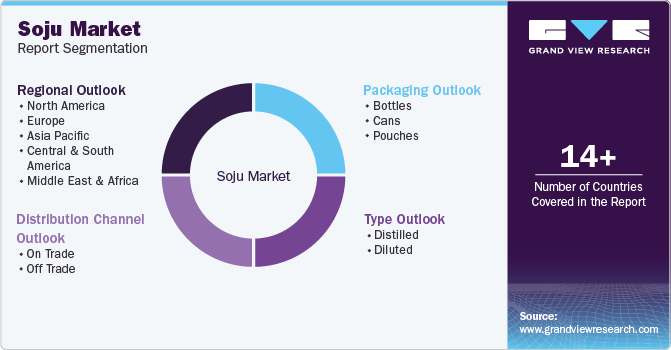

Soju Market Size, Share & Trends Analysis Report By Type (Distilled, Diluted), By Packaging (Bottles, Cans, Pouches), By Distribution Channel (On-trade, Off-trade), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-435-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Soju Market Size & Trends

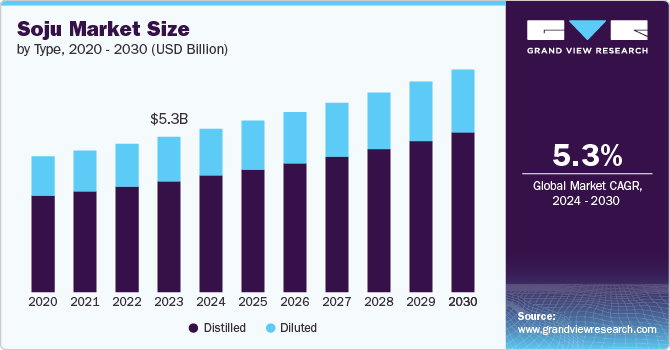

The global soju market size was estimated at USD 5.30 billion in 2023 and is expected to grow at a CAGR of 5.3% from 2024 to 2030. Several interconnected factors influence the rising demand and consumption of soju. The global surge in the popularity of Korean culture-driven by K-dramas and K-pop has significantly increased interest in Korean cuisine and beverages. This cultural fascination has introduced soju to a wider audience and increased its appeal.

Soju's unique flavor profile and versatility also contribute to its growing popularity. It can be enjoyed straight, on the rocks, or in a variety of cocktails, catering to diverse preferences. In addition, its relatively lower alcohol content and fewer calories compared to other spirits make it an attractive option for health-conscious consumers seeking lighter alternatives.

Economic considerations further drive soju's demand. Soju appeals to budget-conscious consumers and is often more affordable than spirits like whiskey or vodka. The beverage's expanding availability through international distribution, online platforms, and the increasing number of Korean restaurants and bars worldwide has also enhanced its reach.

Soju manufacturers are introducing a wide array of innovative flavors to cater to evolving consumer preferences. Fruit-infused varieties like peach, grape, and citrus, as well as unique combinations like green tea and lychee, are becoming increasingly popular, especially among younger consumers. This flavor diversification makes soju more approachable and appealing to a broader audience. Moreover, the rise of premium and craft soju offerings attracts consumers willing to pay more for elevated quality and distinctive flavor experiences. Aged or artisanal soju varieties are considered sophisticated alternatives to spirits like vodka or whiskey.

In December 2023, Spirit of Gallo expanded its spirits portfolio by adding soju through a partnership with LOTTE Chilsung Beverage Co., Ltd. This collaboration will introduce three soju brands-Soonhari, Chum Churum, and Saero-into the U.S. market starting January 2024. Soju, a traditional Korean spirit, has gained popularity in the U.S., particularly among multicultural consumers and Gen Z, due to its lower alcohol content and versatility.

Type Insights

Distilled soju accounted for a revenue share of 71.30% in 2023. The strong social drinking culture associated with soju, particularly in South Korea, is being embraced and adopted in other countries. This trend is especially notable among Korean expatriates and individuals interested in Korean cuisine and social practices. Furthermore, global mixologists recognize soju's versatility in cocktails, enhancing its presence in bars and restaurants.

Diluted soju is expected to grow at a CAGR of 5.0% from 2024 to 2030. Diluted soju typically has a lower alcohol content compared to traditional distilled soju. This makes it more appealing to consumers who prefer lighter alcoholic beverages or want to enjoy the taste of soju without the higher alcohol levels, making it a more accessible choice for a broader audience. The trend of offering diluted soju in various flavors caters to diverse taste preferences. Consumers are drawn to flavored diluted soju for its refreshing and less intense taste, which can be enjoyed in a variety of social settings or casual drinking occasions.

Distribution Channel Insights

Off-trade accounted for a revenue share of 69.20% in 2023.Off-trade channels provide consumers easy access to soju at their convenience, whether in physical stores or online. This accessibility allows consumers to purchase soju without the need to visit specialized venues or bars, making it a more convenient option for home consumption. Off trade is further segmented into supermarkets & hypermarkets, convenience stores, online, and others.

On-trade is expected to grow at a CAGR of 5.8% from 2024 to 2030.On trade stores offer easy access to a variety of soju brands, allowing consumers to pick up what they need during their regular shopping trips. The convenience of finding soju’s in local grocery stores makes it simple for consumers to quickly purchase and use them at home.

Packaging Insights

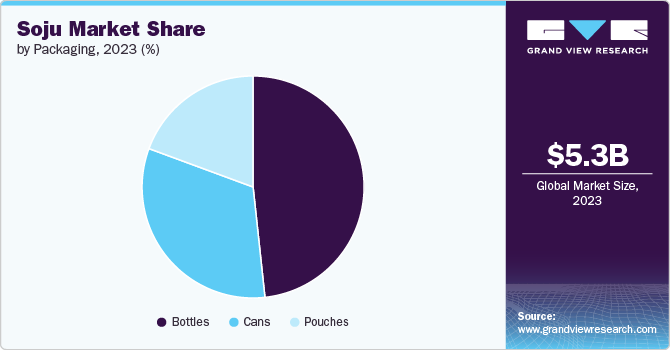

Bottled soju accounted for a revenue share of 48.50% in 2023. Bottled soju preserves flavor and quality better than other packaging options. The sealed bottle helps maintain the integrity of the soju, ensuring that it remains fresh and enjoyable for a longer period, which can boost consumer confidence and preference for bottled options.

Pouched soju is expected to grow at a CAGR of 5.2% from 2024 to 2030. Pouched soju represents a modern and trendy packaging format that attracts younger consumers. The innovative design and casual appeal of pouches can enhance the brand’s image and attract a demographic interested in novel and convenient packaging options.

Regional Insights

The soju market in North America accounted for a revenue market share of 20.20% in 2023. Soju's versatility in cocktails and mixed drinks is gaining traction among North American consumers. Bartenders and mixologists are increasingly incorporating soju into innovative and diverse cocktail recipes, enhancing its appeal in bars and restaurants across the region.

U.S. Soju Market Trends

The soju market in the U.S. is facing intense competition and innovation.The rising popularity of Korean cuisine, K-dramas, and K-pop in the U.S. has introduced many consumers to soju. As Korean cultural influence continues to grow, soju is becoming a familiar and preferred choice for those seeking to experience authentic Korean dining and drinking experiences.

Europe Soju Market Trends

The soju market in Europe is expected to grow at a CAGR of 5.0% during the forecast period. European consumers are often keen to explore new and unique beverages. Soju's distinctive flavor profile and cultural heritage appeal to those looking for novel drinking experiences. This curiosity and willingness to try new products contribute to its growing popularity.The growing interest in Korean restaurants and Korean culinary traditions has introduced European consumers to soju as an integral part of the dining experience.

Asia Pacific Soju Market Trends

The soju market in Asia Pacific is expected to grow at a CAGR of 5.8% from 2024 to 2030. Soju has deep cultural roots in countries like South Korea, where it is a staple in social and dining settings. Its popularity in South Korea influences neighboring countries in the Asia-Pacific region, where Korean culture and cuisine are increasingly appreciated and adopted. Rapid urbanization and modernization in the Asia-Pacific region have led to a growing middle class with changing lifestyles and drinking habits. Soju's presence in bars, restaurants, and social venues in urban areas aligns with contemporary social practices and the increasing demand for a variety of alcoholic beverages.

Key Soju Company Insights

The soju market is characterized by dynamic competitive dynamics shaped by a combination of factors, including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective, quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Soju Companies:

The following are the leading companies in the soju market. These companies collectively hold the largest market share and dictate industry trends.

- HiteJinro Co., Ltd.

- Lotte Chilsung Beverage Co., Ltd.

- Korea Alcohol Co., Ltd.

- Hwayo

- The Soju Company

- OB Brewing Co., Ltd.

- Sool Soju

- Tokki Soju

- The Han

- C1 Soju

Recent Developments

-

In March 2024, HiteJinro launched a new soju brand called "Chamisul Fresh" in the U.S. market. This product is designed to appeal to American consumers by offering a smooth and mellow taste profile, which is less intense than traditional soju. The company aims to promote Chamisul Fresh as a versatile beverage suitable for various occasions, including casual gatherings and dining experiences. HiteJinro is focusing on expanding its presence in the U.S. as the demand for soju continues to grow, particularly among younger consumers and those interested in Korean culture.

Soju Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.57 billion |

|

Revenue forecast in 2030 |

USD 7.59 billion |

|

Growth rate |

CAGR of 5.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, packaging, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; UAE |

|

Key companies profiled |

HiteJinro Co., Ltd.; Lotte Chilsung Beverage Co., Ltd.; Korea Alcohol Co., Ltd.; Hwayo; The Soju Company; OB Brewing Co., Ltd.; Sool Soju; Tokki Soju; The Han; C1 Soju |

|

Customization scope |

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Soju Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global soju market report based on type, packaging, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Distilled

-

Diluted

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

Pouches

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On Trade

-

Off Trade

-

Hypermarkets & Supermarkets

-

Convenience stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global soju market size was estimated at USD 5.30 billion in 2023 and is expected to reach USD 5.57 billion in 2024.

b. The global soju market is expected to grow at a compounded growth rate of 5.3% from 2024 to 2030 to reach USD 7.59 billion by 2030.

b. Bottled soju accounted for a share of 48.5% in 2023. Bottled soju offers convenience for consumers who prefer to enjoy their drinks at home or on the go. The ease of storage, handling, and transportation makes bottled soju a practical choice for many, enhancing its appeal.

b. Some key players operating in soju market include HiteJinro Co., Ltd., Lotte Chilsung Beverage Co., Ltd., Korea Alcohol Co., Ltd., Hwayo, and others.

b. Key factors that are driving the market growth include rising flavor and product innovation, growing cultural diversity and globalization

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."