Solid State Transformers Market Size, Share & Trends Analysis Report By Product, By Application (Renewable Power Generation, Automotive, Power Grids), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-274-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Solid State Transformers Market Trends

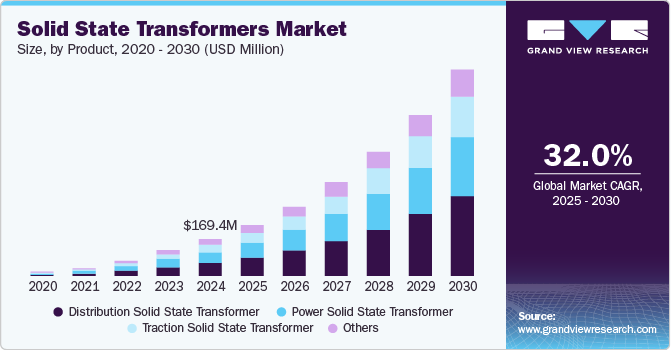

The global solid state transformers market size was valued at USD 169.4 million in 2024 and is projected to grow at a CAGR of 32.0% from 2025 to 2030. Continued efforts to modernize the aging power distribution infrastructure and increasing adoption of electric vehicles (EVs) are key factors anticipated to drive the presence of solid state transformers (SSTs) in the region. Moreover, with constant developments in smart grid infrastructure, there is an urgent need to coordinate different stress levels brought about by deploying multiple energy sources in this system, which can be challenging for conventional transformers.

SSTs help address these concerns, controlling and improving electricity quality through compensation of reactive power and reduction in voltage drops. Developed nations such as the U.S., Australia, Canada, Japan, and economies in Western Europe have announced ambitious plans concerning smart grids, increasing companies' focus on developing innovative and efficient components such as solid state transformers.

The growing demand for electric vehicles globally and the need to establish an optimized charging infrastructure is a primary factor driving industry expansion. Governments globally are undertaking several important steps to ensure a constant increase in the density of charging stations. For instance, the National Electric Vehicle Infrastructure (NEVI) Formula Program and the National EV Charging Initiative are major programs launched in the U.S. to enable expansion and innovations in this ecosystem. In January 2024, the U.S. Government announced USD 623 million in grants to enhance the EV charging network across the country. The move is part of the government's objective of developing a comprehensive national network of EV charging solutions, including a minimum of 500,000 public chargers by 2030. As a result, competitors are launching application-specific solutions and partnering with various automakers and automotive associations to drive growth. For instance, in October 2022, Delta Americas, a subsidiary of Delta Electronics, demonstrated a cutting-edge SiC MOSFET SST-based 400kW extremely fast EV charging solution to General Motors, NextEnergy, the American Center for Mobility, DTE Energy, and Virginia Tech's Center for Power Electronics Systems (CPES), all of which are the company's U.S. Department of Energy grant program partners.

The need for constant innovations in the market and promising developments in application areas are expected to shape industry growth positively over the forecast period. Using wide-bandgap materials such as silicon carbide (SiC) and gallium nitride (GaN) allows for higher voltage operation, better thermal performance, and improved efficiency, leading to more compact and efficient designs. Modular SST architectures facilitate scalability and redundancy, allowing for easier upgrades and maintenance. This design approach can enhance the overall reliability and adaptability of the systems. Advanced technologies such as AI and machine learning are expected to drive promising developments in the market, as they are being increasingly integrated into SST control systems to optimize performance, predict maintenance needs, and enhance decision-making processes.

Government bodies encourage established companies and start-ups to develop advanced transformers through funding programs. For instance, in April 2024, the U.S. Department of Energy announced an opportunity for USD 18 million in funding for Flexible Innovative Transformer Technologies (FITT). As per the announcement, the DOE will select up to nine awardees who can research, develop, and demonstrate advanced transformers across a range of distribution and transmission scale applications, enhancing grid reliability and addressing transformer supply chain constraints.

Product Insights

Distribution solid state transformers (D-SSTs) accounted for the largest revenue share of 37.0% in the global market in 2024. The demand for these products is growing steadily due to several factors enabling the evolution of electrical distribution systems. For instance, the shift toward renewable energy sources such as solar and wind requires efficient and flexible power conversion solutions, with distribution SSTs facilitating the integration of such intermittent resources into the grid. Furthermore, the transition to smart grids is driving the need for advanced technologies that enhance monitoring, control, and automation in power distribution, aiding segment growth. The existing power infrastructure requires constant upgrades due to the growing urbanization and population. The compact design of these transformers makes them ideal for urban environments where space is limited. Additionally, the rising popularity and adoption of electric vehicles (EVs) have highlighted the need for a robust charging infrastructure wherein D-SSTs can efficiently manage the required power distribution at charging stations.

The traction solid state transformers segment is expected to advance at a substantial CAGR from 2025 to 2030. The increasing pace of modernization and electrification of railway infrastructure presents a major avenue for growth for these types of transformers. The development of high-speed rail systems and urban transit systems such as electric buses and trams has driven the need for efficient conversion and distribution of power and energy usage. Traction SSTs are advanced power conversion devices specifically designed for railway and transportation applications. They combine the functionalities of conventional transformers with modern power electronics to enhance efficiency, reliability, and flexibility in electrified rail systems.

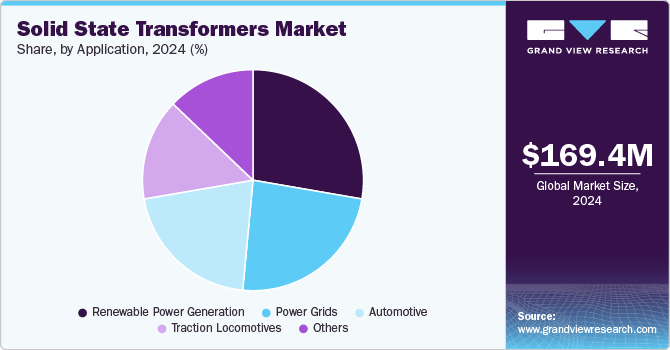

Application Insights

The renewable power generation segment accounted for a leading revenue share in the global market in 2024. Increasing clean energy requirements globally and government initiatives to establish large-scale wind and solar projects have necessitated the utilization of solid state transformers to ensure efficiency and reliability in power generation. SSTs minimize energy losses during conversion, making them more efficient than traditional transformers in maximizing the output from renewable sources. It can conveniently adjust output voltage levels, accommodating the varying voltages produced by renewable energy sources like solar panels and wind turbines.

The automotive segment is anticipated to grow at a significant CAGR from 2025 to 2030. The industry is witnessing significant advancements and innovations due to the increasing adoption of EVs and the emergence of technologies such as Vehicle-to-Grid (V2G). Solid state transformers offer significant efficiency, integration, and functionality advantages, making them a key component in modern and upcoming automotive power systems. They provide efficient power conversion solutions to manage high voltage and current levels essential for EV propulsion systems. They can also improve the efficiency of the battery charging and discharging processes, making them ideal for integrating with advanced battery management systems in these vehicles.

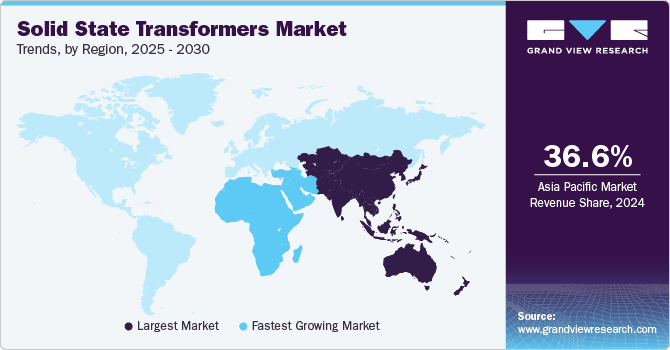

Regional Insights

Asia Pacific accounted for a leading revenue share of 36.6% in the global market in 2024, aided by rising investments in smart grid technology by governments and private organizations and rising pace of modernization across economies. The increasing rate of urbanization in the region that has created demand for improvements in power infrastructure acts as another major industry driver. Nations such as India, China, and Japan are aiming to constantly improve their railways and transportation infrastructure, leading to the utilization of SSTs that offer features such as voltage regulation, power flow control, and reactive power compensation in railway traction systems. Furthermore, the growing market for electric vehicles in Asia Pacific economies has driven a substantial demand for advanced charging infrastructure, with solid state transformers offering support for optimal power conversion in EV charging stations.

China Solid State Transformers Market Trends

China is anticipated to account for a significant revenue share in the regional market in the coming years. The country is one of the leading technology adopters globally, with the presence of several major electrical and electronics companies creating a highly competitive environment that has led to the development of advanced offerings in this industry. China is also shifting its focus towards renewable power generation using wind and solar energy, propelling market growth, as solid state transformers enhance the integration of these variable energy sources into the grid, substantially improving reliability and efficiency. The large-scale adoption of electric vehicles in the country and the development of advanced charging infrastructure is expected to further present several growth avenues to major market players in the coming years.

North America Solid State Transformers Market Trends

North America accounted for a substantial revenue share in the global market in 2024, on account of the presence of major companies involved in the development of solid state transformers such as General Electric, ABB, and Siemens. Governments in the U.S. and Canada are implementing policies and providing incentives to promote clean energy and the adoption of modern power systems, which is expected to aid regional market growth. For instance, Canada’s Smart Grid Program aims to accelerate smart grid development and reduce greenhouse gas emissions, while the Smart Renewables and Electrification Pathways Program (SREPs) has outlined goals such as electricity grid modernization and reduced dependence on fossil fuel generation. Such programs are expected to boost developments in the market. Additionally, the well-established industrial sector in the region is extensively using power solutions that can ensure operational improvements and reduction in energy costs, driving the presence of SSTs in this sector to enhance power management.

MEA Solid State Transformers Market Trends

The Middle East and Africa region is expected to witness the fastest growth during the forecast period. The development of various large-scale commercial projects in the region, along with the fast pace of urbanization in economies such as the UAE and Saudi Arabia, are major factors aiding industry expansion. In Saudi Arabia, the constantly increasing demand for electricity has resulted in major improvements in the economy’s electricity generation, transmission, and distribution sector, with stakeholders striving to reduce the utilization of oil for electricity production. The government has further planned to invest in the development of 30 wind and solar projects as part of its Vision 2030 strategy. This is expected to encourage major global manufacturers to introduce advanced offerings, propelling market expansion.

Key Solid State Transformers Company Insights

Some of the major companies involved in the solid state transformers market include ABB, Alstom, and Toshiba, among others.

-

ABB specializes in the development of automation and electrification solutions. The company's major activities include the production and distribution of solutions, systems, and services that are part of electrification products and motion & industrial automation. ABB's solid-state transformers (SSTs) represent a notable advancement in power conversion technology, combining conventional transformer functions with power electronics. Its products are mainly distributed through direct sales force as well as third-party channel partners such as wholesalers, distributors, installers, OEMs, and system integrators. ABB provides digitally connected industrial equipment and systems to major verticals such as utilities, industrial, transportation, and infrastructure.

-

Alstom is a French multinational company that develops and markets sustainable mobility solutions for the transportation sector. The company’s products include high-speed trains, metros, monorails, trams, signaling, infrastructure, and digital mobility solutions; it also provides various services, including maintenance and modernization of equipment and systems. Alstom’s SSTs are designed to operate with high efficiency, reducing energy losses compared to conventional transformers, which is critical for applications in rail and urban transit. These products further support bidirectional energy flow, enabling functionalities such as regenerative braking in electric trains, where energy can be fed back into the grid.

Key Solid State Transformers Companies:

The following are the leading companies in the solid state transformers market. These companies collectively hold the largest market share and dictate industry trends.

- Semiconductor Components Industries, LLC

- ABB

- Infineon Technologies AG

- Siemens

- ROHM Co., Ltd.

- STMicroelectronics

- Renesas Electronics Corporation

- Alstom SA

- Toshiba Corporation

- Mitsubishi Electric Corporation

Solid State Transformers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 233.8 million |

|

Revenue forecast in 2030 |

USD 935.8 million |

|

Growth Rate |

CAGR of 32.0% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, U.K., France, China, Japan, India, South Korea, Australia, Brazil, UAE, Saudi Arabia, South Africa |

|

Key companies profiled |

Semiconductor Components Industries, LLC; ABB; Infineon Technologies AG; Siemens; ROHM Co., Ltd.; STMicroelectronics; Renesas Electronics Corporation; Alstom SA; Toshiba Corporation; Mitsubishi Electric Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Solid State Transformers Market Report Segmentation

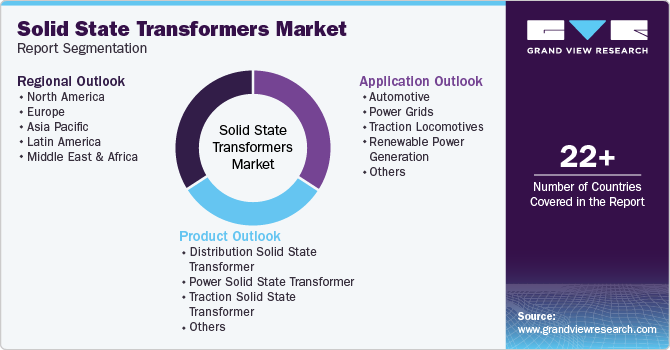

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the solid state transformers market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Distribution Solid State Transformer

-

Power Solid State Transformer

-

Traction Solid State Transformer

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Power Grids

-

Traction Locomotives

-

Renewable Power Generation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."