- Home

- »

- Renewable Energy

- »

-

Solar Cell Market Size, Share & Growth Analysis Report 2030GVR Report cover

![Solar Cell Market Size, Share & Trends Report]()

Solar Cell Market Size, Share & Trends Analysis Report By Technology (Monocrystalline, Polycrystalline, CDTE, A-Si, CIGD), By Application (Residential, Commercial, Utility), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-691-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Solar Cell Market Size & Trends

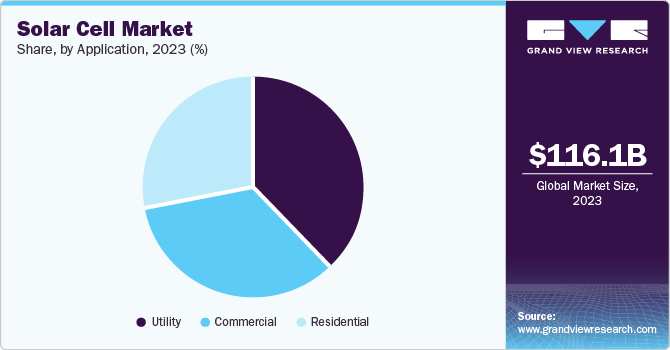

The global solar cell market size was valued at USD 116.1 billion in 2023 and is projected to grow at a CAGR of 16.4% from 2024 to 2030. The growing environmental awareness and the urgent need to reduce carbon emissions push governments and consumers towards renewable energy sources. Technological advancements in solar cell efficiency and manufacturing processes make solar energy more cost-effective and accessible. In addition, supportive government policies, subsidies, and incentives encourage solar power adoption. The constantly increasing demand for sustainable energy solutions in residential, commercial, and industrial sectors further fuels this growth, as does the growing investment in solar infrastructure and grid integration.

Regulatory frameworks significantly influence the solar cell market by fostering an environment conducive to expansion and advancement. Notably, policies such as the Renewable Portfolio Standards (RPS) stipulate a minimum requirement for electricity generation from renewable sources, including solar power, thereby substantially impacting market dynamics and innovation.

In addition, Feed-in Tariffs (FiTs) and Power Purchase Agreements (PPAs) provide financial stability by guaranteeing prices for solar energy producers and encouraging long-term investments. The Investment Tax Credit (ITC) in the U.S. enables homeowners and businesses to offset a significant portion of solar system expenses from their federal taxes, thereby improving cost-effectiveness. Furthermore, tax incentives and subsidies reduce the financial burden on solar projects, making them more attractive to developers and investors.

Technology Insights

The polycrystalline segment accounted for 43.7% of the total revenue generated in the global solar cell market in 2023. Polycrystalline solar cells, or multi-crystalline cells, are known for their cost-effectiveness and relatively simpler manufacturing process than monocrystalline cells. This affordability makes them popular for large-scale installations, contributing significantly to their market dominance. Despite having a lower efficiency rate than monocrystalline cells, polycrystalline cells offer a good balance between performance and cost, making them suitable for various applications, from residential rooftops to large solar farms. The widespread adoption of polycrystalline technology is also driven by its proven reliability and the extensive experience manufacturers have with this type of solar cell.

The copper indium gallium diselenide (CIGS) segment is expected to grow at a CAGR of 21.0% over the forecast period. CIGS solar cells are a thin-film technology known for their high efficiency and flexibility. This technology produces lightweight and flexible solar panels for various applications, including building-integrated photovoltaics (BIPV) and portable solar devices. The rapid segment growth is driven by ongoing advancements in thin-film technology, improving efficiency and reducing production costs. Moreover, CIGS panels' versatility and aesthetic appeal make them attractive for commercial and residential installations. The increasing demand for high-efficiency, flexible solar solutions is expected to propel the growth of the CIGS segment significantly in the coming years.

Application Insights

The utility segment dominated the global solar cell market in 2023 attributed to the increasing demand for renewable energy from utility companies and the need to meet regulatory requirements for renewable energy quotas. In addition, advancements in solar technology and economies of scale have reduced the cost of utility-scale solar projects, making them more financially viable. Countries such as the U.S. and China have been leading in utility-scale solar installations, with substantial investments in solar infrastructure to support their energy transition goals.

The residential segment is expected to grow at the fastest CAGR from 2024 to 2030. Homeowners are increasingly adopting solar panels to reduce their electricity bills and carbon footprint. Government incentives, such as tax credits and rebates, have made residential solar installations more affordable. Technological advancements in terms of efficiency and pleasing aesthetics of solar panels have also contributed to the segment growth.

In addition, the rise of smart home technologies and energy storage solutions, such as home batteries, has made it easier for homeowners to manage and optimize their solar energy use. Integrating solar panels into building materials, such as solar roof tiles, is another trend expected to drive growth in the residential segment.

Regional Insights

North America solar cell market held a significant share in the global market in 2023. The U.S. solar cell market, particularly, is witnessing substantial growth driven by federal and state-level incentives, falling solar installation costs, and increasing public awareness about climate change. The recent solar Investment Tax Credit (ITC) expansion has been a game-changer, encouraging residential and commercial solar technology investments. Furthermore, as more utilities integrate solar into their energy portfolios, the market is poised for sustained growth, reflecting a broader shift toward sustainability across the region.

U.S. Solar Cell Market Trends

The U.S. solar cell market is projected to experience significant growth over the forecast period, driven by policy support, technological advancements, and increasing demand for clean energy. The U.S. administration’s commitment to combating climate change has resulted in a more favorable regulatory environment for renewable energy investments. This includes proposed incentives for solar deployment in low-income communities and increased funding for research and development.

In addition, as major corporations commit to sustainability targets, the demand for solar energy solutions continues to rise. For instance, tech giants such as Google and Apple are investing heavily in solar energy to power their operations, showcasing the corporate shift towards renewable energy adoption. This trend supports environmental goals and encourages economic growth within the solar sector.

Asia Pacific Solar Cell Market Trends

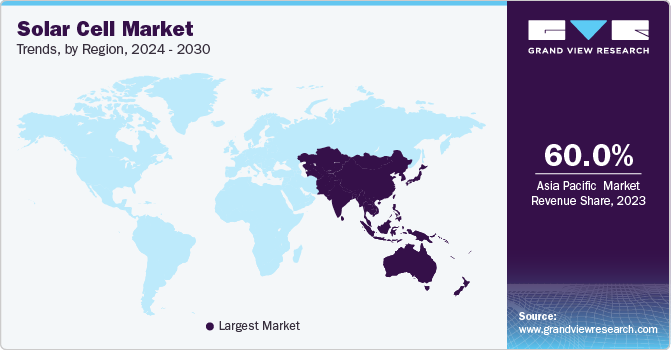

Asia Pacific dominated the global solar cell market with a revenue share of 60.0% in 2023, driven by rapid industrialization, increasing energy demands, and government policies promoting renewable energy sources. Countries such as India, Japan, and Australia also invest heavily in solar infrastructure, further boosting regional growth. The competitive landscape is characterized by both established players and emerging companies, reflecting a vibrant market with ongoing technological advancements. For instance, innovations in solar efficiency and storage solutions have been pivotal in meeting the diverse energy needs of this vast region.

China accounted for a substantial revenue share of the Asia Pacific solar cell market in 2023 owing to the country’s aggressive policies supporting renewable energy development, including substantial subsidies for solar projects and ambitious government targets for renewable energy capacity. Chinese manufacturers such as JinkoSolar and Trina Solar have become popular market players in terms of production volume and technological innovations.

The country's focus on reducing production costs through economies of scale has allowed it to remain competitive internationally. In addition, the ongoing transition towards electric vehicles and smart grid technologies is expected to further stimulate the demand for solar energy in China, positioning it as a critical player in the global energy landscape.

Europe Solar Cell Market Trends

The Europe solar cell market is expected to grow at a CAGR of 15.9% from 2024 to 2030. The European Union's (EU) aggressive renewable energy goals and commitment to reducing greenhouse gas emissions are key drivers of this growth. Countries such as Germany and Spain are leading the charge with robust solar energy policies that include feed-in tariffs and tax incentives for solar installations.

The EU's Green Deal of September 2023 aims to significantly boost the share of renewables to 42.5% by 2030 in its energy mix, providing a strong impetus for the solar sector. Notably, European manufacturers also focus on sustainability in their production processes, with companies such as Group pioneering eco-friendly solar technologies. As the demand for clean energy continues to surge, Europe is likely to emerge as a critical hub for solar innovation and investment.

Key Solar Cell Company Insights

Some of the key companies in the solar cell market include Panasonic Corporation, JINERGY, Hevel, ReneSola, United Renewable Energy, LLC, SunPower Corporation, Risen Solar, Trina Solar, and Jinko Solar.

-

Jinko Solar is one of the largest solar module manufacturers globally. The company focuses on its high-efficiency N-type monocrystalline silicon solar cells, which offer a conversion efficiency of 26.4%.

-

Risen Solar is known for its technological advancements, such as its heterojunction (HJT) Hyper-ion Modules, with a record efficiency rate of 23.9%. The company focuses extensively on energy storage and building-integrated photovoltaics (BIPV).

Key Solar Cell Companies:

The following are the leading companies in the solar cell market. These companies collectively hold the largest market share and dictate industry trends.

- Panasonic Corporation

- JINERGY

- Hevel

- ReneSola

- United Renewable Energy, LLC

- SunPower Corporation

- Risen Solar

- Trina Solar

- Jinko Solar

- Yingli Green Energy Holding Company Limited

- SunPower Corporation

- Canadian Solar Inc.

- GCL-Poly Energy Holdings Limited

Recent Developments

-

In August 2024, Tongwei launched the TNC-G12/G12R series modules marked a significant industry milestone. These modules offer superior power output, efficiency, and quality, leveraging its proprietary solar cell technology and setting a new benchmark for high-performance solar solutions.

-

In July 2024, First First Solar, Inc. acquired the intellectual property rights related to TetraSun, Inc.'s innovative thin-film solar technology. This acquisition has enabled the company to initiate legal proceedings against several crystalline silicon solar manufacturers for alleged infringement of the patent portfolio.

-

In February 2024, ECOKRAFT acquired Fenix Solar, a renowned solar panel monitoring and optimization specialist. Fenix Solar's cutting-edge technology is expected to enable ECOKRAFT to offer its customers more comprehensive and advanced solutions. By leveraging Fenix Solar's capabilities for proactive troubleshooting and real-time data analysis, ECOKRAFT is likely to be able to deliver enhanced performance, reliability, and efficiency to its solar installations.

-

In December 2023, Qcells finalized the acquisition of full intellectual property rights for LECO technology. This innovative technology is recognized for its potential to boost the efficiency of PERC and TOPCon solar cells significantly.

Solar Cell Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 134.5 billion

Revenue forecast in 2030

USD 333.8 billion

Growth rate

CAGR of 16.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, China, India, Japan, Australia, South Korea, Brazil, Argentina, UAE, Saudi Arabia, South Africa

Key companies profiled

Panasonic Corporation, JINERGY, Hevel, ReneSola, United Renewable Energy, LLC, SunPower Corporation, Risen Solar, Trina Solar, Jinko Solar, Yingli Green Energy Holding Company Limited, SunPower Corporation, Canadian Solar Inc., GCL-Poly Energy Holdings Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solar Cell Market Report Segmentation

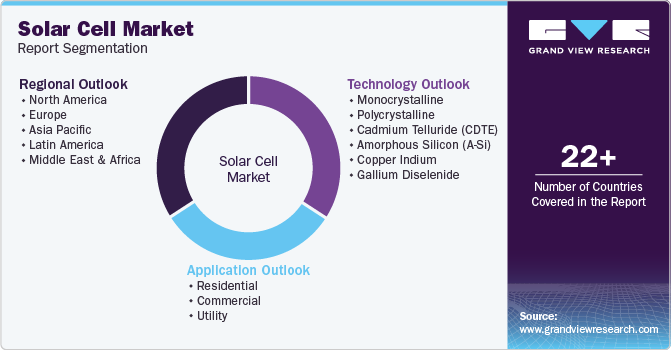

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global solar cell market report based on technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Monocrystalline

-

Polycrystalline

-

Cadmium Telluride (CDTE)

-

Amorphous Silicon (A-Si)

-

Copper Indium Gallium Diselenide

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Utility

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."