- Home

- »

- Electronic Devices

- »

-

Soundbar Market Size, Share & Growth Analysis Report 2030GVR Report cover

![Soundbar Market Size, Share, & Trends Report]()

Soundbar Market (2024 - 2030) Size, Share, & Trends Analysis Report By Type, By Installed Method (Active Soundbar, Passive Soundbar), By Connectivity, By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-457-9

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Soundbar Market Summary

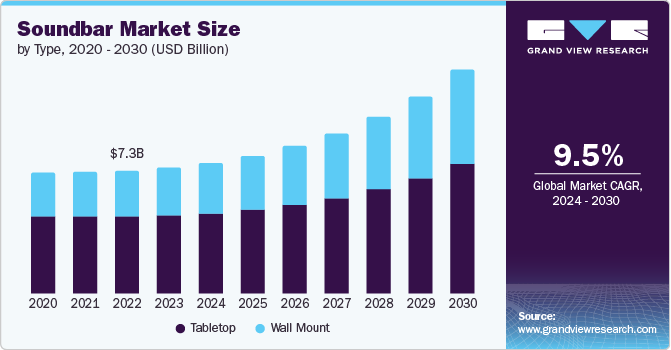

The global soundbar market size was estimated at USD 7.50 billion in 2023 and is projected to reach USD 13.40 billion by 2030, growing at a CAGR of 9.5% from 2024 to 2030. The soundbar market is experiencing significant growth due to evolving consumer preferences for high-quality home entertainment systems and the increasing demand for enhanced audio experiences.

Key Market Trends & Insights

- By region, the soundbar market in North America held a market share of 25% in 2023.

- The soundbar market in the U.S. is expected to grow significantly at a CAGR of 10.3% from 2024 to 2030.

- By type, the tabletop segment accounted for the largest market share of 62% in 2023.

- By application, the commercial segment is expected to grow at a significant rate during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 7.50 Billion

- 2030 Projected Market Size: USD 13.40 Billion

- CAGR (2024–2030): 9.5%

- North America: Largest regional market in 2023

One of the key factors driving the market is the growing adoption of smart TVs and streaming services, which has spurred demand for complementary audio devices. As more consumers shift towards minimalistic home setups, soundbars have become a popular choice over traditional multi-speaker systems, owing to their compact design, ease of installation, and advanced sound technologies.

The rising trend of home automation and smart homes presents significant growth potential for the soundbar market. Manufacturers are increasingly incorporating voice assistants such as Amazon Alexa and Google Assistant into soundbars, which adds value for consumers looking for multifunctional devices that can control various smart home applications. The market is also poised to benefit from the growing demand for immersive audio experiences in gaming, as soundbars equipped with spatial audio capabilities attract a broader range of users. Furthermore, the increasing availability of affordable soundbars with high-end features presents opportunities for market penetration in price-sensitive regions, particularly in emerging markets where consumer spending on home entertainment is rising.

The ongoing innovations in soundbar technologies and the introduction of premium features, such as 3D surround sound, virtual assistant integration, and multi-room audio support presents a potential growth opportunity in the market. Moreover, partnerships between soundbar manufacturers and streaming service providers or gaming companies are driving cross-industry synergies, enhancing product visibility and user engagement. The increasing inclination towards wireless and portable soundbars also underscores a shift in consumer behavior, where convenience and performance converge to influence purchasing decisions. Brands that successfully capitalize on these trends by delivering innovative products with superior audio quality and smart connectivity are expected to drive the market growth.

Recent events such as COVID-19 pandemic, work from home, and remote work cultures have accelerated the demand for home entertainment systems, as people spent more time indoors and sought high-quality, cinematic experiences at home. This trend led to a surge in sales of soundbars, especially those with features like built-in subwoofers, enhanced bass, and voice clarity, which are designed to create an immersive audio experience. As consumers become more aware of sound quality, there is a growing inclination towards soundbars that offer clear dialogue delivery, rich bass, and compatibility with high-resolution content. Manufacturers are responding by introducing a variety of models tailored to different room sizes and sound preferences, enhancing the overall market growth.

The rising consumer awareness and growing demand for sustainable living practices, consumers are becoming more conscious of the environmental impact of electronics, leading manufacturers to develop soundbars with recyclable materials, energy-efficient components, and minimal packaging. Thus, companies are also exploring the potential of modular soundbar designs that allow users to upgrade parts rather than replacing the entire device, reducing electronic waste.

Type Insights

The tabletop segment accounted for the largest market share of over 62% in 2023. The key trend driving the growth of the segment is the increasing demand for compact and flexible audio solutions that can easily integrate into modern home entertainment systems. With the rise of smart TVs and streaming platforms, consumers are looking for plug-and-play audio enhancements that offer simplicity without compromising sound quality. Tabletop soundbars are favored for their portability and ability to fit into various room configurations without requiring permanent installation. These soundbars are often equipped with built-in subwoofers and advanced sound technologies like virtual surround sound, making them ideal for smaller spaces or users who prefer a streamlined setup. The integration of wireless technologies such as Bluetooth and Wi-Fi further enhance their appeal, allowing users to control their soundbars via smartphones or voice assistants, adding convenience to the audio experience.

The wall mount segment in the soundbar market is experiencing growth driven by the increasing complexity of digital transformation initiatives. The wall mount segment of the soundbar market is driven by the increasing popularity of sleek, wall-mounted TV installations, where consumers seek an unobtrusive audio solution that complements the aesthetics of their living spaces. Wall-mounted soundbars are designed to deliver immersive audio while seamlessly blending with the home’s décor, appealing to those who prioritize design and space efficiency. As consumers invest in larger, high-definition televisions, there is a rising demand for audio systems that can match the enhanced visual experience. Wall-mounted soundbars, often equipped with Dolby Atmos and other advanced audio technologies, are positioned as premium products that offer superior sound projection and clarity. This trend is particularly strong in the luxury home market, where integrated, high-performance home theater systems are becoming a status symbol.

Installed Method Insights

The active soundbar segment accounted for the largest market share of over 86% in 2023. The active sound segment is a major driver in the soundbar market, largely due to its all-in-one design that includes built-in amplifiers and speakers, making it highly convenient for consumers. One of the key trends driving the growth of the active sound segment is the increasing demand for plug-and-play devices, as consumers seek hassle-free installation and minimal setup time. This segment is particularly popular among consumers with limited technical knowledge who prioritize ease of use and immediate functionality. Additionally, active soundbars often come with features like wireless connectivity, Bluetooth, and integrated subwoofers, offering a complete audio solution without the need for external components.

The passive soundbar segment is expected to grow at a significant rate during the forecast period. The passive sound segment is experiencing growth driven by consumers who prefer greater customization and sound fidelity. Passive soundbars, which require an external amplifier or receiver, allow users to build a more tailored and high-performance audio system. This segment appeals to audiophiles and home theater enthusiasts who prioritize superior sound quality and flexibility in their setups. A key trend driving the growth of the passive sound segment is the resurgence of high-end home theater systems, where users seek to combine passive soundbars with external speakers and subwoofers for a more immersive experience.

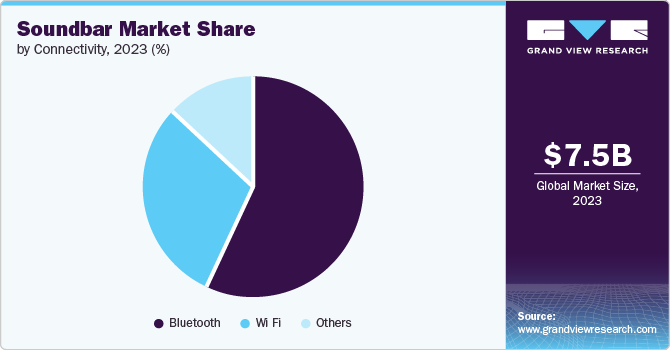

Connectivity Insights

The Bluetooth segment accounted for the largest market share of over 57% in 2023. The Bluetooth segment in the soundbar market is driven by the increasing demand for wireless audio solutions that offer convenience and portability. The rising shift toward minimalistic, clutter-free home setups. Bluetooth soundbars are highly sought after for their easy connectivity with smartphones, tablets, and laptops, making them ideal for users who prioritize flexibility in their audio experience. As more consumers opt for multi-functional devices that can serve multiple purposes, Bluetooth-enabled soundbars allow users to stream music, watch movies, and play games without the need for additional cables or complicated setups. This trend is particularly strong among younger consumers and urban households, where compact and wireless solutions fit well with limited space and a modern aesthetic.

The Wi Fi segment is expected to grow at a significant rate during the forecast period. The Wi-Fi segment in the market is primarily driven by the increasing adoption of smart home technologies and multi-room audio systems. Wi-Fi-enabled soundbars offer superior connectivity compared to Bluetooth, allowing users to integrate them seamlessly with home networks, smart speakers, and other devices such as TVs and streaming platforms. One major trend in this segment is the rise of voice-activated smart soundbars with built-in assistants such as Alexa, Google Assistant, and Siri. These soundbars not only enhance the audio experience but also serve as smart home hubs, giving users control over their entire home automation system through voice commands.

Application Insights

The home audio segment accounted for the largest market share of over 77% in 2023. In the home audio segment, a key trend driving growth is the increasing integration of smart home technologies with soundbars. As households adopt smart home ecosystems, soundbars equipped with voice assistants are gaining popularity. These soundbars offer not only high-quality audio but also control over other smart devices such as lighting and thermostats. The demand for seamless connectivity between smart TVs, streaming devices, and home audio systems has further propelled the growth of this segment. In addition, innovations in wireless technology, such as Wi-Fi-enabled and Bluetooth soundbars, make it easier for users to connect multiple devices without complex wiring, enhancing convenience and driving adoption in the home audio market.

The commercial segment is expected to grow at a significant rate during the forecast period. The rising use of soundbars in conference rooms, retail spaces, and hospitality venues is driving the demand for soundbars in the commercial segment. The adoption of soundbars in these environments is driven by the demand for streamlined audio systems that offer powerful sound in a compact form. Businesses and commercial spaces are increasingly opting for soundbars due to their ease of installation and integration with video conferencing tools, making them a preferred choice for virtual meetings and presentations. Soundbars with advanced features, such as beamforming technology and noise cancellation, provide crystal-clear audio for voice communications, which has become crucial in the hybrid work environment. This shift is particularly noticeable in sectors like corporate offices and educational institutions that prioritize efficient, high-quality audio setups.

Distribution Channel Insights

The online segment accounted for the largest market share of over 61% in 2023. The online segment of the soundbar market has seen substantial growth, driven by the increasing shift toward e-commerce and digital retail channels. A key trend propelling this segment is the growing consumer preference for the convenience and variety offered by online platforms. The ability to compare multiple brands, read user reviews, and access exclusive online discounts has made e-commerce an attractive option for purchasing soundbars. In addition, the rise of tech-savvy consumers, especially among millennials and Gen Z, has boosted online sales, as these demographics are more comfortable making high-value purchases through digital channels.

The offline segment is expected to grow at a significant rate during the forecast period. The Wi-Fi segment in the market is primarily driven by the increasing adoption of smart home technologies and multi-room audio systems. Wi-Fi-enabled soundbars offer superior connectivity compared to Bluetooth, allowing users to integrate them seamlessly with home networks, smart speakers, and other devices such as TVs and streaming platforms. One major trend in this segment is the rise of voice-activated smart soundbars with built-in assistants such as Alexa, Google Assistant, and Siri. These soundbars not only enhance the audio experience but also serve as smart home hubs, giving users control over their entire home automation system through voice commands.

Regional Insights

The soundbar market in North America held a market share of over 25% in 2023. In North America, the soundbar market is driven by the high adoption of advanced home entertainment systems and smart home technologies. A key trend in the region is the increasing consumer demand for soundbars with integrated voice assistants, such as Amazon Alexa and Google Assistant, which complement the region's strong smart home ecosystem. The trend toward streaming services such as Netflix, Hulu, and Disney+ has spurred the demand for high-quality audio experiences at home, leading to a surge in soundbar sales.

U.S. Soundbar Market Trends

The soundbar market in the U.S. is growing significantly at a CAGR of 10.3% from 2024 to 2030. In the US, a key trend driving the soundbar market is the growing demand for immersive audio experiences that complement high-definition displays. As consumers upgrade their video systems, they are increasingly investing in soundbars that deliver enhanced audio performance. The market is also benefiting from the rising popularity of home theater setups, particularly among younger consumers who prefer streaming content at home.

Asia Pacific Soundbar Market Trends

The soundbar market in Asia Pacific is growing significantly at a CAGR of 8.3% from 2024 to 2030. In the Asia Pacific, rapid urbanization and rising disposable incomes are driving the soundbar market, as consumers seek to enhance their home entertainment systems. The region is seeing a growing trend toward wireless soundbars, driven by the increasing adoption of smart devices and mobile connectivity. With a tech-savvy population, particularly in countries such as China, Japan, and South Korea, there is strong demand for soundbars with advanced connectivity features and integration with smart home ecosystems.

Europe Soundbar Market Trends

The soundbar market in Europe is growing significantly at a CAGR of 10.1% from 2024 to 2030. In Europe, the soundbar market growth is fueled by the increasing focus on minimalist home entertainment setups and the demand for high-fidelity audio in small living spaces. The trend towards compact, all-in-one sound systems that eliminate the need for bulky speaker setups is driving soundbar adoption. Moreover, the rise of streaming services and the popularity of on-demand content is influencing consumers to upgrade their audio systems.

Key Soundbar Company Insight

Some of the key players operating in the market include Hisense Home Appliance Group Co. Ltd, Xiaomi Corporation, Sonos Inc., Polk Audio (DEI Holdings Inc.), Bose Corporation, Samsung Electronics Co. Ltd, LG Electronics Inc., Sony Corporation, Koninklijke Philips NV, Panasonic Corporation, Sennheiser Electronic GmbH & Co. KG among others. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In July 2024, LG Electronics India launch of its latest soundbar range for 2024. The new lineup features five advanced models: the SG10Y, SQ75TR, S77TY, SQ70TY, and S65TR. Designed to perfectly integrate with LG TVs, these soundbars offer exceptional sound quality and an enhanced cinematic experience. With their powerful audio performance, comprehensive features, and sleek designs, LG’s new soundbars are set to redefine home entertainment for enthusiasts across India.

-

In January 2024, Samsung introduced two new soundbars designed to enhance its latest Neo QLED and OLED TV series. The lineup includes the ultra-slim HW-S800D and the premium HW-Q990D. The HW-S800D features a sleek 1.6-inch profile, crafted to fit seamlessly into any space that meets its width specifications, offering a refined and unobtrusive audio solution.

Key Soundbar Companies:

The following are the leading companies in the soundbar market. These companies collectively hold the largest market share and dictate industry trends.

- Hisense Home Appliance Group Co. Ltd

- Xiaomi Corporation

- Sonos Inc.

- Polk Audio (DEI Holdings Inc.)

- Bose Corporation

- Samsung Electronics Co. Ltd

- LG Electronics Inc.

- Sony Corporation

- Koninklijke Philips NV

- Panasonic Corporation

- Sennheiser Electronic GmbH & Co. KG

Soundbar Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.79 billion

Revenue forecast in 2030

USD 13.40 billion

Growth rate

CAGR of 9.5% from 2024 to 2030

Actual data

2018 - 2023

Base year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, installed method, connectivity, application, distribution channel, and region

Regional scope

North America, Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa.

Key companies profiled

Hisense Home Appliance Group Co. Ltd; Xiaomi Corporation; Sonos Inc.; Polk Audio (DEI Holdings Inc.); Bose Corporation; Samsung Electronics Co. Ltd; LG Electronics Inc.; Sony Corporation; Koninklijke Philips NV; Panasonic Corporation; Sennheiser Electronic GmbH & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Soundbar Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For the purpose of this study, Grand View Research has segmented the global soundbar market report based on type, installed method, connectivity, application, distribution channel, and region:

-

Soundbar Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tabletop

-

Wall Mount

-

-

Soundbar Installed Method Outlook (Revenue, USD Billion, 2018 - 2030)

-

Active Soundbar

-

Passive Soundbar

-

-

Soundbar Connectivity Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wi-Fi

-

Bluetooth

-

Others

-

-

Soundbar Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Home Audio

-

Commercial

-

-

Soundbar Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Soundbar Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global soundbar market was valued at USD 7.50 billion in 2023 and is expected to reach USD 7.79 billion in 2024.

b. The global soundbar market is expected to grow at a compound annual growth rate of 9.5% from 2024 to 2030 to reach USD 13.40 billion by 2030.

b. The tabletop segment accounted for the largest market share of over 62% in 2023. The key trend driving the growth of the segment is the increasing demand for compact and flexible audio solutions that can easily integrate into modern home entertainment systems. With the rise of smart TVs and streaming platforms, consumers are looking for plug-and-play audio enhancements that offer simplicity without compromising sound quality.

b. Key players in the soundbar market include Hisense Home Appliance Group Co. Ltd, Xiaomi Corporation, Sonos Inc., Polk Audio (DEI Holdings Inc.), Bose Corporation, Samsung Electronics Co. Ltd, LG Electronics Inc., Sony Corporation, Koninklijke Philips NV, Panasonic Corporation, Sennheiser Electronic GmbH & Co. KG among others

b. The soundbar market is experiencing significant growth due to evolving consumer preferences for high-quality home entertainment systems and the increasing demand for enhanced audio experiences. One of the key factors driving the market is the growing adoption of smart TVs and streaming services, which has spurred demand for complementary audio devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.