- Home

- »

- Semiconductors

- »

-

Solid State Drive Market Size & Share, Industry Report, 2030GVR Report cover

![Solid State Drive Market Size, Share & Trends Report]()

Solid State Drive Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (External, Internal), By Storage (Under 120 GB, 120GB - 320GB, 320GB - 500GB, 500 GB To 1 TB, Above 2 TB), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-328-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Solid State Drive Market Summary

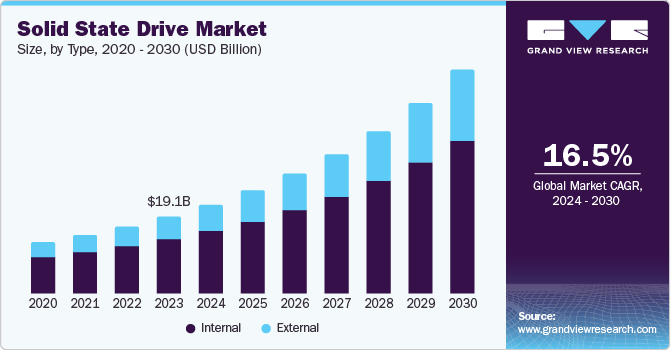

The global solid state drive market size was estimated at USD 19.1 billion in 2023 and is projected to reach USD 55.1 billion by 2030, growing at a CAGR of 16.5% from 2024 to 2030. Solid State Drives (SSDs), which have very high read/write speeds, are increasingly considered a suitable alternative to conventional hard disk drives (HDDs), which have moving parts and comparatively slower read and write speeds.

Key Market Trends & Insights

- North America held the highest market share, 42.2%, in 2023.

- The U.S. held the largest share of the regional market in 2023.

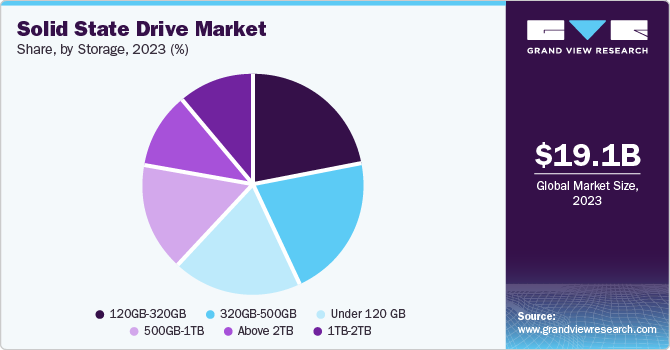

- By storage, 120 GB-320 GB storage segment held the highest market revenue share of 21.8% in 2023.

- By type, the internal SSD segment accounted for the highest market revenue share of 70.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 19.1 Billion

- 2030 Projected Market Size: USD 55.1 Billion

- CAGR (2024-2030): 16.5%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The exponential growth of data generation and the increasing adoption of high-performance cloud computing have necessitated the utilization of faster and more reliable data storage solutions. SSDs offer significant advantages over traditional hard disk drives regarding power consumption and access times, making them ideal for data centers. As a result, the industry is expected to witness promising growth in the coming years.

The increasing demand for high-performance portable devices such as smartphones and laptops is fueling the growth of the solid state drive (SSD) market. SSDs are becoming a preferred storage solution for consumers due to their compact size, lower power consumption, and faster read and write speeds, thus enhancing user experience in mobile computing. Consumers with laptops with HDDs prefer to install SSDs for faster boot speeds. According to a recent report titled ‘EaseUS Disk Drives Stats 1’ published by EaseUS, there has been significant growth in the number of SSD users compared to HDDs due to their obvious benefits. The survey reported that of around 750,000 surveyed hard drives, SSD users accounted for approximately 46.0%, while the proportion of HDD users was around 26.6%. Knowing the requirements of consumers, laptop manufacturers have started offering SSDs in budget laptops in their recent models, leading to further market growth.

The boot up time of SSDs is much lower than conventional hard disk drives, being in the range of 10-20 seconds. Professionals working on high-end software and gamers playing high-resolution games prefer to install the required software on SSDs for faster response times. Addressing these needs, manufacturers are constantly innovating and developing new SSD technologies, such as 3D NAND flash and PCIe interfaces, which have replaced earlier SATA-based technology. These advancements offer increased storage capacity, faster data transfer rates, and lower latency, further propelling the SSD industry forward. In addition, the need for reliable data storage for backup and archiving purposes is fostering SSD adoption within enterprises.

Type Insights

The internal SSD segment accounted for the highest market revenue share of 70.6% in 2023. Internal SSDs are the preferred storage solution for various consumer electronics products, including laptops, desktops, and tablets. Their faster boot times, improved application responsiveness, and lower power consumption than traditional HDDs make them ideal for enhancing user experience. While SSDs are more expensive than HDDs, advancements in NAND flash memory technology and optimized production techniques have driven down costs significantly. This has made internal SSDs a more viable option for a broader range of consumer electronics, further propelling segment growth.

External SSDs are expected to witness significant demand growth in the coming years, registering a faster CAGR of 17.7% during the forecast period. External SSDs provide additional storage capacity for laptops and desktops, facilitating the management of growing data volumes without costly internal hardware upgrades. Moreover, their portability makes them ideal for professionals working from remote workspaces, enabling them to carry critical data and applications of varying sizes. This caters to the growing mobile workforce and remote collaboration trend, aiding in promising segment expansion.

Storage Insights

120 GB-320 GB storage held the highest market revenue share of 21.8% in 2023. This is owing to an optimal balance between performance and affordability offered by this segment. They significantly improve speed and responsiveness compared to traditional HDDs at a price point that is increasingly accessible to budget-conscious consumers and businesses. The rising proclivity of students and working professionals to work on their assignments using their devices is expected to shape this segment expansion positively. These devices can boot faster and simultaneously run multiple applications without lagging or slowing down. Furthermore, SSD storage in this range is suitable for various devices, including laptops, desktops, and ultrabooks. This versatility makes it a popular choice for manufacturers seeking to equip their products with fast storage solutions while remaining cost-competitive.

The 320 GB-500 GB segment is expected to register the fastest growth rate of 17.6% during the forecast period. While larger SSDs provide more storage, the 320 GB-500 GB segment offers a significant performance upgrade over traditional HDDs at an affordable price. It caters to a growing demand for data storage due to the growing adoption of high-resolution media, complex software, and increased digital file sizes. Moreover, with an optimum storage capacity, the segment addresses the requirements of individual users and businesses, leading to demand growth.

Regional Insights

North America held the highest market share, 42.2%, in 2023. The region has a highly developed IT infrastructure and a large base of early adopters of advanced technologies. This region's reliance on data-intensive industries, such as finance, healthcare, and technology, has driven strong demand for high-performance storage solutions such as SSDs. Furthermore, significant investments in research and development by both industry and academic institutions have contributed to creating innovative SSD products and processes.

U.S. Solid State Drive Market Trends

The U.S. held the largest share of the regional market in 2023, owing to numerous multinational corporations and data centers in the country. These organizations require skilled employees working on high-end devices, which has fueled the adoption of SSDs for enterprise applications. In addition, high per capita income and strong consumer spending power have supported the demand for consumer-oriented SSD products, such as those used in laptops, desktops, and gaming consoles, leading to market expansion in the country.

Europe Solid State Drive Market Trends

Europe accounted for a notable market share in 2023. This is aided by the presence of a mature market for high-end electronics in the region. Economic affluence among consumers drives the demand for performance-oriented electronics. The significant advantage of speed and reliability offered by SSDs over HDDs caters perfectly to the requirements of consumers in this region. Moreover, with increasing data storage and transfer demands and HDD obsolescence, the SSD market is expected to advance steadily in the region over the forecast period.

The UK accounted for a significant share of the regional market in 2023 attributed to a surged demand from consumers in the country for SSD-compatible devices. With advancements in data storage technology, SSDs have become increasingly compact and can be installed in smaller devices for better data transfer rates. The rising demand for compact devices has led to market expansion for SSDs. A robust business environment in the country is responsible for driving the popularity of SSDs among organizations.

Asia Pacific Solid State Drive Market Trends

Asia Pacific is expected to register the fastest growth rate of 17.0% over the forecast period. The presence of key semiconductor manufacturers and component suppliers in the region has contributed to a mature and efficient supply chain for SSD production. Moreover, the presence of a large IT workforce is responsible for the heightened demand for SSDs. In addition, the region's strong manufacturing capabilities and skilled workforce have facilitated the production of high-quality SSDs at scale.

In India, there has been a substantial surge in disposable income among the middle-class population. At the same time, there has also been a sharp growth in the number of working professionals and students that prioritize seamless performance from their devices. This has led to an increased demand for personal computers and laptops for educational, professional, and personal uses. Additionally, growing digital literacy and the shift of businesses from offline to cloud-based platforms has positively impacted sales of high-performance SSDs in the country.

Key Solid State Drive Company Insights

Some key companies involved in the solid state drive market include SAMSUNG, Intel Corporation, Kingston Technology Corporation, and others.

-

SAMSUNG is a South Korean multinational company operating in multiple verticals. The company offers a diverse range of consumer electronics and computer accessories. SAMSUNG offers internal SSDs, external SSDs, USB flash drives, and memory cards under its memory and storage segment. The company offers SSDs with data storage ranging from 250 GB to 4 TB and of different types such as NVMe, SATA, and portable SSDs for varying requirements. SAMSUNG PCIe 4.0 NVMe M.2 V-NAND SSD is among the latest and bestselling SSDs offered by the company.

-

Intel Corporation is a U.S.-based organization offering semiconductor-based computer processors, software, graphics cards, and related services. Intel offers RAMs, cloud-based storage infrastructure, and SSDs required for computer motherboards to a majority of computer manufacturers. The company offers Intel Optane SSD DC P5801X series, based on PCIe 4.0 x4, NVMe interface, and storage capacity ranging from 58 GB to 3.2 TB.

Key Solid State Drive Companies:

The following are the leading companies in the solid state drive market. These companies collectively hold the largest market share and dictate industry trends.

- ADATA Technology Co., Ltd.

- Intel Corporation

- Kingston Technology Corporation

- Micron Technology, Inc.

- Microsemi (Microchip Technology Inc.)

- SAMSUNG

- Seagate Technology LLC

- SK HYNIX INC

- Western Digital Corporation

- Toshiba Corporation

Recent Developments

-

In June 2024, SK HYNIX announced that it had developed PCB01, the 5th generation 8-channel PCIe SSD for on-device AI computers. The SSDs are expected to deliver read and write speeds of 14 GB/s and 12 GB/s respectively, along with power efficiency of up to 30% from the preceding generation.

-

In April 2024, Micron Technology, Inc. announced that it had initiated the manufacturing of the world’s first 232-layered QLC NAND. The technology is being leveraged in the company’s Micron 2500 NMVe SSD and offers 28% more compactness than competitor technologies, along with a 24% read performance improvement over the previous generation.

Solid State Drive Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.0 billion

Revenue Forecast in 2030

USD 55.1 billion

Growth Rate

CAGR of 16.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, storage, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Spain, Italy, China, Japan, Singapore, South Korea, India, Taiwan, Brazil

Key companies profiled

ADATA Technology Co., Ltd.; Intel Corporation; Kingston Technology Corporation; Micron Technology, Inc.; Microsemi (Microchip Technology Inc.); SAMSUNG; Seagate Technology LLC; SK HYNIX INC.; Western Digital Corporation; Toshiba Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solid State Drive Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global solid state drive market report based on type, storage, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

External

-

Internal

-

-

Storage Outlook (Revenue, USD Million, 2018 - 2030)

-

Under 120 GB

-

120GB-320GB

-

320GB-500GB

-

500GB-1TB

-

1TB-2TB

-

Above 2TB

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Singapore

-

South Korea

-

Taiwan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.