South Africa Hospitality Point Of Sale Software Market Size, Share & Trends Analysis Report By Application, By Deployment (Cloud, On-premise), By Organization Size, By End-use, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-451-1

- Number of Report Pages: 45

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

The South Africa hospitality point of sale software market was valued at USD 114.5 million in 2024 and is projected to grow at a CAGR of 9.7% from 2025 to 2030. This growth can be attributed to the rapid expansion of hotels, restaurants, and cafes across the region, which has increased the demand for advanced Point of Sale (POS) solutions to optimize transaction processing, inventory management, and operational workflows, thereby enhancing efficiency and service quality. Furthermore, the growing adoption of modern payment methods, such as mobile and contactless transactions, is further contributing to the market's expansion.

A major contributor to this growth is the heightened focus on customer experience. In a highly competitive market, hospitality businesses prioritize personalized services to meet evolving consumer needs. Moreover, POS software allows these businesses to manage customer preferences, process orders and payments efficiently, and deliver seamless service. These capabilities enhance customer satisfaction, encourage repeat business, and drive revenue. In addition, adopting modern payment methods, such as mobile and contactless payments, is fueling demand for flexible and secure POS systems.

Furthermore, technological advancements are significantly transforming the South Africa hospitality POS software industry. Cloud-based systems enable real-time data access and analytics, facilitating faster and more informed decision-making. Meanwhile, mobile POS solutions offer flexibility and improved service delivery, catering to the growing consumer preference for convenience. Hence, these innovations help businesses optimize operations, reduce manual errors, and enhance overall performance, reinforcing the South Africa hospitality point of sale software industry's upward trajectory.

Application Insights

The fixed segment dominated the market with a 54.9% share in 2024. This dominance can be attributed to large enterprises' preference for fixed POS terminals, which provide enhanced data security and operational control. Moreover, hospitality businesses rely on fixed systems to efficiently manage inventory, order processing, and customer management. In addition, the reliability and stability of fixed POS solutions make them ideal for high-traffic environments such as hotels and restaurants, ensuring seamless transaction processing. Hence, the fixed segment is expected to continue its leading position during the forecast period.

The mobile segment of the South Africa hospitality point of sale software industry is projected to achieve the fastest CAGR during the forecast period. This growth is attributable to the increasing demand for mobile POS systems, which enhance operational efficiency, table turnover, and customer service. Moreover, the integration of mobile POS solutions allows for accurate dish information and suggestive selling, particularly benefiting restaurants and cafes. Furthermore, the affordability and widespread use of smartphones and tablets are accelerating adoption. The mobile segment is set for substantial growth, with businesses seeking to optimize costs and improve service delivery.

Deployment Insights

The cloud segment held the largest market share in 2024. This dominance can be attributed to the growing demand for real-time data access and operational flexibility among hospitality businesses. Furthermore, technological advancements have made cloud solutions more affordable and user-friendly, increasing their accessibility. In addition, seamless integration with inventory and customer management tools has also enhanced their appeal. Consequently, many hospitality businesses are transitioning to cloud-based POS systems to improve operational efficiency and deliver superior customer service.

The on-premise segment of the South Africa hospitality POS software industry is expected to grow significantly, driven by increasing demand for enhanced data security and operational control. Rising concerns over data breaches and cyber threats are prompting businesses to adopt on-premise solutions to safeguard sensitive customer information. In addition, the need for reliable performance without reliance on internet connectivity further supports this preference. This trend highlights the strong market presence of on-premise systems during the forecast period.

Organization Size Insights

The large enterprise segment held the largest market share in 2024. This dominance is due to the significant investments made by large businesses in specialized POS solutions that cater to their complex operational needs. In addition, large enterprises require advanced systems that integrate various functions, such as inventory management, customer relationship management, and financial reporting. Furthermore, the ability of these systems to enhance efficiency and improve customer interactions makes them particularly appealing. Consequently, the demand for sophisticated POS solutions among large enterprises is expected to remain strong, driving steady growth in this segment.

The SME segment is expected to experience the highest CAGR over the forecast period. This growth is attributable to the increasing adoption of POS solutions among SMEs as they seek to improve transaction efficiency and inventory management. Many SMEs are looking for affordable and user-friendly POS systems to enhance customer service and streamline operations. The rise of digital payments and mobile transactions is also contributing to the demand for POS solutions. Hence, SMEs are expected to significantly contribute to the overall growth of the South Africa hospitality POS software industry in the coming years.

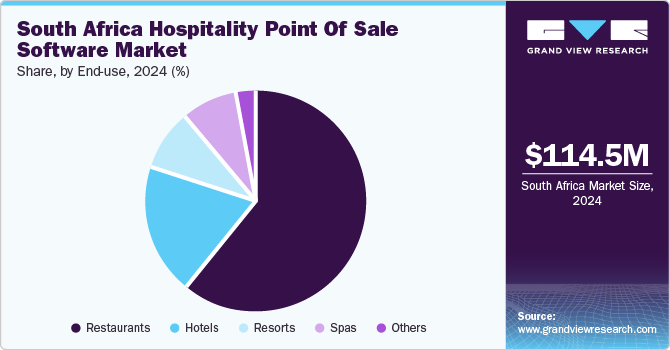

End-use Insights

The restaurant segment dominated the market in 2024. This dominance can be attributed to the strong demand for tailored solutions in the food service industry. In addition, the need for efficient transaction processing and effective inventory management also contributed to this growth. Furthermore, innovations such as mobile applications and touchless payment options are enhancing POS system functionality. With restaurants adapting to evolving consumer preferences, the demand for advanced POS solutions in this segment is expected to remain strong in the coming years.

The spas segment is anticipated to witness the fastest CAGR over the forecast period. This growth is attributable to the increasing consumer focus on wellness and self-care, leading to a higher demand for spa services. Moreover, with the growing demand for relaxation and rejuvenation, spas are expanding their offerings to attract a broader clientele. In addition, the rising trend of wellness tourism is contributing to this segment's growth as travelers increasingly incorporate spa experiences into their trips. Overall, the spas segment is well-positioned to capitalize on these trends and expand rapidly in the coming years.

Key South Africa Hospitality Point Of Sale Software Company Insights

The South Africa hospitality POS software market is dominated by key players such as Oracle, NCR Voyix Corporation, Clover Network, LLC, POS Tech Direct, and Lightspeed. These organizations are focusing on expanding their customer base and gaining a competitive edge in the market. In order to achieve this, key players are actively pursuing several strategic initiatives, such as mergers and acquisitions, as well as forming partnerships with other leading companies.

-

Oracle is a global leader in cloud computing, renowned for delivering robust and innovative solutions across various industries, including hospitality. Its comprehensive point-of-sale system integrates seamlessly with Oracle’s cloud infrastructure, improving operational efficiency and enhancing customer experiences. With a focus on security, scalability, and continuous innovation, Oracle empowers businesses to optimize operations and deliver exceptional service.

-

NCR Voyix Corporation is a leading provider of digital commerce solutions, specializing in point of sale software for the retail and restaurant industries. The company focuses on enhancing customer interactions through innovative technology and integrated systems. Its solutions are designed to improve operational efficiency and drive business growth.

Key South Africa Hospitality Point Of Sale Software Companies:

- Oracle

- NCR Voyix Corporation

- Clover Network, LLC

- POS Tech Direct

- Lightspeed

- ThinnPro

- Block, Inc.

- Sapaad Pte Ltd

- inTouch Point of Sale

- TouchBistro

Recent Development

-

In January 2024, NCR Voyix Corporation introduced its Next Generation Self-Checkout Solution to enhance the retail checkout experience. Moreover, this SaaS-based solution supports assisted and self-checkout, accommodating cash and cashless transactions. Furthermore, leveraging technologies such as barcode scanning and computer vision reduces friction in shopping, addressing evolving consumer demands for efficiency and convenience.

-

In September 2024, TouchBistro launched its inventory and labor management solutions following the acquisition of Peachworks, aiming to enhance its back-of-house offerings for restaurants. This new software integrates seamlessly with the existing TouchBistro POS system, providing real-time data insights for improved decision-making. Ultimately, TouchBistro reaffirmed its commitment to helping restaurant operators manage costs and optimize resources effectively.

South Africa Hospitality Point Of Sale Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 126.4 million |

|

Revenue forecast in 2030 |

USD 200.4 million |

|

Growth rate |

CAGR of 9.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, deployment, organization size, end-use |

|

Key companies profiled |

Oracle; NCR Voyix Corporation; Clover Network, LLC; POS Tech Direct; Lightspeed; ThinnPro; Block, Inc.; Sapaad Pte Ltd; inTouch Point of Sale; TouchBistro |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

South Africa Hospitality Point Of Sale Software Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the South Africa hospitality point of sale software market report based on application, deployment, organization size, and end-use:

-

Application Outlook (USD Million, 2018 - 2030)

-

Fixed

-

Mobile

-

-

Deployment Outlook (USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Organization Size Outlook (USD Million, 2018 - 2030)

-

Large Enterprise

-

SME

-

-

End-use Outlook (USD Million, 2018 - 2030)

-

Restaurants

-

Spas

-

Hotels

-

Resorts

-

Others

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."