- Home

- »

- Medical Devices

- »

-

South East Asia Defibrillators Market, Industry Report, 2030GVR Report cover

![South East Asia Defibrillators Market Size, Share & Trends Report]()

South East Asia Defibrillators Market Size, Share & Trends Analysis Report By Product (EDs, ICDs), By End Use (Hospital, Public Access Market, Alternate Care Market), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-417-6

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

South East Asia Defibrillators Market Trends

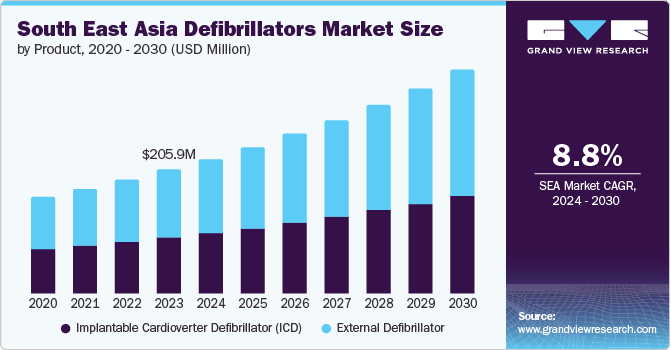

The Southeast Asia defibrillators market size was valued at USD 205.93 million in 2023 and is projected to grow at a CAGR of 8.83% from 2024 to 2030. The increased awareness regarding the critical role of early defibrillation, the growing incidence of impulsive cardiac detentions, innovations in defibrillator technology, and favorable government measures to enhance accessibility to these devices are key factors driving the market. According to WHO, the SEAHEARTS initiative aims to combat cardiovascular diseases in Southeast Asia by enhancing hypertension and diabetes management, integrating non-communicable disease strategies, and leveraging political commitment and investment in primary health care to save lives.

Among Southeast Asia's primary drivers of the defibrillator market, the growing incidence of sudden cardiac arrests is the most prevalent. As per the World Health Organization, the prevalence of sudden cardiac arrest is rising in Southeast Asia (SEA) owing to an aging population, increasing rates of obesity and diabetes, and unhealthy lifestyle habits. For instance, a study published in the Singapore Medical Journal 2021 found that out-of-hospital cardiac arrests in Singapore increased from 16.2 per 100,000 in 2001 to 19.4 per 100,000 in 2016.

Ever-rising awareness about the importance of early defibrillation is another crucial driver of the defibrillator market in Southeast Asia. Numerous public awareness campaigns and educational initiatives have been launched in the region to educate people about the signs & symptoms of sudden cardiac arrest and the need for immediate action, including defibrillators. These efforts have helped to increase the demand for defibrillators in public places, such as airports, shopping malls, and sports facilities. For instance, the Singapore Heart Foundation has been actively promoting the use of automated external defibrillators (AEDs) through its "Save a Life" campaign, which has resulted in the installation of over 1,000 AEDs across the country.

Market Concentration & Characteristics

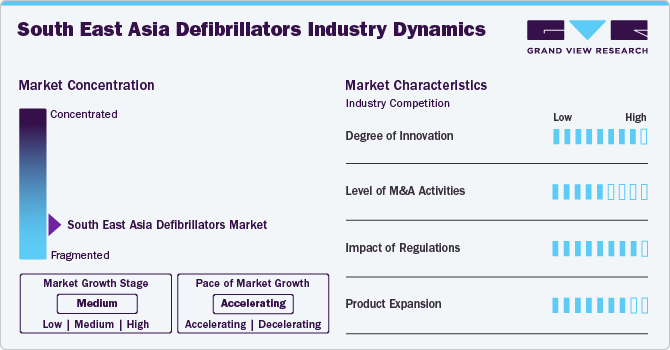

The degree of innovation in the SEA defibrillator market is observed to be high. Companies are increasingly focusing on developing advanced technologies to enhance the effectiveness and usability of defibrillators. For instance, innovations such as automated external defibrillators (AEDs) with real-time feedback mechanisms and smartphone connectivity have emerged, allowing users to receive guidance during emergencies. For instance, Philips HeartStart FRx AED incorporates child mode and CPR coaching features. Additionally, integrating artificial intelligence in monitoring heart rhythms and predicting cardiac events is gaining traction, further driving innovation in this sector.

The level of merger and acquisition activities in this market is medium. The market saw strategic consolidations to enhance product portfolios and expand geographical reach. Such acquisitions are often motivated by leveraging complementary technologies or entering new markets more effectively. However, while there are notable transactions, the overall frequency remains moderate compared to other healthcare sectors due to regulatory complexities and high capital requirements associated with medical device manufacturing.

The impact of regulations on the SEA defibrillator market is high. Regulatory bodies across Southeast Asia impose stringent guidelines for medical equipment to ensure safety & efficacy before they can be marketed. For example, Singapore's rigorous pre-market approval processes require extensive clinical data demonstrating a device's performance. The ASEAN medical device directive also aims to harmonize regulations across member states but still needs to improve due to varying local compliance requirements. These regulatory frameworks can significantly affect time-to-market for new products and influence investment decisions within the industry.

Product expansion in the SEA defibrillator market is high as manufacturers continuously seek to diversify their offerings beyond traditional models. Companies are introducing portable AEDs designed for public access in public places such as airports and shopping malls, reflecting a growing awareness of sudden cardiac arrest incidents outside hospital settings. For instance, Zoll Medical Corporation expanded its product line with innovative AEDs catering to non-technical persons while ensuring ease of use during emergencies. Furthermore, there’s an increasing trend toward integrating telemedicine capabilities into defibrillators for remote monitoring and support during critical situations.

Product Insights

The external defibrillator segment led the market with the largest revenue share of 53.95% in 2023. The increasing prevalence of cardiovascular diseases (CVDs) across the region heightened the demand for effective emergency medical devices, with external defibrillators being critical in treating life-threatening arrhythmias such as ventricular fibrillation and pulseless ventricular tachycardia. Furthermore, government initiatives to improve public health infrastructure and emergency response systems led to more significant investments in healthcare facilities and training programs for non-technical persons and first responders on effectively using these devices.

The Implantable Cardioverter Defibrillator (ICD) segment represented a significant market share in 2023. The aging population in SEA countries is also a significant contributor, as older adults are more susceptible to heart-related ailments that necessitate advanced interventions such as ICDs. Moreover, technical advancements have led to the development of more sophisticated and patient-friendly ICD devices that offer remote monitoring and improved battery life, enhancing their appeal among healthcare providers and patients.

End Use Insights

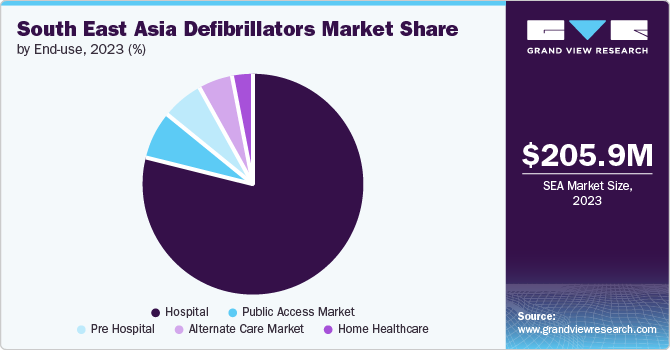

Hospitals held the largest share with over 78.69% in 2023, owing to the higher volume of cardiac cases in hospitals and surgeries performed in hospital settings. Hospitals are increasingly investing in state-of-the-art technology to improve emergency response capabilities and ensure compliance with international health standards. Furthermore, favorable government initiatives to improve healthcare infrastructure and access to emergency medical services have increased hospital funding, enabling them to procure more defibrillators. The increasing awareness of sudden cardiac arrest & the importance of immediate intervention has also prompted hospitals to prioritize training staff on using these devices effectively.

The public access market segment is anticipated to experience the fastest CAGR from 2024 to 2030, driven by increasing efforts to enhance the accessibility of automated external defibrillators (AEDs), train individuals in their use, and improve responses to sudden cardiac arrest incidents. Furthermore, the rise in awareness campaigns, strategic placement of AEDs in busy public areas, and implementation of public access defibrillation initiatives all contribute to the growing demand in this sector. The focus on making AEDs more readily available to the general population is part of a more significant commitment to enhancing emergency response capabilities and minimizing the time it takes to respond during cardiac emergencies.

Regional Insights

Singapore Defibrillators Market Trends

led the market with the largest revenue share of 24.17% in 2023. Increasing prevalence of cardiovascular diseases, heightened awareness about sudden cardiac arrests, and favorable government initiatives aimed at enhancing emergency response capabilities are the major drivers for this market. For instance, Singapore’s Ministry of Health launched campaigns to promote the use of AEDs in public spaces, increasing accessibility and encouraging bystander intervention during cardiac emergencies.

Indonesia Defibrillators Market Trends

Indonesia represented a significant share of the market in 2023. The increasing prevalence of cardiovascular diseases, which are among the leading causes of mortality in Indonesia, heightened awareness regarding the importance of immediate medical response and access to life-saving devices such as defibrillators. Multiple government initiatives to improve healthcare infrastructure and emergency response systems also significantly boosts market growth. For instance, campaigns promoting public access to AEDs in public places such as airports, shopping malls, and schools have been implemented to enhance community preparedness for cardiac emergencies. For instance, the enhanced AED-on-Wheels Programme launched on February 25, 2022, to provide drivers in Singapore with Automated External Defibrillators (AEDs) for their privately-owned vehicles.

Key South East Asia Defibrillators Company Insights

The South East Asia defibrillators market faces fierce competition, prompting players to adopt various strategic measures to enhance their market presence. These strategies encompass product innovation, geographical expansion, partnerships, collaborations, and mergers and acquisitions. For instance, in August 2022, Medtronic announced that it had successfully met the trial endpoints for its experimental extravascular implantable cardioverter defibrillator (EV ICD) system. This advanced device aims to reduce certain risks linked with conventional trans venous ICDs by positioning its lead outside the heart and veins beneath the sternum, utilizing a minimally invasive technique.

Key SEA Defibrillator Companies:

- Medtronic

- St. Jude Medical, LLC

- Boston Scientific Corporation

- Philips

- Zoll Medical Corporation

- Cardiac Science

- Physio-Control Inc.

- Nihon Kohden Corporation

- Progetti Srl

- FUKUDA DENSHI

- Schiller AG

Recent Developments

-

In December 2023, BIOTRONIK announced the opening of its new Asia Manufacturing and Research Hub. This facility, covering 20,000 m², is Asia's main center, employing hundreds of staff across manufacturing, quality assurance, research and development (R&D), and sales and marketing.

-

In June 2024, Stryker unveiled its newest product in the monitor/defibrillator category, the LIFEPAK 35 monitor/defibrillator.

South East Asia Defibrillators Market Report Scope

Report Attribute

Details

Revenue forecast in 2024

USD 223.85 million

Revenue forecast in 2030

USD 371.88 million

Growth rate

CAGR of 8.83% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Key companies profiled

Medtronic; St. Jude Medical, LLC; Boston Scientific Corporation; Philips; Zoll Medical Corporation; Cardiac Science; Physio-Control Inc.; Nihon Kohden Corporation; Progetti Srl; FUKUDA DENSHI; Schiller AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

South East Asia Defibrillators Market Report Segmentation

This report forecasts revenue growth in South East Asia and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the SEA defibrillators market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Implantable Cardioverter Defibrillator (ICD)

-

S-ICD

-

T-ICD

-

Single Chamber

-

Dual Chamber

-

CRT-D

-

-

-

External Defibrillator

-

Manual ED

-

Automated ED

-

Wearable cardioverter defibrillators

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Pre hospital

-

Public Access market

-

Alternate care market

-

Home healthcare

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

South East Asia

-

Singapore

-

Philippines

-

Thailand

-

Malaysia

-

Indonesia

-

Rest of Southeast Asia

-

-

Frequently Asked Questions About This Report

b. The Southeast Asia defibrillators market size was valued at USD 205.93 million in 2023 and is projected to reach USD 223.85 million in 2024.

b. The Southeast Asia defibrillators market is projected to grow at a compound annual growth rate (CAGR) of 8.83% from 2024 to 2030 to reach USD 371.88 million in 2030.

b. The external defibrillator segment led the market with the largest revenue share of 53.95% in 2023. The increasing prevalence of cardiovascular diseases (CVDs) across the region heightened the demand for effective emergency medical devices.

b. Some of the key players in SEA Defibrillators market include Medtronic, St. Jude Medical, LLC, Boston Scientific Corporation, Philips, Zoll Medical Corporation, Cardiac Science, Physio-Control Inc., Nihon Kohden Corporation, Progetti Srl, FUKUDA DENSHI, Schiller AG.

b. The increased awareness regarding the critical role of early defibrillation, the growing incidence of impulsive cardiac detentions, innovations in defibrillator technology, and favorable government measures to enhance accessibility to these devices are key factors driving the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."