Software Asset Management Market Size, Share & Trends Analysis Report By Offering (Software (License Management, Contract Management), Services), By Enterprise Size, By Deployment, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-420-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Software Asset Management Market Trends

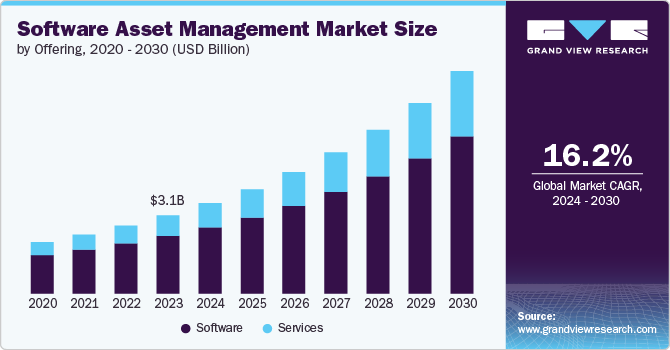

The global Software Asset Management (SAM) market size was estimated at USD 3.14 billion in 2023 and is projected to grow at a CAGR of 16.2% from 2024 to 2030. The growth is driven by the increasing complexity of software management, regulatory compliance requirements, and the need for cost optimization. The rise in cloud adoption and digital transformation initiatives also fuels demand for SAM tools, which help businesses manage hybrid environments and optimize software investments. Additionally, SAM solutions play a vital role in risk management by ensuring software is up-to-date and secure, reducing the risk of cyberattacks. As organizations continue to expand their software portfolios, the demand for effective SAM solutions will grow.

The proliferation of software audits, the shift towards remote work, and the integration of SAM solutions with IT Service Management (ITSM) tools drive the growth of the SAM market. The increasing need for data-driven decision-making, the expansion of small and medium-sized enterprises (SMEs), and the globalization of multinational corporations are also contributing to the rising demand for SAM solutions. As organizations adopt more software tools across diverse locations and regions, SAM tools are essential for maintaining compliance, optimizing software usage, and improving overall IT governance.

Advancements in artificial intelligence and automation are enhancing the capabilities of SAM tools, making them more effective in license tracking, predictive analytics, and intelligent optimization. The growing focus on sustainability and green IT initiatives is also driving organizations to adopt SAM solutions, which help reduce unnecessary software purchases and minimize energy consumption. Additionally, effective SAM practices are becoming increasingly important for vendor management and negotiation, enabling organizations to secure favorable licensing terms and achieve cost savings.

Offering Insights

The software segment dominated the SAM market in 2023, accounting for over 73.0% of global revenue, driven by its core functionality of managing, tracking, and optimizing software licenses across organizations. As businesses navigate increasingly complex software ecosystems, SAM software provides essential tools such as license tracking, compliance management, and usage analytics. The shift towards cloud-based SAM solutions, associated with the need for customization and integration with existing IT infrastructure, has further fueled demand for SAM software. Recurring revenue models and continuous advancements in software capabilities, such as AI-driven analytics and automation, enhanced the adoption of SAM tools.

The services segment is experiencing growth due to the increasing complexity of software management and the need for specialized expertise. Organizations, specifically small and medium-sized enterprises (SMEs), are increasingly outsourcing SAM functions to third-party providers to focus on core activities while ensuring efficient software asset management. The demand for customized solutions tailored to specific business needs and industry regulations is also driving the growth of this segment. Additionally, the need for implementation, consulting, and ongoing support services, including license renewals and compliance checks, is further expanding the services segment as organizations seek comprehensive and continuous SAM management.

Enterprise Size Insights

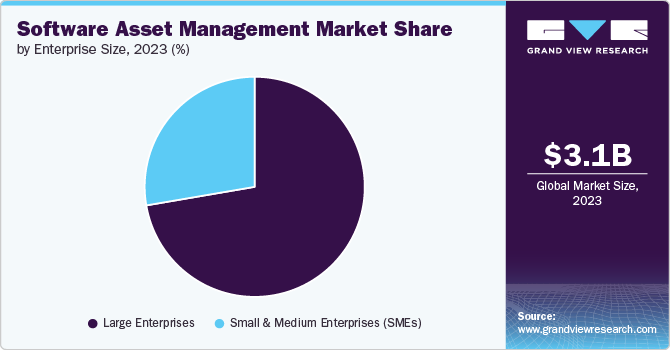

The large enterprises segment led the SAM market in 2023 due to the scale and complexity of their IT operations. These organizations manage extensive software applications across multiple departments and regions, necessitating robust SAM solutions to handle the high volume of licenses, ensure compliance, and mitigate audit risks. Their substantial IT budgets enable them to invest in comprehensive SAM tools and services, which are essential for managing complex licensing agreements and integrating with other IT systems. Additionally, the global operations of large enterprises require SAM solutions to navigate diverse regulatory environments and optimize software usage across various regions.

The Small & Medium Enterprises (SMEs) segment is experiencing significant growth as these organizations increasingly recognize the benefits of effective software management, such as cost savings and operational efficiency. Budget constraints and the need to optimize software investments drive SMEs to adopt SAM tools to identify unused software, negotiate better licensing terms, and ensure compliance with stringent regulations. The shift to cloud-based solutions has also strengthened demand for SAM tools that manage complex cloud licenses and subscriptions. Affordable, scalable SAM solutions tailored for SMEs, combined with the growing complexity of software usage as these businesses expand, further contribute to the segment's rapid growth.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2023, driven by the rapid adoption of cloud-based solutions and the complexities of managing cloud licenses and subscriptions. The rise in cloud spending has increased the need for SAM tools that monitor and control expenditures, optimize resources, and ensure compliance in cloud environments. Enhanced cloud management features, such as real-time monitoring and automated provisioning, as well as vendor-specific SAM tools offered by major cloud providers, also contribute to the segment's growth. Moreover, the diverse range of cloud services, including SaaS, IaaS, and PaaS, necessitates comprehensive SAM solutions to handle this complexity effectively.

The on-premises segment of the SAM market is poised for significant growth, driven by the continued use of legacy systems and the need to manage software licenses in hybrid IT environments that include both on-premises and cloud solutions. Regulatory and compliance requirements, especially in regulated industries such as finance and healthcare, necessitate on-premises solutions for greater control and adherence to standards. Additionally, concerns over data security and privacy, along with the desire for greater customization and control offered by on-premises systems, fuel the demand for SAM tools tailored to these environments. Effective integration of SAM solutions with existing on-premises IT infrastructures also contributes to the segment's expected growth.

Vertical Insights

The manufacturing segment accounted for the prominent revenue share in 2023, due to its complex IT infrastructure and high volume of software licenses used across various functions such as production management and ERP. The sector's stringent regulatory and compliance requirements drive the need for robust SAM solutions to ensure adherence to industry standards and avoid penalties. Additionally, manufacturing companies focus on operational efficiency and cost optimization, leveraging SAM tools to streamline software management and reduce costs. The integration of advanced technologies, such as automation and IoT, along with the use of specialized software for functions such as CAD and CAM, further contributes to the sector's dominance in the SAM market.

The healthcare segment is poised for significant growth over the forecast period, due to the complexity of its IT ecosystems, which include Electronic Health Records (EHR), medical imaging systems, and patient management systems. Stringent regulatory compliance requirements, such as those mandated by HIPAA, drive the need for robust SAM solutions to ensure adherence and avoid penalties. The protection of sensitive patient data and effective cost management further fuel demand for SAM tools, as these tools offer features for enhancing software security, optimizing license usage, and reducing overall software spend. Additionally, the increasing adoption of cloud-based solutions in healthcare emphasizes the significance of SAM solutions for managing cloud licenses and ensuring compliance.

Regional Insights

North America represented a significant market share of over 42.0% in 2023, driven by its rapid adoption of advanced technologies and digital transformation initiatives. The region's large number of enterprises across diverse sectors, including technology, finance, healthcare, and manufacturing, creates a strong demand for SAM solutions to manage complex IT environments and ensure compliance. North American organizations lead in cloud adoption and digital transformation, enabling SAM tools to manage cloud-based licenses and integrate with existing systems. Additionally, the region's focus on cost optimization and the presence of major SAM vendors headquartered in North America further contribute to its region's growth.

U.S. Software Asset Management Market Trends

The software asset management market in the U.S. is expected to grow significantly over the forecast period due to the increased adoption of cloud services, which drives demand for tools to manage cloud subscriptions, optimize usage, and ensure compliance. U.S. companies' strong focus on cost optimization further fuels the need for SAM solutions that can identify unused licenses, streamline software usage, and negotiate better vendor terms. Additionally, the complexity of IT environments in many U.S. organizations, which often include a mix of on-premises, cloud, and hybrid systems, necessitates robust SAM solutions to manage software assets across these diverse setups effectively.

Europe Software Asset Management Market Trends

The Software Asset Management (SAM) market in Europe is gaining significant traction due to increased regulatory requirements and digital transformation efforts. The General Data Protection Regulation (GDPR) emphasizes data protection and privacy, making SAM solutions essential for compliance, mainly in software audits. The EU's Digital Services Act (DSA) further drives demand for SAM tools to ensure transparency and adherence to new rules for digital services. Additionally, Brexit has created a need for SAM solutions to handle varying compliance requirements across the U.K. The digitalization of public sector organizations also boosts the market as SAM solutions are needed to manage software assets and ensure compliance in large-scale digital projects.

Asia Pacific Software Asset Management Market Trends

The software asset management market in Asia Pacific is poised for significant growth due to rapid digital transformation, with increased investments in IT infrastructure driving the need for effective SAM tools. Accelerated cloud adoption in the region further boosts demand for SAM solutions to manage cloud subscriptions and ensure compliance. Rising IT spending, mainly in Southeast Asia and India, along with stricter regulatory compliance requirements, also contributes to market growth. Additionally, expanding middle-class consumption, emerging markets, and the need for cost efficiency in diverse IT environments emphasize the growing need for robust SAM solutions across APAC.

Key Software Asset Management Company Insights

Key players in the industry have strengthened their market presence through a strategic mix of product launches, expansions, mergers and acquisitions, contracts, partnerships, and collaborations. These initiatives serve as vital tools for enhancing market penetration and strengthening their competitive edge within the industry. For instance, in June 2024, Salesforce, Inc. unveiled new features aimed at helping field service organizations efficiently manage and maintain the entire lifecycle of their physical assets, from purchasing to service. With real-time data and intelligence, including remote access and AI models for predicting potential failures, businesses can extend asset lifespans for greater sustainability, minimize unplanned repairs, and uncover new recurring revenue opportunities, such as end-of-life upsells.

The following are the leading companies that collectively hold the largest market share and dictate industry trends.

Key Software Asset Management Companies:

The following are the leading companies in the software asset management market. These companies collectively hold the largest market share and dictate industry trends.

- Belarc, Inc.

- Certero

- Eracent

- Flexera

- IBM Corporation

- Ivanti

- Matrix42

- ServiceNow

- Snow Software

- USU Software AG

Recent Developments

-

In June 2024, IFS, an innovator in cloud and Industrial AI software, announced a definitive agreement to acquire Copperleaf Technologies Inc. The integration of Copperleaf Technologies Inc. and IFS brings together complementary strengths, delivering a comprehensive suite of software capabilities to organizations. This combination provides customers with advanced Industrial AI-powered tools to manage every aspect of their critical assets throughout their lifecycle, enhancing operational efficiency and effectiveness.

-

In June 2024, Freshworks Inc. announced the acquisition of Device42, a company specializing in providing comprehensive and continuously updated views of assets across an organization's entire IT infrastructure. This acquisition highlights a significant step for Freshworks Inc., strengthening its adherence to enhancing IT Asset Management (ITAM) solutions and empowering IT teams with more robust tools.

-

In February 2024, Softchoice, a North American IT solutions provider, introduced SAM+, a comprehensive suite of software asset management solutions. SAM+ is designed to address the complexities of managing subscription-based licensing. It offers a range of solutions for every phase of the subscription lifecycle, including assessment, planning, transition, and deployment. These services can be implemented individually or integrated, depending on an organization’s level of maturity in software asset management.

Software Asset Management (SAM) Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.62 billion |

|

Revenue forecast in 2030 |

USD 8.94 billion |

|

Growth rate |

CAGR of 16.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered Application |

Offering, enterprise size, deployment, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA; South Africa |

|

Key companies profiled |

Belarc, Inc.; Certero; Eracent; Flexera; IBM Corporation; Ivanti; Matrix42; ServiceNow; Snow Software; USU Software AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Software Asset Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global Software Asset Management (SAM) market report based on offering, enterprise size, deployment, vertical, and region:

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

License Management

-

Audit and Compliance Management

-

Software Discovery, Optimization and Metering

-

Contract Management

-

Configuration Management

-

Others

-

-

Services

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-Premises

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

IT & telecom

-

BFSI

-

Retail

-

Manufacturing

-

Government/Public Sector

-

Energy & utilities

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."