South Africa Business Process Outsourcing Market Size, Share & Trends Analysis Report By Service, By Type (Offshore, Onshore, Nearshore), By Deployment (On Premise, Cloud), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-314-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

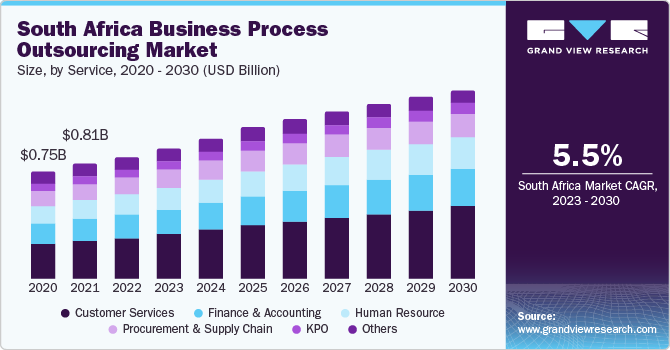

The South Africa business process outsourcing market size was valued at USD 1.85 billion in 2023 and is projected to grow at a CAGR of 10.1% from 2024 to 2030. The country’s strategic location to serve the European market, its sizable talent pool of skilled and multilingual professionals, and favorable government policies have contributed to steady market growth. Organizations worldwide are increasingly outsourcing routine tasks to focus on their core competencies, leading to significant cost savings.

South Africa offers competitive operational costs that are significantly lower than those in developed markets such as the UK, the U.S., and Australia, making it an appealing option for companies looking to reduce their expenses without compromising on service quality. As operational costs in competing economies such as India, the Philippines, and Indonesia continue to rise, businesses are compelled to outsource their routine operations to South Africa.

The integration of advanced technologies, including Artificial Intelligence (AI) and automation, is reshaping the BPO landscape in the economy. South Africa is witnessing a shift towards Business Process as a Service (BPaaS), with this technology expected to expand significantly. This transition allows BPO providers to enhance service delivery and operational capabilities, thereby attracting more international clients. Moreover, the availability of a large, skilled, and diverse talent pool is another critical factor for industry growth. The South African workforce is highly proficient in English with a neutral accent, which aligns well with the requirements of Western markets. The demographic composition is favorable, with a significant percentage of youth and female employees, enhancing the sector's appeal to global companies seeking to establish their operations in the country.

The South African government has been proactive in supporting the BPO sector through various initiatives, including financial incentives and infrastructural developments. Projects such as the Monyetla Work Readiness Programme aim to increase the pool of employable talent, while significant funding has been allocated to support the growth of the BPO industry. This government backing has been crucial in developing an environment suited for industry expansion. The global business process outsourcing (BPO) market is projected to grow substantially, with significant opportunities for South Africa to capture a larger share. As international companies increasingly seek cost-effective outsourcing solutions, South Africa's established reputation as a reliable BPO destination has positioned it favorably in the global market.

Type Insights

The offshore segment accounted for the largest revenue share of 64.7% in 2023. This is owing to the country's strategic location and time zone overlap with several European markets, facilitating seamless communication and collaboration and making it an attractive destination for international clients seeking to outsource their business processes. Additionally, South Africa's well-developed infrastructure, robust telecom sector, and reliable transportation network have ensured efficient and effective delivery of BPO services to global clients. Furthermore, the country's expertise in specialized verticals such as financial services, healthcare, and travel has further solidified its position as a preferred offshore BPO destination, catering to the needs of international clients seeking high-quality services.

The onshore segment is expected to register the fastest CAGR over the forecast period. An increasing demand for process optimization among domestic companies, coupled with supportive government initiatives and policies, has created a strong base for market growth. Furthermore, South Africa's economic expansion and the corresponding rise in new business opportunities have fueled the need for companies to outsource their non-core functions, thereby driving growth in this segment. Additionally, the expansion of the country's talent pool, with expertise in key areas, and the adoption of digital technologies have aided onshore BPO providers in enhancing their service offerings, attracting a growing client base.

Service Insights

Customer services held a leading revenue share in the country’s BPO market in 2023. The increasing establishment of customer service centers in South Africa that provide comprehensive online and offline technical support has been a major growth driver of this segment. These centers are dedicated to managing customer queries and interactions across various channels, such as email, chat, phone, and social media. Moreover, the customer service BPO industry, particularly in Cape Town, has been thriving in recent years and is expected to witness significant growth in the future. The city has emerged as a preferred BPO destination, attracting investments and driving the expansion of service centers.

The training and development outsourcing segment is projected to register the fastest growth from 2024 to 2030. The increasing need for organizations to upskill and reskill their workforce in response to rapid technological advancements and changing market dynamics has created a surge in demand for specialized training and development services. Moreover, the requirement for cost-effective solutions with high quality has led companies to outsource training and development functions to expert BPO providers. Additionally, the South African government's emphasis on skills development and training through various initiatives has further fueled segment growth.

Deployment Insights

The cloud deployment segment accounted for a larger market share in 2023. The scalability and flexibility offered by cloud-based BPO solutions have enabled organizations to efficiently manage fluctuating workloads and adapt to changing business requirements. Additionally, the cost-effectiveness of cloud deployment by eliminating the need for significant investments in infrastructure and maintenance, attracts companies seeking to optimize their operational expenditures. Furthermore, the enhanced agility and speed of deployment provided by cloud-based solutions allows businesses to rapidly respond to evolving market conditions and customer needs, driving their demand in the South African market.

The on premise segment held a substantial revenue share in 2023. The need for data security and compliance with regulatory requirements, particularly in industries such as finance and healthcare, has led organizations to opt for on premise deployment, thus ensuring complete control over sensitive information. Moreover, the requirement for customization and tailored solutions specific to individual business parameters is more effectively addressed through this form of deployment, allowing for better flexibility and adaptability. Additionally, current investments in infrastructure by several organizations have made on premise deployment a viable option, enabling seamless integration and minimizing disruption to existing operations.

End-use Insights

IT & telecommunications accounted for the highest revenue share of the market in 2023. This is owing to a combination of several factors, such as the exceptional speech skills of professionals in this industry, which have made it a preferred location for service desk and technical helpdesk functions within the IT sector. Additionally, the presence of a large base of IT graduates with relevant technical skills reduces the training burden and costs for outsourcing companies. The country's growing cluster of IT companies offering website architecture and development, platform, and application development services has solidified its position as a prominent destination for IT outsourcing. Furthermore, increasing spending on information & communication technology (ICT) in the economy to maintain existing IT and communication systems and replace outdated infrastructure is anticipated to fuel further growth in this segment.

The retail segment is expected to register the fastest CAGR during the forecast period. An increasing pressure to enhance customer experience amidst intensifying competition has led retailers to outsource their non-core functions, such as customer service, logistics, and inventory management, to specialized BPO providers. Moreover, the need for operational efficiency, cost reduction, and scalability in response to fluctuating demand has made BPO an attractive solution for retailers. Additionally, the growing adoption of e-commerce and digital channels by South African consumers has created a surge in demand for BPO services such as order management, returns processing, and data analytics to support omnichannel retailing, which has significantly contributed to segment growth.

Key Business Process Outsourcing Company Insights

Some key companies involved in the South Africa business process outsourcing market include BDO South Africa, TTEC, and Wipro, among others.

-

BDO South Africa is a part of the global BDO network and is a prominent professional services firm based in Johannesburg. The company offers a comprehensive range of services, including auditing, tax consulting, and business advisory. BDO South Africa employs approximately 2,000 people and operates seven offices across the country. The firm focuses on delivering customized solutions across various sectors, such as financial services, real estate, and technology.

-

TTEC Holdings Inc. is a prominent player in the South African business process outsourcing (BPO) market. TTEC's offerings include AI-enabled digital solutions through its TTEC Engage and TTEC Digital divisions, focusing on omnichannel contact center technology, customer engagement, and operational orchestration. The company aims to capitalize on South Africa's reputation as a leading nearshore delivery location, with plans for further expansion in the region to meet the growing demand for high-quality customer service solutions.

Key South Africa Business Process Outsourcing Companies:

- Accenture

- Amdocs

- BDO South Africa

- Capgemini

- CBRE

- Deloitte South Africa

- SNG Grant Thornton

- HCL Technologies Limited

- Infosys Limited

- KPMG Services Proprietary Limited

- NCR Voyix Corporation

- PwC

- Sodexo

- TTEC

- Wipro

Recent Developments

-

In July 2024, BDO South Africa entered a strategic alliance with KnowBe4, a prominent provider of simulated phishing and security awareness training platforms. This partnership is expected to enhance BDO's capabilities to offer its clients advanced and comprehensive cybersecurity solutions in response to the escalating sophistication of cyber threats.

-

In November 2023, TTEC Holdings Inc. inauguratedits new global customer experience (CX) delivery center in Cape Town. With a capacity to accommodate a substantial number of customer service associates, the new center offers services to multinational brands across several major industries, such as telecommunications, automobile manufacturing, and healthcare.

South Africa Business Process Outsourcing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.02 billion |

|

Revenue Forecast in 2030 |

USD 3.60 billion |

|

Growth Rate |

CAGR of 10.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Service, type, deployment, end-use |

|

Key companies profiled |

Accenture; Amdocs; BDO South Africa; Capgemini; CBRE; Deloitte South Africa; SNG Grant Thornton; HCL Technologies Limited; Infosys Limited; KPMG Services Proprietary Limited; NCR Voyix Corporation; PwC; Sodexo; TTEC; Wipro |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

South Africa Business Process Outsourcing Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the South Africa business process outsourcing market report based on service, type, deployment, and end-use.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Finance & Accounting

-

Human Resource

-

KPO

-

Procurement & Supply Chain

-

Customer Services

-

Sales & Marketing

-

Logistics

-

Training and Development Outsourcing

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Onshore

-

Offshore

-

Nearshore

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On Premise

-

Cloud

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

Manufacturing

-

IT & Telecommunications

-

Retail

-

Government & Defense

-

Others

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."