- Home

- »

- Next Generation Technologies

- »

-

Smart Ticketing Market Size & Share, Industry Report, 2030GVR Report cover

![Smart Ticketing Market Size, Share & Trends Report]()

Smart Ticketing Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Service), By Product (E-Kiosk, E-Ticket, E-Toll), By System (Open Payment System, Smart Card), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-063-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Ticketing Market Summary

The global smart ticketing market size was estimated at USD 13,263.0 million in 2024 and is projected to reach USD 31,650.4 million by 2030, growing at a CAGR of 15.7% from 2025 to 2030. The primary factor leading to the growth in adopting smart ticketing solutions is the increasing incorporation of emerging technologies.

Key Market Trends & Insights

- In terms of region, Europe was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, hardware accounted for a revenue of USD 7,803.4 million in 2024.

- Service is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 13,263.0 Million

- 2030 Projected Market Size: USD 31,650.4 Million

- CAGR (2025-2030): 15.7%

- Europe: Largest market in 2024

The introduction of innovative means for purchasing and paying for tickets, such as contactless payment systems, virtual tickets (E-tickets), and smart cards, enables smooth and efficient transit. Additionally, the availability of multi-modal disbursement channels through online ticketing systems, smartphones, E-kiosks, and smart ticketing machines is supplementing effective crowd management and making smart ticketing systems preferable over traditional paper-based ticketing systems.

Moreover, changing customer preferences for digital channels to access transport services is driving the growth of the smart ticketing solutions market. Various benefits in the form of reduced waiting time compared to waiting in queues during peak hours, subsidized fares, real-time route updates, and a personalized mobility experience make a strong appeal among customers for online ticketing systems. Moreover, the advantages of smart ticketing solutions for transport operators include reduced maintenance costs, access to an integrated ticketing infrastructure, and cost-effective use of resources such as employees, energy, and paper. Thus, the use of smart ticketing systems is expected to rise over the forecast period contributing to the growth of the overall smart ticketing industry.

In addition to its application in transportation operations, smart ticketing solutions are also gaining traction to meet ticketing needs in the sporting and entertainment industry. Smart ticketing systems allow scalability when integrated with point-of-sale and self-service kiosks. Smart ticketing systems also provide real-time customer data and improve customer engagement and experience. For instance, in March 2023, Major League Soccer (MLS) selected Ticketmaster as its official ticketing partner through a multi-year agreement seeking to personalize the entire customer experience using next-generation interactive tools such as 3D stadium views.

Data security concerns are one of the restraints plaguing the smart ticketing market. Smart ticketing systems are open-loop and typically require users to provide personal information such as their name, contact details, and payment information. They also inherit the risks of such data being accessed or misused if the system's security measures need to be improved. Market players and vendors are upgrading to use technology, such as blockchain, to overcome such restraints.

Component Insights

The hardware segment accounted for the largest share of 51.4% in 2024.The deployment of custom and readily available innovative hardware solutions enables transport operators to issue and read tickets via a single interface. The adoption of smart ticketing systems as a measure to transcend to a more digitally advanced ticketing infrastructure has been a driving factor for the growth of the hardware segment. Moreover, the need for upgrades to legacy transportation ticketing systems is expected to drive the growth of the hardware segment.

The service segment is expected to grow at a significant CAGR during the forecast period. A comprehensive and straightforward ticketing system is essential to promote the use of public transportation systems. Smart ticketing companies increasingly emphasize supporting the integration and deployment services for the convenient use of smart ticketing systems. An illustration of a prominent service provided by smart ticketing companies is Mobility as a Service (MaaS) which enables end-to-end booking and payments.

Product Insights

The e-ticket segment held the largest market share in 2024. The pandemic outbreak resulted in a surge in contactless payments and services across industries, including the transportation industry. For instance, in May 2023, VIA Metropolitan Transit enabled riders to purchase tickets through the Uber application and other means, such as the VIA goMobile+ application. E-ticketing systems provide users with flexibility in payments for ticket purchases across transportation modes.

The smart parking system segment is expected to register the fastest CAGR during the forecast period. Rising emphasis on building smart cities and improving the reliability and productivity of urban infrastructure is expected to drive the smart parking segment growth. Smart ticketing solutions are being introduced for efficient traffic and parking management. For instance, in March 2023, Mobile Smart City installed pay-in-lane contactless equipment for entry and exit access control.

System Insights

The smart card segment dominated the market in 2024. The benefits associated with using smart cards, such as durability, efficiency, and convenience in travel, are expected to drive its growing adoption over the forecast period. Trainline, a UK-based online coach and rail ticket seller, reported that local travelers saved as much as 69% in travel costs in 2022. Moreover, numerous countries such as Hong Kong, South Korea, and Japan have multi-purpose smart cards that can also be used to purchase at retail stores and vending machines.

The near-field communication is projected to grow at a significant CAGR over the forecast period. Near-field communication systems have proved vital in providing a frictionless ticketing experience. Additionally, near-field communication transactions can be validated in 120 milliseconds. Innovative payment methods such as tap-and-go through Quick Response (QR) codes, debit, and credit cards have increased customer convenience in conducting many transactions, which are expected to bode well for the smart ticketing market.

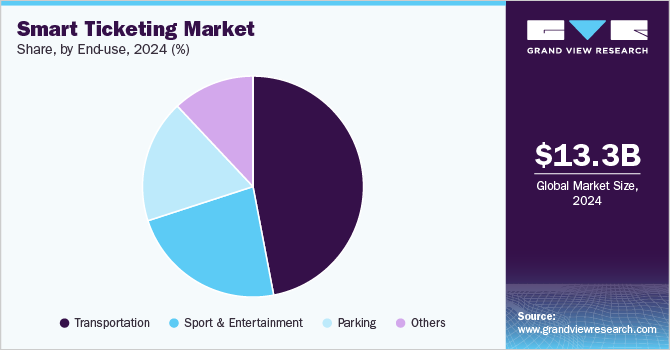

End-use Insights

The transportation segment dominated the market in 2024. Smart ticketing systems are safe, and agile and help with automated fare collection and resource management. The benefits of a streamlined travel and ticketing system are leading to its rising incorporation by various transportation departments. For instance, in February 2023, the Australian Capital Territory (ACT) Government partnered with NEC Corporation to build a next-generation ticketing solution.

Sport & entertainment is projected to grow at the fastest CAGR over the forecast period. The growth of the segment can be attributed to sporting stadiums and entertainment venues incorporating contactless ticketing systems. The latest technology, blockchain, is also being leveraged to make smart ticketing more efficient and secure. For instance, France is considering implementing a blockchain-based, Non-fungible token ticketing system for the Olympic Games in 2024.

Regional Insights

North America smart ticketing market held a significant share in 2024. The shift toward contactless payment technologies are significantly fueling the growth of smart ticketing systems in North America. Consumers increasingly prefer seamless, quick, and secure payment methods, which smart ticketing offers. Contactless solutions eliminate the need for cash transactions, reducing waiting times and improving the overall user experience.

U.S. Smart Ticketing Market Trends

The smart ticketing market in the U.S. held a dominant position in 2024. The growing investment in public transportation and infrastructure in the country drives the growth of the market. Governments and private entities in the U.S. are heavily investing in modernizing public transportation systems. Smart ticketing solutions are being integrated into buses, trains, and other transit modes to streamline operations and enhance efficiency. These systems allow for better tracking of ridership data, enabling transit authorities to optimize routes and schedules.

Europe Smart Ticketing Market Trends

Europe smart ticketing market dominated the market in 2024 and accounted for a revenue share of 34.48%. The smart ticketing market in Europe was identified as a lucrative region in 2024. The growing emphasis of the European Commission to develop intelligent transportation systems and tackle the region’s congestion and emission problems is a primary factor driving the demand for smart ticketing systems. In February 2023, the Multimodal Passenger Mobility Forum was established to assist the European Commission in drafting policy initiatives targeting multimodal mobility. Moreover, the presence of prominent players, such as Thales and Giesecke & Devrient GmbH, bode well for the regional market growth.

The U.K. smart ticketing market is expected to grow rapidly in the coming years due to the proliferation of smartphones and advancements in NFC and QR code technologies in the U.K. Commuters can now purchase, store, and use tickets via mobile apps, eliminating the need for physical tickets.

Asia Pacific Smart Ticketing Market Trends

The smart ticketing market in Asia Pacific is anticipated to grow at a CAGR of 16.9% during the forecast period. The adoption of smart ticketing solutions is expected to rise in the Asia Pacific region due to the presence of highly populated countries, such as China and India. Growing regional digitization is also expected to bode well for the growth of the market. For instance, in April 2023, China launched a train ticketing system that integrates various ticket-selling platforms from over 140 nations into a unified mobile application.

Japan smart ticketing industry is expected to grow rapidly in the coming years owing to the growing tourism industry. Japan's position as a global tourist destination has fueled the demand for efficient and user-friendly transportation solutions. Smart ticketing systems simplify travel for international visitors by eliminating language barriers and providing multi-modal access through a single card or app.

The smart ticketing market in China held a substantial market share in 2024 owing to rapid urbanization and increasing public transportation demand. China’s rapid urbanization has significantly increased the demand for efficient public transportation systems. Major cities like Beijing, Shanghai, and Guangzhou face high commuter traffic daily, necessitating seamless and scalable ticketing solutions. Smart ticketing systems, integrated with subway lines, buses, and high-speed rail networks, reduce congestion, minimize queues, and improve the overall efficiency of transit systems.

Key Smart Ticketing Company Insights

Some of the key companies in the smart ticketing market include Confidex Ltd., Cubic Corporation,Giesecke & Devrient GmbH, CPI Card Group Inc., and others. Organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Confidex Ltd. is a company specializing in advanced RFID (Radio Frequency Identification) and NFC (Near Field Communication) technologies. It offers high-performing contactless smart tickets, industrial RFID tags, and specialty labels, catering to a diverse range of industries, including transportation, logistics, and manufacturing. It serves a wide network of customers across Europe, the Americas, the Middle East, and Asia, leveraging its expertise to deliver tailored solutions that improve supply chain management and asset tracking.

-

Cubic Corporation provides innovative solutions that enhance public transportation systems worldwide. The company specializes in integrated fare collection technologies, including contactless payment options that allow users to pay for transit services using credit cards and mobile devices. The smart ticketing offered by the organization has been successfully implemented in various locations, such as the Gold Coast Light Rail in Queensland, Australia, and the Umo Mobility Platform in Bloomington, Indiana. These systems streamline the payment process and offer features such as fare capping and account management, making public transport more accessible and user-friendly.

Key Smart Ticketing Companies:

The following are the leading companies in the smart ticketing market. These companies collectively hold the largest market share and dictate industry trends.

- Confidex Ltd.

- CPI Card Group Inc.

- Cubic Corporation

- Thales

- Giesecke & Devrient GmbH

- HID Global Corporation (ASSA ABLOY)

- Infineon Technologies AG

- NXP Semiconductors

- IDEMIA

- Xerox Corporation

Recent Developments

-

In September 2024, FPT IS partnered with Mastercard to implement advanced payment technology in the traffic management systems and smart ticketing for Metro Line 1 in Ho Chi Minh City. This collaboration formalized through a Memorandum of Understanding (MoU), aims to deploy an open-loop EMV (Europay, Mastercard, and Visa) electronic payment system that allows passengers to use bank cards, QR codes, or their citizen ID cards for fare payments.

-

In October 2024, the Tasmanian Government selected Cubic Corporation to implement a state-wide smart ticketing solution for the public transport network, which includes buses and ferries. This innovative system will allow passengers to pay their fares using contactless methods such as bank cards and mobile devices, eliminating the need for pre-loaded travel cards or cash. The integration of real-time journey planning and tracking features aims to enhance the convenience and efficiency of public transport for commuters.

Smart Ticketing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.26 billion

Revenue forecast in 2030

USD 31.65 billion

Growth Rate

CAGR of 15.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, product, system, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Confidex Ltd.; CPI Card Group Inc.; Cubic Corporation; Thales; Giesecke & Devrient GmbH; HID Global Corporation (ASSA ABLOY); Infineon Technologies AG; NXP Semiconductors; IDEMIA; Xerox Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Ticketing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart ticketing market report based on component, product, system, end-use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Service

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

E-Kiosk

-

E-Ticket

-

E-Toll

-

Request Tracker

-

Smart Parking System

-

Ticket Machine

-

Ticket Validators

-

Others

-

-

System Outlook (Revenue, USD Billion, 2018 - 2030)

-

Open Payment System

-

Smart Card

-

Near-field Communication

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Parking

-

Sport & Entertainment

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart ticketing market size was estimated at USD 13.26 billion in 2024 and is expected to reach USD 15.26 billion in 2025.

b. The global smart ticketing market is expected to grow at a compound annual growth rate of 15.7% from 2025 to 2030 to reach USD 31.65 billion by 2030.

b. Europe dominated the smart ticketing market with a share of 34.48% in 2024. This is attributable to the presence of prominent market players such as Giesecke & Devrient GmbH, Gemalto NV, and Infineon Technologies AG in the region.

b. Some key players operating in the smart ticketing market include Confidex Ltd.; CPI Card Group Inc.; Cubic Corporation; Thales; Giesecke & Devrient GmbH; HID Global Corporation (ASSA ABLOY); Infineon Technologies AG; NXP Semiconductors; IDEMIA; Xerox Corporation.

b. Key factors that are driving the smart ticketing market growth include increased adoption of advanced technologies in smart ticketing systems and increasing demand for smart ticketing from the tourism and sports & entertainment industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.