South East Asia Construction Coatings Market Analysis By Product (Water Borne, Solvent Borne, Powder), By End-use (Residential, Non-Residential, Infrastructure), By Country, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-251-8

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2014 - 2016

- Forecast Period: 2017 - 2025

- Industry: Bulk Chemicals

Industry Insights

The South East Asia construction coatings market size was valued at USD 3.81 billion in 2016. Rising demand for various coatings such as powder, waterborne, and solvent-borne coupled with the growing construction industry is expected to elevate the product demand over the forecast period.

Supportive government policies to improve education infrastructure is expected to propel non-residential construction, which, in turn, is likely to increase the product demand over the forecast period. In addition, the growing tourism sector is further expected to propel product demand.

Infrastructure restructuring plans adopted by countries such as the Philippines and Vietnam are expected to drive the demand. The increasing use of reflective coatings for warning signs during road construction is likely to provide a positive scope for market growth over the next eight years.

The Asia Pacific is likely to observe an increase in its construction expenditure over the forecast period due to quick urbanization coupled with an increase in population. Overall, Asia Pacific capital project and infrastructure market are likely to register 7.0% to 8.0% growth a year over the next decade, approaching USD 5,300.0 billion by 2025 and representing nearly 60.0% of the world total market.

The growing construction industry in Southeast Asian economies is likely to drive market demand over the forecast period. Increased urbanization, government spending, investment, and consumer spending are likely to increase infrastructure development in the region. The Philippines is predicted to display the fastest growing CAGR, in terms of revenue, over the forecast period.

Southeast Asian countries including Thailand, Indonesia, and Malaysia have competitive advantages such as low labor costs and the availability of raw material. These factors are likely to drive the growth of the construction industry in the region which, in turn, is expected to drive demand over the forecast period.

Southeast Asia market is controlled by different regulatory agencies with protocols & norms ranging from environmental to economic policies. Thailand has implemented rules regarding lead paints under the Industrial Products Standards Act to control the use of heavy metals such as lead. Such coatings are mainly used in waterproofing, rot proofing, and decorative purposes in the building & construction sector.

Product Insights

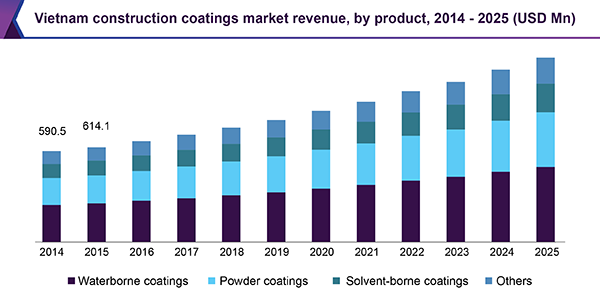

Waterborne coatings accounted for a major volume share of 37.5% in 2016 on account of its properties such as stain resistance, corrosion resistance, hardness, and flexibility. It is used as a coating for the external environment to improve wear resistance, thermal protection, and corrosion/glazing. These beneficial features of waterborne coatings are expected to augment the growth of the market over the forecast period.

Conventional solvents and organic solvents are the two types of solvents. Conventional solvents comprise alcohols, glycol ethers, acetate esters, hydrocarbons, ketones, and chlorinated. Organic solvents are mainly used in traditional applications including manufacturing industries and dry cleaning. This segment is projected to witness CAGR of 4.5%, in terms of volume, from 2017 to 2025.

Powder-based coatings are more economical and cover more surface area in comparison to other organic solvents. These reduce the labor cost due to the low requirement of training and guidance for operators. Powder-based paint technology results in less waste production and low energy & disposal costs.

Powder-based coatings are VOC-free and contain no solvents, unlike other paints that contain toxic solvents and higher VOC components. Hence, powder-based paints are eco-friendly and meet all EPA requirements for water/air pollution. Such factors are expected to propel the demand for the product over the forecast period.

Application Insights

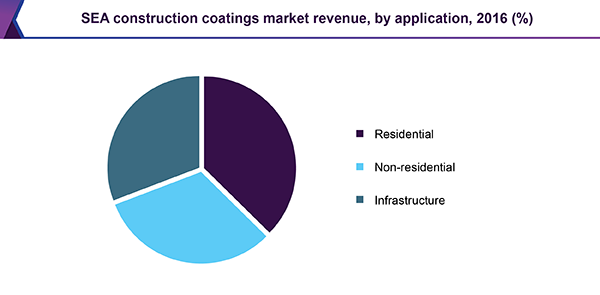

The residential segment witnessed a volume share of 37.6% in 2016. The policies introduced by the Philippines government to increase employment through the infrastructure sector is likely to provide a positive scope for market growth over the forecast period. In the first quarter of 2015, the government of Philippines sanctioned projects to build 25,000 residential condominiums in a span of 2 years, which is expected to drive market growth.

Non-residential applications include malls, cinema theaters, restaurants, educational institutes, and office buildings. The rising focus on tourism is expected to increase the development of entertainment complexes in the region. The product is likely to witness high demand from the education sector due to increasing government investments in the construction of educational institutes.

Rapidly developing industrial sector in Malaysia is expected to increase the demand for office buildings and manufacturing units, which, in turn, is likely to increase the demand for the product. However, volatile raw material prices and increasing concerns toward the environment are likely to impact the construction industry and, therefore, restrain the market growth.

Infrastructure application is projected to register a CAGR of 5.7%, in terms of volume, over the forecast period. The segment includes public infrastructure such as roads, ports, drainage systems, and bridges. Increasing use of reflective coatings in road construction is expected to drive the market over the forecast period.

Regional Insights

Indonesia accounted for the largest volume share of 25.0% in 2016. Overall infrastructure spending in Indonesia is anticipated to grow around USD 165.0 billion by 2025. In addition, public investments are likely to grow by around 7.0% per annum. These factors are expected to drive the building sector in Indonesia over the forecast period, which, in turn, is anticipated to propel the product demand in the future.

The Vietnam construction industry recorded a growth of 9.1% in 2016 and is anticipated to expand over the forecast period on account of investments in affordable housing projects, transport infrastructure, and energy & utilities. In addition, the country’s government-financed educational healthcare buildings and public infrastructure as a part of the 2016–2020 Development Plan, which is likely to propel the demand for the product in the country.

Infrastructure investments in Malaysia increased from USD 6.0 billion to USD 16.0 billion between 2005 and 2013. Infrastructure expenditure is anticipated to register a 9.0% growth per annum by 2025. The government has been working to meet the country's housing shortage, which is likely to have a positive impact on the construction coatings industry over the forecast period.

The Philippines accounted for a revenue share of 14.0% in 2016. Infrastructure spending of the country is anticipated to reach USD 27.0 billion by 2025, growing at 10.0% per annum in the next decade. In addition, at least 25,000 residential condominiums are likely to be built in Manila’s main business districts in the next few years. At least 37 projects in total are currently active, which are predicted to boost the construction sector.

Competitive Insights

The industry is extremely competitive in nature with the presence of a large number of market players in the region. BASF, AkzoNobel NV, DuPont, Performance, Coatings, PPG Industries, and Asian Paints are some of the major manufacturing companies in construction coatings for end-use industries in the SEA region.

Key players in the regional market have adopted sustainable solutions keeping in mind the long-term benefits and the prevailing regulatory scenario. Some companies are now focusing on sustainable methods to manufacture coatings that are high quality and minimal Volatile Organic Component (VOC).

Report Scope

|

Attribute |

Details |

|

Base year for estimation |

2016 |

|

Actual estimates/Historical data |

2014 - 2016 |

|

Forecast period |

2017 - 2025 |

|

Market representation |

Revenue in USD Million, Volume in Kilotons, and CAGR from 2017 to 2025 |

|

Regional scope |

South East Asia |

|

Country scope |

Indonesia, Vietnam, Malaysia, Philippines, Thailand, and Singapore |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

Market information, which is not currently within the scope of the report, we will provide it to you as a part of customization |

Segments Covered in the Report

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the SEA construction coatings market on the basis of product, end use, and country.

-

Product Outlook (Revenue, USD Million; Volume, Kilotons; 2014 - 2025)

-

Powder coatings

-

Waterborne coatings

-

Solvent-borne coatings

-

Others

-

-

End-use Outlook (Revenue, USD Million; Volume, Kilotons; 2014 - 2025)

-

Residential

-

Non-residential

-

Infrastructure

-

-

Country Outlook (Revenue, USD Million; Volume, Kilotons; 2014 - 2025)

-

Indonesia

-

Vietnam

-

Malaysia

-

Philippines

-

Thailand

-

Singapore

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."