robust growth over the forecast period. This dominance can be attributed to the region's pressing need for reliable and sustainable energy sources to meet its growing electricity demands. Southeast Asia's rapid economic growth and urbanization have significantly increased the demand for power, and biomass has proven to be an effective solution. The abundance of biomass resources, such as agricultural residues and forest waste, provides a cost-effective and locally sourced feedstock for power generation. Additionally, biomass power plants offer the dual benefits of waste management and energy production, aligning with the region's environmental goals and reducing reliance on imported fossil fuels.

The robust growth forecasted for power generation in Southeast Asia is driven by supportive government policies and investments in renewable energy infrastructure. Governments in the region are increasingly implementing policies and incentives to promote renewable energy projects, including biomass. These initiatives include feed-in tariffs, tax incentives, and subsidies aimed at encouraging the development of biomass power plants. Moreover, advancements in biomass conversion technologies have improved the efficiency and feasibility of biomass power generation, making it a more attractive option for both public and private sectors. As Southeast Asia continues to prioritize energy security and environmental sustainability, the demand for biomass-based power generation is expected to grow, solidifying its position as the leading application segment in the market.

End-Use Insights

Industrial emerged as the largest end-use segment with a market share of 57.3% in 2023 and is expected to witness robust growth over forecast period. This dominance can be attributed to the extensive energy demands of industrial operations, which often require reliable and large-scale energy sources. Industries such as manufacturing, chemical processing, and food production are energy-intensive, making them prime candidates for adopting alternative energy solutions like biomass. Biomass provides a cost-effective and sustainable energy source that can meet the high energy needs of these sectors while also helping companies reduce their carbon footprint. The availability of various biomass feedstock’s, such as agricultural residues and wood waste, further supports its adoption in industrial applications, offering a steady and local supply of energy resources.

The expected robust growth of the industrial segment over the forecast period is driven by several factors, including favorable government policies and increasing corporate commitments to sustainability. Governments are implementing regulations and incentives to promote the use of renewable energy in industrial processes, such as tax breaks, grants, and renewable energy credits. Additionally, many companies are setting ambitious sustainability targets and looking to renewable energy sources like biomass to achieve these goals. Technological advancements in biomass conversion and energy efficiency are also enhancing the feasibility and attractiveness of biomass for industrial use. As industries seek to enhance their energy security, reduce operational costs, and meet environmental standards, the demand for biomass energy in the industrial sector is projected to grow, reinforcing its leading position in the end-use market.

Country Insights

Indonesia Biomass Market Trends

Indonesia dominated market and accounted for the largest revenue share of 49.1% in 2023. This dominance can be attributed to Indonesia's abundant natural resources and favorable geographical conditions, which make it an ideal location for biomass production. The country is one of the world's largest producers of palm oil, and the resulting biomass by-products, such as palm kernel shells and empty fruit bunches, provide a plentiful and cost-effective feedstock for biomass energy production. Additionally, Indonesia's vast agricultural sector generates significant amounts of agricultural residues, which can be efficiently converted into biomass energy. The combination of these factors ensures a steady and sustainable supply of raw materials for the market, driving its growth and prominence in the region.

The anticipated robust growth of the market in Indonesia over the forecast period is further supported by proactive government policies and increasing investments in renewable energy infrastructure. The Indonesian government has set ambitious renewable energy targets and implemented supportive policies, such as feed-in tariffs, tax incentives, and subsidies, to encourage the development of biomass projects. Moreover, there is growing interest from both domestic and international investors in Indonesia's biomass sector, driven by the country's commitment to reducing carbon emissions and enhancing energy security. Technological advancements and collaborations with international partners are also helping to improve the efficiency and scalability of biomass production in Indonesia. As the country continues to prioritize sustainable development and renewable energy, the demand is expected to expand significantly, solidifying its leading position in the market.

Key Southeast Asia Biomass Company Insights

The market is moderately fragmented with presence of a sizable number of medium and large-sized companies. Key players mainly cater to power generation, heating and others industries. Key companies are adopting several organic and inorganic growth strategies, such as facility expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In December 2023, Sumitomo Corporation signed an agreement with Solariant Capital LLC for experimental trial to manufacture biofuel and biochemical products by using pyrolysis technology with the help of raw materials such as Sugarcane and Wooden Biomass.

-

In March 2023, The Asian Development Bank collaborated with SAEL Industries Limited to sign a loan agreement of approximately USD 91.14 million to promote biomass energy generation using agricultural waste, which helps to diversify India's energy mix and reduce energy intensity carbon. With the help of this collaboration, the Asian Development Bank support will fund the construction of five biomass power plants with a production capacity of 14.9 megawatts in the districts of Jhunjhunu, Churu, Bikaner, Hanumangarh, and Sikar. These five power plants will convert approximately 650,000 tons of agricultural waste into electricity and are expected to generate approximately 544 gigawatt-hours of energy per year.

Key Southeast Asia Biomass Companies:

- DP CleanTech

- Drax Plc

- Singapore BioEnergy

- QLD Resources Berhad

- Malakoff Corporation Berhad

- BE Green

- Asia Renewables Ltd

- Vietnam Biomass Energy JSC (VBE)

- QLD Resources Berhad

- Golden Agri-Resources Ltd

Southeast Asia Biomass Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.97 billion |

|

Revenue forecast in 2030 |

USD 7,788.67 million |

|

Growth rate |

CAGR of 11.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Feedstock, technology, application, product, end-use, country |

|

Country Scope |

Indonesia; Malaysia; Vietnam; Thailand; Brunei; Myanmar; Cambodia; Timor-Leste; Laos; the Philippines; Singapore |

|

Key companies profiled |

DP CleanTech; Drax Plc; Singapore BioEnergy; QLD Resources Berhad; Malakoff Corporation Berhad; BE Green; Asia Renewables Ltd; Vietnam Biomass Energy JSC (VBE); QLD Resources Berhad; Golden Agri-Resources Ltd |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Southeast Asia Biomass Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Southeast Asia biomass market report based on feedstock, technology, application, product, end-use, and country:

-

Feedstock Outlook (Volume, Million Tons, Revenue, USD Million, 2018 - 2030)

-

Wood Pallets

-

Palm Kernel Shells (PKS)

-

-

Technology Outlook (Volume, Million Tons, Revenue, USD Million, 2018 - 2030)

-

Thermal

-

Combustion

-

Pyrolysis

-

Biochemical

-

Fermentation

-

Anaerobic Digestion

-

Electrochemical

-

Physical Conversion

-

-

Application Outlook (Volume, Million Tons, Revenue, USD Million, 2018 - 2030)

-

Power Generation

-

Heating

-

Others

-

-

Product Outlook (Volume, Million Tons, Revenue, USD Million, 2018 - 2030)

-

Biodiesel

-

Bio methanol

-

Bio Gas

-

Others

-

-

End-Use Outlook (Volume, Million Tons, Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Commercial

-

Residential

-

-

Country Outlook (Volume, Million Tons, Revenue, USD Million, 2018 - 2030)

-

Southeast Asia

-

Indonesia

-

Malaysia

-

Vietnam

-

Thailand

-

Brunei

-

Myanmar

-

Cambodia

-

Timor-Leste

-

Laos

-

The Philippines

-

Singapore

-

-

Frequently Asked Questions About This Report

b. The Southeast Asia biomass market size was estimated at USD 3.68 billion in 2023 and is expected to reach USD 3.97 billion in 2024.

b. The Southeast Asia biomass market is expected to grow at a compound annual growth rate of 11.9% from 2024 to 2030 to reach USD 7.79 billion by 2030.

b. Based on feedstock, palm kernel shells (PKS) was the dominant segment in 2023 with a revenue share of about 68.75% in 2023. This is attributable to their abundant availability, cost-effectiveness, and high calorific value. Additionally, PKS offers environmental benefits by reducing waste and lowering greenhouse gas emissions. These factors make PKS an attractive and sustainable feedstock for biomass energy production.

b. Some of the key players operating in this industry include DP CleanTech; Drax Plc; Singapore BioEnergy; QLD Resources Berhad; Malakoff Corporation Berhad; BE Green; Asia Renewables Ltd; Vietnam Biomass Energy JSC (VBE); QLD Resources Berhad; Golden Agri-Resources Ltd

b. The key factors driving the Southeast Asia biomass market include surging electricity demand necessitating reliable sources and government policies promoting renewable energy like biomass, which offers a stable and dependable alternative to solar or wind.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."