- Home

- »

- Consumer F&B

- »

-

Smoothies Market Size, Share And Growth Report, 2030GVR Report cover

![Smoothies Market Size, Share & Trends Report]()

Smoothies Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Fruit-based, Dairy-based), By Distribution Channel (Restaurants, Smoothie Bars, Supermarkets & Convenience Stores), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-936-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smoothies Market Summary

The global smoothies market size was estimated at USD 12.46 billion in 2023 and is projected to reach USD 23.08 billion by 2030, growing at a CAGR of 9.3% from 2024 to 2030. The market has experienced significant growth in recent years, driven by increasing consumer awareness of health and wellness.

Key Market Trends & Insights

- North America dominated the market with a revenue share of 45.5% in 2023.

- Based on product, the fruit-based smoothies segment accounted for the largest revenue share of 51.6% in 2023.

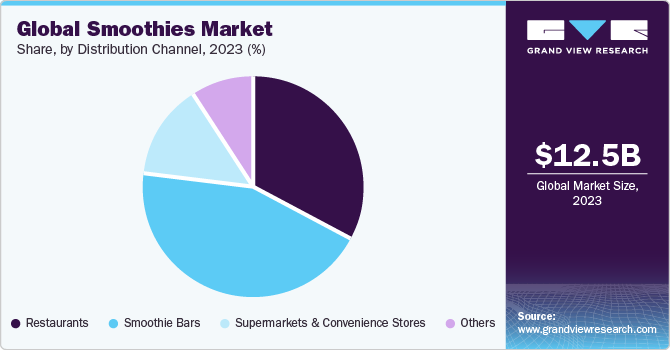

- Based on distribution channel, the sales of smoothies through smoothie bars segment accounted for a 44.0% share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 12.46 Billion

- 2030 Projected Market Size: USD 23.08 Billion

- CAGR (2024-2030): 9.3%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

As people become more conscious of their dietary choices, the demand for nutritious and convenient food and beverage options has risen. Smoothies, with their blend of fruits, vegetables, and often added supplements, cater to this demand by offering a quick and tasty way to consume essential nutrients. The penetration of smoothies into mainstream consumer preferences is evident, as they are now commonly found in cafes, juice bars, and even as pre-packaged products in grocery stores.With the growing concern about the adverse impact of fast food, there is a rising trend toward healthier meal options such as smoothies. For example, Tropical Smoothie Cafe, a chain with over 500 locations, has introduced a new menu featuring smoothies designed to be consumed as complete meals. One example is the Chia Banana Boost with peanut butter, a breakfast shake made from roasted banana, whole-grain oats, chia seeds, coconut, and strawberries. Another option is the Detox Island Green smoothie, which contains five whole vegetables and fruits-mango, spinach, kale, banana, and pineapple. It is now widely accepted that a smoothie is a convenient option and can be a substantial meal since it comprises vegetables, fruits, and grains.

In addition, social media and the wellness movement have played a significant role in popularizing smoothies. Platforms like Instagram and Pinterest have become hubs for sharing visually appealing and health-focused content, including vibrant images of colorful smoothie bowls and creative recipes. This online presence has increased awareness and created a sense of community around the idea of embracing a healthy lifestyle, with smoothies at the forefront.

For instance, Innocent Smoothies, a renowned smoothie company, has effectively utilized social media to build a following of several hundred thousand individuals and generate annual sales exceeding USD 100 million. Their distinct strategy involves leveraging humor, wit, and an engaging social media presence to connect with their audience. The brand's dedicated representatives ensure consistent and authentic communication with their audience on platforms like Twitter.

Market Concentration & Characteristics

The appeal of smoothies extends beyond their nutritional value to include factors such as flavor innovation and customization. As consumers become more adventurous in their taste preferences, the market has responded with a wide variety of smoothie options, ranging from classic fruit blends to exotic combinations that cater to diverse palates. This variety not only enhances the overall consumer experience but also contributes to the sustained market growth.

The global smoothie market exhibits high fragmentation, attributed to significant regional and domestic players across various countries. Leading companies employ key strategies, including mergers, expansions, acquisitions, partnerships, and product development, to enhance brand visibility among consumers.

The regulations play a critical role in shaping the smoothie market by ensuring product safety, transparency, and compliance with health and environmental standards. As consumer demands and regulatory landscapes continue to evolve, the impact of regulations on the smoothie market is likely to remain a focal point for industry stakeholders and consumers alike..

Substitutes in the smoothie market primarily include other ready-to-drink beverages or meal replacement options that offer similar health benefits, convenience, and nutritional value.

Product Insights

The fruit-based smoothies segment accounted for the largest revenue share of 51.6% in 2023. Fruits are widely recognized for their nutritional content, including essential vitamins, minerals, and antioxidants. This has led consumers to often associate fruit-based smoothies with health and wellness. Furthermore, fruits have natural sweetness, and those with high water content, such as berries and watermelon, contribute to the hydrating and refreshing nature of smoothies. All these factors have significantly contributed to the market dominance of fruit-based smoothies worldwide.

The dairy-based smoothies segment is expected to grow at a CAGR of 10.9% from 2024 to 2030. Dairy-based smoothies are valued for their rich and creamy texture, often derived from ingredients like milk, yogurt, or kefir. This contributes to a satisfying and indulgent beverage experience, which resonates with consumers seeking a more substantial and fulfilling drink. Dairy ingredients add a source of high-quality protein and essential nutrients like calcium and vitamin D, enhancing the nutritional profile of the smoothie.As consumers look for diverse and enjoyable options that combine taste with nutritional value, the appeal of dairy-based smoothies continues to rise.

Distribution Channel Insights

The sales of smoothies through smoothie bars accounted for a 44.0% share in 2023. Smoothie bars offer consumers the option to customize their drinks by choosing specific fruits, vegetables, bases, and add-ins. Furthermore, smoothie bars offer a diverse menu with a wide array of flavors and ingredient combinations. Moreover, many companies in the smoothie market are expanding their businesses by opening bars owing to the high demand for smoothies. As a result, smoothie bars will continue to be the dominant sales platform for the smoothie market during the forecast period.

Smoothie sales through restaurants are expected to register a CAGR of 9.7% from 2024 to 2030. Restaurants are expanding their beverage menus to offer a diverse range of options, including smoothies. Restaurants are the most convenient and easily accessible channel for smoothies, particularly in developing countries, which is expected to drive the sales of smoothies through restaurants. Quick-service restaurants (QSRs) offering smoothies are adapting their menus to cater to evolving consumer preferences, focusing on less sweetness and incorporating healthy, plant-based ingredients, herbs, and spices. Despite the move toward healthier options, the emphasis remains on creating smoothies that not only contribute to well-being but also taste good. The challenge for QSRs is to strike a balance between customization and a streamlined ordering process

Regional Insights

North America dominated the market with a revenue share of 45.5% in 2023. The increasing popularity of healthy beverages in North America is significantly contributing to this growth. Smoothies, which are typically blended concoctions of fruits, vegetables, nuts, and dairy products, are often included in health-conscious diets, contributing to their popularity among consumers. Moreover, the shift in lifestyle choices toward healthier food options, driven by growing health awareness among consumers, is fueling the market's expansion.

Asia Pacific is expected to grow at a CAGR of 12.3% from 2024 to 2030. The influence of Western dietary patterns and the popularity of fitness and wellness trends are driving the regional popularity and consumption of smoothies. The consumption of fruit-based smoothies has experienced a significant surge in popularity across Asia Pacific in recent years. This trend can be attributed to various factors that appeal to the diverse preferences and health-conscious mindset of the population. One key factor driving the high consumption of fruit-based smoothies in Asia Pacific is the growing awareness of health and wellness. As people become more conscious of their lifestyles and dietary choices, there is an increasing inclination toward nutritious and wholesome options.

Key Companies & Market Share Insights

The global smoothie market exhibits high fragmentation, attributed to significant regional and domestic players across various countries. Leading companies employ key strategies, including mergers, expansions, acquisitions, partnerships, and product development, to enhance brand visibility among consumers.

Some of the key developments and strategic initiatives carried out by leading manufacturers are listed below:

-

In April 2023, Smoothie King strengthened its position as the country's premier Smoothie Bowl destination by introducing six enticing Smoothie Bowls at over 1,100 locations in the U.S. The Smoothie Bowls are a delicious combination of premium ingredients in attaining an active and balanced lifestyle. The Acai bowls include PB Swizzle, Berry Gogi Getaway, and Go-Go Goji Crunch, while the Pitaya bowls include Be Berry Stings, High Five, and PB Delight

-

In November 2022, Barfresh Food Group introduced a line of environmentally conscious 7.6oz Smoothie Cartons. Beyond its economic and ecological benefits, the ready-to-drink packaging was designed to yield higher profit margins compared to the company's earlier bottle format. Specifically tailored for schools, it is ideal for larger school districts and those without access to single-use plastics.

-

In November 2021, Bolthouse Farms partnered with two agencies to strengthen its marketing and communications initiatives. The Many was appointed as the advertising agency of record, while FINN Partners was selected as the Public Relations agency of record. This strategic move was geared toward strengthening the company's marketing and sales efforts, with a particular focus on beverages and functional mixes, including smoothies.

Key Smoothies Companies:

- Barfresh Food Group, Inc.

- Bolthouse Farms

- Ella’s Kitchen Ltd

- innocent ltd

- Jamba Juice LLC

- Maui Wowi Hawaiian Coffees & Smoothies

- Smoothie King

- Suja Juice

- Tropical Smoothie Café

- The Smoothie Company

Smoothies Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.54 billion

Revenue forecast in 2030

USD 23.08 billion

Growth rate

CAGR of 9.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; Russia; France; China; Japan; India; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Barfresh Food Group, Inc.; Bolthouse Farms; Ella’s Kitchen Ltd.; innocent ltd.; Jamba Juice LLC; Maui Wowi Hawaiian Coffees & Smoothies; Smoothie King; Suja Juice; Tropical Smoothie Café; The Smoothie Company

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smoothies Market Report Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global smoothies market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruit-based

-

Dairy-based

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Restaurants

-

Smoothie Bars

-

Supermarkets & Convenience Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global smoothies market size was estimated at USD 12.46 billion in 2023 and is expected to reach USD 13.54 billion in 2024

b. The global smoothies market is expected to grow at a compound annual growth rate of 9.3% from 2024 to 2030 to reach USD 23.08 billion by 2030.

b. North America dominated the market for smoothies and accounted for 45.5% share of the global revenue in 2023. The increasing popularity of healthy beverages in North America is significantly contributing to the growth of the smoothie market in the region.

b. Some of the key market players in the smoothies market are Barfresh Food Group, Inc., Bolthouse Farms, Ella’s Kitchen Ltd., innocent ltd., Jamba Juice LLC, Maui Wowi Hawaiian Coffees & Smoothies, Smoothie King, Suja Juice, Tropical Smoothie Café, The Smoothie Company.

b. The smoothies market has experienced significant growth in recent years, driven by increasing consumer awareness of health and wellness. As people become more conscious of their dietary choices, the demand for nutritious and convenient food and beverage options has risen.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.