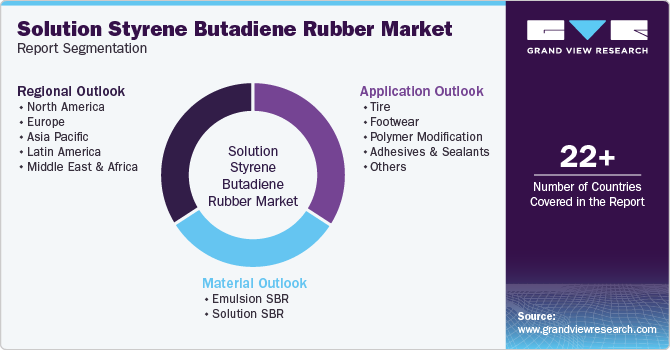

Solution Styrene Butadiene Rubber Market Size, Share & Trends Analysis Report By Material (Emulsion SBR, Solution SBR), By Application (Tire, Footwear, Polymer Modification), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-529-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

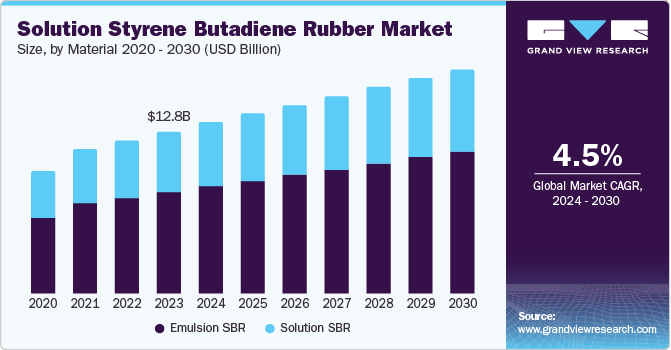

The global solution styrene butadiene rubber market size was valued at USD 12.84 billion in 2023 and is projected to grow at a CAGR of 4.5% from 2024 to 2030. The use of SSBR in tires and various other rubber goods as a solution is increasing leading to its high demand in the market. Manufacturers are replacing emulsion styrene butadiene rubber (E-SBR) with solution-styrene butadiene rubber (S-SBR) to enhance fuel efficiency, wet grip, and decrease vehicle rolling resistance.

SSBR protects against deterioration and exposure to the elements making it ideal for outdoor and automotive uses apart from just tires, such as shoes, conveyor belts, and industrial products. It is widely used in the cable industry for cable insulation and sheathing, and in the footwear industry for shoe soles and heels. The increasing urbanization is driving the demand for packaged goods, resulting in a high demand for styrene butadiene rubber.

The growing demand for electronic vehicles is necessitating the development of new SBR formulations. The huge investment in research and development of bio-based rubber is allowing the gaining of a portion of the market influenced by environmentally aware customers and government regulations. Furthermore, SBR is essentially used in the construction sector utilized in various applications such as sealants, roofing materials, and adhesives. The rise in the construction industry is expected to lead to an increase in demand for SBR.

Material Insights

The emulsion SBR segment dominated the market and accounted for the largest revenue share of 62.8% in 2023 owing to the lower production costs compared to SBR. The large-scale emulsion SBR production benefits from scale economies, leading to additional cost reductions. Different polymerization techniques and compounding can be used to modify the properties of emulsion SBR in order to meet the customized demands of customers.

The solution SBR segment is expected to grow at a significant CAGR of 4.3% over the forecast years. The increasing demand for superior quality tires with specialized properties such as enhanced grip and low rolling resistance is driving the segment growth. The continuous progress in polymer engineering has resulted in the creation of solution SBR with enhanced characteristics, broadening its range of potential uses.

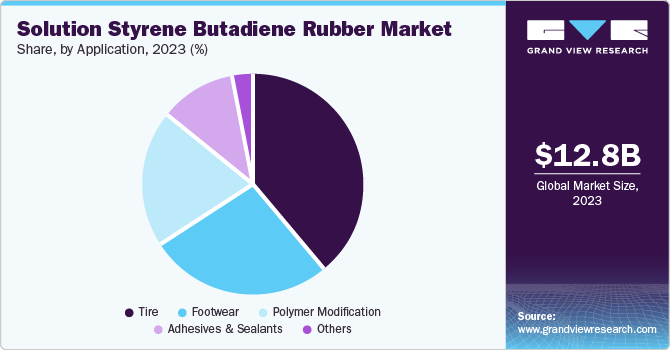

Application Insights

The tire segment dominated the market and accounted for the largest revenue share in 2023. High-performance tire production enhances vehicle performance and fuel efficiency that is driving the segment growth. The essential mechanical properties and advanced functional capabilities offered by the solution SBR are leading to the rise in demand for tires. The excellent performance in braking standards and cost-effectiveness is aiding in the growth of the tire segment.

The footwear segment is expected to grow at a significant CAGR of 4.3% over the forecast years. SBR is a direct replacement for natural rubber offering several benefits including set resistance and water resistance. These factors contribute to the rise in demand for SBR in manufacturing footwear.

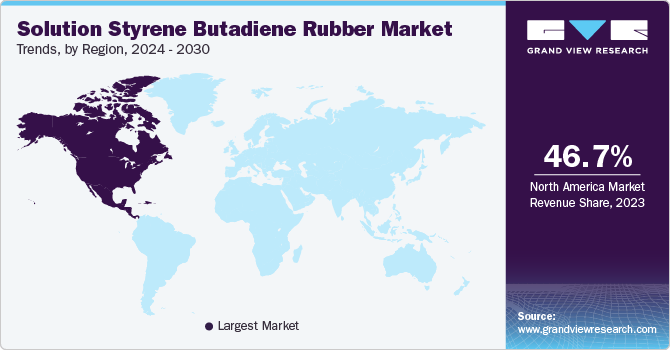

Regional Insights

North America solution styrene butadiene rubber market dominated the market share with 46.7% in 2023. The region is a major hub for the automotive industry. High-performance vehicles are driving the SSBR solutions demand in vehicle manufacturing.

U.S. Solution Styrene Butadiene Rubber Market Trends

The U.S. dominated the North America solution styrene butadiene rubber market in 2023. The continuous technological development in tire technology such as the creation of silica-based compounds, have raised the need for SSBR as an essential element. The improvement in SSBR manufacturing processes have resulted in better quality and more affordable products, thereby boosting the growth of SSBR market.

Europe Solution Styrene Butadiene Rubber Market Trends

The Europe solution styrene butadiene rubber market was identified as a lucrative region in 2023. S-SBR offers high-performance tires improved wet grip, low rolling resistance, and increased fuel efficiency, which are stated in the tire labelling regulations. In addition, stringent regulation on the use of winter tires is expected to further increase the consumption of S-SBR in this region. The manufacturing facilities of the major automotive manufacturers are in Germany. It is an automotive hub in terms of production as well as consumption of all types of vehicles.

The UK solution styrene butadiene rubber market is expected to grow rapidly in the coming years. The increasing focus on luxury and performance vehicles is driving the demand for SSBR market. The ongoing construction projects in the UK need large quantities of rubberized asphalt, which makes use of SSBR. Additionally, the changing consumer preferences and product innovation help maintain the demand for SBR in the manufacturing of consumer goods.

Asia Pacific Solution Styrene Butadiene Rubber Market Trends

Asia Pacific solution styrene butadiene rubber market is anticipated to witness significant growth in the coming years. The advancements in technology and processes for recycling used rubber goods and tires provide chances for rubber producers to engage in the circular economy. The increasing need for rubber in specialized applications customized for electric cars is also resulting in the growing demand for SBR in eco-friendly tires and sustainable building materials in India.

The China solution styrene butadiene rubber market held a substantial market share in 2023. SBR is widely used in vehicle manufacturing leading to its increased demand in the automotive sector. The Chinese government's emphasis on upgrading industries and advancing technology is promoting the use of advanced materials such as SSBR.

Key Solution Styrene Butadiene Rubber Company Insights

Some of the key participants in the global solution styrene butadiene rubber market areAsahi Kasei Corporation, Versalis S.p.A, LG Chem, LANXESS, and others. Businesses place a strong emphasis on expanding the service area in order to grow market share and increase company revenue.

-

Asahi Kasei Corporation focuses on developing fiber products, chemicals, and electronic materials using its core chemistry technology. The product portfolio of the company includes styrene, foam insulation panels, membrane filtration systems,polymers, ion-exchange membranes, and others.

Key Solution Styrene Butadiene Rubber Companies:

The following are the leading companies in the solution styrene butadiene rubber market. These companies collectively hold the largest market share and dictate industry trends.

- Versalis S.p.A

- Asahi Kasei Corporation

- ARLANXEO

- LG Chem

- LANXESS

- BRP Manufacturing

- Vardhman

- ZEON CORPORATION

- Saiko Rubber (M) Sdn Bhd.

- Hallstar

Recent Developments

-

In November 2022, Asahi Kasei launched ISCC-certified synthetic rubber. It announced that the company would market its ISCC Plus-certified Tufdene-branded SSBR and Asadene butadiene rubber from November.

Solution Styrene Butadiene Rubber Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 13.60 billion |

|

Revenue forecast in 2030 |

USD 17.76 billion |

|

Growth rate |

CAGR of 4.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in Billion/Million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, application and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, The Netherlands, Denmark, Sweden, Norway, China, India, Japan, South Korea, Thailand, Indonesia, Brazil, Argentina, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

Versalis S.p.A; ARLANXEO; LG Chem ; LANXESS; BRP Manufacturing ; Vardhman; ZEON CORPORATION; Saiko Rubber (M) Sdn Bhd.; Hallstar |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Solution Styrene Butadiene Rubber Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyses the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global solution styrene butadiene rubber market report based on application and region.

-

Material Outlook (Volume; Revenue, USD Million, 2018 - 2030)

-

Emulsion SBR

-

Solution SBR

-

-

Application Outlook (Volume; Revenue, USD Million, 2018 - 2030)

-

Tire

-

Footwear

-

Polymer Modification

-

Adhesives & Sealants

-

Others

-

-

Regional Outlook (Volume; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

The Netherlands

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Indonesia

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."