SONAR System Market Size, Share & Trends Analysis Report By Product (Hull-Mounted, Stern Mounted, Sonobuoy, DDS), By Platform (Ship Type, Airborne), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-343-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

SONAR System Market Size & Trends

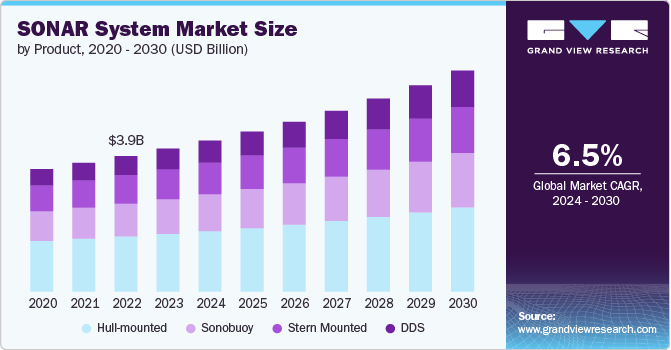

The global SONAR system market size was estimated at USD 4.16 billion in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030. The growth of the SONAR systems is attributed to the increasing national security and defense across the globe. SONAR systems enhance a country's ability to monitor and secure its coastal waters and strategic maritime routes. Hence, navies and maritime forces rely on SONAR technology to detect submarines, mines, and underwater threats. Many nations prioritize the modernization of their naval fleets, investing in advanced SONAR systems for improved underwater surveillance and threat detection. This trend is particularly strong in countries with extensive coastlines and strategic maritime interests, such as the U.S., China, and India. Enhanced detection capabilities of modern SONAR systems are essential for maintaining national security and ensuring maritime dominance.

Countries across the globe are increasingly investing in SONAR technology to bolster their naval capabilities, protect their coastlines, and monitor maritime traffic, thereby enhancing their security posture. Consequently, defense budgets are increasingly allocated toward developing and procuring sophisticated SONAR technology. Furthermore, the rise of offshore industries such as oil & gas exploration and renewable energy projects has led to an increased reliance on SONAR for underwater mapping, inspection, and maintenance. As a result, the growing need for maritime security and surveillance has fueled the demand for SONAR systems.

Marine exploration and scientific research represent additional driving forces in the SONAR system market. Researchers and oceanographers utilize SONAR systems to study marine biodiversity, map underwater topography, and monitor environmental changes. The growing interest in understanding and preserving marine ecosystems has led to increased funding for oceanographic research and exploration missions. High-resolution SONAR systems provide valuable data that aids in the conservation of aquatic life and the sustainable management of ocean resources. As environmental awareness and scientific curiosity continue to grow, the demand for advanced SONAR systems in the scientific community is expected to rise.

Technological advancements in SONAR systems, including improved sensor technology, data processing capabilities, and the integration of artificial intelligence, are making these systems more versatile and efficient. As a result, SONAR systems are finding applications beyond traditional maritime and defense sectors, such as underwater archaeology, underwater robotics, and autonomous underwater vehicles. For instance, in November 2022, DRDO (Defense Research and Development Organization), an Indian agency under the Department of Defense Research and Development in the Ministry of Defense of the Government of India, launched the SONAR systems evaluation and test facility named Hull Module of Submersible Platform for Acoustic Characterization and Evaluation (SPACE) for Indian Navy.

The commercial shipping and fishing industries contribute to the market's growth by adopting SONAR technology for various applications. Commercial vessels use SONAR for navigation, collision avoidance, and locating fish stocks, improving the efficiency and safety of their operations. The fishing industry, in particular, benefits from SONAR systems that help identify and track fish populations, leading to more sustainable fishing practices. As these industries seek to optimize their operations and comply with stricter environmental regulations, the adoption of advanced SONAR technology is becoming increasingly essential. This trend highlights the diverse applications of SONAR systems beyond defense, underscoring their importance in various maritime activities.

Product Insights

The hull-mounted segment dominated the market with a revenue share of 40.5% in 2023. Key factors driving the use of hull-mounted include enhancing maritime security by detecting submarines and underwater mines, supporting fisheries management through fish detection, and facilitating underwater mapping and exploration. Advancements in technology, such as improved sensor sensitivity and signal processing capabilities, continue to drive the evolution of hull-mounted, making them indispensable for various marine applications. Additionally, technological advancements have led to the development of more compact and efficient hull-mounted SONAR systems, making them easier to install and maintain on various types of vessels. As maritime security concerns continue to escalate, both military and commercial fleets are increasingly investing in hull-mounted SONAR technology to ensure safe and effective operations.

The Sonobuoy segment is experiencing growth driven by its critical role in anti-submarine warfare and maritime surveillance. Sonobuoys, which are deployed from aircraft or ships, provide real-time data on underwater acoustic environments, aiding in the detection and tracking of submarines. The increasing need for enhanced maritime security and defense capabilities is a major driver, prompting investments in advanced sonobuoy technology. Innovations such as improved signal processing, longer operational life, and better data transmission have made sonobuoys more effective and reliable. Additionally, the rising geopolitical tensions and the strategic importance of maintaining naval dominance in contested waters are further propelling the demand for sophisticated sonobuoy systems.

Platform Insights

The ship type segment dominated the market in 2023. This dominance can be attributed to the growing need for effective underwater navigation, detection, and communication. These systems enhance maritime safety and security by enabling ships to detect underwater obstacles, map the seabed, locate submarines, and communicate with other vessels or underwater assets. Naval and commercial vessels are increasingly being equipped with sophisticated hull-mounted and towed array SONAR systems, which are essential for navigation, threat detection, and marine research. These systems provide critical data that enhances maritime situational awareness and ensures the safety of vessel operations.

The airborne segment is experiencing notable growth due to its critical role in rapid and expansive underwater surveillance. Maritime patrol aircraft and helicopters equipped with advanced SONAR systems can quickly deploy and collect real-time data over large ocean areas. This capability is essential for anti-submarine warfare, search and rescue operations, and maritime border security, providing a swift response to potential threats. Technological advancements have enhanced the efficiency and accuracy of airborne SONAR systems, making them more effective in diverse operational environments.

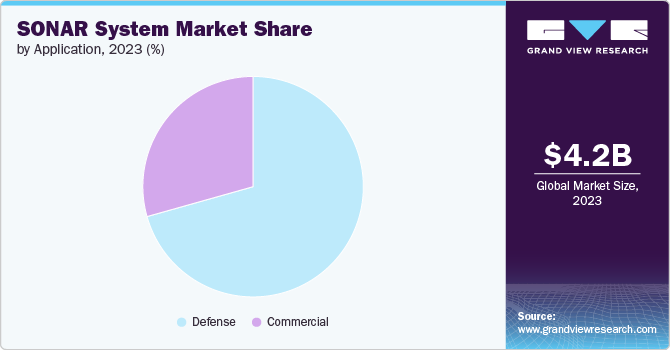

Application Insights

The defense segment held the largest market share in 2023. The growth of the sector is owing to the growing maritime threats, including submarine activity, which drive the need for advanced underwater surveillance and detection capabilities. Moreover, the rise of Autonomous Underwater Vehicles (AUVs) and unmanned underwater systems has created a demand for improved underwater communication and navigation, further fueling the adoption of SONAR systems. Technological advancements, such as improved signal processing and AI integration, have made defense SONAR systems more effective in detecting and tracking underwater threats. The modernization of naval fleets and the development of new submarines and surface vessels are further driving the demand for cutting-edge SONAR technology. As nations prioritize national security and maritime dominance, the defense segment of the SONAR system market is expected to see continued growth and innovation.

The commercial segment is expanding rapidly, driven by the growing need for advanced underwater navigation, exploration, and resource management. Commercial applications such as oil and gas exploration, commercial fishing, and maritime shipping rely heavily on SONAR technology for safe and efficient operations. Innovations in high-resolution imaging and seabed mapping have significantly improved the accuracy and effectiveness of commercial SONAR systems. Additionally, the increasing focus on sustainable fishing practices and environmental monitoring is driving the adoption of SONAR systems in the commercial sector. As global maritime trade and underwater resource exploration continue to grow, the demand for reliable and sophisticated SONAR technology in the commercial segment is set to rise.

Regional Insights

The North America SONAR system market dominated the global market in 2023 and accounted for a 31.4% share. The market is driven by robust defense spending and technological innovation. The United States, in particular, is focused on maintaining its naval superiority through the continuous upgrade of its SONAR capabilities for anti-submarine warfare, mine detection, and underwater surveillance. The presence of major defense contractors and advanced research facilities in North America supports the development of cutting-edge SONAR technology. Additionally, the commercial sector, including offshore oil and gas exploration and marine research, is also a significant driver of the SONAR market. The region's emphasis on securing its maritime borders and protecting critical underwater infrastructure further fuels the demand for advanced SONAR systems.

U.S. SONAR System Market Trends

In the U.S. SONAR system market, technological advancements and innovations in anti-submarine warfare systems are critical to addressing evolving maritime threats. Additionally, the commercial sector's demand for advanced SONAR systems in offshore oil and gas exploration and marine research contributes to market growth.

Asia Pacific SONAR System Market Trends

The growth in the Asia Pacific SONAR system market can be attributed to the deployment and utilization of SONAR systems that are driven by a complex interplay of factors heightened maritime concerns, territorial disputes, imperative to safeguard lucrative shipping routes, and underwater resources. Countries such as China, India, and Japan actively modernizing their naval capabilities, with SONAR technology enhancing underwater surveillance, submersible detection, and ensuring maritime domain awareness. Additionally, the rapid growth of commercial shipping and the burgeoning offshore energy industry further increase demand for the SONAR system to ensure safe navigation and protection region stability. Technological advancements and regional collaborations are also contributing to the market's expansion, as countries seek to bolster their defense and commercial maritime capabilities.

Europe SONAR System Market Trends

The Europe SONAR system market is propelled by the need to enhance maritime security and maintain strategic maritime interests. Countries such as the UK, Germany, and France are investing in advanced SONAR technologies to support their naval modernization programs and bolster underwater surveillance capabilities. The region's focus on anti-submarine warfare and the protection of maritime borders is a key driver of market growth. Additionally, Europe's extensive involvement in marine research and environmental monitoring activities necessitates the use of high-resolution SONAR systems. Collaborative defense initiatives within the European Union and with NATO allies further stimulate the demand for state-of-the-art SONAR technology in the region.

Key SONAR System Company Insights

Some of key players operating in the market include Raytheon Systems International Company, Thales, Lockheed Martin Corporation, and among others. Companies are employing various growth strategies such as forming partnerships, executing mergers & acquisitions, and expanding into new geographical markets to thrive in the competitive market environment.

For instance, in September 2023, SEA, a defense & space manufacturer in the UK, launched KraitOptimise, an Underwater Situational Awareness (UWSA) tool. The tool would help to improve sonar positioning and performance. Moreover, in July 2023, Meteksan Savunma, a defense technology company in Turkey launched Yakamos-RT, a retractable sonar at the 16th International Defence Industry Fair (IDEF) held in Istanbul. The Yakamos-RT is designed for Unmanned Surface Vessels (USVs) and patrol boats with anti-submarine warfare (ASW) capability in shallow waters.

Key SONAR System Companies:

The following are the leading companies in the SONAR system market. These companies collectively hold the largest market share and dictate industry trends.

- Raytheon Systems International Company

- Thales

- Atlas Elektronik

- Sonardyne

- L3Harris Technologies, Inc.

- Ultra Electronics Group

- KONGSBERG

- Lockheed Martin Corporation

- Teledyne Technologies Incorporated

- Furuno Electric Co., Ltd.

SONAR System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.40 billion |

|

Revenue forecast in 2030 |

USD 6.44 billion |

|

Growth rate |

CAGR of 6.5% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, platform, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Raytheon Systems International Company; Thales; Atlas Elektronik; Sonardyne; L3Harris Technologies, Inc.; Ultra Electronics Group; KONGSBERG; Lockheed Martin Corporation.; Teledyne Technologies Incorporated; Furuno Electric Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global SONAR System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global SONAR system market report based on product, platform, application and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hull-Mounted

-

Stern Mounted

-

Sonobuoy

-

DDS

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Ship Type

-

Airborne

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Defense

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global SONAR system market size was estimated at USD 4.16 billion in 2023 and is expected to reach USD 4.40 billion in 2024.

b. The global SONAR system market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 6.44 billion by 2030.

b. North America dominated the SONAR system market with a share of 31.39% in 2023. The presence of major defense contractors and advanced research facilities in North America supports the development of cutting-edge SONAR technology.

b. Some key players operating in the SONAR system market include RAYTHEON SYSTEMS INTERNATIONAL COMPANY Thales; ATLAS ELEKTRONIK; Sonardyne; L3Harris Technologies, Inc.; Ultra Electronics Group; KONGSBERG; Lockheed Martin Corporation.; Teledyne Technologies Incorporated; and FURUNO ELECTRIC CO., LTD.

b. Key factors that are driving the market growth include growth in the deliveries of military vessels and increasing defense expenditures in emerging economies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."