Software Defined Data Center Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Type, By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-377-3

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Software Defined Data Center Market Trends

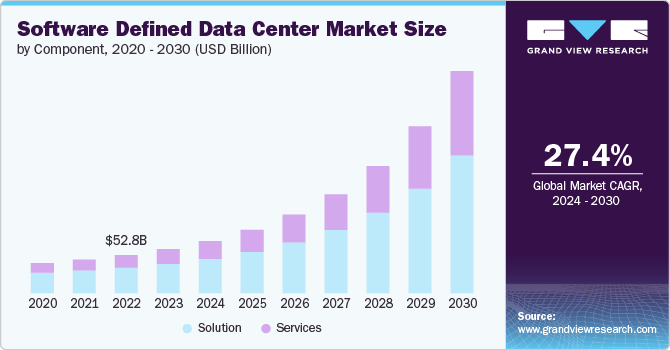

The global software defined data center market size was estimated at USD 61.24 billion in 2023 and is projected to grow at a CAGR of 27.4% from 2024 to 2030. The market is experiencing significant growth driven by the increasing demand for more efficient and agile IT infrastructure solutions. Key factors driving the market growth include the need for enhanced resource management, the proliferation of cloud computing, and the rising importance of data security.

Organizations are increasingly adopting software defined data center technologies to achieve greater flexibility, scalability, and automation in their data center operations. In addition, the shift towards digital transformation and the growing adoption of hybrid cloud environments are further propelling the demand for software defined data center solutions.

The ongoing digital transformation across industries necessitates more agile, scalable, and efficient data center operations. The SDDC model, which leverages virtualization, software-defined networking (SDN), and software-defined storage (SDS), offers a more dynamic and flexible alternative to traditional data centers, aligning perfectly with the modern demand for cloud-native and hybrid cloud environments.

The market presents substantial opportunities, particularly in sectors such as healthcare, finance, and telecommunications, which require robust and secure data management solutions. The increasing adoption of Internet of Things (IoT) devices and the growing volume of data generated by these devices are creating a pressing need for more efficient data processing and storage solutions, driving demand for software defined data centers.

The ongoing trend towards digitalization and the need for businesses to remain competitive in a rapidly changing technological landscape further underscore the potential for market growth. As organizations continue to seek innovative ways to enhance their IT infrastructure, the market is poised for continued expansion and evolution.

Emerging trends in the global market include the integration of artificial intelligence (AI) and machine learning (ML) for predictive analytics and automated decision-making processes. These technologies are enhancing the capabilities of software defined data centers by enabling proactive management and optimization of data center resources. Further, the rise of edge computing, which requires decentralized data centers to handle data processing closer to the source. Similarly, advancements in network function virtualization (NFV) and software-defined networking (SDN) are playing crucial roles in the evolution of software defined data centers, enabling more efficient and agile network management.

Component Insights

Based on component, the solution segment led the market with the largest revenue share of 66.67% in 2023. The growth of the solution segment includes the increasing demand for agile and flexible IT environments, the rising need for cost-effective data center solutions, and the growing adoption of cloud computing. The proliferation of big data and the Internet of Things (IoT) has further accelerated the need for advanced data center management solutions. Moreover, the shift towards digital transformation across various industries is prompting organizations to invest in SDDC technologies to enhance their operational efficiencies and remain competitive.

The service segment is expected to grow at a significant CAGR during the forecast period. The services segment of this market encompasses various services such as consulting, implementation, integration, and managed services. Consulting services help organizations understand the benefits and implications of adopting SDDC technologies, providing them with strategic guidance and planning. Implementation and integration services ensure that the SDDC solutions are seamlessly integrated with the existing IT infrastructure, facilitating a smooth transition and minimizing operational disruptions.

Type Insights

Based on type, the software-defined compute (SDC) segment led the market with the largest revenue share of 35.89% in 2023. The key factors driving the market include the increasing adoption of cloud computing, the need for improved operational efficiency, and the demand for agile and scalable IT infrastructure. Enterprises are increasingly looking to reduce costs and improve resource utilization, making SDC an attractive solution. The integration of artificial intelligence (AI) and machine learning (ML) to optimize compute workloads is also a significant driver, enabling smarter and more autonomous data center operations.

The software-defined networking (SDN) segment is expected to grow at a significant CAGR during the forecast period. The increasing need for network agility and flexibility, the rise of cloud services, and the demand for improved network security are among the key factors driving the demand for SDN in the market. SDN offers a more responsive and adaptable network infrastructure, capable of supporting dynamic workloads and varying traffic patterns. In addition, the growing trend of network function virtualization (NFV) complements SDN by enabling the virtualization of network services, further enhancing operational efficiency and reducing costs.

Deployment Insights

Based on deployment, the public segment led the market with the largest revenue share of 48.90% in 2023. The public SDDCs are typically hosted by third-party providers and offer a scalable, cost-effective solution for organizations looking to offload their data center management. The increasing adoption of cloud computing, the need for flexibility and scalability, and the desire to reduce capital expenditures. Public SDDCs also offer enhanced disaster recovery and business continuity solutions, which are critical for enterprises aiming to maintain uninterrupted operations.

The hybrid segment is expected to grow at a significant CAGR during the forecast period. Hybrid SDDCs, on the other hand, combine private and public data center resources, offering the best of both worlds. This approach allows organizations to maintain control over sensitive data and applications while leveraging the scalability and cost benefits of public SDDCs. Key factors driving the adoption of hybrid SDDCs include the need for data sovereignty, compliance with regulatory requirements, and the ability to optimize workloads across different environments.

Enterprise Size Insights

Based on enterprise size, the large enterprise segment led the market with the largest revenue share of 57.92% in 2023. SDDCs offer large organizations with the capability to centralize and automate their IT operations, significantly reducing the time and effort required for manual configurations and management. This level of automation and control is vital for large enterprises to maintain competitiveness and respond swiftly to market changes. Furthermore, SDDCs facilitate seamless integration with existing legacy systems, enabling large enterprises to modernize their IT infrastructure without disrupting ongoing operations.

The SMEs segment is expected to grow at a significant CAGR over the forecast period. Small and Medium-sized Enterprises (SMEs) are increasingly adopting Software Defined Data Centers due to their need for cost-effective and scalable IT solutions. SDDCs offer SMEs the flexibility to manage and allocate resources dynamically, reducing the reliance on expensive physical infrastructure. This capability is crucial for SMEs, which often operate with limited budgets and require efficient resource utilization.Moreover, the integration of cloud-based services within SDDCs allows SMEs to access advanced technologies and services that were previously unaffordable.

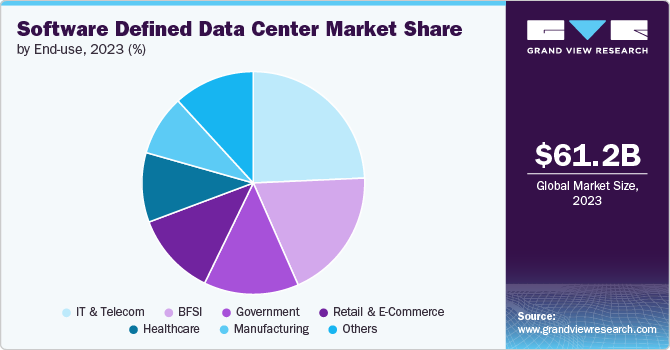

End-use Insights

Based on end use, the IT and telecom segment led the market with the largest revenue share of 24.3% in 2023. The IT and telecom sector represents a substantial portion of the software-defined data center market, driven by the need for flexible, scalable, and efficient infrastructure solutions. Organizations within this segment adopt SDDCs to enhance agility and responsiveness in managing vast amounts of data and applications. Further, the key factors driving this adoption include the demand for virtualization technologies that optimize resource utilization and reduce operational costs. In addition, the scalability of SDDCs allows IT and telecom companies to rapidly deploy new services and accommodate fluctuating workloads, thus improving overall service delivery and customer satisfaction.

The healthcare segment is expected to grow at a significant CAGR during the forecast period. Healthcare organizations leverage SDDCs to centralize and manage patient data securely, ensuring accessibility and confidentiality across disparate systems and locations. Further, key trends include the integration of IoT devices and wearables, which generate vast amounts of real-time patient data necessitating scalable and secure SDDC infrastructures. In addition, advancements in data governance and compliance frameworks will play a crucial role in shaping the evolution of SDDCs within the healthcare industry, ensuring alignment with stringent regulatory standards and privacy mandates.

Regional Insights

North America dominated the software defined data center market with the revenue share of 37.29% in 2023. The North America market is poised for substantial growth, driven by the region's advanced technological infrastructure and the rapid adoption of cloud computing. Key factors include the presence of major tech companies, significant investments in data center technologies, and a high demand for efficient and scalable IT infrastructure. Rising technology spent across the region is driving the integration of AI and machine learning within SDDC, enhancing automation and operational efficiency. Thus, these are the key factors driving for market growth in the North America.

U.S. Software Defined Data Center Market Trends

The software defined data center market in the U.S. is anticipated to grow at a significant CAGR of 24.5% from 2024 to 2030. In U.S. the push towards digital transformation across various industries, including finance, healthcare, and retail, necessitates flexible and scalable data center solutions, are fueling the demand for SDDCs. Moreover, government initiatives promoting smart city projects and digital infrastructure are also bolstering the market growth. Further, trends such as the integration of edge computing with SDDCs and the increasing adoption of hybrid cloud environments present substantial growth opportunities in the U.S.

Asia Pacific Software Defined Data Center Market Trends

The software defined data center market in Asia Pacific is expected to grow at a significant CAGR of 30.5% from 2024 to 2030. The Asia Pacific market is experiencing rapid expansion due to the region's booming digital economy and significant investments in IT infrastructure. Key drivers include the growing adoption of cloud services, increased focus on digital transformation, and supportive government initiatives promoting technological advancements. The market is poised for opportunities in emerging economies across the region, where businesses are increasingly recognizing the benefits of SDDC in terms of cost savings and operational efficiency.

Europe Software Defined Data Center Market Trends

The software defined data center market in Europe is anticipated to grow at a significant CAGR of 27.2% from 2024 to 2030. The market in Europe is characterized by stringent data protection regulations and a strong emphasis on sustainability. Factors driving growth include the increasing need for data sovereignty, compliance with GDPR, and the adoption of green data center practices. The region's focus on reducing carbon footprints and energy consumption in data centers is creating opportunities for innovation in energy-efficient SDDC solutions.

Key Software Defined Data Center Company Insights

Some of the key players operating in the market include Microsoft Corporation; Oracle Corporation; IBM Corporation; Cisco Systems Inc.; SAP SE; Dell Software Inc.; Citrix Systems, Inc.; VMware, Inc.; NEC Corporation; Hewlett Packard Enterprise Company among others. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Software Defined Data Center Companies:

The following are the leading companies in the software defined data center market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft Corporation

- Oracle Corporation

- IBM Corporation

- Cisco Systems Inc.

- SAP SE

- Dell Software Inc.

- Citrix Systems, Inc.

- VMware, Inc.

- NEC Corporation

- Hewlett Packard Enterprise Company

Recent Developments

-

In February 2024,IBM Corporation expanded its enterprise networking portfolio to include Software Defined Data Center (SDDC) and Software Defined Networking (SDN) solutions, with a focus on Cisco networking. This new offering includes IBM Support and Implementation Services for SDN, as well as IBM Network Health Check, aimed at enhancing network integration, performance, and reliability. These services are designed to help organizations manage complex networking environments and prevent unplanned downtime

-

In December 2023, Rackspace Technology, a provider of end-to-end hybrid and multi-cloud solutions, announced the launch of SDDC (Software Defined Data Center) Enterprise and Business for SAP. This new offering features VMware virtualized storage, computer, networking, and cloud management, delivering a single-tenant solution designed to support mission-critical SAP and SAP HANA environments. The enterprise-grade solution comes with a fully integrated hardware and software stack for private cloud, based on SAP-certified pre-configurations and Dell VxRail

-

In August 2022, VMware launched VMware Aria, a comprehensive multi-cloud management portfolio. VMware Aria offers end-to-end solutions for overseeing the cost, performance, configuration, and delivery of infrastructure and applications. Tailored to address the operational challenges of cloud-native applications and public cloud environments, VMware Aria introduces a fresh approach to multi-cloud management.This new portfolio is set to transform how businesses manage their multi-cloud operations, ensuring efficiency and optimized performance

Software Defined Data Center Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 72.29 billion |

|

Revenue forecast in 2030 |

USD 309.06 billion |

|

Growth rate |

CAGR of 27.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, type, deployment, enterprise size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

Microsoft Corporation; Oracle Corporation; IBM Corporation; Cisco Systems Inc.; SAP SE; Dell Software Inc.; Citrix Systems, Inc.; VMware, Inc.; NEC Corporation; Hewlett Packard Enterprise Company |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Software Defined Data Center Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global software defined data center market report based on component, type, deployment, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Services

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software Defined Compute (SDC)

-

Software Defined Networking (SDN)

-

Software defined Storage (SDS)

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public

-

Private

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT and Telecom

-

Government

-

Retail and E-commerce

-

Manufacturing

-

Healthcare and E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global software defined data center market size was estimated at USD 61.24 billion in 2023 and is expected to reach USD 72.29 billion in 2024.

b. The global software defined data center market is expected to grow at a compound annual growth rate of 27.4% from 2024 to 2030 to reach USD 309.06 billion by 2030.

b. The solution segment accounted for the largest market share of over 67% in 2023. The growth of the solution segment includes the increasing demand for agile and flexible IT environments, the rising need for cost-effective data center solutions, and the growing adoption of cloud computing.

b. Some key players operating in the software defined data center market include Microsoft Corporation; Oracle Corporation; IBM Corporation; Cisco Systems Inc; SAP SE; Dell Software Inc.; Citrix Systems, Inc.; VMware, Inc.; NEC Corporation; Hewlett Packard Enterprise Company.

b. The Software Defined Data Center (SDDC) market is experiencing significant growth driven by the increasing demand for more efficient and agile IT infrastructure solutions. Key factors driving the growth of the market include the need for enhanced resource management, the proliferation of cloud computing, and the rising importance of data security.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."