Software Market Size, Share & Trends Analysis Report By Type (Application Software, System Infrastructure Software, Productivity Software), By Deployment (On-premises, Cloud), By Enterprise Size, By Vertical (IT & telecom) By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-927-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Software Market Size & Trends

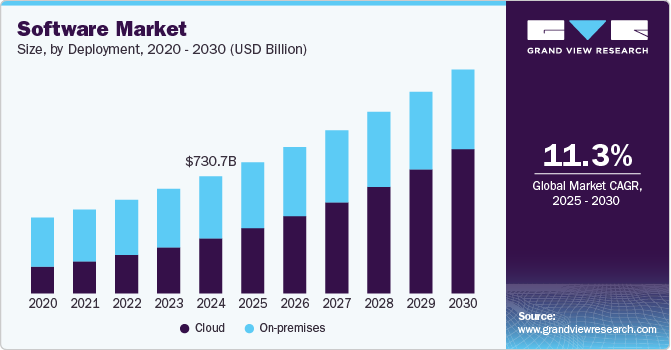

The global software market size was estimated at USD 730.70 billion in 2024 and is projected to grow at a CAGR of 11.3% from 2025 to 2030. This growth is driven by several key factors, including technological advancements, government initiatives, and research projects that enhance software capabilities. The increasing adoption of cloud-based solutions, digital transformation initiatives, and the integration of AI and machine learning into software products are also significant drivers.

In addition, the rise of IoT technology and smart city developments further boost demand for software products, as these technologies require sophisticated software solutions to manage and analyze vast amounts of data.

The software mainly aims to protect and secure individual computing devices, information systems, internet communication, transactions, and networks. Security software performs tasks such as access management, data and network protection as well as security against viruses, intrusions, and any other system-level security risks. The demands of remote working have increased expenditure on cybersecurity software. With highly sophisticated methods and means of attack development, software innovators are firing back. For instance, in May 2023, Dell Inc., a technology company, enhanced the security software of its storage portfolio PowerStore3 to assist organizations in accelerating the adoption of Zero Trust. This security architecture ensures the authorization of only known entities and model actions. With the security upgrades, organizations can prevent unauthorized modifying or deleting of snapshots before their expiration date. It also permits storage administrators to handle access directly from PowerStore to respond quickly to security threats.

Recent years have observed a considerable adoption of software solutions, driven by the increase of e-commerce, large technology developments such as artificial intelligence and IoT, and the growing number of connected devices. The rising sophistication of malware and methods of attack, as well as its growing accessibility, has led to the development of advanced cybersecurity software, including innovative and varied cybersecurity tools and solutions. For instance, in May 2023, Stacklock, a Seattle-based company, raised USD 17.5 billion to protect its software from cybersecurity threats. The company’s investment to protect its software would help gain end-to-end provenance in its software supply chain, enabling it to protect against attacks, mitigate risks, and ensure the integrity of its digital assets.

Type Insights

The application software segment led the market with over 44% share of the global revenue in 2024. The growth is supported by the rising demand for various software applications designed to accelerate and streamline business processes using cutting-edge IoT technologies and cloud-based solutions. Application software in the market study includes enterprise resource planning (ERP), customer relationship management (CRM), supply chain management (SCM), enterprise collaboration software, enterprise content management (ECM) software, education software, and others.

The development and deployment software segment is anticipated to grow at a significant CAGR during the forecast period. This growth is driven by the increasing need for efficient data management tools that can handle complex data environments. Software solutions in this segment enable organizations to extract, transform, and load data effectively, supporting real-time analytics and decision-making. The adoption of these tools is further facilitated by low-code/no-code interfaces, making data integration more accessible to business users. This trend is expected to continue as businesses seek to leverage data insights for strategic advantages.

Deployment Insights

The on-premises segment held the largest market revenue share in 2024. This approach allows organizations to maintain control over their data, ensuring compliance with data sovereignty laws and integrating legacy systems without significant overhauls. On-premises data integration solutions are particularly beneficial for industries with strict data privacy regulations, such as healthcare and finance. These solutions often include data replication tools that ensure data consistency across local networks. By maintaining data on-premises, organizations can ensure high levels of security and control.

The cloud segment is anticipated to grow at the fastest CAGR over the forecast period. Cloud-based data integration solutions offer scalability, flexibility, and cost-effectiveness, making them appealing for organizations seeking to manage diverse data sources efficiently. Cloud platforms enable real-time data exchange and support the integration of data from multiple cloud sources, such as AWS, Azure, and Google Cloud. This approach is particularly beneficial for businesses adopting cloud-first strategies to enhance operational agility. Cloud-based data integration also supports the integration of data from IoT devices and edge computing environments.

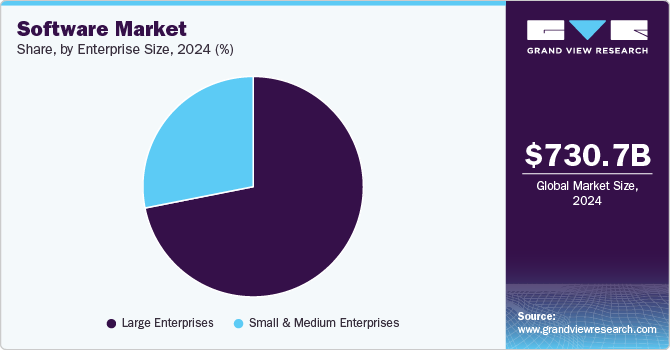

Enterprise Size Insights

The large enterprises segment dominated the market in 2024 due to its high adoption rate of data integration software. Large enterprises benefit from data integration by enhancing productivity, gaining greater visibility, and reducing IT burdens. This allows them to maintain a competitive edge in complex business environments. Companies in this segment often have complex data ecosystems, necessitating advanced data integration solutions to manage diverse data sources effectively. Large enterprises also leverage data integration to improve customer experiences and optimize supply chains.

The small and medium enterprises segment is expected to grow at the fastest CAGR during the forecast period. SMEs are increasingly adopting cloud-based data integration solutions to improve operational efficiency and reduce costs. These solutions provide SMEs with scalable and affordable tools to manage data from multiple sources. The adoption is driven by the need for SMEs to compete effectively in a data-driven business environment. For instance, according to Capterra’s 2025 Tech Trends Survey, a significant majority of Indian businesses plan to increase their software spending in 2025 compared to the previous year. This trend is driven by India's rapidly evolving technological landscape.

Vertical Insights

The IT & telecom segment held the largest market revenue share in 2024 due to its extensive reliance on data-driven operations. This sector generates vast amounts of data, necessitating advanced data integration tools to manage and analyze it effectively. Data integration supports strategic decision-making and operational efficiency in IT & telecom companies. The rapid adoption of technologies such as 5G and edge computing further increases the demand for data integration solutions in this sector. IT & telecom companies use data integration to unify customer data, enhancing personalized interactions and improving customer experiences.

The retail segment is anticipated to grow at the fastest CAGR during the forecast period. Retailers are increasingly using data integration to unify customer, sales, and operational data, providing insights that help expand their businesses. Integrated data enables retailers to personalize customer experiences and optimize supply chains. This approach helps retailers stay competitive in a rapidly evolving market environment. Retailers also leverage data integration to analyze consumer behavior and preferences, creating targeted marketing campaigns.

Regional Insights

North America software industry dominated the market in 2024, accounting for over 41% share of the global revenue. This dominance is attributed to the region's mature technology ecosystem and high adoption rate of data integration solutions across various industries. North America's strong presence of large enterprises and innovative startups contributes to its market share. The region's emphasis on digital transformation further drives the demand for data integration technologies. Companies such as Microsoft and IBM are key players in the North American market.

U.S. Software Market Trends

The software market in the U.S. is expected to grow substantially over the forecast period. This growth is driven by the increasing demand for data integration solutions to manage complex data environments and support real-time analytics. The U.S. features a diverse range of industries that benefit from data integration, including finance, healthcare, and technology. The U.S. market is characterized by a high level of technological innovation, which supports the adoption of advanced data integration tools. This innovation ecosystem encourages the development of new data integration solutions.

Europe Software Market Trends

The software industry in Europe is expected to witness significant growth over the forecast period. This growth is driven by the adoption of cloud computing and big data technologies, which require efficient data integration solutions. European businesses are investing in data integration to enhance operational efficiency and comply with stringent data privacy regulations such as GDPR. The European market is also influenced by strategic partnerships between vendors and clients, which expand the reach of data integration services. Companies such as SAP and Oracle provide data integration solutions that cater to European regulatory requirements.

Asia Pacific Software Market Trends

The software industry in the Asia Pacific region is anticipated to register the fastest CAGR over the forecast period. This rapid growth is attributed to the increasing adoption of digital technologies and the need for data integration solutions to manage diverse data sources efficiently. The Asia Pacific region's vibrant technology landscape and growing demand for cloud-based services drive this growth. Countries such as China and India are experiencing rapid digital transformation, leading to increased demand for data integration tools that support real-time analytics and decision-making. The region's expanding IT infrastructure further supports the adoption of advanced data integration solutions.

Key Software Company Insights

Some key companies in the global software industry are IBM Corporation, McAfee Corporation, Oracle, and NortonLifeLock Inc.

-

McAfee Corporation is a global cybersecurity company specializing in threat detection, prevention, and response solutions. It offers a range of products and services designed to protect individuals, businesses, and governments from cyber threats. McAfee's solutions include antivirus software, endpoint security, and cloud-based security platforms, providing comprehensive protection across various devices and networks. The company is recognized for its robust security technologies and innovative approaches to cybersecurity challenges.

-

IBM Corporation is a global technology company that provides a wide range of software solutions, including IBM DataStage, which is a leading ETL tool. IBM's software offerings are designed to help businesses connect, transform, and deliver data across various systems and environments. IBM's solutions support complex software tasks, enabling organizations to leverage their data assets effectively and make informed decisions. IBM's software tools are part of a broader suite of data management solutions that cater to diverse industry needs.

Key Software Companies:

The following are the leading companies in the software market. These companies collectively hold the largest market share and dictate industry trends.

- IBM Corporation

- McAfee Corporation

- Microsoft

- SAP

- Oracle

- NortonLifeLock Inc.

- Adobe Inc.

- VMware Inc.

- Block, Inc.

- Intuit Inc.

Recent Developments

-

In February 2025, Oracle enhanced its supply chain management platform by integrating AI capabilities. This update enables the automation of various tasks for procurement professionals, such as generating standardized product descriptions and providing supplier recommendations, which can significantly streamline procurement processes. In addition, the AI-driven enhancements aim to accelerate the order fulfillment process, improving overall operational efficiency and reducing errors in supply chain operations.

-

In January 2025, Block, a technology, announced the launch of Goose, an open-source AI agent designed to empower developers with customizable tools. Goose allows users to leverage various large language models, providing flexibility in its application across different tasks and industries. This platform is primarily focused on software development, enabling developers to automate complex coding tasks and integrate with multiple software tools and platforms.

-

In December 2024, Microsoft unveiled cloud-connected software that enables customers to deploy Azure computing, networking, storage, and application services across various environments, including edge locations, on-premises data centers, and hybrid cloud setups. This capability provides businesses with the flexibility to run Azure services wherever they are needed, ensuring consistent performance and management across different infrastructure types.

Global Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 817.77 billion |

|

Revenue forecast in 2030 |

USD 1,397.31 billion |

|

Growth rate |

CAGR of 11.3% from 2025 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, deployment, enterprise size, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, Brazil, KSA, UAE, South Africa |

|

Key companies profiled

|

IBM Corporation; McAfee Corporation; Microsoft; SAP; Oracle; NortonLifeLock Inc.; Adobe Inc.; VMware Inc.; Block, Inc.; Intuit Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global software market report based on type, deployment, enterprise size, vertical, and region.

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Application Software

-

Enterprise resource planning (ERP)

-

Customer Relationship Management (CRM)

-

Supply Chain Management (SCM)

-

Enterprise Collaboration Software

-

Enterprise Content Management (ECM) Software

-

Education Software

-

Others

-

-

System Infrastructure software

-

Network Management Systems (NMS)

-

Storage Software

-

Security Software

-

-

Development and Deployment Software

-

Enterprise Data Management (EDM)

-

Business Analytics & Reporting Tools

-

Application Servers

-

Integration & Orchestration Middleware

-

Data Quality Tools

-

-

Productivity Software

-

Office Software

-

Creative Software

-

Others

-

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

IT & telecom

-

BFSI

-

Retail

-

Government/Public Sector/Public Sector

-

Energy & utilities

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global software market size was estimated at USD 730.70 billion in 2024 and is expected to reach USD 817.77 billion in 2025.

b. The global software market is expected to grow at a compound annual growth rate of 11.3% from 2025 to 2030 to reach USD1,397.31 billion by 2030.

b. North America dominated the market in 2024, accounting for over 41% share of the global revenue. The North American region has widely adopted various software and generates the highest revenue there. Besides, the U.S. is the major country in the world that contributed mainly to the software market.

b. Some key players operating in the software market include IBM Corporation; McAfee Corporation; NortonLifeLock Inc.; Microsoft; Oracle; SAP SE; Adobe Inc.; VMware Inc.; Block, Inc.; and Intuit Inc.

b. Key factors that are driving the software market growth include increasing mobile digitization and rapid advancements in technology

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."