- Home

- »

- Electronic Devices

- »

-

Smartwatch Chips Market Size & Share Analysis Report, 2030GVR Report cover

![Smartwatch Chips Market Size, Share & Trends Report]()

Smartwatch Chips Market (2022 - 2030) Size, Share & Trends Analysis Report By Type (32-bit, 64-bit), By Application (Android System, iOS System Smartwatches), By Region (North America, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-024-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global smartwatch chips market size was valued at USD 1,343.3 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.3% from 2022 to 2030. Factors such as the increasing demand for wearable devices from consumers and technological advancements by market players are driving the demand for smartwatch chips. In addition, rising health awareness among consumers is driving the demand for fitness bands and smartwatches, which, in turn, is expected to drive industry growth. The industry was positively impacted by the pandemic, which created havoc globally and persists even after two years of the initial outbreak.

Various markets were hampered. However, the demand for smartwatches increased during the pandemic owing to the health-tracking features embedded in these devices. In 2021, various companies introduced watches with SpO2, heart rate, and temperature measuring features. For instance, in August 2020, a fitness technology company, GOQii, launched a smartwatch with features such as a pulse oximeter and body temperature measurement. Connected watches and other activity trackers have become essential companions for athletes and health-conscious people.

These advanced devices gather information about the user’s movements, activities, and vital parameters such as age, sleep cycle, weight, sex, heart rate, etc. Depending on the nature of the user’s activity, they can be connected to a variety of external sensors that add extra information. This allows users to view, analyze and share their activities. A smartwatch chip handles critical functions for connected and IoT-enabled smartwatches. Advancements in semiconductor technology are supporting the growth of the industry. In August 2021, Samsung launched a new smartwatch chip, the Exynos W920.

It is a new processor for smartwatches that also supports other wearable devices, ahead of the launch of Galaxy 4. Exynos W920 is the world's first wearable devices-specific chip based on a 5nm process, enhancing the efficiency and performance of wearable devices. The semiconductor shortage caused by the pandemic also affected the market as the smartwatch chip is the most critical part of any smartwatch. The shortage impacted new technological developments in the industry. The backlog caused by the shortage took around 40 weeks to fulfill pending orders.

Type Insights

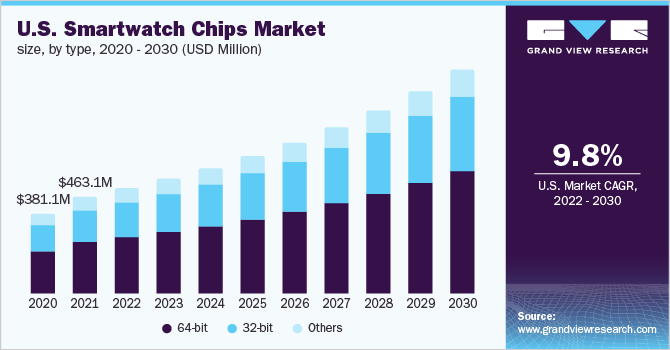

On the basis of types, the global industry has been further segmented into 32-bit, 64-bit, and others. The 64-bit type segment dominated the global industry in 2021 and accounted for the largest share of more than 53.5% of the overall revenue. The segment is projected to expand further at a significant growth rate, maintaining its leading position throughout the forecast period. The growth of this segment can be attributed to the features of these devices, such as greater processing power and compatibility. The decade-old Pebble E Ink smartwatch is now available with a 64-bit processor.

The watch series is compliant with the Pixel 7 smartphones and other similar android smartphones. The 32-bit segment is also expected to grow significantly in the near future. The segment is estimated to register the second-fastest growth rate during the forecast period. Factors such as the lower cost of 32-bit chips and established technology are expected to drive the growth of this segment during the forecast period. The others segment is also projected to have lucrative growth.

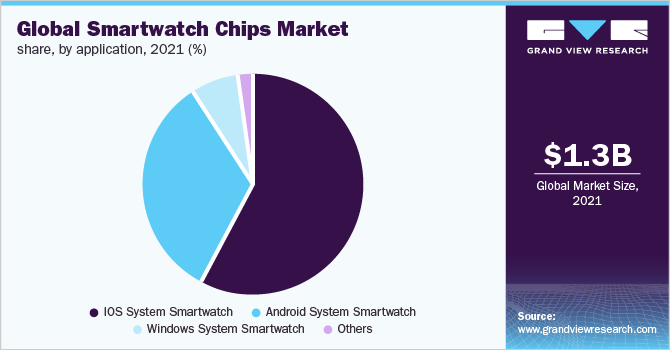

Application Insights

On the basis of applications, the global industry has been segmented into android system smartwatches, iOS system smartwatches, Windows system smartwatches, and others. The iOS system smartwatch segment dominated the global industry in 2021 and accounted for the largest share of more than 57.6% of the overall revenue. The domination of the iOS system smartwatch segment can be attributed to the growing attach rate of Apple smartwatches to its base of billion iPhone users.

The Android system smartwatch segment is likely to progress at the second-fastest CAGR over the forecast period. The growth of this segment can be attributed to the availability of Android system smartwatches at an affordable price range and their efficient battery life. In July 2022, Qualcomm launched Snapdragon Wear 5 plus. It contains a primary CPU for interactive operations and an always-on chipset that helps save battery life. Qualcomm is reducing the size of the main chip for the W5 Plus from 12nm to 4nm and the coprocessor from 28nm to 22nm.

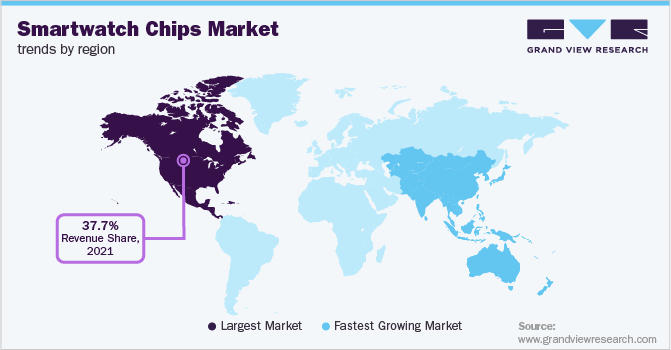

Regional Insights

On the basis of geographies, the industry has been divided into North America, Asia Pacific, Europe, Latin America, and Middle East & Africa. The North American region dominated the industry in 2021 and accounted for the maximum share of 37.7% of the overall revenue. The segment is projected to expand further at a significant growth rate, maintaining its dominant position throughout the forecast period. The presence of prominent companies, such as Analog Devices, Inc., Microchip Technology Inc., Broadcom, etc., and the presence of a developed semiconductor industry are contributing to the segment growth.

The Asia Pacific region is expected to register the fastest growth rate during the forecast period. The market growth across the region can be attributed to various factors, such as the rapidly growing consumer electronics industry and a rising tech-savvy population. In addition, the rapid adoption and popularity of advanced gadgets and a rise in the levels of consumer disposable income are other primary factors driving the market growth in the Asia Pacific region.

Key Companies & Market Share Insights

The industry has a fragmented competitive landscape featuring several global and regional players. The industry players are investing in R&D to develop advanced solutions and gain a competitive edge in the industry. Moreover, key participants are focusing on new product launches. For instance, in August 2022, Qualcomm launched the Snapdragon Wear 4100 processor for future smartwatches. The AON CO-processor covers offload experiences to include quicker tilt-to-wake responsiveness alarms, continuous heart rate monitoring, steps, timers, and haptics. Some of the prominent players in the global smartwatch chips market include:

-

Analog Devices, Inc.

-

Arm Ltd.

-

Microchip Technology Inc.

-

Broadcom

-

Huawei Technologies Co., Ltd.

-

Ingenic Semiconductor Co., Ltd.

-

Intel Corp.

-

Silicon Laboratories

-

Qualcomm Technologies, Inc.

-

Nordic Semiconductor

Smartwatch Chips Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1,467.8 million

Revenue forecast in 2030

USD 3.22 billion

Growth rate

CAGR of 10.3% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion, volume in 000’ units, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; Mexico

Key companies profiled

Analog Devices, Inc.; Arm Ltd.; Microchip Technology Inc.; Broadcom; Huawei Technologies Co., Ltd.; Ingenic Semiconductor Co.,Ltd.; Intel Corp.; Silicon Laboratories; Qualcomm Technologies, Inc.; Nordic Semiconductor

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smartwatch Chips Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global smartwatch chips market report based on type, application, and region:

-

Type Outlook (Volume, 000’ Units; Revenue, USD Million, 2017 - 2030)

-

32-bit

-

64-bit

-

Others

-

-

Application Outlook (Volume, 000’ Units; Revenue, USD Million, 2017 - 2030)

-

Android System Smartwatch

-

iOS System Smartwatch

-

Windows System Smartwatch

-

Others

-

-

Regional Outlook (Volume, 000’ Units; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global smartwatch chips market size was estimated at USD 1,343.3 million in 2021 and is expected to reach USD 1,467.8 million in 2022.

b. The global smartwatch chips market is expected to grow at a compound annual growth rate of 10.3% from 2022 to 2030 to reach USD 3.22 billion by 2030

b. North America dominated the smartwatch chips market with a share of 37.7% in 2021. This is attributable to the existence of leading companies researching & developing smartwatch chips.

b. Some key players operating in the smartwatch chips market include Dell Inc., Analog Devices, Inc., Arm Limited, Microchip Technology Inc., Broadcom, Huawei Technologies Co., Ltd., Ingenic Semiconductor Co.,Ltd, Intel Corporation, Silicon Laboratories., Qualcomm Technologies, Inc., and Nordic Semiconductor.

b. Key factors driving the market growth include the increasing demand for wearable devices from consumers and the technological advancements by market players.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.