South Korea Botulinum Toxin Type A Market Size, Share & Trends Analysis Report By Application (Upper Face, Mid Face, Lower Face, Body), By Gender ( Female, Male), By Age, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-328-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

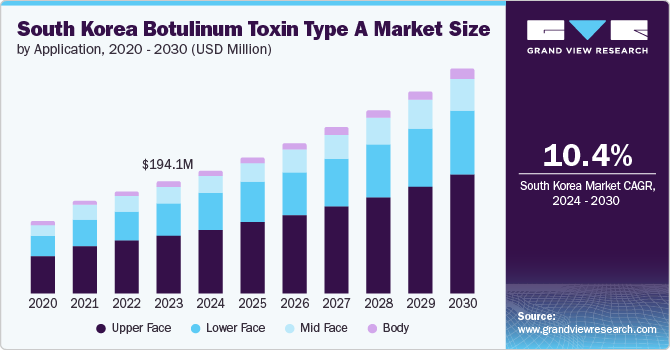

The South Korea botulinum toxin type A market size was estimated at USD 194.1 million in 2023 and is projected to grow at a CAGR of 10.4% from 2024 to 2030. Increasing demand for aesthetic procedures, advancements in technology and techniques, and growing applications for existing products are some of the key factors boosting market growth. According to a news article published in March 2024, about one in five women in South Korea had opted for plastic surgery, indicating a significant trend in the country's cosmetic procedures.

Advancements in technology and techniques are boosting the growth of the market, according to the MDPI article published in May 2022, featuring a diverse range of commercial offerings from both domestic and international brands. Innovations like Liztox (Humedix, Seongnam, Korea) and ReNTox (PharmaResearch Bio, Gangneung, Korea) highlight ongoing advancements and market expansion. This competitive landscape, combined with the competitive pricing of local products, has significantly popularized toxin injections, influencing global market trends. These additions expand the range of options available to clinicians and patients, enhancing the market's ability to address diverse cosmetic indications and patient preferences.

Another key drift is taking place within the paradigm of the Korean botulinum toxin type A industry, as aesthetic injectable companies are gaining prominence across developed countries. Korean players such as Medytox, Hugel, Daewoong, and Huons BioPharma are some of the key South Korean manufacturers entering the two largest botulinum toxin markets, i.e., the U.S. & China. The U.S. market has been primarily dominated by Allergan's product, BOTOX Cosmetic, and the product recorded sales worth nearly USD 1.6 billion in 2022 & 2023 within the country. However, the product's growth has stalled in the country post aggressive marketing & approval by Korean companies.

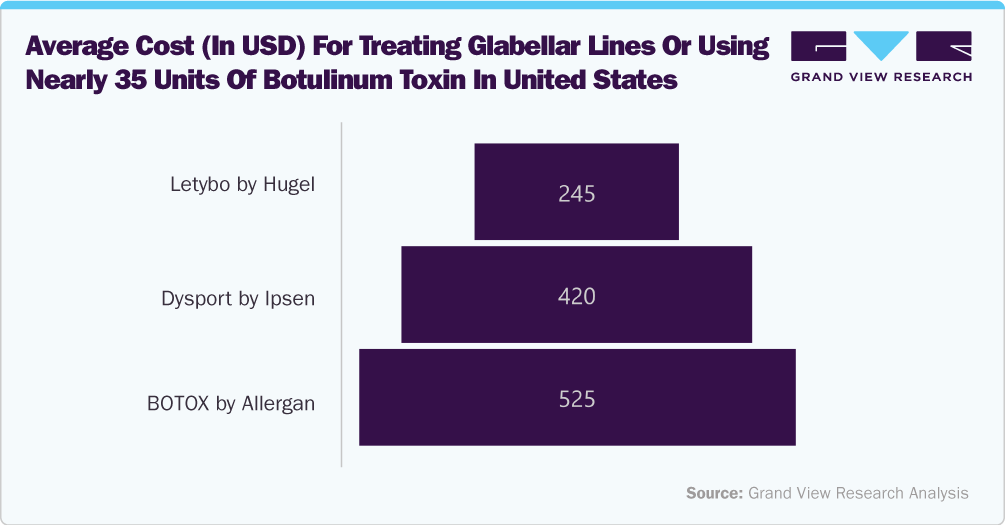

Hugel is expected to launch its botulinum toxin commercially in the U.S. market by late 2024. This development is expected to swirl around the market owing to immense price variations. As the graph above shows, 35 units of BOTOX by Allergan cost nearly USD 525, while Dysport costs nearly USD 420. Thus, launching Letybo at USD 7 per unit could result in significant savings of nearly 110%. A similar pricing range is expected from another competitor, such as Medytox.

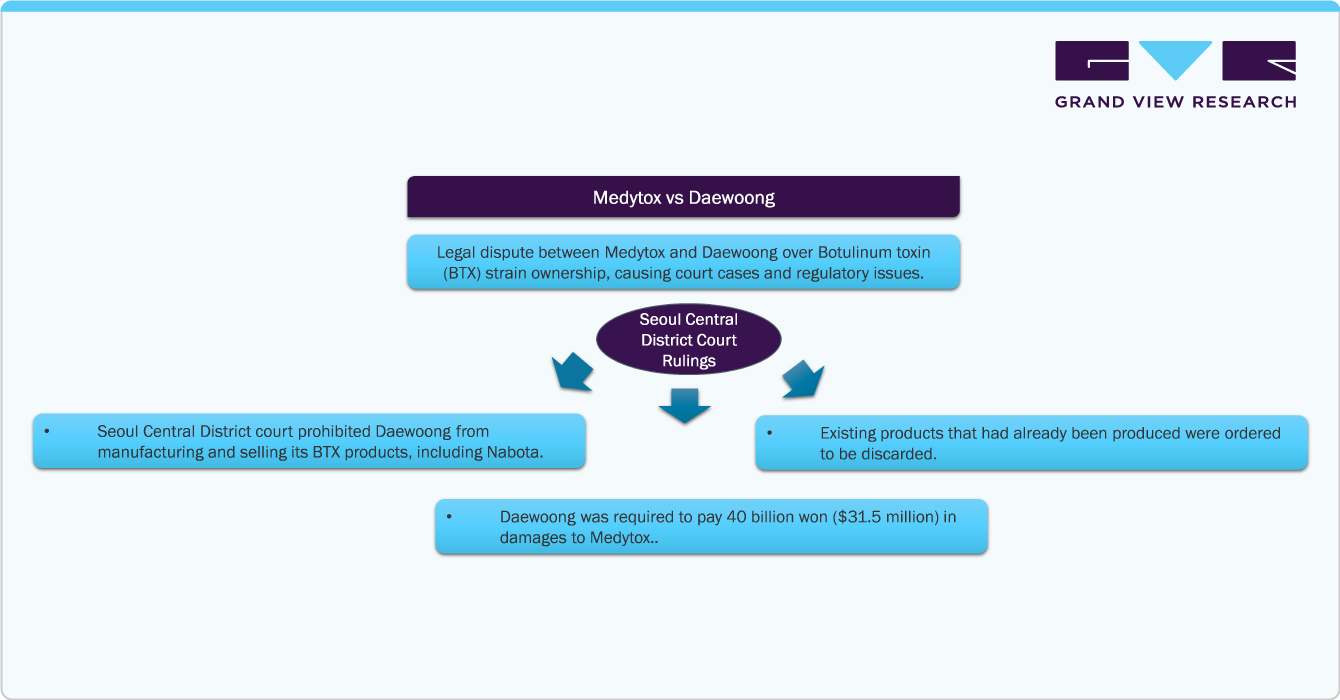

Local market saturation & legal battles within the country are some of the key challenges in the market. According to The Korea Times article published in February 2023, the key challenge in the market is the legal clash between Medytox and Daewoong Pharmaceutical over the ownership of botulinum toxin (BTX) strains used for cosmetic treatments. This conflict has led to court cases and regulatory issues, affecting market dynamics and innovation. Resolving these disputes is essential for ensuring fair competition.

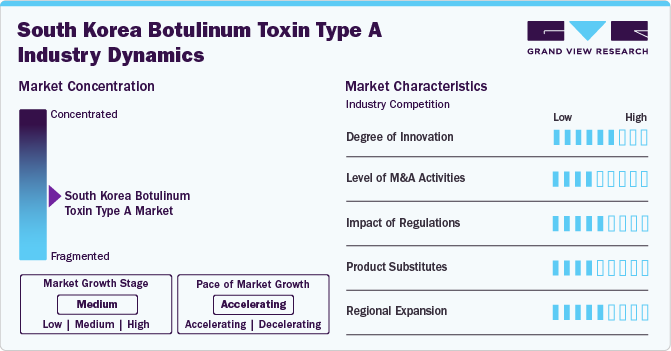

Industry Dynamics

The market is witnessing a high degree of innovation, particularly in product development and treatment techniques. For instance, in October 2023, Sinclair Pharma's parent company, Huadong Medicine Aesthetics Investment (Hongkong) Limited, partnered with ATGC Co., Ltd. to develop and commercialize ATGC-110, a new botulinum toxin type A. It is designed to temporarily improve moderate to severe glabellar lines. Phase 3 trials in South Korea are complete, with ATGC aiming to file for approval with the Korean Ministry of Food and Drug Safety (MFDS). Upon approval, ATGC will co-market ATGC-110 with Sinclair in South Korea.

Several market players, such as Hugel, Medytox, and Daewoong, are involved in mergers and acquisitions. Through M&A activity, these companies employ key strategies such as product innovation, strategic collaborations, and geographical expansion to enhance their presence and address the rising preference for non-invasive or minimally invasive procedures.

Market regulations have a significant impact, setting high standards for product approval and compliance. For example, consensus recommendations have been established to ensure the safe and effective use of BoNT-A in aesthetic treatments among Asians. These guidelines provide standardized practices for clinicians, covering patient characteristics, common cosmetic uses, reconstitution methods, treatment intervals, and management of potential side effects, thereby optimizing treatment outcomes.

Potential product substitutes in the industry product substitutes include dermal fillers, chemical peels, and laser treatments. For instance, hyaluronic acid-based dermal fillers, like Juvederm, offer an alternative for wrinkle reduction and facial volume enhancement, catering to patients seeking non-toxin cosmetic solutions.

Market players are growing their presence by entering new geographical areas, forming partnerships with local distributors, and customizing products to address specific regional healthcare requirements. For instance, in March 2024, Medytox Inc., a biopharmaceutical company based in South Korea, revealed that it has entered into an agreement with Brazilian pharmaceutical firm Blau Farmaceutica SA. The contract specifies that Medytox will supply botulinum toxin products valued at USD 73 million over the span of five years.

Application Insights

The upper face segment held the largest share of over 51.85% in 2023 due to increasing demand for aesthetic treatments to reduce wrinkles in areas such as the forehead, glabella, and crow's feet. For instance, in May 2022, an NCBI article suggested that Glabellar wrinkles were the most treated indication (40.9%) in the upper face by dermatologists, followed by forehead wrinkles (36.1%) and crow's feet (22.9%) among the Korean population. These preferences highlight the significance placed on reducing frown lines and forehead creases, which are key signs of aging and stress among individuals seeking botulinum toxin type A treatments. Moreover, technological advancements and product innovations have improved the precision and longevity of treatments, enhanced patient satisfaction, and led to repeat procedures.

The lower face segment is expected to show lucrative growth during the forecast period. Increasing demand for treatments targeting areas such as the jawline, chin, and neck, where botulinum toxin type A can effectively reduce wrinkles and provide facial contouring. This demand is fueled by rising aesthetic consciousness among South Korean consumers seeking comprehensive facial rejuvenation beyond the traditional upper face treatments. According to the NCBI article published in June 2023, the rising demand for lower face and neck treatments is driven by social media influence and heightened aesthetic awareness. However, a lack of published guidance on evaluating and treating these areas highlights the need for expert advice.

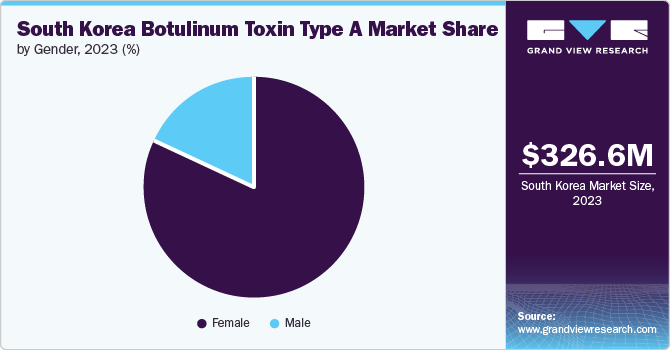

Gender Insights

The female segment held the largest share of 82.02% in 2023 as the women in the country experience early signs of aging and skin dullness, influenced by hormonal fluctuations such as declining estrogen levels. This accelerates aging processes, making women more proactive in seeking treatments like botulinum toxin type A to tackle wrinkles and maintain youthful skin. Moreover, women in South Korea often prioritize personal appearance and invest in treatments like botulinum toxin type A to maintain youthful looks and address signs of aging such as wrinkles and fine lines. This cultural emphasis on beauty and self-care plays a significant role in driving demand among female consumers.

The male segment is expected to grow at the fastest CAGR of 11.9% during the forecast period. It is due to increasing awareness and acceptance of cosmetic procedures among men. Traditionally, societal patterns around male grooming and appearance have shifted, leading to a greater willingness among men to invest in treatments like botulinum toxin for facial rejuvenation and wrinkle reduction. Additionally, advancements in treatment techniques and formulations are provided specifically to male skin concerns, enhancing the efficacy and appeal of these procedures.

Age Insights

The age segment of 31 to 59 held the largest share of over 44.35% in 2023. This age group is concerned with signs of aging, such as wrinkles and fine lines, making botulinum toxin type A injections a popular choice for rejuvenating facial appearance. Moreover, advancements in product formulations and techniques have improved the effectiveness and safety of treatments, catering specifically to the needs and expectations of this demographic. According to an NCBI article published in May 2022, Korean dermatologists estimated a notable preference among Korean adults aged over 40 and those in their 20s to 30s for cosmetic Botulinum Toxin Type A (BoNT-A) injections.

Below 30 Years segment is expected to grow at the fastest CAGR of 11.0% during the forecast period. Younger individuals are increasingly proactive about skincare and aesthetics, starting preventive measures earlier to maintain youthful appearances. This demographic is more open to exploring non-invasive cosmetic treatments like botulinum toxin to address early signs of aging, such as fine lines, and prevent future wrinkles. According to the MilfordMD Cosmetic Dermatology Surgery & Laser Center article published in March 2020, the American Academy of Facial Plastic and Reconstructive Surgery (AAFPRS) reports that 41% of patients cite a fear of looking unnatural as their top concern when considering cosmetic enhancements. There's also been a significant rise in patients under 30 seeking cosmetic treatments. Similar to the U.S., South Korea has used 'Skin Botox' for ten years due to the increasing demand for natural-looking results, particularly among millennials.

End Use Insights

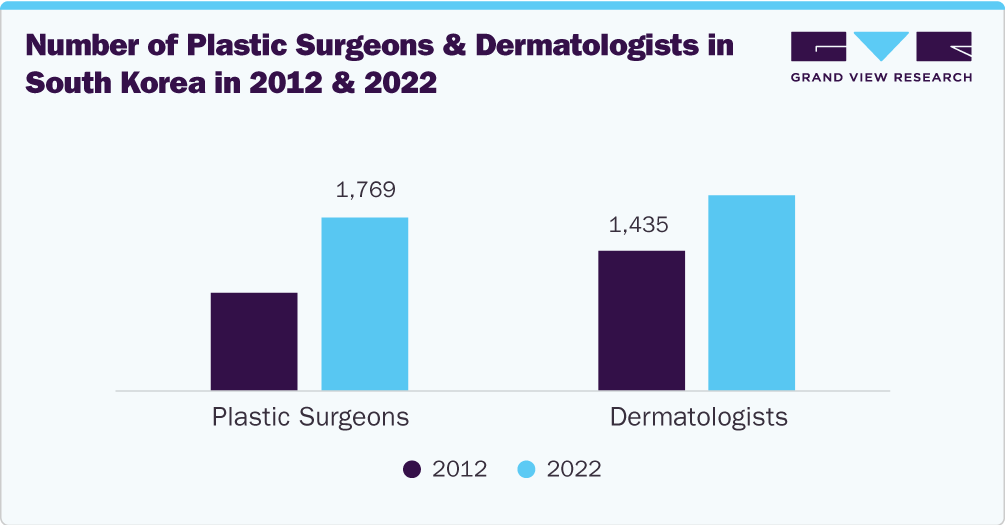

The specialty clinics & aesthetic centers segment held the largest share of over 42.99% in 2023. These facilities provide a range of cosmetic procedures under one roof, serving to diverse patient needs. According to the article published in The Korean Times in January 2024, the number of plastic surgeons at local clinics in South Korea leaped significantly to 1,769 by 2022, marking a 76.4% increase in a decade. Similar growth has been seen in a number of dermatologists and private clinics, amongst others, which illustrates the expanding infrastructure of skilled professionals and facilities capable of offering advanced aesthetic treatments like botulinum toxin injections. Additionally, their strong reputation and patient trust increased the demand for specialty clinics & aesthetic centers.

The medspas segment is expected to show fastest CAGR of 11.2% during the forecast period. Upscale ambiance and relaxing environment fuels the demand for medspas. These facilities offer a spa-like atmosphere combined with medical expertise, appealing to clients seeking a luxurious experience alongside effective treatment. Moreover, increased accessibility and convenience boost the growth of the segment. For instance, these establishments are often conveniently located in urban centers or retail areas, making them easily accessible to busy professionals and residents alike. Additionally, medspas that offer flexible scheduling, online booking options, and efficient treatment procedures offer clients seeking quick and convenient cosmetic enhancements without lengthy downtime.

Key South Korea Botulinum Toxin Type A Company Insights

Some of the key players operating in the industry include Hugel, Medytox and Daewoong. Company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, Huons Global and Pharma Research BIO are some of the emerging players in the South Korea botulinum toxin type A industry. These industry players are continuously focused on niche segments, leveraging specialized technologies to differentiate themselves.

Key South Korea Botulinum Toxin Type A Companies:

- Hugel

- Medytox

- Daewoong

- Galderma

- Ipsen

- Huons Global

- Pharma Research BIO

- AbbVie

Recent Developments

-

In June 2024, Daewoong Pharmaceutical revealed that its global partner, Evolus, has launched Nuceiva in the Spanish market. Nuceiva, developed by Daewoong, is the same botulinum toxin (BTX) product marketed as Nabota in Korea and Jeuveau in North America.

-

In December 2023, Medytox revealed that its subsidiary, NEWMECO, has introduced a new botulinum toxin product called NEWLUX. Approved by the Ministry of Food and Drug Safety in August, NEWLUX represents a next-generation formulation that eliminates animal-derived components from its raw material production.

-

In May 2023, Daewoong Pharmaceutical of South Korea revealed to invest 100 billion South Korean won (about USD 74.6 million) to construct a third manufacturing facility in Korea. This expansion aims to meet rising global demand for its botulinum toxin product, Nabota.

South Korea Botulinum Toxin Type A Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 214.0 million |

|

Revenue forecast in 2030 |

USD 386.9 million |

|

Growth rate |

CAGR of 10.4% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, gender, age, end use |

|

Country scope |

South Korea |

|

Key companies profiled |

Hugel; Medytox; Daewoong; Galderma;Ipsen; Huons Global; Pharma Research BIO; AbbVie |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

South Korea Botulinum Toxin Type A Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the South Korea botulinum toxin type A market report based on application, gender, age and end use:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Upper Face

-

Glabellar Wrinkles

-

Forehead Wrinkles

-

Crow’s Feet

-

-

Mid Face

-

Lower Face

-

Body

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Female

-

Male

-

-

Age Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 30 Years

-

31 to 59 Years

-

Over 60 Years

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics & Aesthetic Centers

-

Medspas

-

Frequently Asked Questions About This Report

b. The South Korea botulinum toxin type A market size was estimated at USD at USD 194.1 million in 2023 and is expected to reach 214.0 million in 2024.

b. The South Korea botulinum toxin type A market is expected to grow at a compound annual growth rate of 10.4% from 2024 to 2030 to reach USD 386.9 million by 2030.

b. The upper face segment held the largest share of over 51.85% in 2023 due to increasing demand for aesthetic treatments to reduce wrinkles in areas such as the forehead, glabella, and crow's feet. Moreover, lower face segment is expected to show lucrative growth during the forecast period.

b. The key players currently operating in this market are Hugel, Medytox, Daewoong, Galderma,Ipsen, Huons Global, Pharma Research BIO, AbbVie, and others.

b. Increasing demand for aesthetic procedures, advancements in technology and techniques, and growing applications for existing products are some of the key factors boosting botulinum toxin type A market growth in South Korea.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."