- Home

- »

- Electronic & Electrical

- »

-

Smart Washing Machine Market Size, Industry Report, 2030GVR Report cover

![Smart Washing Machine Market Size, Share & Trends Report]()

Smart Washing Machine Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Front Load, Top Load), By Capacity, By Application (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-506-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Washing Machine Market Summary

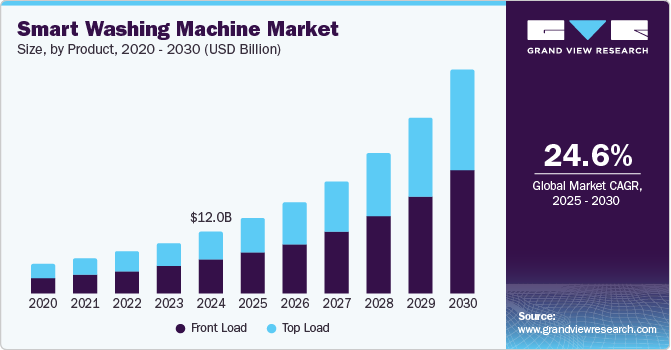

The global smart washing machine market size was valued at USD 12.02 billion in 2024 and is projected to reach USD 43.63 billion by 2030, growing at a CAGR of 24.6% from 2025 to 2030. Significant increase in demand from urban consumers, increasing technological advancements incorporated in products by manufacturers, and large-scale distribution accomplished through online channels are some of the key growth driving factors for this market.

Key Market Trends & Insights

- Asia Pacific smart washing machines market dominated the global industry with a revenue share of 45.9% in 2024.

- China smart washing machines market held the largest revenue share of the regional industry in 2024.

- By capacity, In 2024, the 6-10 kg capacity segment held the largest revenue share of the global smart washing machine industry.

- By application, the residential application segment dominated the global smart washing machine industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.02 Billion

- 2030 Projected Market Size: USD 43.63 Billion

- CAGR (2025-2030): 24.6%

- Asia Pacific: Largest market in 2024

Demand for commercial laundry instruments has grown significantly in recent years, driven by the growing healthcare industry and hospitality market requirements. Increasing urbanization in developing economies such as India also adds to growth opportunities.

Additionally, a significant rise in household spending and greater adoption of smart appliances in the residential sector fuel the market growth. Greater penetration of smartphones and wireless internet connections is helping increase the adoption rate of smart appliances, such as smart washing machines, across the residential and commercial sectors.

The emergence of modern technologies such as artificial intelligence (AI) has significantly influenced the development phase and customer preferences regarding convenience and experience with washing machines. AI-enabled machines launched by key competitors in the market with features such as identifying fabric type, optimizing water and detergent use, and achieving energy efficiency have been attracting greater customer attention.

New product launches by multiple companies with innovation-based product developments and post-sale service delivery are also contributing to the growth of this market. For instance, in August 2024, Samsung introduced a newly developed range of large-sized, AI-equipped, front-load washing machines. Featuring intuitive AI technology, a 12 kg size, and a Bespoke design, a series of 10 products is expected to address new-age digital technology-driven appliance demand in India.

Changing lifestyles, busy routines, extended work hours, young customers' requirements for clean casual wear, and the availability of appliances through online distribution channels such as online company portals, e-commerce websites, etc., have also contributed to the growth. According to the United Nations, nearly half of the global population resides in urban areas, and this number is estimated to increase to two-thirds of the total population by 2050. This is anticipated to generate a surge in demand for smart appliances such as washing machines during the forecast period.

Product Insights

The front load washing machines segment dominated the global smart washing machine industry with a revenue share of 54.9% in 2024. Ease of use, convenience offered by the product, and increasing incorporation of advanced technologies are key growth drivers for this segment. Energy and water efficiency ensured by front-load products also contribute to commercial users' growing utilization of front-load machines. Higher spin speeds, greater load capacity, and space-saving designs influence customers' purchase decisions.

The top-load washing machine segment is anticipated to experience significant growth from 2025 to 2030. The zero-to-no-energy-consumption requirement for draining water, facilitated by gravity in top-load machines, results in enhanced energy efficiency compared to front-load machines. Cost-effectiveness plays a vital role in the growth experienced by this segment. Ease of access mid-cycle, simpler operations compared to front-load machines, and lower initial costs are likely to grow.

Capacity Insights

In 2024, the 6-10 kg capacity segment held the largest revenue share of the global smart washing machine industry. Household users in urban areas worldwide primarily drive this segment, and the 6-10 kg capacity machines are increasingly preferred in modern low-space homes in urban settings. New product launches in the capacity range also add to the growth experienced by this segment. For instance, in August 2024, Panasonic Life Solutions India (PLSIND) launched a brand new range of front-load washing machines with a 7 to 9 kgs capacity. The newly introduced range of products is equipped with an IoT-driven connected living platform of Panasonic, MirAIe.

The segment with a more than 10 kg capacity is projected to experience significant growth during the forecast period. The development of this segment is mainly influenced by the utilization of commercial laundry service providers, healthcare service facilities, and hospitality industry participants. Such machines are often used for bulkier items such as blankets, duvet covers, curtains, etc. High-capacity machines provide quick washes and consume less energy for commercial purposes.

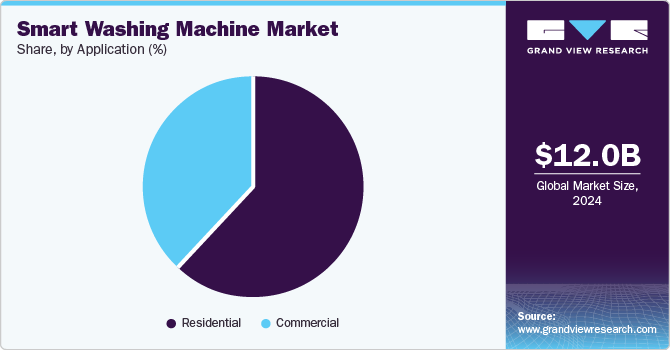

Application Insights

The residential application segment dominated the global smart washing machine industry in 2024. This is attributed to factors such as a significant rise in the population living in urbanized areas, changing lifestyles, and increasing participation of individuals in the workforce. In recent years, the inclination towards incorporating digital technology-driven products has grown significantly in urban consumers. The availability of smart washing machines through online portals and e-commerce websites also adds growth opportunities for this segment.

The commercial application segment is projected to experience lucrative growth during the forecast period. Commercial users such as luxury hotels, theme resorts, private rental properties, modern hostels, large healthcare facilities, and commercial laundry service suppliers rely on high-capacity washing machines. Frequent laundry requirements and washing of bulky items such as bedsheets, curtains, blankets, and others require technology-driven machines that provide energy efficiency, convenience, and enhanced performance.

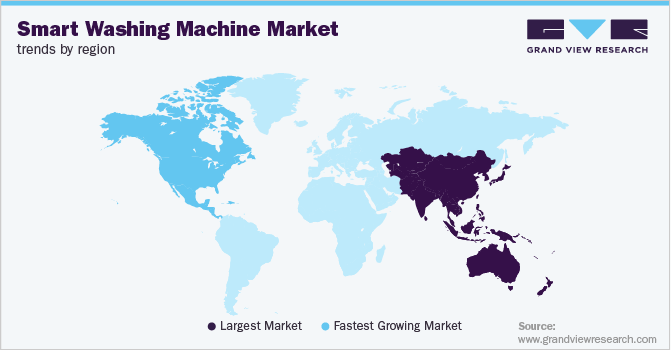

Regional Insights

Asia Pacific smart washing machines market dominated the global industry with a revenue share of 45.9% in 2024. This is attributed to factors such as the increasing focus of multiple global manufacturers and marketers on expanding their presence in developing economies such as India and growing demand driven by increasing urbanization and disposable income levels. Market penetration achieved by the e-commerce industry also plays a vital role in the growth experienced by this market. In recent years, numerous brands have launched region-specific ranges of products equipped with advanced technology features and product specifications tailored according to the requirements of urban consumers in Asia Pacific.

China smart washing machines market held the largest revenue share of the regional industry in 2024. This market is primarily driven by aspects such as increasing growth in urbanization in the country, the presence of a robust consumer electronics industry in China, and the entry of multiple global companies in the domestic market. China has the presence of large healthcare facilities, hotels, and facility management entities that utilize commercial-grade washing machines to address routine laundry requirements. Ease of availability driven by the online distribution and diversified portfolios offered by the domestic market participants is anticipated to drive growth for this market during the forecast period.

Europe Smart Washing Machines Market Trends

Europe was identified as one of the key global smart washing machine industry regions in 2024. This market is mainly influenced by factors such as growing demand by urban consumers in the EU, technology advancements embraced by the key manufacturers in the region, and significant commercial sector utilization by the hospitality and healthcare industry. European customers are inclined to use cutting-edge technology-driven appliances such as washing machines, home appliances, kitchen appliances, etc.

France dominated the regional market for smart washing machines in 2024. Domestic customers' strong focus on embracing energy-efficient appliances and increasing penetration of smart home integration technology in the country are contributing to this market's growth. In recent years, multiple brands have launched products equipped with smart features such as fabric identification, water level adjustments, optimized drying, and more, which is adding to the growth opportunities for this market.

North America Smart Washing Machines Market Trends

North America smart washing machines market is anticipated to experience significant growth over forecast period. This market is largely driven by the presence of numerous manufacturers in the region, the rapid increase in the population residing in urbanized areas, and the availability of advanced product portfolios offered by key industry participants. High penetration of e-commerce is also adding to the growth of regional industry.

The U.S. smart washing machines market held the largest revenue share of the regional market for smart washing machines in 2024. This is attributed to the high purchase power of urban consumers, increasing demand from individuals and families engaged in routine work shifts, and growth experienced by commercial laundry applications. The presence of multiple commercial laundry service businesses and the growing demand for commercial-grade products by hotels, healthcare facilities, and other commercial users are expected to generate lucrative growth opportunities for this market during the forecast period.

Key Smart Washing Machine Company Insights

Some of the key companies in the global smart washing machine market are SAMSUNG, LG Electronics, Whirlpool, Haier Inc., IFB Appliances, and others. Multiple manufacturers have adopted strategies such as automation, product portfolio diversification, new launches, enhanced post-sale services, collaborations, and more to address growing competition and increasing demand from urban consumers.

-

SAMSUNG specializes in innovation and technology-driven consumer electronics and appliances and operates in various regional markets. The company offers a range of products, including mobiles, TVs and audio, home appliances, semiconductors, B2B products, and more.

-

Haier Inc., a global lifestyle and digital technology solutions provider, operates around three principles: smart living, industrial internet, and comprehensive health. It has six listed companies and a portfolio of global brands, such as Haier, Leader, GE Appliances, and others.

Key Smart Washing Machine Companies:

The following are the leading companies in the smart washing machine market. These companies collectively hold the largest market share and dictate industry trends.

- SAMSUNG

- GIRABU

- LG Electronics

- Whirlpool

- Haier Inc.

- IFB Appliances

- Electrolux (AB Electrolux (publ))

- BOSCH

- Panasonic Corporation

- Motorola Mobility LLC

Recent Developments

-

In July 2024, Electrolux launched smart laundry appliances comprising 600-900 series washers, 600-900 series tumble dryers, and 700-800 series washer dryers. The newly introduced product range has features such as UltraQuick functions, DynamicDisplay by company, SmartSelect, and others.

-

In March 2024, SAMSUNG introduced a new range of washing machines, AI Ecobubble. With a capacity of 11 kg, these front load machines are equipped with technology features such as AI wash, auto dispense, Q-drive, and more. The newly launched series is expected to deliver 50% time savings, enhanced fabric care, and excellence in energy efficiency.

Smart Washing Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.55 billion

Revenue forecast in 2030

USD 43.63 billion

Growth Rate

CAGR of 24.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, capacity, application, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

SAMSUNG; GIRABU; LG Electronics; Whirlpool; Haier Inc.; IFB Appliances; Electrolux (AB Electrolux (publ)); BOSCH; Panasonic Corporation; Motorola Mobility LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

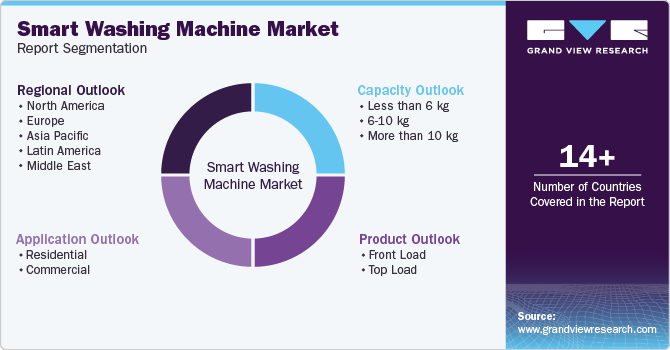

Global Smart Washing Machine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart washing machine industry report based on product, capacity, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Front Load

-

Top Load

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 6 kg

-

6-10 kg

-

More than 10 kg

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.