- Home

- »

- Power Generation & Storage

- »

-

Solid State Car Battery Market Size & Share Report, 2030GVR Report cover

![Solid State Car Battery Market Size, Share & Trends Report]()

Solid State Car Battery Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Cathode, Electrolyte, Anode), By Vehicle Type, By Propulsion, By Battery Energy Density, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-360-9

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Solid State Car Battery Market Summary

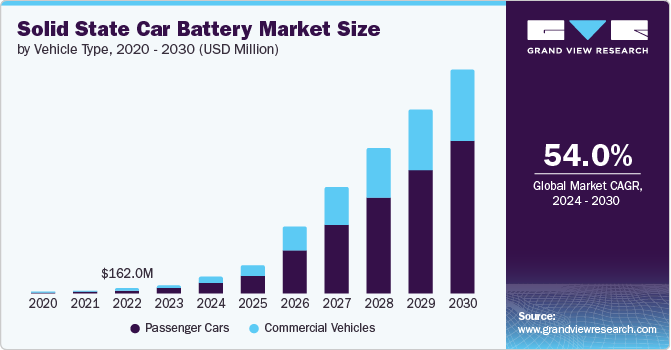

The global solid state car battery market size was estimated at USD 259.8 million in 2023 and is projected to reach USD 6,889.2 million by 2030, growing at a CAGR of 54.0% from 2024 to 2030. The global registration of electric vehicles (EVs) is anticipated to increase significantly over the forecast period. Rising availability of charging outlets and financial incentives have emerged as crucial factors for the development of electric vehicles market.

Key Market Trends & Insights

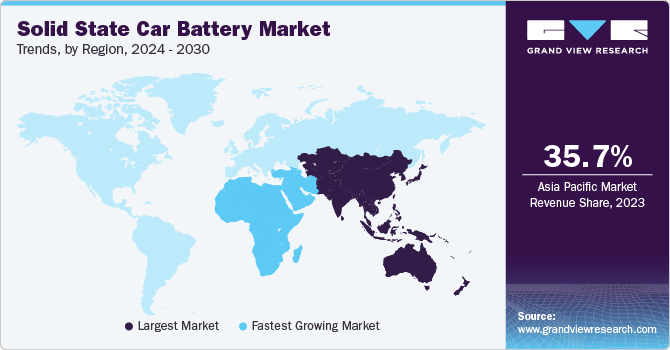

- Asia Pacific is expected to account for the largest market share of 35.66% over the forecast period in terms of the revenue in 2023.

- The U.S. solid state car battery market accounted for largest share of 62.14% in North America.

- China Solid State Car Battery Market accounted for largest share of 48.00% in Asia Pacific in 2023.

- Based on vehicle type, passenger cars segment led the market in 2023 by accounting for a share of 61.16% of the global market.

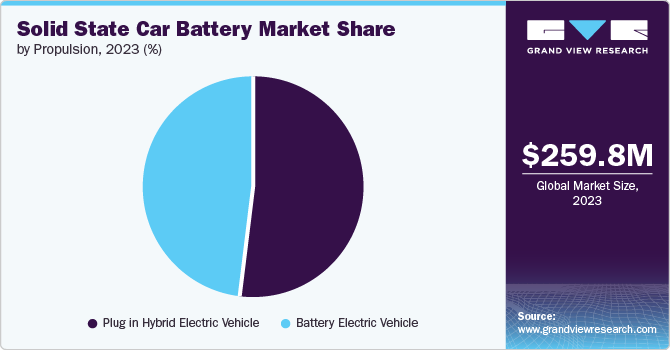

- In terms of propulsion, plug in hybrid electric vehicle segment led the market in 2023 by accounting for a share of 51.85% of the market.

Market Size & Forecast

- 2023 Market Size: USD 259.8 Million

- 2030 Projected Market Size: USD 6,889.2 Million

- CAGR (2024-2030): 54.0%

- Asia Pacific: Largest market in 2023

EVs have lower running cost as compared to conventional ICE-operated vehicles. EVs form the foundation for sustainable transport systems in the future along with the optimization of urban & suburban infrastructures. However, the global deployment of all types of EVs is necessary to achieve the sustainability target set by regulatory authorities. The Paris Declaration on “Electro-Mobility and Climate Change and Call to Action” proposed a target of deploying 100 million electric cars and 400 million electric two- and three-wheelers by 2030.

EVs form the foundation for sustainable transport systems in the future along with the optimization of urban & suburban infrastructures. However, the global deployment of all types of EVs is necessary to achieve the sustainability target set by regulatory authorities. The Paris Declaration on “Electro-Mobility and Climate Change and Call to Action” set a target to deploy 100 million electric cars and 400 million electric two- and three-wheelers by 2030.

Furthermore, rise in EV sales set the platform for significant growth of the e-mobility market over the forecast period. Arrival of integrated charging stations, green power-generation opportunities, e-mobility providers, battery manufacturers, and energy suppliers are anticipated to boost the solid state battery market in the coming years. General Motors (GM) was speculated to manufacture 500,000 EVs annually by 2017 end along with the subsistent electric technology that includes eAssist systems, requisite energy distributors, and charging facilities.

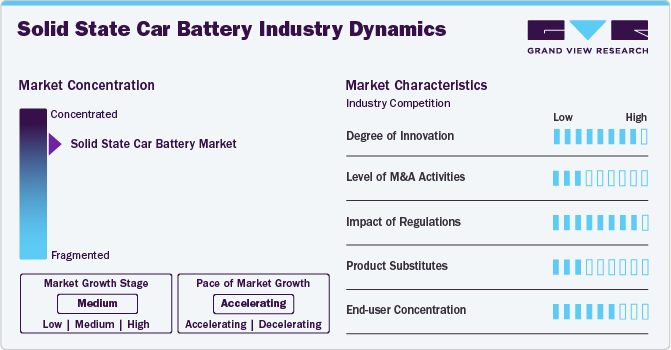

Industry Dynamics

The solid-state car battery market is characterized by rapid growth, driven by increasing demand for electric vehicles and advancements in technology. Key trends include the focus on safety, energy density, and cost reduction. Companies in this sector are increasingly leveraging new product development and research & development investment to attract customers and enhance product portfolio.

The demand for solid-state car batteries is influenced by several factors, including the increasing adoption of electric vehicles, government incentives and regulations, and technological advancements. The growing awareness of environmental concerns and the need for sustainable transportation options has led to a significant increase in the demand for electric vehicles, which in turn drives the demand for solid-state car batteries.

Component Insights

Based on component, the solid state car battery market is segregated into cathode, electrolyte, and anode. In terms of revenue, the electrolyte segment accounted for the largest share of 43.09% in the global solid state car battery market in 2023. Electrolyte plays a crucial role in boosting solid-state battery efficiency. The electrolyte is a critical component of solid state batteries, helping ions move between the cathode and anode. Its dominance in the market highlights its importance in making solid-state car batteries work well and efficiently.

The electrolyte is a key factor in determining the overall performance and safety of solid-state batteries. As the demand for electric vehicles continues to grow, the demand for advanced battery technologies such as solid-state batteries is also increasing. The electrolyte is a critical component in this growth, as it enables the efficient storage and release of energy. The ongoing research and development in electrolyte technologies, such as sulfide electrolytes, ceramic electrolytes, and polymer electrolytes are expected to further enhance the performance and efficiency of solid-state batteries.

The demand for anode in solid-state car batteries is significant, driven by the growing adoption of electric vehicles (EVs) and the need for more efficient and safer battery technologies. The leading players in the solid-state car battery market, such as Toyota Motor Corporation, Solid Power, QuantumScape, Samsung SDI, and LG Chem, are investing heavily in research and development to improve the performance and efficiency of anode materials. The anode market is expected to be driven by the increasing demand for high-energy density and long-cycle life batteries, which require advanced anode materials. In addition, the growing focus on sustainability and environmental concerns is also driving the demand for anode materials that are more eco-friendly and recyclable.

Vehicle Type Insights

Based on vehicle type, the solid state car battery market has been segmented into passenger cars and commercial vehicles. Passenger cars segment led the market in 2023 by accounting for a share of 61.16% of the global market. Passenger vehicles are expected to be the major consumers of solid state batteries. Government incentives and subsidies to encourage the adoption of electric vehicles have brought down their prices considerably. Besides, the availability of publicly accessible charging booths has also increased the popularity of these vehicles, particularly in Europe and North America.

The demand for solid-state car batteries in commercial vehicles is expected to grow significantly over the forecast period. The increasing adoption of electric commercial vehicles, such as buses and trucks, is driving the demand for solid-state batteries. These batteries offer higher energy density, faster charging times, and longer lifespan compared to traditional lithium-ion batteries, making them more suitable for commercial applications.

Propulsion Insights

Based on propulsion, the solid state car battery market has been segmented into battery electric vehicle, plug in hybrid electric vehicle. In terms of revenue, plug in hybrid electric vehicle segment led the market in 2023 by accounting for a share of 51.85% of the market.

The demand for solid-state car batteries in plug-in hybrid electric vehicles (PHEVs) is expected to grow significantly over the forecast period. PHEVs offer a more efficient and environmentally friendly alternative to traditional internal combustion engine vehicles, and solid-state batteries can further enhance their performance and range. The increasing adoption of PHEVs, driven by government incentives and regulations, is expected to drive the demand for solid-state batteries.

Battery Energy Density Insights

Based on battery energy density, the solid state car battery market has been segmented into <450 WH/KG (Watt Hour/KG) and >450 WH/KG (Watt Hour/KG). In terms of revenue, >450 WH/KG (Watt Hour/KG) segment led the market in 2023 by accounting for a share of 61.39% of the market.

>450 WH/KG (Watt Hour/KG) in the solid state car battery industry have faster increasing architecture which allows for faster movement of lithium ions, enabling quicker charging times. This is expected to revolutionize electric mobility, reducing range anxiety and making EVs more convenient for long journeys. A battery with 450 Wh/kg or more can store significantly more energy per kilogram of weight. This translates to a longer driving range for EVs, potentially exceeding 600 miles on a single charge.

Regional Insights

The U.S. accounted for the largest share in North America solid-state battery market in 2023 and is anticipated to progress at the significant rate over the forecast period. Canada is another important solid-state battery market in North America. Robust manufacturing base and rapid growth of electric vehicle production in the U.S. is expected to augment the demand for solid state batteries in the upcoming years. North America is expected to witness a reasonable market growth over the forecast period owing to the growing sales of electric vehicles and consumer electronics in the U.S. and Canada.

U.S. Solid State Car Battery Market Trends

The U.S. solid state car battery market accounted for largest share of 62.14% in North America. Federal policies promoting EV sales coupled with the presence of a large number of players in the market is expected to drive the solid state battery demand. The federal policies include the American Recovery and Reinvestment Act of 2009 which established tax credits for purchasing electric vehicles. In addition, the new CAFE standards (Corporate Average Fuel Economy) have mandated fuel economy standards for passenger cars and light commercial vehicles resulting in expansion of electric drive technologies. The market players in the country are investing heavily in the research and development of solid state batteries for electric vehicles. Such initiatives are anticipated to drive the solid state battery market in the U.S.

The solid state car battery marketin Canada is also expected to grow at CAGR of 56.4%. The demand for solid-state car batteries in Canada is expected to grow significantly in the coming years. The Canadian government has set a target of having 100% of new light-duty vehicle sales be electric by 2040, which will drive the demand for solid-state batteries. In addition, major automakers such as General Motors, Ford, and Fiat Chrysler Automobiles (FCA) have announced plans to invest heavily in electric vehicle technology, including the development of solid-state batteries.

Asia Pacific Solid State Car Battery Market Trends

Asia Pacific is expected to account for the largest market share of 35.66% over the forecast period in terms of the revenue in 2023. Shift of production industry toward emerging economies, particularly China and India, is expected to positively influence market growth over the forecast period. The region is home to the fastest electric vehicle market which presents vast potential for solid-state battery manufacturers in the region. In addition, Asia Pacific is recognized by the availability of a large skilled workforce at low cost along with ample support from the local governments.

China Solid State Car Battery Market accounted for largest share of 48.00% in Asia Pacific in 2023. China is expected to be a significant market for solid-state car batteries, driven by increased investment in charging infrastructure and government initiatives to boost the demand for electric vehicles. The country is projected to be a major contributor to the global solid-state car battery market, with a significant portion of the demand coming from the passenger car segment. China has been actively promoting the adoption of electric vehicles through policies such as purchase grants and subsidies, which are expected to further drive the demand for solid-state batteries.

Solid state car battery market in India also expected to grow at highest CAGR of 56.6%. The demand for solid-state car batteries in India is expected to grow significantly in the coming years. The Indian government has been actively promoting the adoption of electric vehicles through policies such as the FAME II scheme, which offers incentives for the purchase of electric vehicles. In addition, the government has set a target of having 30% of all new vehicle sales to be electric by 2030.

Europe Solid State Car Battery Market Trends

Growing EU funding and supportive measures taken by governments including subsidies, tax breaks, and incentives are expected to augment the production of electric vehicles in the region.

France solid state car battery market accounted for largest share of 20.42% in Europe. France is expected to be a significant market for solid-state car batteries, driven by the country's commitment to reducing carbon emissions and increasing the adoption of electric vehicles. The French government has set ambitious targets for the adoption of electric vehicles, with a goal of having 50% of new car sales be electric by 2030.

The solid state car battery marketin Germany is also expected to grow at significant CAGR. The demand for solid-state car batteries in Germany is expected to grow significantly in the coming years. Germany is a key player in the global electric vehicle (EV) market, with major automakers such as Volkswagen, BMW, and Mercedes-Benz investing heavily in EV technology. The German government has also implemented various incentives to promote the adoption of EVs, including purchase grants and subsidies for the purchase of electric vehicles.

Central & South America Solid State Car Battery Market Trends

The demand for solid-state car batteries in Central & South America is expected to grow significantly in the coming years. The region is seeing an increase in the adoption of electric vehicles, driven by government incentives and the growing awareness of the environmental benefits of EVs.

Brazil solid state car battery market accounted for largest share of 44.05% in 2023 in Central & South America. The market is driven by the increasing adoption of electric vehicles, government incentives, and investments in electric vehicle technology. Brazil has set ambitious targets for the adoption of electric vehicles, with a goal of having 50% of new car sales be electric by 2030.

Middle East & Africa Solid State Car Battery Market Trends

The region is undergoing a remarkable transformation in the fields of energy and technology, with Saudi Arabia and the United Arab Emirates (UAE) emerging as the primary drivers of solid-state battery development.

Saudi Arabia solid state car battery market accounted for largest share of 43.21% in 2023 in Middle East & Africa. The Saudi government has also set ambitious targets for the adoption of electric vehicles, with a goal of having 50% of new car sales be electric by 2030. This, coupled with the country's Vision 2030 and 2021 focus on technology-driven development and innovation, is driving investments in emerging technologies like solid-state batteries.

Key Solid State Car Battery Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new Product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share. Key companies in solid state car battery market include Gotion, Toyota, and others

-

In May 2024, Gotion unveiled solid state EV battery with energy density of 350 Wh/kg. The company plans initiate mass production of solid state car batteries by 2030.

-

In April 2024, Nissan announced plans to produce electric vehicles powered by solid state batteries in Yokohama, Japan. The company also revealed plans for mass production of electric vehicles powered by next generation batteries by 2028.

-

In January 2024, Toyota announced plans for mass production of solid state batteries for cars by 2027 or 2028 with promising technologies which provides double vehicle range and low charging time.

Key Solid State Car Battery Companies:

The following are the leading companies in the solid state car battery market. These companies collectively hold the largest market share and dictate industry trends.

- Solid Power

- QuantumScape

- Ion Storage System

- Blue Solutions

- CATL

- BYD

- LG Chem

- Panasonic

- Wellon

- QingTao

Solid State Car Battery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 516.8 million

Revenue forecast in 2030

USD 6,889.2 million

Growth rate

CAGR of 54.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, vehicle type, propulsion, battery energy density, region

Regional Scope

North America; Europe; Asia Pacific; Central and South America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; France; Germany; Netherlands; Norway; UK; Spain; China; Japan; South Korea; India; Brazil; Argentina;Saudi Arabia; UAE; South Africa

Key companies profiled

Solid Power, QuantumScape, Ion Storage System, Blue Solutions, CATL, BYD, LG Chem, Panasonic, Wellon, QingTao

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solid State Car Battery Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global solid state car battery market report on the basis of component, vehicle type, propulsion, battery energy density, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Cathode

-

Electrolyte

-

Anode

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

Battery Electric Vehicle

-

Plug in Hybrid Electric Vehicle

-

-

Battery Energy Density Outlook (Revenue, USD Million, 2018 - 2030)

-

<450 WH/KG (Watt Hour/KG)

-

>450 WH/KG (Watt Hour/KG)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Netherlands

-

Norway

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global solid state car battery market size was estimated at USD 259.8 million in 2023 and is expected to reach USD 516.8 million in 2024.

b. The global solid state car battery market is expected to witness a compound annual growth rate of 54.0% from 2024 to 2030 to reach USD 6,889.2 million by 2030.

b. The passenger vehicles segment occupied the largest solid state car battery market share of about 61.2% in 2023 owing to the government incentives and subsidies to encourage the adoption of electric vehicles have brought down their prices considerably.

b. Some key players in the solid-state car battery market include Solid Power, QuantumScape, Ion Storage System, Blue Solutions, CATL, BYD, LG Chem, Panasonic, Wellon, and QingTao.

b. The global solid state car battery market is expected to register substantial growth owing to the rising availability of charging outlets and financial incentives have emerged as crucial factors for the development of electric vehicles market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.