Soft Starter Market Size, Share & Trends Analysis Report By End Use (Mining & Metal, Food & Beverages, Energy & Power, Oil & Gas), By Region, And By Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-443-9

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Soft Starter Market Size & Trends

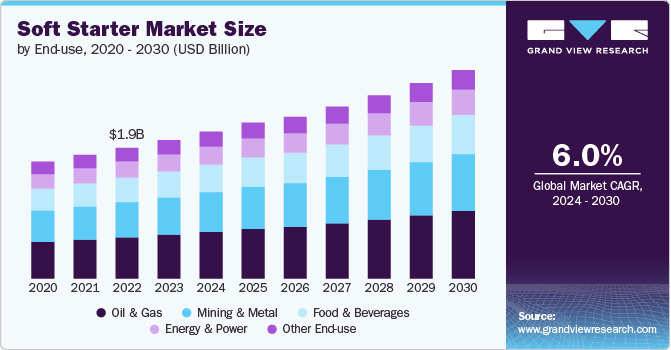

The global soft starter market size was estimated at USD 2.04 billion in 2023 and is forecasted to grow at a CAGR of 6.0% from 2024 to 2030. Soft starters are often used as a central starting system because they reduce initial current and minimize mechanical stress on the equipment. In specific electrical installations, there may be unbalanced voltage due to uneven phase load distribution, and in extreme cases, there may be a significant voltage drop. Their versatility and scalability make them essential technologies in various industrial applications, meeting the needs of different sectors such as manufacturing, utilities, and oil & gas.

The growth and expansion of the semiconductor industry, especially in emerging markets, the increasing use of soft starters by small and medium-sized enterprises in developing economies, growing awareness about the benefits of soft starters, infrastructure upgrades, and revitalization, growth in the automation sector, the increasing number of oil and gas exploration activities, the upgrading of existing infrastructure with advanced systems, and the rising infrastructural development activities, especially in developing economies, are the significant factors contributing to the growth of the market.

A significant trend in the market is the integration of soft starters with advanced control systems. This integration improves performance, efficiency, and flexibility by allowing users to optimize motor operation based on specific requirements and load conditions. Soft starters can adapt dynamically to varying operational demands, leading to improved efficiency, advanced control systems, and responsiveness. This trend demonstrates the industry's focus on enhancing motor control capabilities to meet the evolving needs of various applications across different sectors.

Several factors influence the growth of the market. The increasing emphasis on energy efficiency across industries and the drive toward industrial automation have increased demand for these systems. Soft starters are essential in sectors such as oil and gas and manufacturing, where precision control and reduced mechanical stress are crucial. They optimize operations and ensure equipment longevity.

Moreover, these systems provide a scalable and flexible solution for various industrial requirements. Soft starters can be customized to meet specific application needs in small-scale production units or large industrial complexes. Their flexibility and efficiency make them ideal for addressing the diverse requirements of various industries, which has led to them being a highly sought-after technology for enhancing motor control and operational efficiency.

End Use Insights

On the basis of end-use, the soft starter market is segmented into mining & metal, food & beverages, energy & power, and oil & gas. Among these, oil & gas end-use accounted for the largest revenue share of 31.67% in 2023 and is further expected to grow at the fastest rate over the forecast period. Soft starter technology significantly benefits compressor, pump, centrifuge applications, and blower/fan in the onshore and offshore oil and gas industry. The reduced starting current minimizes stress on the electrical supply, making it particularly useful for remote applications like offshore isolated pumping stations or oil rigs.

Soft starters are vital in smoothly operating heavy-duty machinery in the mining and metals industry. These devices help in the gradual increase or decrease of power supply, which reduces mechanical stress and extends the life of motors used in drills, conveyors, and crushers. This ensures operational efficiency and significantly decreases maintenance costs and downtime. A significant market driver for soft starters in this sector is the increasingly stringent regulations on energy consumption and environmental impact. By enabling energy-efficient operations, soft starters help companies in the mining and metals industry meet regulatory demands while reducing energy costs.

Regional Insights

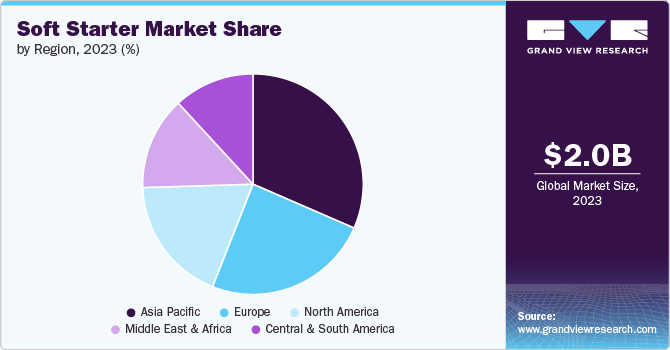

The demand for soft starters in North America is expected to grow at a significant pace over years. This demand is supported by a strong focus on energy efficiency, driven by regulations and consumer awareness. In addition to this, North America has presence of areas consisting of harsh climates, which increases the demand for products as these provide better durability and weather resistance compared to traditional materials.

Asia Pacific dominated the global market in 2023 with a revenue share of 31.52% and is expected to grow at a significant rate over the forecast period. Asia Pacific is experiencing rapid urbanization and growth in energy and power, food and beverages, and oil and gas activities, increasing the demand for modern, soft starters over VFDs.

The soft starter market in the China is growing at a CAGR of 6.7% over the forecast period. The China market is expected to grow due to increasing demand for food & beverages in the region, this is due to the growing population in the region. Furthermore, the use of soft starter in the food and beverages industry has led to rise in demand for the product market in region leading to market growth.

Europe Soft Starter Market Trends

Soft starters play a significant role in European energy efficiency initiatives and automation. European countries prioritize energy conservation and sustainability, leading to the adoption of soft starters in infrastructure developments, manufacturing plants, and renewable energy projects; the region's commitment to reducing carbon emissions further boosts the market for these energy-efficient solutions.

Key Soft Starter Company Insights

Some of the key players operating in the market Siemens AG and Schneider Electric SE:

-

Siemens AG is a technology company that operates in electrification, digitalization, and automation. The company designs, develops, manufactures, and installs complex systems and projects, providing customized solutions to meet individual requirements. Siemens focuses on distribution, power generation, and intelligent infrastructure for buildings and distributed energy systems. Additionally, it offers innovative mobility solutions for medical technology, rail and road transport, and digital healthcare services. With research and development facilities, warehouses, production plants, and sales offices worldwide, Siemens serves customers in various industries, including healthcare, energy, process, infrastructure, and manufacturing.

-

Schneider Electric SE is an energy management and automation company. The company develops related technologies and solutions for electricity distribution. Its major products include control products and automation, solar storage, low voltage products and systems, energy storage, grid automation, medium voltage distribution, critical power, cooling, and racks. The company also offers energy and sustainability services, cloud, field and automation, training services, and consulting. The company serves various industries, including finance and banking, healthcare, food & beverage, marine, life sciences, minerals, metals, cement, oil and gas, mining, automotive, retail, and mobility. The company is in Africa, Europe, Asia-Pacific, the Middle East, South America and North America.

Eaton Corporation PLC and Rockwell Automation Inc. are some of the emerging participants in the market.

-

Eaton Corporation Plc is a power management company. The company's primary activities involve developing, designing, and technologies selling energy-efficient products and services. These offerings are aimed at helping customers manage aerospace, electrical, mechanical power, and hydraulic in an efficient, safe, reliable, and sustainable manner. The company serves customers in the governmental, utility, information technology, industrial, institutional, residential, marine, machine tools, commercial, material handling, agriculture, construction, oil and gas, renewable energy, mining, utility, automotive, forestry, primary metals, molding, aerospace sectors, and power generation. It operates in various countries across North America, Europe, Latin America, Asia Pacific, Africa, and the Middle East, with worldwide manufacturing facilities.

-

Rockwell Automation Inc. provides industrial automation power, control, and information systems. The company offers various products and services, including connected components, assets, midrange architecture systems, engineered packages, consultancy management, front-end engineering, panels integration, integration services, design, on-machine solutions, and manufacturing intelligence. Additionally, the company provides connected enterprise solutions, drive systems, discrete control, machine, information solutions, migration solutions, equipment builders, motion solutions, process solutions, safety solutions, connected and maintenance services, and sustainable production. The company sells its products through a direct sales force and a network of distributors across the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

Key Soft Starter Companies:

The following are the leading companies in the soft starter market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens AG

- Schneider Electric SE

- Eaton Corporation PLC

- Rockwell Automation Inc.

- Danfoss Group

- Fairford Electronic Inc. (Motortronics UK Ltd)

- Toshiba International Corporation

- CG Power and Industrial Solutions Ltd.

- IGEL Electric GmbH

- AuCom Electronics Ltd

Recent Developments

-

thus, November 2023, Siemens AG recently raised its ownership in its Indian subsidiary to 69% by purchasing an extra 18% stake from Siemens Energy in December 2023, thus consolidating its position in the expanding Indian market. In addition, Siemens remains committed to substantial research and development (R&D) investment, allocating USD 6.2 billion in fiscal year 2023. Their primary focus areas encompass digitalization and cutting-edge technologies for sectors such as healthcare and infrastructure.

Soft Starter Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.17 billion |

|

Revenue forecast in 2030 |

USD 3.08 billion |

|

Growth rate |

CAGR of 6.0% from 2023 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, trends |

|

Segments covered |

End use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina |

|

Key companies profiled |

Siemens AG; Schneider Electric SE; Eaton Corporation PLC; Rockwell Automation Inc.; Danfoss Group; Fairford Electronic Inc. (Motortronics UK Ltd); Toshiba International Corporation; CG Power and Industrial Solutions Ltd.; IGEL Electric GmbH; AuCom Electronics Ltd |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Soft Starter Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global soft starter market based on end use and region:

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Mining & Metal

-

Food & Beverage

-

Energy & Power

-

Oil & Gas

-

Other End Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global soft starter market size was estimated at USD 2.04 billion in 2023 and is expected to reach USD 2.16 billion in 2024.

b. The global soft starter market is expected to grow at a compound annual growth rate (CAGR) of 6.0% from 2024 to 2030 to reach USD 3.07 billion by 2030.

b. The residential segment accounted for the largest revenue share, 58.7%, in 2023. Composite windows and doors are often used in residential buildings, emphasizing aesthetic appeal and design flexibility.

b. Some key players operating in the soft starter market include Andersen Corporation, The Pella Corporation, Profine International Group, Starline uPVC Window Systems, Marvin, Prestige Windows and Doors, Signature Windows & Doors, Fenesta, Windoorz Inc, and PolyTech Products LTD.

b. The key factors that are driving the soft starter market growth are the strength and resistance to weathering of soft starter, which reduces the need for frequent maintenance compared to traditional materials.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."