- Home

- »

- Next Generation Technologies

- »

-

Smart Thermostat Market Size, Share, Industry Report, 2030GVR Report cover

![Smart Thermostat Market Size, Share & Trends Report]()

Smart Thermostat Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (LoRaWAN, Wi Fi), By Product (Connected, Learning), By Installation (New Installation, Retrofit), By End Use (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: 978-1-68038-513-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Thermostat Market Summary

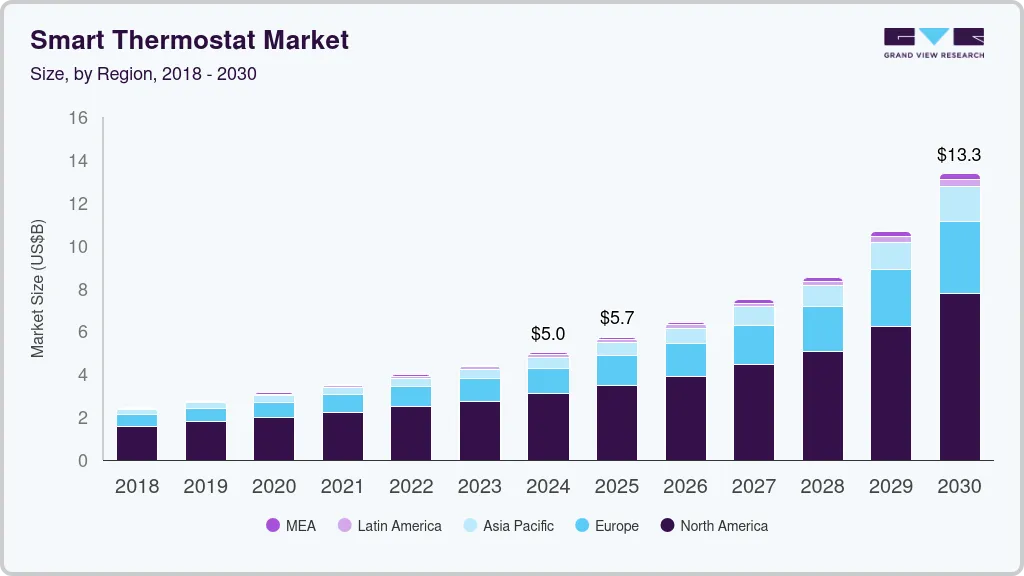

The global smart thermostat market size was estimated at USD 4.99 billion in 2024 and is projected to reach USD 13.35 billion by 2030, growing at a CAGR of 18.5% from 2025 to 2030. Smart thermostats are increasingly being integrated into IoT ecosystems, enabling seamless communication with other smart home devices.

Key Market Trends & Insights

- North America smart thermostat market dominated global market with a revenue share of over 61% in 2024.

- The smart thermostat market in the U.S. is expected to grow at a CAGR from 2025 to 2030.

- By technology, the Wi-Fi segment led the market and accounted for over 66% of the global revenue share in 2024.

- By product, the connected segment accounted for the largest revenue share in 2024.

- By Installation, the new installation segment accounted for the largest revenue share in 2024

Market Size & Forecast

- 2024 Market Size: USD 4.99 Billion

- 2030 Projected Market Size: USD 13.35 Billion

- CAGR (2025-2030): 18.5%

- North America: Largest market in 2024

This trend supports interoperability, allowing users to control heating, cooling, lighting, and security systems from a single platform. As consumer demand for convenience and automation rises, manufacturers are embedding advanced features like voice control and AI-based learning capabilities. This integration also drives higher energy efficiency, as smart thermostats adjust in real time based on data from interconnected devices. Businesses are leveraging these advancements to create ecosystems that encourage customer loyalty and cross-device compatibility.

Energy efficiency is a critical driver for smart thermostat industry adoption, as both residential and commercial users seek to lower energy costs and reduce carbon footprints. These devices provide real-time data and usage insights, enabling users to optimize heating and cooling schedules. Governments worldwide are implementing energy-saving regulations, further boosting demand for such solutions. Businesses are marketing these products as eco-friendly investments, which appeal to environmentally conscious consumers. This trend also opens opportunities for partnerships between thermostat manufacturers and utility companies to offer rebates and energy-saving programs.

Commercial sectors, including office buildings, retail spaces, and hospitality, are rapidly adopting smart thermostat industry to manage large-scale energy consumption. Advanced features such as zoning, remote monitoring, and analytics support efficient climate control across multiple locations. This adoption aligns with corporate sustainability goals, as businesses prioritize reducing energy wastage. Furthermore, the ability to integrate with existing building management systems enhances the operational efficiency of commercial spaces. The trend signifies a shift towards a smarter, greener infrastructure, supported by government incentives and corporate initiatives.

AI and machine learning are revolutionizing the smart thermostat industry by enabling predictive analytics and adaptive learning. These technologies allow thermostats to learn user behaviors and preferences over time, ensuring optimal comfort and efficiency. Predictive maintenance alerts are also becoming a key feature, helping users address potential issues before they escalate. Businesses benefit by gaining access to anonymized data analytics, which helps in improving future product designs and features. This trend positions smart thermostats not just as devices, but as integral components of intelligent building management systems.

Emerging markets are witnessing a surge in smart thermostat industry adoption due to growing urbanization and the penetration of smart technologies. As disposable incomes rise and awareness of energy efficiency increases, these regions present significant growth opportunities. Manufacturers are launching cost-effective models tailored to these markets, ensuring broader accessibility. Governments in these regions are also investing in smart city projects, further boosting demand for connected devices like smart thermostats. Businesses entering these markets can capitalize on the untapped potential and contribute to the development of sustainable energy practices.

Technology Insights

The Wi-Fi segment led the market and accounted for over 66% of the global revenue share in 2024. The Wi-Fi-enabled smart thermostat is gaining popularity in residential settings due to their ease of installation and user-friendly features. Homeowners value the ability to remotely control temperature settings via mobile apps, offering convenience and enhanced comfort. These devices are increasingly integrated into smart home ecosystems, allowing seamless connectivity with other appliances and systems. Rising energy costs and a growing focus on sustainability are driving consumers to adopt Wi-Fi thermostats that optimize energy usage. This trend underscores a shift toward personalized and automated home climate control solutions.

The LoRaWAN segment is predicted to foresee the highest growth from 2025 to 2030. LoRaWAN-enabled smart thermostats are gaining traction due to their ability to operate on low power while providing long-range communication. This makes them particularly suited for large-scale deployments in residential and commercial settings. Technology’s ability to transmit data over long distances without the need for constant power supply enhances its appeal in remote or hard-to-reach locations. With growing energy efficiency requirements, LoRaWAN thermostats offer an optimal solution by facilitating continuous monitoring and control with minimal energy consumption. Businesses are capitalizing on this trend by integrating LoRaWAN with smart thermostat solutions to cater to diverse market demands.

Product Insights

The connected segment accounted for the largest revenue share in 2024. The segment is thriving due to its ability to seamlessly integrate with broader smart home ecosystems. These thermostats interact with devices like smart lighting, security systems, and voice assistants, creating a unified, automated living experience. This integration appeals to tech-savvy consumers looking for centralized control and enhanced convenience. Companies are investing in compatibility with platforms like Amazon Alexa, Google Home, and Apple HomeKit to increase adoption. This trend reflects the growing consumer preference for interconnected and intelligent living environments.

The learning segment is predicted to foresee the significant growth rate from 2025 to 2030. Learning smart thermostats are increasingly incorporating artificial intelligence and predictive analytics to offer smarter and more proactive climate control. These devices can anticipate temperature needs based on weather forecasts, occupancy patterns, and historical data. Predictive maintenance features are also being added, enabling timely alerts for system repairs or replacements. Businesses benefit from these innovations by offering value-added features that distinguish their products from standard models. This trend reflects the growing demand for intelligent devices that go beyond basic functionality.

Installation Insights

The new installation segment accounted for the largest revenue share in 2024. This segment is thriving due to the increasing prevalence of smart home developments. Builders and developers are integrating smart thermostats into new residential projects to appeal to tech-savvy buyers. These installations offer seamless connectivity with other smart home devices, creating a unified and intelligent living environment. Consumers are drawn to the convenience, energy efficiency, and modern aesthetic of smart thermostats. This trend reflects the growing expectation for smart technology as a standard feature in new homes.

The retrofit segment is predicted to foresee the highest growth from 2025 to 2030. The retrofitting smart thermostat is increasingly popular in commercial and industrial settings where upgrading entire HVAC systems can be prohibitively expensive. These thermostats provide centralized control, energy usage monitoring, and scheduling capabilities tailored to the needs of large facilities. Businesses benefit from reduced energy costs and improve operational efficiency, aligning with corporate sustainability goals. Government incentives for energy-efficient retrofitting projects are also fueling adoption in this segment. This trend underscores the importance of retrofit solutions in addressing the unique needs of large-scale operations.

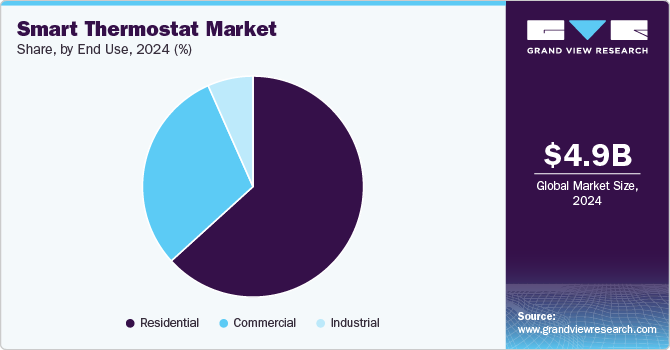

End Use Insights

The residential segment accounted for the largest revenue share in 2024.This segment is experiencing robust growth due to increasing consumer awareness of energy efficiency and cost savings. Homeowners are adopting smart thermostats to reduce utility bills and minimize environmental impact. These devices offer real-time energy usage insights and personalized recommendations, empowering users to make informed decisions. Government incentives and rebates for energy-efficient appliances are further driving adoption in the residential market. This trend reflects the alignment of consumer preferences with sustainable and cost-effective solutions.

The commercial segment is expected to exhibit a significant CAGR from 2025 to 2030. This segment is witnessing increased adoption as businesses prioritize energy efficiency and sustainability. Smart thermostats offer precise control over HVAC systems, reducing energy consumption and operational costs in commercial buildings. Features like energy monitoring and optimization help organizations meet sustainability goals and comply with green building certifications. Governments worldwide are introducing regulations and incentives to encourage energy-efficient technologies, further driving adoption. This trend reflects the critical role of smart thermostats in creating sustainable commercial spaces.

Regional Insights

North America smart thermostat market dominated global market with a revenue share of over 61% in 2024. This growth can be attributed to the increasing adoption of smart home technologies, energy efficiency initiatives, and the rising demand for IoT devices. Consumers in the region are increasingly aware of the benefits of smart thermostats in terms of convenience, cost savings, and environmental impact, leading to higher adoption rates compared to other regions.

U.S. Smart Thermostat Market Trends

The smart thermostat market in the U.S. is expected to grow at a CAGR from 2025 to 2030. Various government initiatives promoting energy efficiency in buildings have encouraged the adoption of smart thermostats as part of broader efforts to reduce carbon emissions and combat climate change.

Europe Smart Thermostat Market Trends

The Europe smart thermostat market is expected to witness significant growth over the forecast period. Many European countries have set ambitious targets for reducing carbon emissions and promoting energy efficiency. Governments are incentivizing the adoption of smart technologies, including smart thermostats, through various programs and regulations. This support from regulatory bodies is expected to drive the demand for smart thermostats in the region.

Asia Pacific Smart Thermostat Market Trends

The smart thermostat market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. Governments in various countries within the Asia-Pacific region are implementing initiatives and regulations aimed at promoting energy efficiency and reducing carbon emissions. This includes incentives for adopting smart technologies like thermostats that can contribute to overall energy savings.

Key Smart Thermostat Company Insights:

Top players in the smart thermostat industry include Google (Nest Labs), Honeywell, Ecobee, Emerson Electric, Johnson Controls, and Schneider Electric, are pursuing strategies to expand their market presence. These companies are focusing on partnerships, acquisitions, and collaborations while developing innovative AI-driven products and technologies to enhance contract management solutions. Their efforts aim to address growing demands for enhanced security and operational transparency. By continuously advancing their technological offerings, they strive to stay competitive and meet evolving market needs.

-

Honeywell International Inc. is a diversified company excelling in sectors like aerospace, building technologies, and safety solutions. The company leverages its technological expertise to deliver intelligent HVAC systems as part of its smart building solutions. Its smart thermostats focus on enhancing energy efficiency and user comfort while integrating seamlessly with other smart home devices. A commitment to user-friendly designs and cutting-edge technology has established Honeywell as a leader in the smart thermostat market.

-

Ecobee Inc. specializes in sustainable smart home solutions that prioritize energy conservation and user convenience. Its flagship product, the ecobee SmartThermostat, employs Wi-Fi connectivity and occupancy sensors to adapt to user schedules for optimal comfort and energy savings. Advanced features such as voice control, remote access, and compatibility with platforms like Amazon Alexa and Google Home elevate its product offerings. By combining innovation with environmental responsibility, Ecobee has positioned itself as a key player in the smart thermostat industry.

Key Smart Thermostat Companies:

The following are the leading companies in the smart thermostat market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- General Electric

- HORIBA Scientific

- Aeroqual

- Emerson Electric Co.

- Seimens

- Merck KGaA

- Teledyne Technologies Incorporated.

- Testo SE & Co. KGaA

- Thermo Fisher Scientific Inc.

Recent Developments

-

In February 2024, Carrier Corporation unveiled its latest smart thermostat, designed to improve comfort and energy efficiency for both residential and light commercial use. This new thermostat features remote access, geofencing capabilities, and intelligent scheduling, enabling users to optimize energy consumption while maintaining personalized comfort levels. Carrier's focus on user-friendly design ensures that homeowners can easily control their environment, enhancing overall satisfaction. The product is set to begin shipping in the second quarter of 2024.

-

In December 2023, Sinope introduced the 'TH1123WF' smart Wi-Fi thermostat tailored for electric baseboard and convector heating systems. This device allows users to control their heating remotely through the Neviweb platform or mobile app and is compatible with major smart home ecosystems such as Apple HomeKit, Alexa, and Google Home. The TH1123WF aims to provide convenience and efficiency for users managing their home heating systems. Sinope's commitment to innovation positions it as a competitive player in the smart thermostat market.

-

In May 2022, Ecobee launched the Ecobee SmartThermostat Premium alongside the Ecobee SmartCamera with Voice Control. The SmartThermostat Premium features built-in Alexa voice service, a sleek glass touchscreen display, and high-quality audio designed for whole-home sound. These products aim to elevate smart home experience by incorporating advanced features like voice control, enhanced sensing capabilities, and superior audio quality, reinforcing Ecobee's reputation for innovation in home automation technology.

Smart Thermostat Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.72 billion

Revenue forecast in 2030

USD 13.35 billion

Growth rate

CAGR of 18.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, product, installation, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Denmark; Norway; Sweden; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Google Nest; Honeywell Home; ecobee; Emerson; Johnson Controls; Control4; Vine Connected Corporation; Resideo Technologies, Inc.; Netatmo SA; Tado GmbH; Siemens; Lux Products Corporation; Centrica Hive Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Thermostat Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart thermostat market report based on technology, product, installation, end use, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

LoRaWAN

-

Wi-Fi

-

Zigbee

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Connected

-

Standalone

-

Learning

-

-

Installation Outlook (Revenue, USD Million, 2018 - 2030)

-

New Installation

-

Retrofit

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Million Units, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Denmark’

-

Norway

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the smart thermostat market include Schneider Electric, Emerson Climate Technologies, Radio Thermostat Company of America, Carrier Corporation, Ingersoll Rand (Trane), Allure Energy Inc., Tado GmbH, Eneco, British Gas Hive, and Lux Products Corporation.

b. Key factors that are driving the market growth include the increasing need for energy-efficient solutions in the residential sectors and the need for remote access solutions to monitor and control energy consumption.

b. The global smart thermostat market size was estimated at USD 4.99 billion in 2024 and is expected to reach USD 5.72 billion in 2025.

b. The global smart thermostat market is expected to grow at a compound annual growth rate of 18,5% from 2025 to 2030 to reach USD 13.35 billion by 2030.

b. North America dominated the smart thermostat market with a share of more than 61% in 2024. This is attributable to the increasing demand for managing energy consumption solutions and a wide distribution network of key vendors in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.