Sound Recognition Market Size, Share & Trends Analysis Report By Devices, By Application (Automotive, Healthcare & Fitness, Smart Home, Security & Surveillance, Others), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-938-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Sound Recognition Market Size & Trends

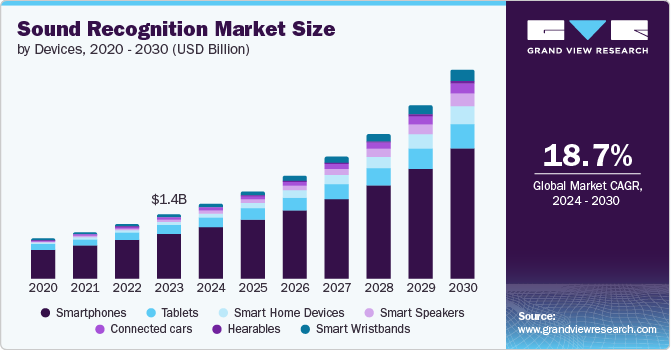

The global sound recognition market size was valued at USD 1.35 billion in 2023 and is projected to grow at a CAGR of 18.7% from 2024 to 2030. As consumers increasingly integrate technology into their daily lives, the demand for devices that recognize and respond to voice commands has surged. Smart home devices such as voice-activated assistants, Amazon Alexa, and Google Home are becoming commonplace. The proliferation of Internet of Things (IoT) devices further amplifies this trend, as these devices often rely on voice recognition for seamless interaction.

Smart home devices, such as voice-activated assistants and security systems, rely heavily on sound recognition to function effectively. As the IoT ecosystem expands, more devices have sound recognition capabilities to enhance user experiences and automation. This trend is further fueled by consumer demand for more intuitive and hands-free interactions with technology, pushing manufacturers to incorporate advanced sound recognition features into their products.

Voice biometrics is increasingly being utilized as a secure method for authentication in various applications, including banking transactions and access control systems. As concerns about data privacy and security continue to rise, organizations seek robust solutions that provide secure access while maintaining user convenience. The integration of voice recognition with existing security protocols offers a compelling solution that effectively addresses these concerns.

Devices Insights

Smartphones dominated the market and accounted for the largest market revenue share of 69.7% in 2023. Modern smartphones have sophisticated microphones and AI-powered algorithms that enable voice assistants, noise cancellation, and contextual sound recognition. These enhancements improve user interactions and provide a more seamless experience, encouraging consumers to upgrade to newer models with advanced sound recognition features. As voice assistants such as Apple's Siri, Google Assistant, and Amazon's Alexa become more prevalent, consumers increasingly rely on their smartphones for voice-activated commands and services.

Smart speakers is anticipated to register the fastest CAGR of 28.4% during the forecast period. Smart speakers serve as central hubs for IoT ecosystems, allowing users to manage multiple connected devices seamlessly. As more households adopt smart home technologies such as smart lights, thermostats, and security systems, the demand for smart speakers that can integrate with these devices continues to rise. This interconnectedness enhances user experience and drives sales as consumers seek out devices that can facilitate a cohesive smart home environment.

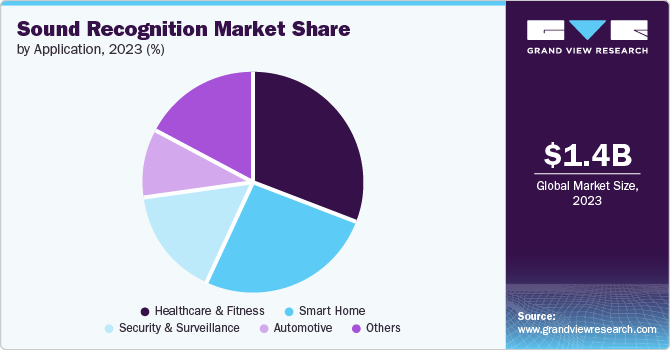

Application Insights

The healthcare and fitness segment accounted for the largest market revenue share in 2023. The rising adoption of wearable devices and smart sensors in the healthcare and fitness industry propels the demand for sound recognition technology. These devices utilize sound recognition to track physical activities, monitor vital signs, and analyze sleep patterns, thereby assisting individuals in managing their fitness and wellness goals. The integration of sound recognition capabilities in these devices enhances the accuracy and depth of health-related data, driving their popularity among consumers and healthcare professionals.

Security and surveillance is anticipated to grow significantly over the forecast period. Modern sound recognition technologies can identify and analyze specific sounds, such as breaking glass, footsteps, or unusual noises, and trigger immediate alerts. This ability to detect potential security breaches in real time makes sound recognition valuable for residential and commercial security systems, driving its widespread adoption.

Regional Insights

North America sound recognition market accounted for the largest market revenue share of 42.5% in 2023. North American consumers increasingly integrate smart speakers, voice-activated assistants, and other sound recognition-enabled devices into their homes. These devices' proliferation is fueled by their ability to offer hands-free convenience, control smart home systems, and provide personalized user experiences. This widespread consumer adoption significantly drives the region's demand for sound recognition technology.

U.S. Sound Recognition Market Trends

The U.S. sound recognition market dominated the North America market in 2023. The country is home to numerous technology giants, and startups focused on advancing artificial intelligence (AI) and machine learning, essential for enhancing sound recognition capabilities. Innovations in natural language processing (NLP), voice biometrics, and acoustic analysis are continuously improving the accuracy and functionality of sound recognition systems.

Europe Sound Recognition Market Trends

Europe sound recognition market was identified as a lucrative region in 2023. Europe's growing emphasis on data privacy and security regulations is shaping the growth of the sound recognition market. The General Data Protection Regulation (GDPR) and other privacy laws require companies to implement robust security measures to protect user data. Sound recognition technology's ability to analyze and process voice data securely aligns with these regulatory requirements.

The UK sound recognition market is anticipated to grow significantly over the forecast period. UK consumers are rapidly embracing smart speakers and home assistants such as Amazon Echo, Google Nest, and Apple HomePod, which rely heavily on sound recognition technology to provide voice commands, control smart home devices, and deliver personalized experiences. As these devices become more integral to daily life, the demand for advanced sound recognition systems to support their functionality continues to rise.

Asia Pacific Sound Recognition Market Trends

The Asia Pacific market is anticipated to register the fastest CAGR over the forecast period. Countries such as China, India, Japan, and South Korea are leading the charge in technological innovation, with considerable resources allocated towards advancing AI capabilities. This focus on AI research and development enhances the performance of sound recognition systems, including improvements in natural language processing, speech-to-text accuracy, and contextual understanding. As these technologies become more sophisticated, they drive the adoption of sound recognition solutions across various sectors.

Japan sound recognition devices market is expected to grow rapidly in the coming years. Japan's aging population and focus on improving healthcare services led to greater adoption of digital health solutions, including those that utilize sound recognition technology. Applications such as remote patient monitoring, voice-based diagnostics, and telemedicine are becoming more prevalent. Sound recognition systems analyze vocal patterns to assist in diagnosing medical conditions or monitoring patient health remotely, making them an integral part of Japan's healthcare modernization efforts.

Key Sound Recognition Company Insights

Some of the key companies in the sound recognition market include Abilisense, Apple Inc., MicrodB, and others. Key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Apple Inc.'s offerings in sound recognition are primarily integrated within its ecosystem of devices and software, enhancing user experience through advanced audio processing capabilities. The company's sound recognition features are prominently showcased in products such as the iPhone, iPad, and HomePod, where they utilize machine learning algorithms to identify specific sounds such as alarms, doorbells, or even the cries of a baby.

-

MicrodB specializes in advanced sound recognition technologies catering to diverse industries, including security, healthcare, and consumer electronics. The company leverages cutting-edge artificial intelligence and machine learning algorithms to develop solutions that accurately identify and classify sound patterns. This capability allows MicrodB to offer noise monitoring systems, acoustic event detection tools, and real-time audio analytics platforms.

Key Sound Recognition Companies:

The following are the leading companies in the sound recognition market. These companies collectively hold the largest market share and dictate industry trends.

- Abilisense

- AltexSoft

- Analog Devices, Inc.

- Apple Inc.

- Audio Analytic

- iNAGO Inc.

- MicrodB

- Renesas Electronics Corporation

- VocalZoom

- Wavio

Recent Developments

-

In July 2024, Apple launched the HomePod mini with sound recognition technology advancements, allowing the device to identify and respond to various sounds within its environment, enhancing user interaction and smart home integration. The sound recognition feature on the HomePod mini is designed to learn from its surroundings, adapting over time to understand better the unique acoustic profile of each user’s home.

Sound Recognition Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.57 billion |

|

Revenue forecast in 2030 |

USD 4.40 billion |

|

Growth Rate |

CAGR of 18.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Devices, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, UAE, and South Africa, Saudi Arabia |

|

Key companies profiled |

Abilisense; AltexSoft; Analog Devices, Inc.; Apple Inc. Audio Analytic; iNAGO Inc.; MicrodB; Renesas Electronics Corporation; VocalZoom; Wavio |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Sound Recognition Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sound recognition market report based on devices, application, and region.

-

Devices Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones

-

Tablets

-

Smart home devices

-

Smart speakers

-

Connected cars

-

Hearables

-

Smart Wristbands

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Healthcare and Fitness

-

Smart Home

-

Security and Surveillance

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

South Africa

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."