- Home

- »

- Medical Devices

- »

-

South Korea Skin Boosters Market Size, Report, 2030GVR Report cover

![South Korea Skin Boosters Market Size, Share & Trends Report]()

South Korea Skin Boosters Market Size, Share & Trends Analysis Report By Type (Mesotherapy, Micro-needle), By Gender (Female, Male), By End-use (Dermatology Clinics, Medical Spa), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-410-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

South Korea Skin Boosters Market Trends

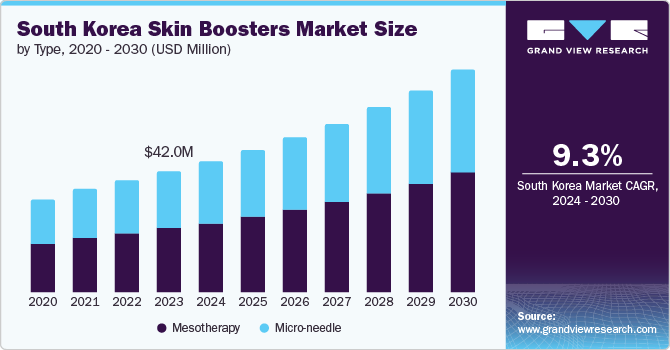

The South Korea skin boosters market size was estimated at USD 42.03 million in 2023 and is anticipated to grow at a CAGR of 9.3% from 2024 to 2030. The increasing prevalence of skin conditions, advancements in skincare technology, and growing influence of Korean beauty trends drive market growth. Rising skin issues such as acne, pigmentation disorders, and early signs of aging are significant drivers for market growth. According to the report published by National Library of medicine, acne vulgaris is a common skin condition, especially in adolescents, affecting over 90% of men and 80% of women by age 21 in Korea. In addition to facial acne, more than half of those affected also experience acne on their chest, back, and shoulders. Notably, around 25% of individuals with both facial and truncal acne do not proactively mention their truncal acne when discussing their symptoms. Urbanization and environmental pollution in South Korea contribute to a higher incidence of skin problems, leading consumers to seek solutions that address these concerns.

South Korea is not just a top destination for K-beauty enthusiasts but also a significant player on the global stage, with its cosmetics market being one of the top ten in the world. According to the International Trade Administration, in 2022, the South Korean beauty market was valued at an impressive USD 3.9 billion, cementing its status as a hub of beauty innovation. Despite a slight decline in local production and exports-down 18.4% and 2.2%, respectively-South Korea remained the fourth-largest cosmetics exporter globally, trailing only behind France, the U.S., and Germany. Country’s total cosmetics iSouth Korea is a top destination for K-beauty enthusiasts and a significant player on the global stage. Its cosmetics market is among the top ten in the world. Mports also saw a modest increase, reaching USD 1.3 billion, with France as the top exporter to South Korea, followed by the U.S. and Japan.

South Korea's advanced skincare industry is known for its innovation and high standards, contributing to a burgeoning demand for skin boosters, products designed to enhance skin hydration, elasticity, and overall texture. The Korean government has supported the skincare and beauty sectors through various initiatives, including research grants and export incentives. In a significant move to drive future growth, the South Korean government announced in March 2023 its plans to invest in advanced technologies for personalized cosmetics. This includes the development of bespoke skincare solutions through sophisticated skin diagnosis programs powered by IoT and big data, aiming to bolster the Korean bio-health industry.

This initiative aligns with South Korean consumers' evolving preferences, who increasingly prioritize health, safety, and authenticity in their beauty products. The 2023 Glowpick 1st Half Awards highlighted this shift, with consumers placing greater value on products that offer genuine benefits and meaningful experiences over those that simply cater to mass consumption. This governmental backing not only aids in technological advancements but also helps South Korean companies penetrate global markets, further stimulating domestic growth.

Skin boosters, which offer targeted treatments for hydration, brightening, and collagen stimulation, have become essential for those looking to counteract the adverse effects of such environmental stressors. Additionally, South Korea's position as a global leader in skincare innovation drives market growth. The country’s emphasis on advanced formulations—such as hyaluronic acid for intense hydration, peptides for boosting collagen production, and vitamin C for brightening—reflects a commitment to cutting-edge solutions that meet consumer demands for visible results. For instance, the introduction of new delivery systems in skin boosters enhances the effectiveness of active ingredients, ensuring deeper penetration and improved outcomes.

Furthermore, the international appeal of K-beauty, characterized by its rigorous skincare routines and emphasis on flawless skin, plays a crucial role. As Korean beauty trends continue to captivate global audiences, there is a growing desire to incorporate these advanced skincare solutions into daily routines, fueling market expansion beyond South Korea’s borders. This combination of increasing skin concerns, technological advancements, and the global allure of K-beauty underscores the strong growth trajectory of the South Korean skin booster market. The rise of digital platforms has also played a crucial role in this market expansion. With the advent of e-commerce and social media, South Korean skincare brands have gained significant international exposure, boosting consumer confidence and driving sales both locally and abroad.

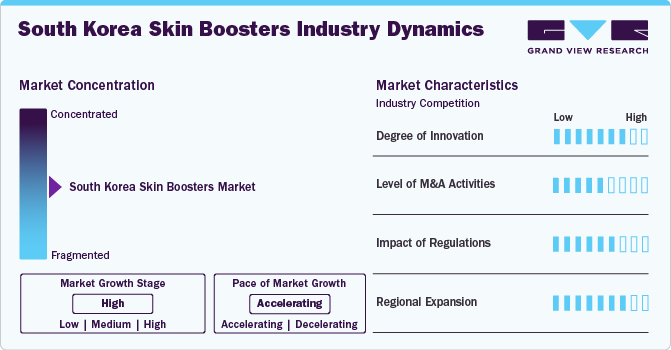

Market Concentration & Characteristics

The South Korea skin booster market is characterized by a high market concentration and significant competition. Established companies benefit from advanced R&D capabilities and extensive resources, which enable them to lead in innovation and product development. For instance, brands like Dr. Jart+ and Innisfree offer specialized skin boosters that cater to particular skin concerns, such as sensitivity or anti-aging, which helps them capture market share.

Innovation is a key driver in the South Korean skin boosters market, with continuous advancements in ingredient formulations and delivery technologies. Companies frequently introduce new products featuring cutting-edge ingredients such as low molecular weight hyaluronic acid for deeper skin penetration or novel peptide complexes to enhance collagen production. For instance, Amorepacific’s advancements in green tea-based boosters illustrate the market's focus on integrating potent, natural ingredients with high efficacy.

The South Korean skin boosters market has witnessed a moderate level of mergers and acquisitions, reflecting the industry's strategic efforts to expand market share and enhance technological capabilities. For instance, in April 2024, Syensqo acquired JinYoung Bio, a South Korean specialist in cosmetic ingredients. This acquisition positions Syensqo to broaden its beauty care portfolio, with a focus on renewable skin care innovations. The move underscores Syensqo's commitment to expanding its offerings. Such strategic moves enable companies to leverage synergies, access new technologies, and enhance their market position. This consolidation trend is indicative of the industry's drive toward greater efficiency and market dominance.

In South Korea, the Ministry of Food and Drug Safety (MFDS) regulates cosmetics, classifying them into two categories: functional and regular. Functional cosmetics-such as whitening, anti-wrinkle, sunscreen, hair colorants, hair nutrients, and products for damaged skin-require pre-market approval from the MFDS. For regular cosmetics, import reviews and certifications are managed by the Korea Pharmaceutical Traders Association (KPTA). Additionally, natural and organic cosmetics face stricter regulations. According to the Cosmetics Labeling Advertisement Guideline, products labeled as natural or organic must meet specific criteria and provide substantial evidence to support these claims. Korean distributors must retain documentation verifying these claims for up to three years from manufacture or customs clearance, or one year post-expiration.

In December 2021, the Ministry of Food and Drug Safety (MFDS) introduced a comprehensive advertisement guideline that incorporates ISO natural and organic indexes to substantiate claims. These indexes include:

-

Natural Index: Represents the percentage of products that meet ISO 16128 standards for natural content.

-

Natural Origin Index: Measures the proportion of products derived from natural sources, as per ISO 16128.

-

Organic Index: Indicates the percentage of organic ingredients in products, calculated based on ISO 16128.

-

Organic Origin Index: Reflects the extent to which product is derived from organic sources according to ISO 16128.

When these ISO indexes are displayed on a product’s packaging, it is mandatory to include a disclaimer stating, "This product is not a natural (or organic) cosmetic according to the standards of the MFDS." This requirement ensures transparency and helps consumers make informed decisions.

Regional expansion is a key trend in South Korea's skin booster market, with brands leveraging the global popularity of K-beauty to enter international markets. COSMOBEAUTY SEOUL, Korea’s top beauty exhibition, highlighted this trend in 2023, featuring 260 companies from seven countries and attracting 14,685 buyers, along with 906 business matchmaking meetings. Similarly, InterCHARM Korea, the largest B2B beauty platform in Korea, offers valuable opportunities for international brands, drawing 25,000 visitors in 2023. This global outreach not only opens new revenue streams for South Korean brands but also strengthens Korea’s influence in the global skincare industry.

Type Insights

Based on type, this market is segmented into mesotherapy and micro needle. Mesotherapy accounted for the largest share of more than 50.0% in 2023 and is also expected to grow at the fastest CAGR over the forecast period. Mesotherapy, a technique involving micro-injection of a customized blend of vitamins, enzymes, hormones, and plant extracts into the mesoderm (middle skin layer), has become increasingly popular in South Korea. This treatment appeals to those seeking significant results with minimal recovery time, fitting well with the country's beauty standards that emphasize both effectiveness and efficiency.

South Korean women frequently choose mesotherapy for its ability to address various skin issues such as dullness and localized fat deposits. The treatment excels in providing targeted hydration, improving skin texture, and offering rejuvenation, all of which are highly valued in South Korea's beauty culture that prizes flawless skin. Furthermore, mesotherapy's fat-reducing benefits contribute to the country's preference for a slim, contoured figure. The rise of mesotherapy's popularity in South Korea can also be attributed to increased awareness and education. Professional training programs, seminars, and extensive media coverage have educated both practitioners and consumers, leading to a better understanding of treatment’s benefits. This growing knowledge base has reinforced mesotherapy's reputation as a reliable and effective cosmetic option.

Gender Insights

Based on gender, the females segment held the largest share of 84.8% in 2023. This dominance is driven by several key factors, including cultural preferences, evolving beauty standards, and recent advancements in aesthetic treatments. For South Korean women, maintaining a flawless complexion is not just a beauty ideal but also a cultural expectation, driving the high demand for such treatments. This focus on skin health and aesthetics has resulted in a significant proportion of female consumers seeking out skin boosters to achieve and maintain their desired look. Moreover, clinics in South Korea are increasingly offering customized solutions based on individual skin needs and conditions, which enhances treatment's effectiveness and aligns with the personalized approach valued by consumers. This trend reflects a broader shift towards more tailored aesthetic solutions in the beauty industry.

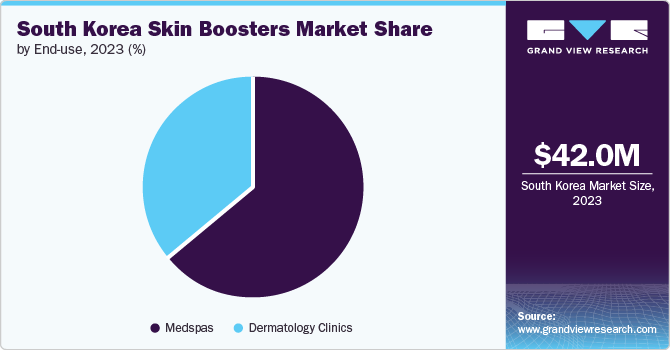

End-use Insights

The medical spa segment held the largest share of more than 60.0% in 2023 and is also expected grow at the fastest CAGR of 10.1% during the forecast period. This rapid expansion is primarily driven by the unique combination of medical expertise and luxurious spa experiences that medical spas offer. These facilities are at the cutting edge of providing advanced skin booster treatments, utilizing state-of-the-art technology and innovative formulations to maximize treatment efficacy.

Medical spas distinguish themselves by integrating advanced equipment and high-quality skin booster products, which are carefully selected to enhance results. The presence of trained medical professionals in these spas is a key factor in their success. These experts offer personalized consultations and tailored treatments to meet individual needs, thereby ensuring both safety and optimal outcomes. The professional oversight provided in medical spas not only boosts the effectiveness of treatments but also fosters greater consumer trust and satisfaction.

Key South Korea Skin Boosters Company Insights

The skin boosters market is characterized by the presence of several key players who dominate the landscape with substantial market share. These companies are leading the industry through technological innovations, extensive distribution networks, and a broad portfolio.

Key South Korea Skin Boosters Companies:

- Bloomage Biotech Co., Ltd.

- Medytox, Inc.

- AbbVie Inc.

- Merz Pharma

- Galderma

- Teoxane

- IBSA Farmaceutici Italia Srl

- PharmaResearch Co., Ltd.

Recent Developments

-

In January 2024, CG Bio, a Korean company specializing in biomaterials, expanded its presence in the U.S. market with its comprehensive anti-aging solutions. The company offers a range of aesthetic products, including fillers and PDO threads, alongside materials for skin and cell regeneration. CG Bio is enhancing its market impact by combining competitive pricing with top-quality educational training for American surgeons, ensuring that both their products and professional development resources meet high standards.

-

In September 2023, Maypharm, aesthetic & beauty supplies from South Korea unveiled its next-generation skin booster, Metoo Healer, a cutting-edge solution designed to enhance skin hydration, texture, and elasticity. This innovative product leverages advanced technology to deliver effective results, making it a significant advancement in skin rejuvenation.

South Korea Skin Boosters Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 45.48 million

Revenue forecast in 2030

USD 77.61 million

Growth rate

CAGR of 9.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, gender, end-use

Country scope

South Korea

Key companies profiled

AbbVie, Inc.; Galderma; Merz Pharma; Teoxane; IBSA Farmaceutici Italia Srl; Bloomage Biotech Co., Ltd.; Medytox, Inc.; PharmaResearch Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

South Korea Skin Boosters Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the South Korea skin booster market report based on type, gender, and end-use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mesotherapy

-

Micro-needle

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Female

-

Male

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medspas

-

Dermatology Clinics

-

Frequently Asked Questions About This Report

b. The South Korea skin boosters market was valued at USD 42.03 million in 2023 and is anticipated to reach USD 45.48 million in 2024.

b. The South Korea skin boosters market is anticipated to grow at a compound annual growth rate (CAGR) of 9.3 % from 2024 to 2030 to reach USD 77.61 million in 2030.

b. The medical spa segment held the largest share of more than 60.0% in 2023 and is also expected grow at the fastest CAGR of 10.1% during the forecast period.

b. Some of the the key players in South Korea Skin Boosters market include AbbVie, Inc.; Galderma; Merz Pharma; Teoxane; IBSA Farmaceutici Italia Srl; Bloomage Biotech Co., Ltd.; Medytox, Inc.; PharmaResearch Co., Ltd.

b. The increasing prevalence of skin conditions, advancements in skincare technology, and growing influence of Korean beauty trends drive market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."