- Home

- »

- Clothing, Footwear & Accessories

- »

-

Smart Socks Market Size, Share And Growth Report, 2030GVR Report cover

![Smart Socks Market Size, Share & Trends Report]()

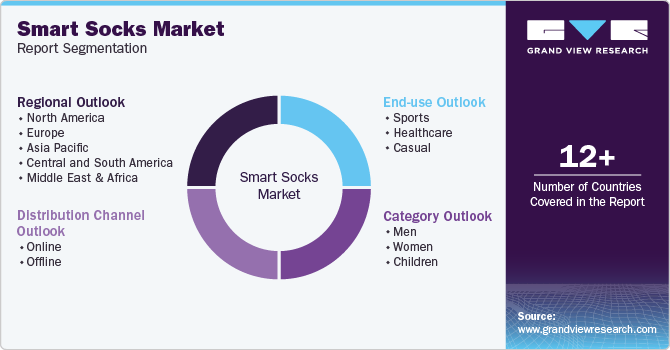

Smart Socks Market Size, Share & Trends Analysis Report By Category (Men, Women, Children), By Distribution Channel (Online, Offline), By End-use (Sports, Healthcare, Casual), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-461-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Smart Socks Market Size & Trends

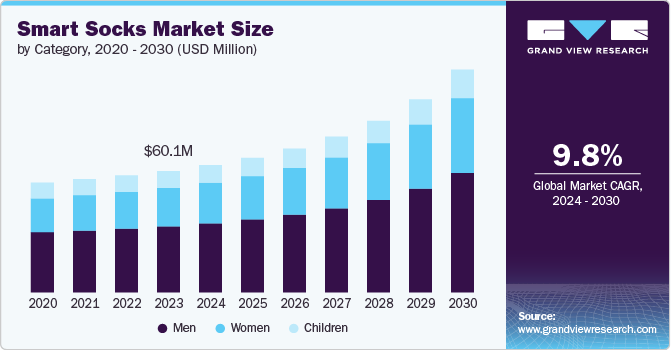

The global smart socks market size was estimated at USD 60.1 million in 2023 and is projected to grow at a CAGR of 9.8% from 2024 to 2030. The rising awareness of chronic health conditions, particularly diabetes, cardiovascular issues, and mobility impairments, is driving the market growth. Smart socks, embedded with sensors and connected to mobile apps or monitoring systems, offer real-time data on various health metrics such as foot temperature, pressure, and movement.

For individuals with diabetes, these socks can detect early signs of foot ulcers or other complications, enabling timely medical intervention and reducing the risk of severe outcomes. As healthcare providers and patients recognize the benefits of continuous, non-invasive monitoring, the demand for smart socks is expected to grow.

Additionally, the growing interest in fitness and athletic performance optimization drives the adoption of smart socks. Athletes and fitness enthusiasts increasingly use smart wearables to enhance training and prevent injuries. Smart socks can provide detailed insights into gait analysis, foot strike patterns, and overall biomechanics, helping users optimize their movements and reduce the risk of injuries such as stress fractures or plantar fasciitis. This trend is particularly strong among professional athletes and serious amateur runners, who are willing to invest in technology to achieve their performance goals.

Moreover, the expansion of the smart socks market is further driven by the increasing integration of Internet of Things (IoT) technology into consumer health products. As IoT becomes more prevalent, connecting smart socks with smartphones, smartwatches, and even home healthcare systems enhances their utility. This connectivity allows users to track their health metrics in real time, receive alerts, and share data seamlessly with healthcare providers or family members. The convenience and comprehensiveness of IoT-enabled health monitoring are particularly appealing to tech-savvy consumers who prioritize ease of use and the ability to manage their health on the go. This trend is expected to drive further adoption of smart socks, particularly in households where multiple health-monitoring devices are already in use.

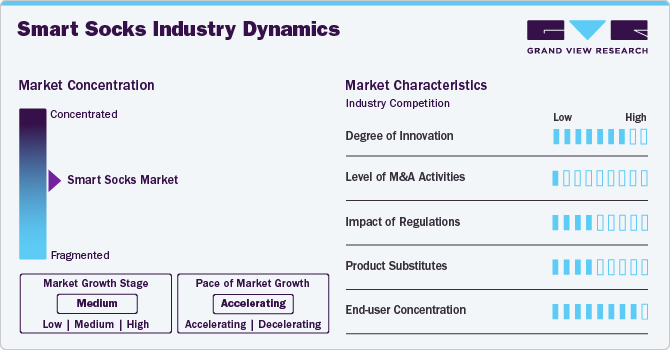

Market Concentration & Characteristics

The industry growth stage is medium, and the pace is accelerating. The smart socks industry is consolidated in nature. The push towards personalized health and wellness also supports the growth of the smart socks market. Consumers are increasingly looking for products catering to their health needs and preferences. Smart socks offer a high degree of customization, with features that can be tailored to monitor specific health metrics based on individual risk factors or fitness goals. This level of personalization enhances the user experience. It makes smart socks more attractive to consumers, from those with specific medical conditions to athletes seeking to optimize their performance. As the trend towards personalized health solutions grows, smart socks will likely see increased demand.

The players are entering into partnerships and mergers & acquisitions as the market is characterized by innovation, disruption, and rapid change. In January 2024, Sensoria, a wearable technology company, partnered with Humo.golf to launch Sensoria Socks for Golf. These innovative socks are engineered to monitor crucial metrics like weight distribution, balance, and foot pressure during a golf swing, providing golfers unparalleled insights into their technique. This collaboration represents a major leap forward in golf training technology, especially for junior and developing golfers. It also highlights a significant milestone for Humo, demonstrating its advanced technology within the sports industry.

The smart socks market is innovative in connectivity and integration with other devices and platforms. Many smart socks are designed to sync seamlessly with smartphones, smartwatches, and health monitoring systems, allowing users to track their health metrics across multiple devices. This connectivity enhances the user experience and allows for more comprehensive health monitoring, as data from the smart socks can be combined with information from other wearables or apps.

Furthermore, some smart socks are being integrated into broader smart home or telehealth ecosystems, enabling remote monitoring by healthcare providers or caregivers. This level of integration represents a significant innovation in how wearable technology can be used to support health and wellness, particularly for individuals with chronic conditions or mobility issues.

Category Insights

Men segment led the market with the largest revenue share of 54.4% in 2023 and is expected to continue to dominate the industry over the forecast period. The increasing awareness of chronic health conditions, particularly those related to foot health, such as diabetes and neuropathy, drives the adoption of smart socks. According to the U.S. Centers for Disease Control and Prevention (CDC), 24.4% of men aged 65 and older were diagnosed with diabetes in 2023. The CDC also estimates that 136 million adults in the U.S. have diabetes or prediabetes. Men are becoming more proactive in managing their health, and smart socks offer a convenient and non-invasive way to monitor important health metrics. By providing continuous monitoring and early warnings, these socks allow men to take preventive measures, reducing the risk of severe health issues and avoiding costly medical treatments.

The women segment is anticipated to witness the fastest CAGR during the forecast period. The growing awareness of foot health, particularly among women who spend long hours on their feet or wear high-heeled shoes, drives the demand for smart socks. Prolonged standing or wearing uncomfortable footwear can lead to foot pain, poor circulation, and other health issues. Smart socks that monitor foot pressure and temperature can help women identify and address these problems before they become more serious. This focus on foot health, combined with the convenience of wearable technology, is fueling the growth of the women’s segment in the smart socks market.

Distribution Channel Insights

The online distribution channel segment led the market with the largest revenue share in 2023. The rapid expansion of e-commerce infrastructure makes it easier for companies to reach a global audience. With the proliferation of online marketplaces, direct-to-consumer websites, and improved logistics, smart sock manufacturers offer their products to customers across different regions without the limitations of physical retail. The global reach of e-commerce platforms also means that consumers in regions where smart socks may not be widely available in stores can still access these products online, contributing to the market's growth.

The offline segment is expected to witness the fastest CAGR during the forecast period. The offline segment is also driven by the strategic placement of smart socks in specialty stores, such as athletic apparel shops, health and wellness stores, and medical supply outlets. The presence of smart socks in these stores allows for targeted marketing and the opportunity to educate potential customers about the benefits and features of the product in a context that aligns with their interests and needs. Additionally, stores that focus on health or sports-related products often have a reputation for quality, which can lend credibility to new and innovative products such as smart socks.

End-use Insights

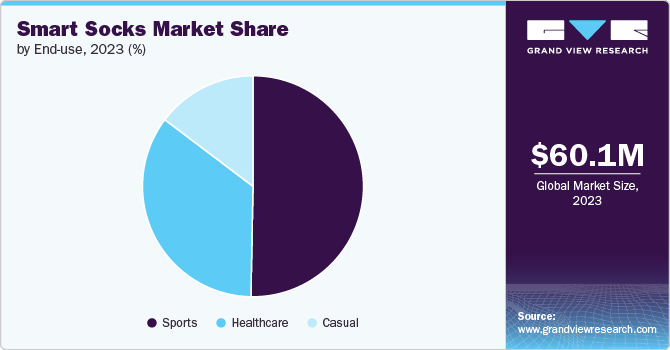

The sports segment held the largest revenue share in 2023. Integrating smart socks with other wearable technology and fitness apps also drives growth in the sports segment. Athletes increasingly rely on digital tools to monitor their performance, track progress, and set goals. Smart socks that can seamlessly connect with smartphones, smartwatches, and fitness apps offer a holistic approach to data collection and analysis. This connectivity allows athletes to view comprehensive data on their performance, including metrics from other devices, all in one place. The ability to sync smart socks with other technology enhances the user experience, making it easier for athletes to track their progress over time and make data-driven decisions about their training. Integrating smart socks into the broader sports technology ecosystem is a significant driver of market growth.

The healthcare segment is expected to witness the fastest CAGR during the forecast period. The rising prevalence of chronic diseases, such as diabetes and peripheral artery disease (PAD), is driving the market growth. Smart socks are increasingly used to manage these conditions by providing continuous data on foot health and circulation. For patients with diabetes, maintaining proper foot health is crucial, as poor circulation and nerve damage can lead to severe complications, including amputations. Smart socks can alert users to changes in foot temperature or pressure that may indicate the early stages of ulcers or other issues, allowing for timely intervention.

Regional Insights

North America dominated the market with a revenue share of 37.3% in 2023 and is projected to grow over the forecast period. The robust healthcare infrastructure in North America facilitates the adoption of smart socks in medical and clinical settings. Hospitals, clinics, and rehabilitation centers are increasingly incorporating wearable technology into patient care to improve outcomes and enhance the monitoring of chronic conditions. Smart socks are used in these settings to provide real-time patient health data, aiding in the diagnosis, treatment, and recovery processes. The integration of smart socks into healthcare practices is supported by the region’s robust regulatory framework, which ensures that these devices meet high safety and efficacy standards.

U.S. Smart Socks Market Trends

U.S. accounted for a market share of 19.5% in global smart socks market in 2023. The U.S. has a robust sports and fitness culture, contributing to the demand for smart socks among athletes and fitness enthusiasts. The increasing popularity of fitness tracking and performance optimization tools has led to a growing market for smart socks that can monitor foot mechanics, detect signs of fatigue or injury, and provide data to enhance training routines. Integrating smart socks with fitness apps and wearables like smartwatches gives users a comprehensive view of their physical performance, helping them achieve their fitness goals more effectively.

Asia Pacific Smart Socks Market Trends

Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. Government initiatives and policies aim to improve healthcare infrastructure and promote the adoption of health technologies. Many governments in the Asia Pacific are investing in digital health initiatives to improve public health outcomes and reduce the burden on healthcare systems. These initiatives create a supportive environment for adopting smart socks, particularly in managing conditions such as diabetes and cardiovascular diseases, which require continuous monitoring.

Smart socks market in China dominated the global market in 2023. The influence of e-commerce in China drives the smart socks market. China boasts one of the most advanced and widespread e-commerce ecosystems in the world, with platforms such as Alibaba, JD.com, and Pinduoduo facilitating the easy purchase of a wide range of products, including wearable health devices. E-commerce platforms also enable companies to reach a broader audience, including consumers in smaller cities and rural areas, who may need access to physical retail stores but are increasingly interested in digital health solutions. The rise of e-commerce in China is thus playing a crucial role in expanding the market for smart socks.

Japan smart socks market is anticipated to grow at the fastest CAGR during the forecast period. With a rapidly increasing proportion of elderly citizens, there is a growing need for products that Japan offers elderly care and help maintain their independence. Smart socks, designed to monitor vital health metrics such as foot pressure, temperature, and gait, are particularly valuable in preventing common age-related health issues such as falls and pressure ulcers. These socks can alert caregivers or family members in real-time if abnormalities are detected, providing peace of mind and ensuring that elderly country duals receive timely care.

Europe Smart Socks Market Trends

Europe market is anticipated to grow at the fastest CAGR during the forecast period. The rise of European sports and fitness culture contributes to the demand for smart socks. As more Europeans engage in physical activities such as running, cycling, and fitness training, there is a growing interest in wearable devices that can enhance performance and prevent injuries. Smart socks, which can monitor biomechanics, detect fatigue, and provide insights into foot mechanics, are becoming popular among athletes and fitness enthusiasts. These devices help users optimize their training routines by providing real-time data on their physical performance, allowing them to make adjustments and avoid injuries.

The UK smart socks market dominated the market in 2023. The growing trend of remote patient monitoring also drives the smart socks market in the UK. The need to minimize in-person visits to healthcare facilities has led to a surge in adopting remote health monitoring technologies, including smart socks. These devices enable continuous tracking of vital signs and other health metrics from the comfort of the patient’s home, reducing the need for frequent hospital visits. This is especially beneficial for patients with chronic conditions who require regular monitoring. The increasing integration of smart socks into telemedicine practices and home healthcare services is expected to drive further adoption in the UK market.

Smart socks market in Spain is anticipated to grow at the fastest CAGR during the forecast period. The impact of sports sponsorships and events in Spain is significant in promoting smart socks. Major sports events such as La Liga football matches and international competitions often showcase advanced technologies. Companies involved in these events increasingly incorporate smart socks into their sponsorship and marketing strategies. This exposure helps raise awareness about smart socks among athletes and sports enthusiasts, driving consumer interest and adoption. The visibility of smart socks at high-profile sports events further accelerates their acceptance in the market.

Key Smart Socks Company Insights

Some of the key players operating in the smart socks market include Sensoria, Inc., Milbotix Ltd, and Danu Sports Ltd.

-

Sensoria, Inc. is a wearable technology company that develops advanced smart textile solutions that enhance health and performance through integrated technology. The company's flagship product is its smart socks, which leverage cutting-edge sensor technology to give users detailed insights into their physical activity and health metrics.

Sensoria's smart socks have embedded sensors that track parameters such as foot pressure, gait, and alignment. These sensors are connected to a mobile app that provides real-time feedback and data analysis. This technology is particularly beneficial for athletes, who can use the information to optimize their training, improve performance, and prevent injuries.

-

Milbotix Ltd is a company specializing in wearable technology. Milbotix's smart socks are designed with embedded sensors that provide comprehensive health tracking and monitoring. These sensors collect data on various health metrics, including foot pressure, gait patterns, and temperature variations. The data is then transmitted to a mobile app or digital platform, where users can access real-time insights and detailed analyses. This technology is especially useful for individuals managing chronic conditions, such as diabetes, where foot health is critical. Milbotix's smart socks help users prevent complications and maintain better overall foot health by continuously monitoring foot pressure and detecting changes that could indicate potential issues.

-

Danu Sports Ltd. is a dynamic company that develops and commercializes innovative sports and fitness technologies. Danu Sports Ltd. offers a range of smart sports products, which include advanced wearables and sensors designed to track and analyze various aspects of physical activity. Their product lineup features smart socks, smart apparel, and other wearable devices that collect real-time metrics such as movement, gait, and performance. This technology is geared towards athletes who require detailed insights into their training, as well as fitness enthusiasts who seek to monitor and improve their physical activities.

Key Smart Socks Companies:

The following are the leading companies in the smart socks market. These companies collectively hold the largest market share and dictate industry trends.

- Sensoria, Inc.

- Milbotix Ltd

- Danu Sports Ltd.

- Siren

- Bionox Group Spain S.L.

- Sidas / Therm-ic

- Vulpés

- QUANTA VICI

- iHood

- Simcos Technology co,.Ltd.

Recent Developments

-

In March 2023, Danu Sports Ltd., a company specializing in wearable sports analytics technology, secured USD 3.7 million in Series A funding. This investment helped the company commercialize its wearable technology products. Initially, the company targeted clinicians and strength and conditioning coaches for professional sports teams in soccer, rugby, basketball, and American football, with plans to expand to broader consumer sports applications.

Smart Socks Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 63.0 million

Revenue forecast in 2030

USD 110.3 million

Growth rate

CAGR of 9.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, distribution channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; UAE; Saudi Arabia; and South Africa

Key companies profiled

Sensoria, Inc.; Milbotix Ltd; Danu Sports Ltd.; Siren; Bionox Group Spain S.L.; Sidas / Therm-ic; Vulpés; QUANTA VICI; iHood; Simcos Technology co,.Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Smart Socks Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the smart socks market research report based on the category, distribution channel, end use, and region:

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Children

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports

-

Healthcare

-

Casual

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart socks market size was estimated at USD 60.1 million in 2023 and is expected to reach USD 63.0 million in 2024

b. The global smart socks market is expected to grow at a compound annual growth rate of 9.8% from 2023 to 2030 to reach USD 110.3 million by 2030

b. North America dominated the market with a revenue share of 37.3% in 2023 and is projected to grow over the forecast period. The robust healthcare infrastructure in North America is facilitating the adoption of smart socks in medical and clinical settings.

b. Some key players operating in the smart socks market include Sensoria, Inc., Milbotix Ltd, Danu Sports Ltd., Siren, Bionox Group Spain S.L., Sidas / Therm-ic, Vulpés, QUANTA VICI, iHood, Simcos Technology co,.Ltd.

b. The rising prevalence of chronic conditions and integration of socks with mobile apps is driving demand for smart socks market growth

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."