- Home

- »

- Beauty & Personal Care

- »

-

Snail Beauty Products Market Size & Share Report, 2030GVR Report cover

![Snail Beauty Products Market Size, Share & Trends Report]()

Snail Beauty Products Market Size, Share & Trends Analysis Report By Product (Creams, Shampoo), By Gender (Male, Female), By Application (Skin, Hair), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-365-8

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Snail Beauty Products Market Size & Trends

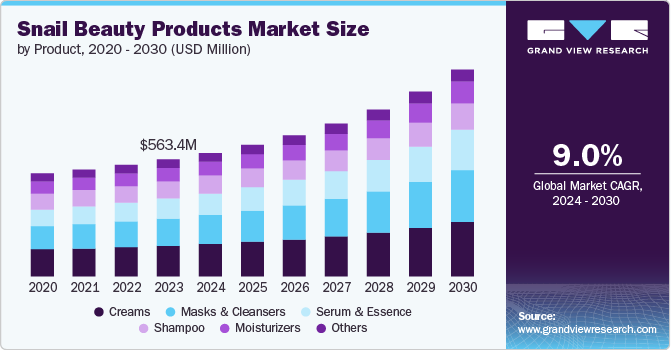

The global snail beauty products market size was estimated at USD 563.4 million in 2023 and is projected to grow at a CAGR of 9.0% from 2024 to 2030. The growing popularity of social media platforms and influencer marketing has played a significant role in driving awareness and demand for snail beauty products. Beauty influencers and skincare enthusiasts share their personal experiences with snail-based products on platforms such as Instagram, YouTube, and TikTok, reaching a wide audience of followers.

Moreover, the influence of Asian beauty trends, particularly those from South Korea (K-beauty), is driving the market growth. Snail mucin has long been a staple in Korean skincare routines, valued for its ability to improve skin texture, promote collagen production, and fade scars and hyperpigmentation. The success of K-beauty brands and their emphasis on a multi-step skincare regimen have contributed to the mainstream acceptance of snail beauty products, driving demand in both Asian and Western markets.

The increasing demand for anti-aging skincare solutions is driving the market growth. As the global population ages, there is a growing market for products that target common signs of aging, such as fine lines, wrinkles, and loss of firmness. Snail mucin has anti-aging properties, including the ability to stimulate collagen production, improve skin elasticity, and reduce the appearance of wrinkles. Skincare products containing snail mucin are sought after by consumers to address age-related concerns, driving demand in the anti-aging skincare segment.

Furthermore, the trend towards gender-neutral and inclusive beauty products has created new opportunities for growth in the market. snail beauty products, with their focus on efficacy and results, are used by all genders, addressing specific skincare concerns. Beauty brands that adopt inclusivity in their marketing and product development efforts tap into a larger and more diverse consumer base, driving growth and innovation in the market.

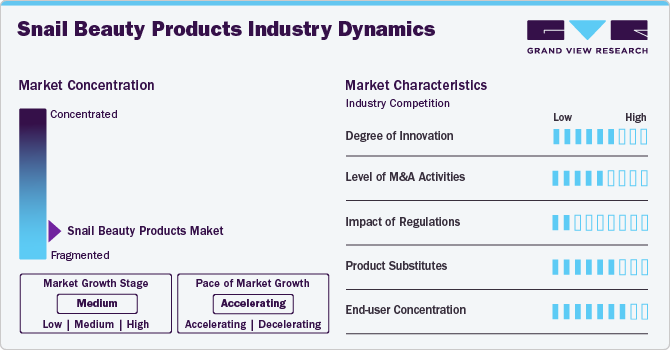

Market Concentration & Characteristics

The industry growth stage is medium, with an accelerating pace owing to increasing demand for natural and organic skincare solutions. Snail mucin offers regenerative and hydrating properties in skincare formulations. Consumers are adopting snail beauty products for their perceived effectiveness and minimal use of synthetic chemicals, aligning with the trend toward clean and green beauty.

The industry is fragmented, featuring several global and regional players. The players are entering into partnerships and, mergers and acquisitions as the market is characterized by innovation, disruption, and rapid change. In November 2023, Amorepacific acquired the skincare brand Cosrx, which specializes in hypoallergenic products for sensitive skin. Cosrx's offerings primarily focus on the Advanced Snail and RX lines. The company aims to accelerate its global expansion through diverse collaborations with Cosrx.

Hyaluronic acid-based skincare products are a substitute for snail beauty products. Hyaluronic acid can retain significant moisture in moisturizers, serums, and masks. Like snail mucin, hyaluronic acid improves skin hydration, plumpness, and overall texture, offering a compelling alternative for consumers seeking effective moisturizing solutions. In addition, aloe vera-based skin care products are prevalent substitutes in the market. Aloe vera provides soothing, anti-inflammatory, and hydrating properties. It is a common ingredient in products designed for sensitive or irritated skin, offering benefits such as calming redness, healing sunburns, and providing gentle hydration. Aloe vera-based products offer a compelling alternative to snail mucin.

Product Insights

Based on product, the creams segment led the market with the largest revenue share of 26.1% in 2023 and is expected to continue to dominate the industry over the forecast period. The growing popularity of dermatology and aesthetics clinics is driving the demand for snail mucin creams. These clinics recommend post-treatment skincare products to aid in recovery and enhance the results of aesthetic procedures such as chemical peels, microdermabrasion, and laser treatments. Snail mucin creams, which offer healing and regenerative properties, are frequently suggested as part of the post-treatment skincare regimen. Professional dermatology and aesthetics clinics' endorsement of snail mucin creams adds to their credibility and popularity among consumers.

The serum & essence segment is anticipated to witness the fastest CAGR during the forecast period. The growing trend towards minimalistic skincare routines is driving the demand for multi-functional products such as snail mucin serums and essences. These products offer a wide range of skincare benefits in one product, including hydration, anti-aging, and brightening for simplified routines. Brands are marketing their snail mucin serums and essences as all-in-one solutions that cater to this trend.

Gender Insights

Based on gender, the female segment led the market with the largest revenue share in 2023. There is an increasing emphasis on skincare as a form of self-care and empowerment among women. Women are increasingly investing time and resources into skincare products that offer tangible benefits, such as snail beauty products. The growing focus on skincare and self-care resonates strongly with the female demographic, driving demand for products that enhance well-being and confidence.

The male segment is expected to witness a significant CAGR during the forecast period. The growing availability of male-specific snail beauty products is also driving market growth. Skincare brands are developing and marketing products tailored specifically to men’s skincare needs. These products often feature masculine packaging, scents, and formulations designed to address common male skin issues. The launch of male-specific snail beauty products helps expand the market and meet the unique needs of male consumers.

Application Insights

Based on application, the skin segment held the largest revenue share in 2023. The trend towards holistic and wellness-focused beauty regimens is driving demand for snail mucin-based skincare products. Consumers increasingly view skincare as integral to their overall wellness and self-care routines. They adopt products that enhance their appearance and improve their skin's long-term health. Snail mucin's ability to promote skin regeneration, hydration, and protection aligns with the holistic approach to beauty and wellness. This trend encourages consumers to invest in high-quality skincare products that offer comprehensive benefits, further boosting the market growth.

The hair segment is expected to witness the fastest CAGR during the forecast period. The increasing prevalence of hair damage due to environmental factors and styling practices is a significant driver for market growth. Modern lifestyles often expose hair to various forms of damage, including pollution, UV radiation, and frequent use of heat styling tools. These factors can lead to dryness, brittleness, and overall deterioration of hair health. Snail mucin products can help repair and fortify hair, making it more resilient to environmental stressors and styling damage.

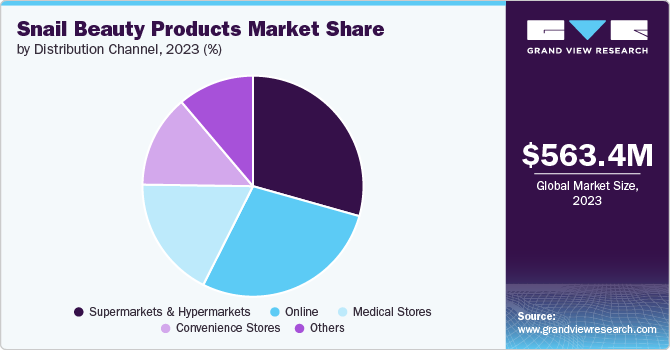

Distribution Channel Insights

Based on distribution channel, the supermarkets & hypermarkets segment dominated the market in 2023. Promotional activities integrated within supermarkets and hypermarkets further drive the growth of the market. These stores frequently run promotions such as discounts, buy-one-get-one-free offers, and loyalty program rewards, which can incentivize purchases and increase sales volume. In-store promotions, samples, and demonstrations allow consumers to try snail beauty products before buying, which can be particularly effective in encouraging trial and adoption.

The medical stores segment is expected to witness the fastest CAGR during the forecast period. The increasing integration of wellness and beauty also propels the market growth within medical stores. Consumers are adopting skincare products that enhance their appearance and contribute to their overall skin health. Snail mucin, known for promoting skin regeneration, hydration, and repair, is a natural and effective ingredient supporting beauty and wellness. Medical stores traditionally focus on health products and are well-positioned to cater to this growing demand for wellness-oriented beauty products.

Regional Insights

The North America snail beauty products market is anticipated to grow at the fastest CAGR over the forecast period. The popularity of DIY beauty treatments has contributed to the growth of the market in North America. DIY skincare enthusiasts often seek natural and effective ingredients to incorporate into their homemade beauty recipes. With its hydrating and skin-repairing properties, snail mucin is used for DIY face masks, serums, and treatments. There is an opportunity for beauty brands to capitalize on this trend by offering ready-to-use snail beauty products that provide the same benefits without the hassle of DIY preparations.

U.S. Snail Beauty Products Market Trends

The U.S. snail beauty products market accounted for a global market share of 10.7% in 2023. The demand for multi-functional skincare products has fueled interest in snail beauty products among American consumers. With busy lifestyles and limited time for extensive skincare routines, consumers seek products that offer multiple benefits in one formula. These products, which often combine moisturizing, anti-aging, and skin-repairing properties, provide consumers with a convenient and efficient solution for addressing various skincare concerns.

Asia Pacific Snail Beauty Products Market Trends

The snail beauty products market in Asia Pacific dominated globally with a revenue share of 28.7% in 2023 and it is projected to grow over the forecast period. The demand for natural and cruelty-free skincare products is driving market growth in the Asia Pacific region. Consumers prefer skincare products derived from natural sources and produced without animal testing. Snail mucin, extracted from snails in a noninvasive and cruelty-free manner, aligns with consumers seeking ethical and sustainable beauty options. Brands that offer snail beauty products formulated with natural and ethically sourced ingredients can capitalize on this trend and gain a competitive edge in the Asia Pacific market.

China snail beauty products market dominated the Asia pacific region in terms of market share in 2023. The rise of e-commerce platforms and digital marketing channels is driving the popularity of snail beauty products in China. Online retailers and social commerce platforms such as Tmall, JD.com, and Xiaohongshu offer a wide range of snail beauty products from domestic and international brands, providing consumers easy access to diverse products. Beauty influencers and key opinion leaders (KOLs) on platforms such as Weibo and Douyin play a crucial role in promoting snail beauty products and influencing consumer purchasing decisions. The seamless integration of online and offline channels enables brands to reach a broader audience and drive sales in the Chinese market.

The snail beauty products market in Japan is anticipated to grow at the fastest CAGR over the forecast period. The country's aging population and the increasing demand for anti-aging skincare solutions are driving the market growth in Japan. Japan has one of the oldest populations globally, with a significant portion of consumers seeking skincare products that address common signs of aging, such as fine lines, wrinkles, and loss of elasticity. Snail mucin is adopted by this demographic, offering potential benefits for improving skin texture and reducing the visible signs of aging.

Central and South America Snail Beauty Products Market Trends

Central and South America snail beauty products market is expected to grow at a significant CAGR over the forecast period. The rise of wellness tourism in Central and South America is driving the market growth. Countries such as Costa Rica, Brazil, and Colombia offer biodiversity and wellness. snail beauty treatments, such as snail facials and spa therapies, have become popular among wellness tourists seeking unique and immersive experiences. Beauty brands and spa facilities that offer snail-based treatments can cater to this growing segment of wellness travelers and tap into the lucrative tourism market in Central and South America.

Key Snail Beauty Products Company Insights

Some of the key players operating in the market include BENTON, TONYMOLY, and Eveline Cosmetics USA.

-

Benton is a Korean cosmetic company in the beauty industry. Benton’s product line includes various serums, essences, creams, and sheet masks infused with snail mucin. The company offers innovative snail beauty products through online platforms and offline stores in multiple countries, including the U.S., Spain, Germany, and Poland.

-

Eveline Cosmetics USA offers a range of snail beauty products that harness the extraordinary properties of snails to provide intense regeneration and skin healing benefits. The company’s snail beauty products are specifically designed for women and aim to rebuild, repair, and moisturize the skin while activating regeneration processes to delay aging and restore a youthful appearance.

-

TONYMOLY is a cosmetic brand in the Korean beauty industry that offers innovative skincare products that incorporate unique and high-quality ingredients. The snail extract used in TONYMOLY’s skincare products is rich in beneficial components such as Allantoin, Glycolic Acid, Collagen, and Elastin. These ingredients work synergistically to repair the skin barrier, soothe the skin, provide hydration, and brighten the complexion.

Key Snail Beauty Products Companies:

The following are the leading companies in the snail beauty products market. These companies collectively hold the largest market share and dictate industry trends.

- Amorepacific

- BENTON

- PFD Co., Ltd.

- KENRA PROFESSIONAL

- Missha

- Eveline Cosmetics USA

- TONYMOLY

- tianDe Rheinland Halabis GmbH

- DRAN Co., Ltd

- YEOUTH

Recent Developments

- In September 2022, Missha, a South Korean cosmetics brand, partnered with Saks Fifth Avenue, a department store in the U.S. This collaboration marks a significant milestone as it represents the first major North American department store to offer Missha's skincare collection. The partnership between Missha and Saks is a substantial advancement in Saks' strategy for expansion across North America.

Snail Beauty Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 595.7 million

Revenue forecast in 2030

USD 998.6 million

Growth rate

CAGR of 9.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, gender, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Amorepacific, BENTON, PFD Co., Ltd., KENRA PROFESSIONAL, Missha, Eveline Cosmetics USA, TONYMOLY, tianDe Rheinland Halabis GmbH, DRAN Co., Ltd, YEOUTH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Snail Beauty Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global snail beauty products market report based on product, gender, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Creams

-

Masks & Cleansers

-

Serum & Essence

-

Shampoo

-

Moisturizers

-

Others

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Female

-

Male

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin

-

Hair

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Online

-

Medical Stores

-

Convenience Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The growing popularity of snail mucin products in skincare can be attributed to several factors that appeal to modern consumers' preferences and concerns. Firstly, snail mucin, also known as snail secretion filtrate, is valued for its purported skincare benefits. Rich in nutrients like hyaluronic acid, glycoproteins, and antimicrobial peptides, it is believed to promote skin hydration, regeneration, and healing. This natural source of ingredients aligns with the increasing demand for clean and sustainable beauty products, appealing to consumers who prioritize natural and effective skincare solutions.

b. The global snail beauty products market size was valued at USD 563.4 million in 2023 and is expected to reach USD 595.7 million in 2024.

b. The global snail beauty products market is expected to grow at a compounded growth rate of 9.0% from 2024 to 2030 to reach USD 998.6 million by 2030.

b. The creams segment led the market with the largest revenue share of 26.1% in 2023. The growing popularity of dermatology and aesthetics clinics is driving the demand for snail mucin creams.

b. Some key players operating in the snail beauty products market are Mizonm, COSRX, Missha, Elensilia, TonyMoly, Benton, Holika Holika, It'S SKIN, Nature Republic SkinFood

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."