Software Defined Radio Market Size, Share & Trends Analysis Report By Type, By Component (Hardware, Software), By Frequency Band (HF, VHF, UHF), By Platform (Ground, Naval), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-911-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Software Defined Radio Market Trends

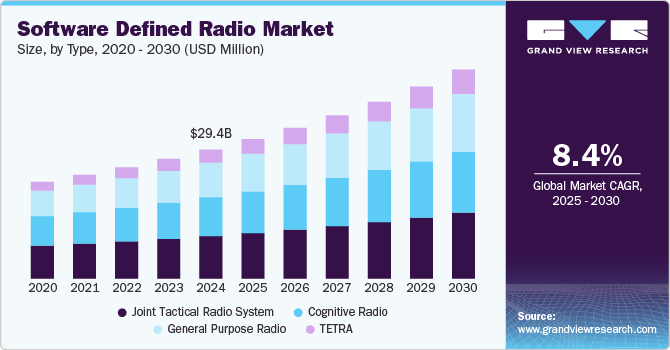

The global software defined radio market size was estimated at USD 29,491.4 million in 2024 and is projected to grow at a CAGR of 8.4% from 2025 to 2030. The market is driven by the demand for flexible, multi-frequency, and interoperable communication solutions across defense, telecommunications, and public safety sectors. Software-defined radio (SDR) technology’s versatility in seamlessly operating across different frequencies and protocols is expected to drive market growth in the coming years.

The rapid development of wireless communication technologies, including 5G, IoT, and satellite communication, is driving the market growth. SDRs offer flexibility to support multiple communication standards through software-based modulation techniques, making them ideal for diverse applications in telecommunications. In addition, there is a growing emphasis on interoperability among different communication systems. SDRs are designed to facilitate seamless integration with both legacy and modern communication networks, enhancing operational effectiveness, which is further driving the adoption of market growth.

Governments are significantly increasing their defense budgets, leading to higher investments in modernizing military communication systems. This surge in funding is largely driven by the need to enhance operational capabilities in an increasingly complex security environment, where rapid technological advancements and evolving threats require agile and resilient communication infrastructures. Moreover, the integration of commercial technologies, including 5G and artificial intelligence, into military communications is expected to improve data transmission speeds and enhance overall network reliability, thereby driving market expansion.

The growing need for dynamic spectrum access is propelling the adoption of SDRs. These systems enable users to maximize spectrum utilization and adapt to changing radio frequency environments, which is crucial in military, public safety, and commercial applications where effective spectrum management is essential. This trend is expected to further boost the market growth in the coming years.

Companies are heavily investing in R&D to innovate and enhance SDR capabilities. This includes improving processing power and software functionalities to meet evolving communication standards and emerging threats in defense scenarios. In addition, companies are exploring artificial intelligence (AI) integration within SDR platforms to facilitate real-time data analysis and decision-making. This AI-driven trend is expected to drive the market growth in the coming years.

Type Insights

Based on type, the joint tactical radio system segment led the market with the largest revenue share of 33.12% in 2024, owing to its critical role in military and defense applications. JTRS provides secure, interoperable communication across various platforms, enabling real-time data sharing among allied forces and enhancing operational effectiveness. The increasing demand for seamless, adaptable communication in defense, especially with rising geopolitical tensions, has led to substantial investments in JTRS, making it a priority for defense agencies worldwide, thereby driving segmental growth.

The TETRA segment is expected to witness at the fastest CAGR of 10.8% from 2025 to 2030, driven by rising demand in public safety, transportation, and critical infrastructure sectors. TETRA’s secure, reliable, and multi-channel communication capabilities make it ideal for emergency and government services, particularly in urban areas requiring resilient and efficient communications. With smart city projects and emergency response needs expanding globally, TETRA-based SDRs are increasingly favored for their flexibility and scalability, propelling rapid growth in this segment.

Component Insights

Based on component, the hardware segment led the market with the largest revenue share of 41.16% in 2024, owing to the foundational importance of high-quality physical components such as transceivers, amplifiers, and antennas that enable SDR functionality. Hardware investments are crucial for delivering the core performance and flexibility that define SDR systems, especially in high-demand applications such as military, public safety, and telecom. As software-defined radio adoption grows across these sectors, there has been a substantial need to upgrade existing infrastructure with SDR-compatible hardware, thereby driving demand and solidifying the segment’s position in the market.

The services segment is expected to register at the fastest CAGR from 2025 to 2030. The complexity of SDR systems, especially as they evolve to meet diverse needs across defense, telecom, and industrial IoT, is fueling the demand for specialized services. These services ensure SDR systems remain up-to-date with new software capabilities and compliant with shifting standards. In addition, as organizations expand their SDR applications, the need for consulting, training, and technical support intensifies, driving growth in this segment.

Frequency Band Insights

Based on frequency band, the high-frequency (HF) segment led the market with the largest revenue share of 30.90% in 2024, as HF frequencies are crucial for long-range communication capabilities, particularly in the military, maritime, and aviation sectors. HF signals can travel vast distances by reflecting off the ionosphere, which is essential for operations in remote or international settings where satellite communication may not be viable. This capability makes HF SDR systems highly valuable for defense, where secure, reliable, and global communication is needed, as well as for emergency response and rural infrastructure projects. This versatility and resilience of HF communications are driving segmental growth.

The ultra-high-frequency (UHF) segment is expected to register at the fastest CAGR from 2025 to 2030, driven by the demand for SDR systems that support UHF frequencies across public safety, telecom, and broadcasting applications. UHF frequencies provide superior signal quality for short- to medium-range communications, making them ideal for densely populated or infrastructure-heavy areas where connectivity needs are high and interference is common. With the continued rollout of 5G networks and the rise of urban IoT and smart city initiatives, SDR systems that can operate on UHF bands are increasingly essential. This surge in applications for UHF SDR solutions is expected to drive strong growth as organizations invest in agile, high-bandwidth communication capabilities that adapt to various operational needs.

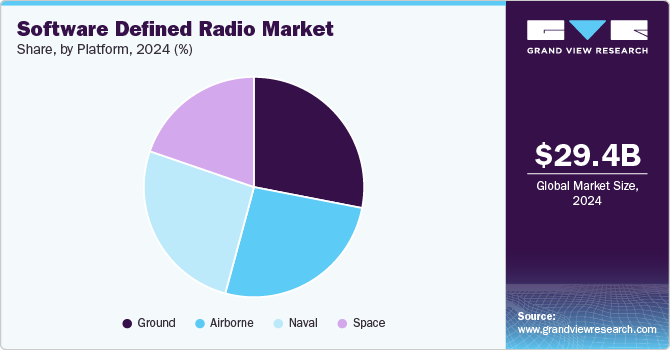

Platform Insights

Based on platform, the ground segment led the market with the largest revenue share of 28.05% in 2024. Ground-based SDR systems offer adaptability and scalability, which are critical for applications such as base stations, emergency response networks, and military command centers that require reliable, high-capacity communication solutions. The demand for resilient, multi-frequency communication systems has been especially high in defense and emergency services, where ground SDRs provide interoperability and quick adaptation to changing operational requirements.

The airborne segment is expected to register at the fastest CAGR from 2025 to 2030, driven by the increasing adoption of SDR technology in aviation, including both military aircraft and commercial drones. SDRs in airborne systems enable flexible, high-frequency communications essential for real-time data exchange, navigation, and coordination, which are critical for modern aviation and tactical operations. As unmanned aerial vehicles (UAVs) and next-generation military aircraft become more common, the demand for SDRs that can support secure, multi-channel communication at high altitudes is expected to surge, thereby driving segmental growth.

End-use Insights

Based on end use, the aerospace & defense segment led the market with the largest revenue share of 23.90% in 2024, owing to the sector's reliance on secure, adaptive communication systems capable of operating across various frequencies and standards. SDRs are indispensable in military operations for their flexibility, which allows forces to switch between communication protocols, frequencies, and encryption standards as needed. This adaptability is crucial for missions requiring secure and interoperable communications, both on the ground and in the air, enabling seamless coordination among units and across allied forces, thereby driving segmental growth.

The commercial segment is expected to register at the fastest CAGR from 2025 to 2030. SDRs offer scalability and support for multiple communication standards, which makes them ideal for commercial applications that need to adapt to evolving connectivity requirements. In the telecom industry, for instance, SDRs facilitate smooth network upgrades, such as the transition to 5G, by enabling equipment to handle various protocols through software updates rather than costly hardware changes. In addition, the growing adoption of IoT and smart city initiatives is driving demand for flexible SDR-based communication systems across commercial sectors, fueling rapid growth in this segment.

Regional Insights

North America software defined radio market dominated with the largest revenue share of 33.52% in 2024, driven by substantial investments in defense modernization and public safety communications. Governments are prioritizing resilient communication systems for secure and adaptable operations across frequencies, spurring innovation in cognitive radio capabilities. The trend toward 5G is further boosting demand as SDRs provide the flexibility needed for these evolving networks.

U.S. Software Defined Radio Market Trends

The software defined radio market in the U.S. held a dominant position in 2024. The market growth is fueled by the growing focus on agile communication solutions that enable cross-platform interoperability. As 5G network deployment accelerates, there is increasing reliance on SDRs for military, telecommunications, and public safety applications. The growing adoption of IoT in critical infrastructure also highlights SDR’s role in secure and adaptable communications, thereby driving market growth.

Europe Software Defined Radio Market Trends

The software defined radio market in Europe is expected to grow at a considerable CAGR of 8.2% from 2025 to 2030, driven by stringent government regulations regarding spectrum management and secure communication networks. The EU’s focus on unified digital policies has led to SDR adoption in telecom and defense sectors, while advancements in cognitive radio technology are addressing the region’s spectrum congestion. SDRs are essential in meeting compliance and connectivity requirements.

The UK software defined radio market is expected to grow at a rapid CAGR during the forecast period. In the UK, market demand is rising in both defense and telecommunications, particularly for secure, resilient communication networks aligned with NATO and EU interoperability standards. The UK government’s emphasis on digital transformation and smart city initiatives is pushing the adoption of SDRs, which offer flexibility for expanding network requirements in urban areas.

The software defined radio market in Germany held a substantial market share in 2024, driven by its robust automotive and industrial IoT sectors, where SDRs enable communication across complex manufacturing environments.

Asia-Pacific Software Defined Radio Market Trends

The software defined radio market in the Asia Pacific region is expected to grow at the fastest CAGR of 9.7% from 2025 to 2030, driven by increasing investments in defense and 5G networks. Countries in the region are rapidly upgrading communication infrastructure, with SDRs enabling adaptable frequency and protocol management across vast geographical areas.

The Japan software defined radio market is expected to grow at a rapid CAGR during the forecast period. The need for reliable communication in disaster-prone areas, especially within public safety and emergency response sectors, is driving the market growth. Japan’s telecom sector is leveraging SDR for smooth transitions between evolving communication standards, especially in 5G networks. The focus on innovation and high-tech infrastructure fuels the development of advanced SDR applications in both commercial and defense markets.

The software defined radio market in China held a substantial market share in 2024. The growth is attributed to the government’s focus on 5G infrastructure and military modernization. With heavy investments in secure communication technology, SDRs are essential for both civilian and defense applications. China’s emphasis on IoT in smart cities and public safety networks also supports SDR growth as these radios facilitate flexible, multi-standard communications.

Key Software Defined Radio Company Insights

Some of the key players operating in the market include RTX Corporation and Northrop Grumman Corporation, among others.

-

RTX Corporation is an aerospace and defense company formed through the merger of Raytheon Company and United Technologies Corporation. The company focuses on delivering advanced technology solutions for both military and commercial applications. The Collins Aerospace subsidiary is particularly notable for its software-defined radio (SDR) systems, which enhance communication capabilities across various platforms, ensuring secure and reliable connectivity.

-

Northrop Grumman Corporation is a global aerospace and defense technology company specializing in innovative solutions for military applications. With a strong emphasis on research and development, the company provides cutting-edge software-defined radio systems that enhance communication capabilities in complex operational environments. The company operates through several segments, including aerospace systems, mission systems, defense systems, and space systems, focusing on areas such as unmanned systems, cyber security, and advanced weapons.

BAE Systems plc and Leonardo S.p.A are some of the emerging participants in the global market.

-

BAE Systems plc is a global defense, security, and aerospace company that specializes in providing advanced technology solutions, including software-defined radios (SDRs). The company is recognized for its commitment to innovation and high-quality products tailored for military applications. The company has invested significantly in research and development to enhance its SDR offerings, which include the RAD5545, a modern radiation-hardened software radio designed for secure communications in challenging environments.

-

Leonardo S.p.A. is a multinational aerospace and defense company that plays a vital role in the software-defined radio market through its innovative communication solutions. The company focuses on developing advanced SDR technologies that enhance operational capabilities for military and civilian applications. The company's expertise in electronic warfare, avionics, and secure communications enables it to deliver cutting-edge SDR systems that ensure interoperability and resilience in dynamic environments.

Key Software Defined Radio Companies:

The following are the leading companies in the software defined radio market. These companies collectively hold the largest market share and dictate industry trends.

- L3Harris Technologies, Inc.

- RTX Corporation

- Thales Group

- General Dynamics Corporation

- Northrop Grumman Corporation

- BAE Systems Plc

- Elbit Systems Ltd.

- Leonardo S.p.A.

- Collins Aerospace

- Rafael Advanced Defense Systems Ltd.

Recent Developments

-

In October 2024, BAE Systems plc was awarded a contract worth up to USD 460 million by the U.S. Army to provide multi-mode aviation radio sets, which are essential for enhancing communication capabilities in military operations. These software-defined radios (SDRs) will support various communication modes, including voice and data, ensuring interoperability across different platforms and enabling secure and reliable communications in diverse environments.

-

In June 2024, L3Harris Technologies secured a significant order from the U.S. Marine Corps for multi-channel handheld and vehicular radio systems valued at over USD 120 million, raising total program orders to more than USD 600 million. This order falls under a 10-year, USD 750 million indefinite delivery, indefinite quantity contract for the Falcon IV handheld radios, which are designed to meet NSA-certified high-assurance standards and provide access to a resilient waveform portfolio.

-

In May 2024, Collins Aerospace delivered the first TruNet TM AR-1500 networked communications airborne radio to the Polish Ministry of Defense for its C-130H Hercules fleet. This software-defined radio (SDR) is designed to provide secure communication capabilities in line with NATO standards, featuring a wide frequency range and advanced functionalities such as L-Band and Link-22 data links.

Software Defined Radio Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 31,850.8 million |

|

Revenue forecast in 2030 |

USD 47,753.9 million |

|

Growth rate |

CAGR of 8.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, component, frequency band, platform, end-use, regional |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE. |

|

Key companies profiled |

3Harris Technologies, Inc.; RTX Corporation; Thales Group; General Dynamics Corporation; Northrop Grumman Corporation; BAE Systems Plc; Elbit Systems Ltd.; Leonardo S.p.A.; Collins Aerospace; Rafael Advanced Defense Systems Ltd. |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Software Defined Radio Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global software defined radio market report based on type, component, frequency band, platform, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

General Purpose Radio

-

Joint Tactical Radio System

-

Cognitive Radio

-

TETRA

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Antenna

-

Transmitter

-

Receiver

-

Others

-

-

Software

-

Services

-

-

Frequency Band Outlook (Revenue, USD Million, 2018 - 2030)

-

High Frequency (HF)

-

Very High Frequency (VHF)

-

Ultra High Frequency (VHF)

-

Others

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Ground

-

Naval

-

Airborne

-

Space

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Telecommunication

-

Public Safety

-

Commercial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global software defined radio market size was estimated at USD 29,491.4 million in 2024 and is expected to reach USD 31,850.8 in 2025.

b. The global software defined radio market is expected to grow at a compound annual growth rate of 8.4% from 2025 to 2030 to reach USD 47,753.9 million by 2030.

b. Based on type, the joint tactical radio system segment dominated the market in 2024 with share of over 33%, owing to its critical role in military and defense applications. JTRS provides secure, interoperable communication across various platforms, enabling real-time data sharing among allied forces and enhancing operational effectiveness.

b. The key players in this industry are L3Harris Technologies, Inc., RTX Corporation, Thales Group, General Dynamics Corporation, Northrop Grumman Corporation, BAE Systems Plc, Elbit Systems Ltd., Leonardo S.p.A., Collins Aerospace, and Rafael Advanced Defense Systems Ltd.

b. Key factors driving the software defined radio market growth include the rapid development of wireless communication technologies, including 5G, IoT, and satellite communication, the surge in government funding, and the growing integration of commercial technologies into military communications.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."