- Home

- »

- Consumer F&B

- »

-

Sour Milk Drinks Market Size, Share & Growth Report, 2030GVR Report cover

![Sour Milk Drinks Market Size, Share & Trends Report]()

Sour Milk Drinks Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Buttermilk, Kefir, Drinking Yoghurt), By Category (Flavored, Unflavored), By Packaging, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-436-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sour Milk Drinks Market Size & Trends

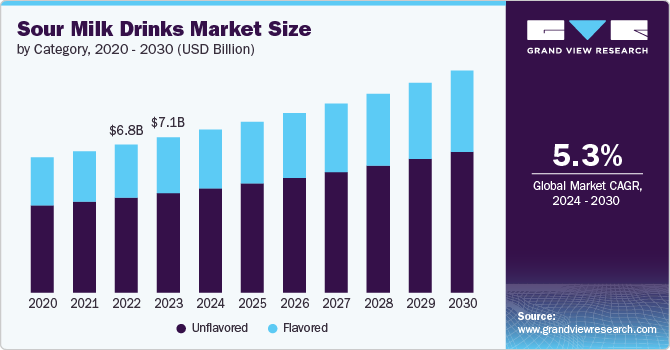

The global sour milk drinks market size was estimated at USD 7.12 billion in 2023 and is expected to grow at a CAGR of 5.3% from 2024 to 2030. One of the primary drivers is the increasing focus on health and wellness. Sour milk drinks such as Kefir, yogurt drinks, and buttermilk are rich in probiotics, which support gut health and overall well-being. As consumers become more health-conscious, there is a growing preference for functional foods that offer specific health benefits. This shift towards healthier diets has made sour milk drinks, which are often naturally fermented and minimally processed, particularly attractive. The clean label trend, where consumers seek products with simple, natural ingredients free from artificial additives, further boosts the appeal of these drinks.

Dietary preferences and the rise of special diets are also contributing to the growing demand for sour milk drinks. The increasing prevalence of lactose intolerance and dairy sensitivities has led to a surge in lactose-free and low-fat sour milk products catering to those with specific dietary needs. In addition, the rise of veganism and plant-based diets has spurred innovation in dairy-free sour milk alternatives, such as those made from almond, coconut, or soy milk. These plant-based options are expanding the market by appealing to consumers who avoid traditional dairy products but still want to enjoy the benefits and flavors of sour milk drinks.

Convenience is another significant factor driving the popularity of sour milk drinks. The modern, fast-paced lifestyle has created a demand for ready-to-drink (RTD) beverages that are easy to consume on the go. Sour milk drinks are often available in portable, single-serve packaging, making them an ideal choice for busy individuals seeking quick, nutritious options. This convenience factor is particularly appealing in urban areas, where consumers are constantly looking for products that fit seamlessly into their hectic schedules.

Cultural and regional acceptance also play a crucial role in the rising demand for sour milk drinks. In many parts of the world, these drinks have deep cultural roots and are considered dietary staples. Traditional drinks such as Lassi in India, Ayran in the Middle East, and Kefir in Eastern Europe have long been popular. The globalization of these regional products is helping to increase their availability and acceptance in new markets, further driving demand.

In addition, sustainability and ethical consumption are increasingly influencing consumer choices. As environmental awareness grows, there is a rising preference for products made using sustainable farming practices and eco-friendly packaging. Sour milk drinks produced from organic, grass-fed, or ethically sourced milk are gaining traction, especially among environmentally conscious consumers. Moreover, the longer shelf life of fermented sour milk drinks compared to regular milk reduces food waste, aligning with the sustainability goals of many consumers.

Type Insights

Drinking yoghurt accounted for a share of 39.8% in 2023. Drinking yogurt is rich in probiotics, which are beneficial for digestive health and immune support. Consumers are increasingly aware of these health benefits and are seeking out probiotic-rich products to enhance their overall well-being, driving the demand for drinking yogurt. It offers a convenient and portable option for consumers who are looking for a quick, on-the-go snack or meal. The ready-to-drink format is especially appealing to busy individuals and families, making it a popular choice for those with hectic lifestyles.

Buttermilk is expected to grow at a CAGR of 6.1% from 2024 to 2030. Buttermilk is valued for its nutritional benefits, including its rich content of calcium, potassium, and vitamins. It is also lower in fat compared to regular milk and is often perceived as a healthier alternative. These benefits make it an attractive choice for health-conscious consumers looking for nutritious beverage options. In many cultures, particularly in South Asia and the Middle East, buttermilk is a traditional staple used in a variety of culinary applications. Its use in traditional recipes and its role as a refreshing drink in hot climates drive its continued popularity and consumption.

Category Insights

Unflavored sour milk drinks accounted for a revenue share of 64.2% in 2023. A growing segment of consumers prefers the natural, unaltered taste of sour milk drinks. These consumers value the authentic flavor profile and the traditional methods of fermentation, which are often associated with unflavored products. This preference is especially strong among those who appreciate artisanal and traditional food products. Unflavored sour milk drinks are versatile and can be used in a variety of culinary applications, such as in smoothies, salad dressings, marinades, or as a base for flavored drinks. This versatility makes them appealing to consumers who enjoy customizing their beverages or incorporating them into their cooking and baking.

Flavored sour milk drinks is expected to grow at a CAGR of 5.6% from 2024 to 2030. Flavored sour milk drinks offer a more palatable and enjoyable taste experience compared to plain versions, making them attractive to a wider range of consumers, including those who may not typically enjoy the tartness of unflavored sour milk. The addition of popular flavors such as fruit, vanilla, or chocolate makes these drinks more appealing to both adults and children. Manufacturers are continuously innovating by introducing new and exotic flavors, as well as incorporating additional health benefits such as added vitamins, minerals, or probiotics. These innovations keep the product category fresh and exciting, attracting new consumers and encouraging repeat purchases.

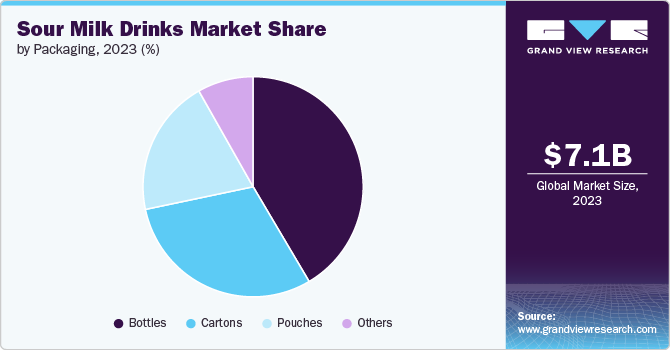

Packaging Insights

Bottles accounted for a revenue share of 41.5% in 2023. Bottled sour milk drinks offer a ready-to-drink, convenient option for consumers with busy lifestyles. The portability of bottled juices makes it easy to incorporate them into daily routines, whether at home, work, or on the go. Modern bottling techniques, such as high-pressure processing (HPP), preserve the drinks freshness and nutritional value while ensuring it remains safe and stable for longer periods.

Cartons is expected to grow at a CAGR of 5.9% from 2024 to 2030. Cartons are often perceived as a more environmentally friendly packaging option compared to plastic bottles. Many cartons are made from recyclable or biodegradable materials, aligning with the growing consumer preference for eco-friendly products and sustainable practices.

Distribution Channel Insights

Off trade accounted for a revenue share of 69.2% in 2023. The availability of sour milk drinks in a wider range of retail outlets, including supermarkets, specialty health stores, and online platforms, has made these products more accessible to a broader audience. The convenience of purchasing these drinks during regular shopping trips has contributed to their increased popularity in the off-trade market.

In addition, retailers are stocking a diverse array of sour milk drinks, including different flavors, formulations (such as lactose-free or low-fat options), and packaging sizes. This variety caters to different consumer preferences and dietary needs, encouraging more people to try and regularly purchase these products.

On trade is expected to grow at a CAGR of 5.8% from 2024 to 2030. The on-trade sector is continuously innovating to attract customers by expanding beverage offerings. Sour milk drinks, such as kefir and drinking yogurt, are being introduced as unique, health-focused options that differentiate menus and appeal to a wider range of customers.

Regional Insights

The sour milk drinks market in North America accounted for a revenue share of 20.2% in 2023 of the global market. The influence of global cuisines and increased awareness of traditional fermented products such as kefir and buttermilk have introduced more consumers in North America to sour milk drinks. As these products gain mainstream recognition, their popularity continues to grow, particularly among those interested in exploring new and diverse food experiences.

U.S. Sour Milk Drinks Market Trends

The sour milk drinks market in the U.S. is facing intense competition due to innovation in sour milk drinks varieties. There is a growing consumer focus on health and wellness, with an increasing awareness of the benefits of probiotics for digestive health. Sour milk drinks such as kefir and drinking yogurt are rich in probiotics, which are popular among health-conscious consumers looking to improve gut health and overall well-being. In addition, the availability of a wide range of flavors, along with convenient packaging options, has made sour milk drinks more accessible and appealing to consumers.

Europe Sour Milk Drinks Market Trends

The sour milk drinks market in Europe is expected to grow at a CAGR of 5.1% during the forecast period. The organic and natural foods market is thriving in Europe, with consumers seeking out products that are free from artificial additives and preservatives. Sour milk drinks, particularly those marketed as organic or made from grass-fed dairy, align with this trend, driving their increased consumption.

Asia Pacific Sour Milk Drinks Market Trends

The sour milk drinks market in Asia Pacific is expected to grow at a CAGR of 6.0% from 2024 to 2030. Many countries in Asia Pacific have a long history of consuming fermented milk products, such as yogurt and Lassi in India, or Yakult in Japan. The cultural acceptance of these beverages makes it easier for newer sour milk drinks such as kefir to gain traction in the market. Also, rapid urbanization and changing dietary habits are leading to an increased demand for convenient and nutritious food options. Sour milk drinks, available in ready-to-drink formats, cater to the needs of busy urban populations looking for healthy, on-the-go snacks.

Key Sour Milk Drinks Company Insights

The sour milk drinks market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Sour Milk Drinks Companies:

The following are the leading companies in the sour milk drinks market. These companies collectively hold the largest market share and dictate industry trends.

- PepsiCo, Inc.

- Danone S.A.

- Nestlé

- Arla Foods

- Lifeway Foods, Inc.

- Yakult Honsha Co., Ltd.

- General Mills, Inc.

- Fonterra Co-operative Group Limited

- Emmi Group

- Meiji Holdings Co., Ltd.

Recent Developments

-

In January 2024, Straus Family Creamery launched a new line of organic low-fat kefirs, expanding its range of premium organic dairy products. The kefirs are made through slow fermentation of whole and nonfat milk, blended with live cultures to create a tangy flavor and creamy texture. They can be enjoyed on their own, used in marinades, or paired with granola. Available flavors include plain and blueberry.

Sour Milk Drinks Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.46 billion

Revenue forecast in 2030

USD 10.17 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, category, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; UAE

Key companies profiled

PepsiCo, Inc.; Danone S.A.; Nestlé; Arla Foods; Lifeway Foods, Inc.; Yakult Honsha Co., Ltd.; General Mills, Inc.; Fonterra Co-operative Group Limited; Emmi Group; Meiji Holdings Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Sour Milk Drinks Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global sour milk drinks market report based on type, category, packaging, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Buttermilk

-

Kefir

-

Drinking Yoghurt

-

Others

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Flavored

-

Unflavored

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cartons

-

Pouches

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On Trade

-

Off Trade

-

Hypermarkets & Supermarkets

-

Convenience stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global sour milk drinks market size was estimated at USD 7.12 billion in 2023 and is expected to reach USD 7.46 billion in 2024.

b. The global sour milk drinks market is expected to grow at a compounded growth rate of 5.3% from 2024 to 2030 to reach USD 10.17 billion by 2030.

b. Drinking yoghurt accounted for a share of 39.8% in 2023. Drinking yogurt is increasingly embraced in various cultures as a healthy alternative to sugary beverages and snacks. It aligns with current dietary trends that emphasize natural and functional foods, further driving its consumption across different markets.

b. Some key players operating in sour milk drinks market include PepsiCo, Inc., Danone S.A., Nestlé, Arla Foods, Lifeway Foods, Inc., and others.

b. Key factors that are driving the market growth include rising lactose intolerance among consumers, growing awareness of nutritional value associated with sour milk drinks and increasing trends for ready to drink options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.