- Home

- »

- Petrochemicals

- »

-

Sodium Sulfate Market Size, Share & Growth Report, 2030GVR Report cover

![Sodium Sulfate Market Size, Share & Trends Report]()

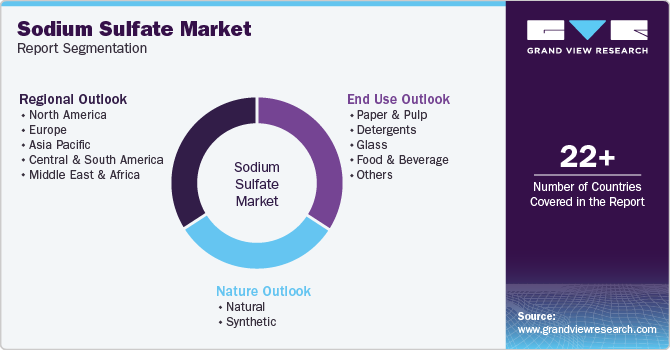

Sodium Sulfate Market Size, Share & Trends Analysis Report By Nature (Natural, Synthetic), By End Use (Paper & Pulp, Detergents, Glass, Food & Beverage), By Region (North America, Asia Pacific), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-469-2

- Number of Report Pages: 98

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Sodium Sulfate Market Size & Trends

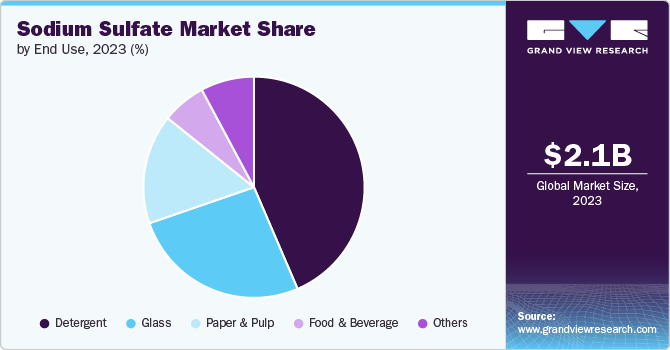

The global sodium sulfate market size was valued at USD 2.10 billion in 2023 and is projected to grow at a CAGR of 4.5% from 2024 to 2030. The market is significantly driven by the growing demand from the detergent industry. The product is widely used as a filler in powdered detergents, enhancing their performance and improving texture. As urbanization increases and disposable incomes rise, consumers are purchasing more cleaning products, leading to a surge in detergent consumption. This trend is particularly pronounced in emerging markets, where the demand for effective and affordable cleaning solutions is on the rise. The detergent sector's expansion is expected to continue fueling the market, making it a critical component in the formulation of cleaning agents.

Another key factor propelling the market is its essential role in the pulp and paper industry. Sodium sulfate is utilized in the kraft process, a method for producing high-quality pulp from wood chips. As global demand for paper products increases-driven by e-commerce, packaging, and printing industries-the need for sodium sulfate in pulp production is also rising.

The industry's focus on sustainable practices further enhances the demand for sodium sulfate, as it aids in chemical recovery and promotes environmentally friendly production methods. This synergy between sodium sulfate and the pulp and paper sector is a significant driver of market growth.

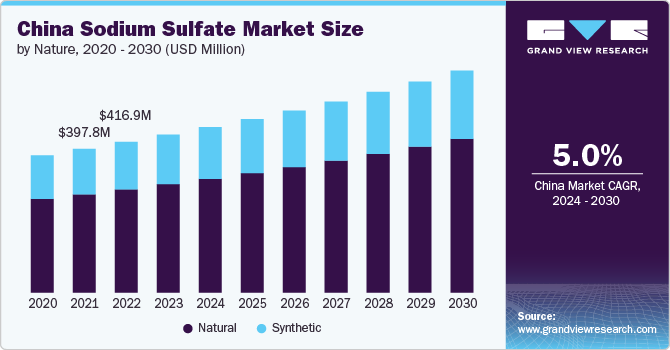

China's sodium sulfate market is significantly driven by the rapid growth of the detergent industry. As one of the largest consumers of household and industrial cleaning products, the demand for sodium sulfate as a filler in powdered detergents has surged. The increasing urbanization and rising disposable incomes among the Chinese population have led to higher consumption of laundry detergents, thereby boosting the need for sodium sulfate. This trend is further supported by the growing awareness of hygiene and cleanliness, especially in urban areas, which has resulted in a consistent demand for effective cleaning agents.

Another critical factor contributing to the demand for sodium sulfate in China is its use in the pulp and paper industry. As the country continues to expand its paper production capabilities to meet both domestic and international demand, sodium sulfate plays a vital role in the kraft pulping process. This process is essential for producing high-quality paper products, and sodium sulfate is used to recover chemicals, making the production process more sustainable. The growth of the packaging and printing sectors, driven by e-commerce and consumer goods, has further amplified the need for sodium sulfate in this industry.

Lastly, the increasing focus on sustainability and environmental regulations in China is shaping the market. The government has been promoting the use of eco-friendly materials and processes, which aligns with the production of sodium sulfate from natural sources. This shift towards sustainable practices is encouraging manufacturers to adopt sodium sulfate as a preferred ingredient in various applications, including textiles and glass production. As industries adapt to these regulations and consumer preferences shift towards greener products, the demand for sodium sulfate is expected to grow, positioning it as a key player in China's chemical landscape.

Nature Insights

Natural sodium sulfate dominated the market with a revenue share of 68.62% in 2023. Natural sodium sulfate, often referred to as Glauber's salt, is derived from natural mineral deposits or through the evaporation of seawater. It is typically found in large quantities in regions with arid climates, where evaporation processes concentrate the mineral.

Synthetic sodium sulfate is produced through chemical processes, often as a byproduct of other industrial activities, such as the production of hydrochloric acid or the neutralization of sulfuric acid. This form of sodium sulfate is typically more consistent in quality and purity compared to its natural counterpart. Synthetic sodium sulfate is used in similar applications, including detergents and industrial processes, but it may be preferred in situations where specific purity levels are required or where natural sources are not readily available.

End Use Insights

Detergent dominated the market with a revenue share of 43.55 in 2023 owing to the fact that sodium sulfate plays a crucial role in the detergent industry, where it is primarily used as a filler in powdered detergents. Its high solubility in water makes it an effective agent for enhancing the cleaning performance of detergents. The demand for sodium sulfate in this sector is significant, as it helps to improve the texture and flow of detergent powders, making them easier to handle and use.

In the pulp and paper industry, the product is utilized in various processes, including the production of paper products. It serves as a key component in the kraft process, which is a method of producing pulp from wood chips. Sodium sulfate helps in the recovery of chemicals used in the pulping process, making it essential for the sustainability of paper production. The increasing demand for paper products, driven by both consumer and industrial needs, is expected to bolster the demand for the product in this sector.

While sodium sulfate is not a primary ingredient in food and beverage products, it can be used in certain applications, such as in the processing of food products and as a food additive in some cases. Its role in this industry is less prominent compared to detergents and paper, but it still contributes to the overall demand for the product as industries seek to optimize their production processes and maintain quality standards.

Regional Insight

North America sodium sulfate market is experiencing dynamic changes, influenced by various economic and industrial factors. The region is witnessing a steady demand for sodium sulfate, primarily driven by its applications in the detergent and cleaning agent industry, as well as in the glass and textile sectors.

Asia Pacific Sodium Sulfate Market Trends

The sodium sulfate market in the Asia Pacific region is experiencing significant growth, driven primarily by the increasing demand from various end-use industries. China, as the world's largest producer, plays a pivotal role in this expansion due to its low production costs and substantial supply capabilities. The market is projected to expand rapidly during the forecast period, fueled by rising consumption in sectors such as textiles, glass, and detergents.

China sodium sulfate market is recognized as the largest market for the product globally, holding significant reserves of mirabilite, also known as Glauber's salt. The country's sodium sulfate market is driven by robust industrial demand, particularly from sectors such as textiles, detergents, and glass manufacturing. The economic growth in China has further fueled the demand for sodium sulfate, which is used in various applications, including as a filler in detergents and as a dyeing agent in textiles.

Europe Sodium Sulfate Market Trends

Sodium sulfate is widely used as a filler in detergents, which remains a significant application in Europe. However, recent trends indicate a weakening in end-user purchasing of detergents, which has impacted the product prices and demand in the region.

Key Sodium Sulfate Company Insights

Some of the key players operating in the market include Nippon Chemical Industrial Co., Elementis Plc., Lenzing AG, Nikunj Chemicals, Shikoku Chemicals Corporation, Cooper Natural Resources Inc., Searles Valley Minerals, Jiangsu Yinzhu Chemical Group Co. Ltd., TCI Chemicals

-

Nippon Chemical Industrial Co., Ltd. is a well-established company in Japan, known for its extensive history and expertise in the chemical industry. The company has been providing a wide range of high-quality inorganic chemical products for over a century. These products include chromium, silicates, phosphorus, and barium, which are essential in various industrial applications.

-

Lenzing AG is a leading global producer of wood-based cellulose fibers, headquartered in Lenzing, Austria. The company has a rich history dating back to 1892 when it was founded by industrialist Emil Hamburger, who initially operated a paper mill in the region. Over the years, Lenzing has evolved into a key player in the textile and nonwoven industries, focusing on sustainable fiber production from renewable resources.

Key Sodium Sulfate Companies:

The following are the leading companies in the sodium sulfate market. These companies collectively hold the largest market share and dictate industry trends.

- Nippon Chemical Industrial Co.

- Elementis Plc.

- Lenzing AG

- Shikoku Chemicals Corporation

- Nikunj Chemicals

- Cooper Natural Resources Inc.

- Searles Valley Minerals

- Sigma Aldrich

- TCI Chemicals

- Jiangsu Yinzhu Chemical Group Co. Ltd.

Recent Developments

-

In September 2023, Cinis Fertilizer announced plans to build a new sodium sulfate creation site in Hopkinsville, Kentucky. They partnered with Ascend Elements to obtain sodium sulfate for the project.

-

In November 2023, the USFDA approved Stride’s generic version of the Suprep Bowel Prep Kit. The kit contains sodium sulfate, potassium sulfate, and magnesium sulfate.

Sodium Sulfate Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.18 billion

Revenue forecast in 2030

USD 2.85 billion

Growth Rate

CAGR of 4.5% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, end-use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; South Africa, Saudi Arabia

Key companies profiled

Nippon Chemical Industrial Co., Elementis Plc., Lenzing AG, Shikoku Chemicals Corporation, Nikunj Chemicals, Cooper Natural resources Inc, Searles valley minerals, Sigma Aldrich, TCI Chemicals, Jiangsu Yinzhu Chemical Group Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sodium Sulfate Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sodium sulfate market report based on nature, end-use & region.

-

Nature Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paper & Pulp

-

Detergents

-

Glass

-

Food & Beverage

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sodium sulfate market size was estimated at USD 2.1 billion in 2023 and is expected to reach USD 2.18 billion in 2024.

b. The global sodium sulfate market is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030, reaching USD 2.85 billion by 2030.

b. Asia Pacific dominated the sodium sulfate market, with a share of 50.8% in 2023. This is attributable to rising consumption in sectors such as textiles, glass, and detergents.

b. Some key players operating in the sodium sulfate market include Nippon Chemical Industrial Co., Elementis Plc., Lenzing AG, Shikoku Chemicals Corporation, Nikunj Chemicals, Cooper Natural resources Inc, Searles valley minerals, Sigma Aldrich, TCI Chemicals, Jiangsu Yinzhu Chemical Group Co. Ltd.

b. Key factors driving market growth include increasing urbanization and disposable incomes and consumers purchasing more cleaning products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."