- Home

- »

- Next Generation Technologies

- »

-

Smart Space Market Size, Share And Trends Report, 2030GVR Report cover

![Smart Space Market Size, Share & Trend Report]()

Smart Space Market (2024 - 2030) Size, Share & Trend Analysis Report By Component, By Application (Energy Management And Optimization, Emergency Management, Security Management), By Premises Type (Commercial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-379-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Space Market Summary

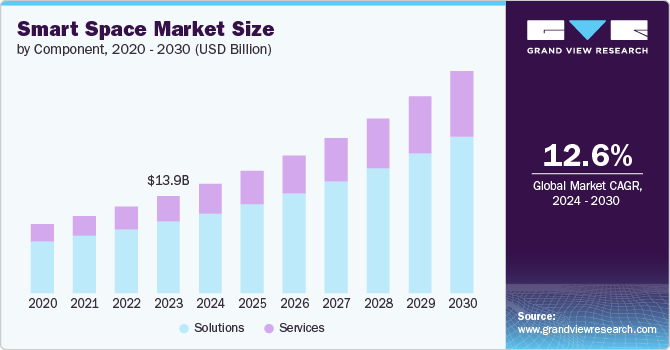

The global smart space market size was estimated at USD 13.96 billion in 2023 and is projected to reach USD 31.96 billion by 2030, growing at a CAGR of 12.6% from 2024 to 2030, driven by technological advancements in IoT, AI, and smart sensors that enhance connectivity and automation. Increasing urbanization necessitates smart infrastructure for efficient resource management, energy conservation, and improved quality of life.

Key Market Trends & Insights

- North America smart space market represented a significant share of over 37% in 2023.

- The smart space market of Asia Pacific is poised for significant growth.

- Based on premises type, the commercial segment accounted for the largest market revenue share in 2023.

- In terms of component, the solution segment led the market and accounted for over 73.6% of the global revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 13.96 Billion

- 2030 Projected Market Size: USD 31.96 Billion

- CAGR (2024-2030): 12.6%

- North America: Largest market in 2023

Rising demand for energy efficiency and environmental sustainability propels the adoption of advanced energy management systems in smart spaces. Enhanced user experiences through personalized technologies boost adoption across residential, commercial, and industrial sectors.The rising adoption of smart devices, including smartphones and tablets, has created a vital ecosystem for smart spaces, enabling better control, monitoring, and automation of environments. The construction industry is increasingly incorporating smart technologies into new buildings and retrofitting existing structures to optimize lighting, heating, and security systems, enhancing operational efficiency and reducing costs.

Significant global investments in infrastructure development focus on creating smart cities and public spaces to improve urban living conditions through smart technologies. Advancements in data analytics provide valuable insights into user behavior, system performance, and energy consumption, driving continuous improvements in smart space solutions.

Growing awareness and education about the benefits of smart spaces are accelerating adoption among businesses and consumers, with educational initiatives and successful implementation demonstrations playing a crucial role. Health and safety concerns, heightened by the COVID-19 pandemic, are driving the focus on smart spaces to monitor air quality, ensure sanitation, and manage occupancy levels for safer environments. Collaboration among technology providers, construction firms, and government bodies fosters innovation and adoption of smart space solutions, developing standardized and interoperable systems. Additionally, smart spaces offer significant economic benefits by reducing operational costs, improving resource management, and increasing asset utilization, appealing to businesses and governments aiming to optimize expenditures and maximize returns on investment.

Component Insights

The solution segment led the market and accounted for over 73.6% of the global revenue in 2023, driven by comprehensive offerings that combine hardware and software into holistic environments. The high demand for customization allows businesses and consumers to tailor solutions to their specific needs, enhancing flexibility in smart homes, offices, and cities. These solutions focus on improving user experience through advanced technologies such as IoT, AI, and machine learning, providing greater comfort, convenience, security, and efficiency. Technological integration, including smart sensors and data analytics, adds significant value, while scalability ensures long-term adaptability and future-proofing.

The services segment within the market is experiencing significant growth due to the increasing complexity of smart space solutions, necessitating expert implementation for optimal functionality. The demand for ongoing maintenance and support, including software updates and troubleshooting, drives the need for service providers. Data management and analytics services enable informed decision-making and optimization of smart environments. Security and compliance services address data privacy and cybersecurity concerns, and integration services ensure seamless connectivity with existing systems.

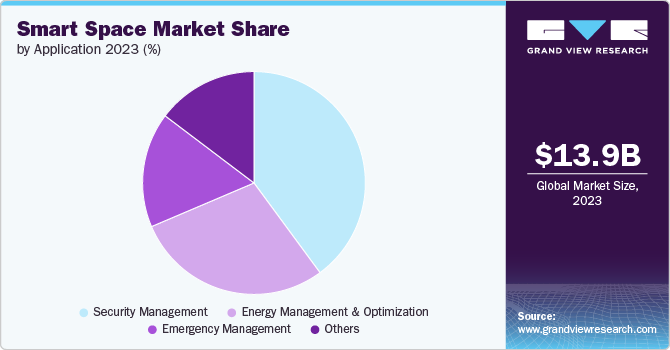

Application Insights

The security management segment led the market in 2023 due to rising security concerns associated with the increasing integration of connected devices and systems, which heightened the risk of cyber threats and data breaches. Security management solutions provide advanced threat detection and prevention capabilities, including real-time monitoring and response mechanisms to safeguard smart environments. Compliance with stringent data privacy and security regulations necessitates robust security management to meet standards and avoid legal issues. These solutions integrate physical and cybersecurity measures to protect against various threats, and the growing adoption of IoT devices in smart spaces further emphasizes the need for comprehensive security management to maintain user trust and prevent breaches.

The emergency management segment is experiencing substantial growth driven by increasing natural disasters and the need for solutions in smart spaces. Technological advancements in IoT, AI, and real-time analytics enhance capabilities to predict, detect, and respond to emergencies effectively. Urbanization and complex infrastructure drive demand for integrated emergency management systems in smart cities and buildings. These solutions seamlessly integrate with existing systems, enhancing overall response effectiveness through proactive risk management, improved communication, and coordinated emergency response efforts among stakeholders.

Premises Type Insights

The commercial segment accounted for the largest market revenue share in 2023, driven by early adoption in offices, corporate campuses, and business centers seeking to enhance operational efficiency and reduce costs through automation and smart building management. The retail and hospitality sectors within this segment prioritize customer experience, leveraging technologies such as personalized shopping and smart hotel rooms to boost engagement and loyalty. Energy efficiency remains a significant driver, with smart space solutions optimizing energy usage in lighting, HVAC systems, and overall energy management, resulting in substantial savings and environmental benefits. Enhanced safety and security measures, including advanced surveillance and emergency response systems, further drive smart space technologies in commercial premises while operational optimizations streamline tasks and improve resource management efficiency.

The residential segment is poised for significant growth driven by increasing consumer demand for smart home technologies that enhance convenience, comfort, and security. Advances in IoT, AI, and the affordability of smart devices such as connected appliances and security systems have made these technologies accessible to more homeowners. Enhanced safety features, including remote monitoring capabilities through smart security cameras and locks, contribute to the growing adoption of smart home solutions. Integration and interoperability among devices further enhance the user experience by allowing centralized control through single interfaces or apps.

Regional Insights

North America smart space market represented a significant share of over 37% in 2023, driven by its status as a hub for technological innovation with key advancements in IoT, AI, cloud computing, and data analytics. The region, specifically the U.S., exhibits early and enthusiastic adoption of smart technologies across homes, buildings, and cities, reflecting a strong preference for solutions that enhance convenience, efficiency, and sustainability. Robust economic growth and rapid urbanization provide opportunities for smart space technologies to address infrastructure management and resource efficiency challenges, with smart city initiatives in major metropolitan areas contributing to market expansion.

U.S. Smart Space Market Trends

The smart space market of the U.S. is expected to grow substantially over the forecast period, driven by significant urbanization and smart city initiatives aimed at creating efficient, sustainable, and livable urban environments through smart technology integration. Rising consumer demand for smart home technologies, including smart thermostats, security systems, and home automation solutions, is boosting growth in the residential segment. Additionally, regulatory support and government initiatives, such as the Smart Cities Council and federal funding for smart infrastructure, along with investments in energy-efficient technologies, are promoting the widespread adoption of smart space solutions.

Europe Smart Space Market Trends

Europe smart space market is gaining significant traction due to a strong focus on sustainability and energy efficiency, driven by stringent environmental regulations and the European Union’s commitment to reducing carbon emissions. Government support and substantial funding for smart city projects, green technologies, and digital transformation initiatives through programs such as Horizon Europe further promote the adoption of smart space solutions. Additionally, significant investments in enhanced digital infrastructure, including high-speed internet, 5G networks, and IoT platforms, facilitate the seamless deployment and operation of smart space technologies across both urban and rural areas in Europe.

Asia Pacific Smart Space Market Trends

The smart space market of Asia Pacific is poised for significant growth due to rapid urbanization and substantial smart city initiatives in countries such as China, India, and Southeast Asian nations aimed at improving infrastructure and enhancing the quality of life. The rising middle class with increased disposable income is driving demand for smart home technologies that offer convenience, security, and energy efficiency. Government policies and initiatives, such as Singapore's Smart Nation and South Korea's U-City, actively promote smart technology adoption. Additionally, significant investments in infrastructure development, exemplified by China's Belt and Road Initiative, support the deployment of smart space solutions across the region.

Key Smart Space Company Insights

Key players in the industry have strengthened their market presence through a strategic mix of product launches, expansions, mergers and acquisitions, contracts, partnerships, and collaborations. These initiatives serve as vital tools for enhancing market penetration and strengthening their competitive edge within the industry. For instance, in February 2024, Ayla Networks, Inc., a smart home platform company, partnered with Meari Technology, a manufacturer of video and camera products, to enhance its smart home platform with video solutions. This collaboration aims to integrate innovative video technology with various smart devices, offering a seamless and enriched home automation experience.

Key Smart Space Companies:

The following are the leading companies in the smart space market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Adappt Intelligence

- Cisco Systems, Inc

- Hitachi Vantara LLC

- Huawei Technologies Co., Ltd.

- ICONICS, Inc.

- Smart Spaces

- Spacewell International NV

- Siemens

- Schneider Electric

Recent Developments

-

In July 2024, Vantiva, a global connectivity technology provider, launched the Vantiva Peek, the first smart security camera with temperature sensors for self-storage unit monitoring, integrated motion, and humidity. This patent-pending device is part of Vantiva's smart storage solution suite, which includes device management software, network connectivity, and purpose-built devices to help self-storage operators modernize facilities and meet consumer demand for smart technology and automation.

-

In July 2024, LG Electronics secured 80% ownership of Athom Living, a smart home platform company, intending to acquire the remaining 20% within the next three years. This move aims to bolster LG's connectivity in open smart home ecosystems by integrating Athom Living's capabilities with LG Electronics' affectionate intelligence technology, positioning LG Electronics to lead in AI-driven home innovation.

-

In March 2024, Lenovo expanded its portfolio with the launch of two new solutions: the Lenovo ThinkSmart Tiny Kit and the ThinkPad Universal USB-C Smart Dock. These tools help businesses upgrade meeting spaces into managed video conferencing spaces and Microsoft Teams Rooms, facilitating smart collaboration for users and providing IT managers with the benefits of managed meeting environments.

Smart Space Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.69 billion

Revenue forecast in 2030

USD 31.96 billion

Growth rate

CAGR of 12.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, premises type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA; South Africa

Key companies profiled

ABB; Adappt Intelligence; Cisco Systems, Inc; Hitachi Vantara LLC; Huawei Technologies Co., Ltd.; ICONICS, Inc.; Smart Spaces; Spacewell International NV ; Siemens; Schneider Electric

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Space Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global smart space market report based on component, application, premises type, and region.

-

Smart Space Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solution

-

Services

-

-

Smart Space Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Energy Management and Optimization

-

Emergency Management

-

Security Management

-

Others

-

-

Smart Space Premises Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Commercial

-

Residential

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global smart space market size was estimated at USD 13.96 billion in 2023 and is expected to reach USD 15.69 billion in 2024.

b. The global smart space market is expected to grow at a compound annual growth rate of 12.6% from 2024 to 2030 to reach USD 31.96 billion by 2030.

b. North America dominated the market in 2023, accounting for over 37% share of the global revenue, driven by its status as a hub for technological innovation with key advancements in IoT, AI, cloud computing, and data analytics.

b. Some key players operating in the smart space market include ABB; Adappt Intelligence; Cisco Systems, Inc; Hitachi Vantara LLC; Huawei Technologies Co., Ltd.; ICONICS, Inc.; Smart Spaces; Spacewell International NV ; Siemens; Schneider Electric

b. Key factors driving the smart space market growth include increasing adoption of Internet of Things (IoT) and Artificial Intelligence (AI) and growing demand for green building initiatives and environmental concerns.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.