Smart Sensors Market Size, Share & Trends Analysis Report By End Use (Industrial, Commercial), By Technology, By Component (Analog To Digital Converter, Digital To Analog Converter), By Type, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-377-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Smart Sensors Market Size & Trends

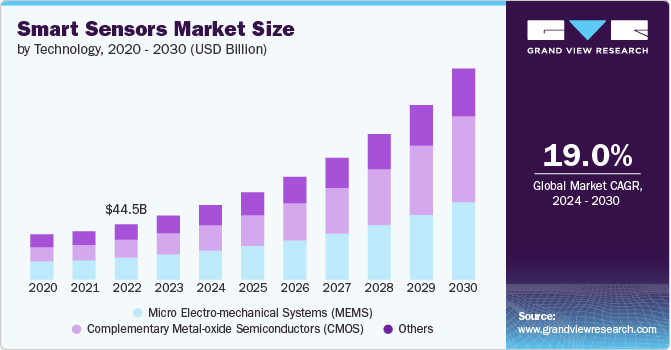

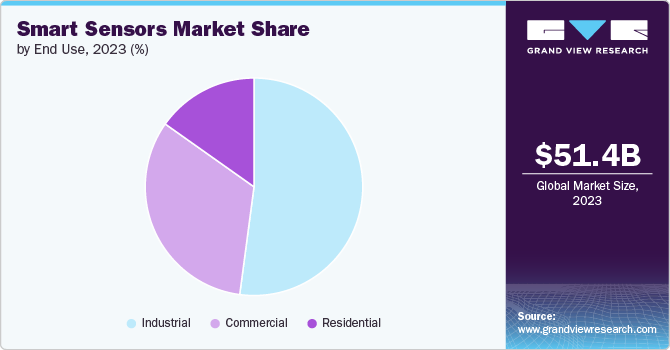

The global smart sensors market size was valued at USD 51.42 billion in 2023 and is expected to grow at a CAGR of 19.0% from 2024 to 2030. The proliferation of connected devices, which rely heavily on smart sensors for data collection and transmission is driving the demand for smart sensors. Additionally, advancements in miniaturization and sensor technology have made it possible to integrate smart sensors into a wide array of products, which is further driving the market expansion. Moreover, the rising emphasis on energy efficiency and environmental monitoring is boosting the adoption of smart sensors, which is expected to fuel the market growth in the coming years.

Furthermore, the increasing use of automation in manufacturing processes has led to a growing demand for sensors that can monitor and control equipment, track inventory, and optimize production processes. Smart sensors are being used to monitor temperature, pressure, flow rate, and other parameters in industrial settings, enabling real-time monitoring and control. This has led to improved efficiency, reduced downtime, and increased productivity, which is further driving the market growth.

The growing use of machine learning (ML) and artificial intelligence (AI) is one of the major trends in the smart sensors market. ML algorithms can analyze data from smart sensors to predict equipment failures, optimize processes, and improve overall efficiency. AI-powered sensors can analyze data from multiple sources to identify patterns and make decisions in real-time. This has led to increased adoption of smart sensors in industries such as manufacturing, healthcare, and logistics.

Furthermore, rapid technological advancements and the deployment of smart sensors in various electronic devices are driving the market expansion. These advancements are particularly notable in automation, robotics, and Internet of Things (IoT) applications where smart sensors are essential for measuring parameters and transmitting data for processing. The integration of multiple smart sensors creates advanced systems with diverse benefits across industries. This trend is expected to further fuel the market growth.

Companies are focusing on innovation and technological advancements to develop cutting-edge smart sensor solutions that cater to evolving consumer needs. Additionally, strategic partnerships and collaborations with other industry players or research institutions are being leveraged to drive product development and expand market reach. Moreover, investments in research and development activities to create more efficient and cost-effective smart sensor technologies are a priority for these companies. Such strategies by key players are expected to boost the market growth in the coming years.

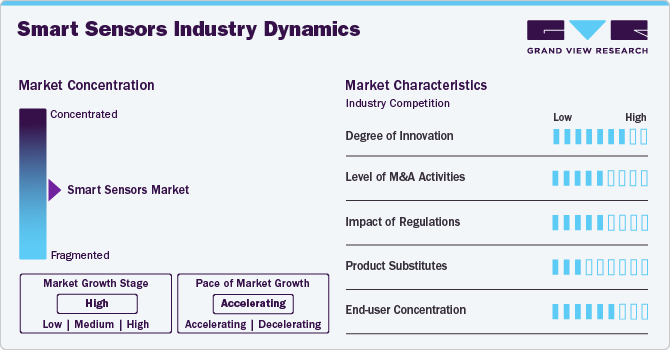

Industry Concentration & Characteristics

The market is characterized by a high degree of innovation, driven by advancements in technology, such as the Internet of Things (IoT) and artificial intelligence. These innovations have led to the development of more sophisticated and efficient smart sensor solutions that cater to a wide range of industries including automotive, consumer goods, healthcare and many more. Furthermore, the adoption of Industry 4.0 principles is driving the adoption of smart sensors for predictive maintenance, improving operational efficiency and reducing downtime in industrial settings, which is further driving innovation in the market.

The level of merger & acquisition activities in the market is moderate. Companies operating in this sector are engaging in M&A activities to expand their offerings, acquire new technologies, and strengthen their competitive positions. There is an increasing number of start-ups and smaller players entering the market with new smart sensor technologies and solutions. This has led to a moderate level of merger and acquisition (M&A) activities as larger players seek to acquire innovative technologies and expand their market presence.

The impact of regulations on the market is expected to be moderate. Regulations play a significant role in shaping the smart sensors market by setting standards for quality, performance, safety, and data privacy. Compliance with regulatory requirements is essential for manufacturers to ensure that their products meet industry standards and address concerns related to data security and privacy.

The competition from product substitutes in the market is expected to be moderate. While some general-purpose sensors may have alternatives from different manufacturers, smart sensors have few direct substitutes due to their specific functionalities and stringent performance requirements.

The end-user concentration in the smart sensors market is high. Smart sensors have seen widespread adoption across various industries due to their versatility and efficiency in data collection and analysis. Industries such as automotive, defense, sports, electronics, smart grids, smart cities, and environmental monitoring have all integrated smart sensors into their operations.

Sensors Type Insights

The image segment accounted for the largest market share of 22% in 2023. Continuous advancements in image sensor technology have led to improved performance, higher resolutions, better sensitivity to light, and lower power consumption. These technological enhancements have made image sensors more versatile and applicable across a wide range of industries. Furthermore, image sensors find applications in various industries such as automotive, consumer electronics, healthcare, industrial automation, and security & surveillance. The versatility of image sensors makes them indispensable in numerous use cases, driving segmental growth.

The touch segment is expected to witness a significant CAGR of 20% from 2024 to 2030. With the increasing focus on user experience and interface design, there is a growing demand for interactive displays that offer touch functionality. This trend is driving the deployment of touch sensors in various applications such as kiosks, digital signage, ATMs, and gaming consoles. Furthermore, the diversification of applications is driving the demand for advanced touch sensor solutions.

Technology Insights

The micro electro-mechanical systems (MEMS) segment registered the largest revenue share in 2023. MEMS-based sensors are significantly smaller than their traditional counterparts, allowing for their integration into compact devices such as smartphones, wearables, and IoT devices. This miniaturization factor has contributed to the widespread adoption of MEMS sensors in various consumer electronics products. Furthermore, the increasing demand for smart devices and IoT solutions has driven the growth of the smart sensors market, with MEMS-based sensors being at the forefront due to their advanced capabilities and compatibility with modern technologies.

The complementary metal-oxide semiconductors (CMOS) segment is anticipated to witness the fastest growth from 2024 to 2030. CMOS-based smart sensors consume less power compared to traditional sensor technologies. This energy efficiency is crucial for battery-powered devices and IoT applications that require prolonged operational lifetimes without frequent recharging or battery replacement. Furthermore, ongoing advancements in CMOS technology continue to improve sensor performance parameters such as sensitivity, accuracy, response time, and signal processing capabilities. These technological enhancements are expected to drive the adoption of CMOS-based smart sensors in diverse applications.

Component Insights

The microcontrollers segment registered the largest share in 2023. Microcontrollers are becoming increasingly integrated into sensor devices, leading to compact designs and enhanced functionality. This trend aligns with the growing demand for smaller, more efficient smart sensor solutions. Microcontrollers provide a high level of customization and flexibility, allowing developers to tailor their functionalities to specific application requirements. This adaptability is crucial in the dynamic landscape of smart sensors, where diverse use cases demand tailored solutions.

The transceivers segment is anticipated to record the fastest growth from 2024 to 2030. The continuous advancements in wireless communication technologies such as Bluetooth Low Energy (BLE), Zigbee, Wi-Fi, and LoRa are driving the need for more sophisticated transceivers in smart sensor applications. Furthermore, the trend towards miniaturization and integration of components is leading to the development of compact smart sensor solutions that require highly integrated transceivers for efficient communication.

End Use Insights

The industrial segment in the market registered the largest share in 2023. This growth can be attributed to the increasing adoption of IoT devices, automation technologies, and the demand for real-time data monitoring and analysis across various industries. Furthermore, industries such as manufacturing, oil & gas, automotive, and utilities require real-time monitoring of critical parameters to ensure smooth operations and prevent downtime, smart sensors enable continuous data collection and analysis, allowing companies to make informed decisions promptly, thereby driving the segmental growth.

The commercial segment is anticipated to record the significant growth from 2024 to 2030. The Internet of Things (IoT) has been rapidly expanding across various industries, including commercial applications, which is driving the segmental growth. Furthermore, smart sensors are integral components of Industry 4.0 initiatives as they enable automation, data exchange, and improved operational efficiency. In the commercial sector, businesses are leveraging smart sensors to optimize production processes, monitor equipment performance, and ensure regulatory compliance.

Regional Insights

North America smart sensors market accounted for the highest revenue share of over 34% in 2023. This dominance is driven by the growing adoption of Industry 4.0 and IoT technologies, the presence of key smart sensor manufacturers such as Analog Devices, Honeywell International, Inc., and the rising demand from the automotive and consumer electronics industries.

U.S. Smart Sensors Market Trends

The smart sensors market in the U.S. is projected to grow at a CAGR of over 18% from 2024 to 2030. The supportive government initiatives promoting the adoption of Industry 4.0 and smart city technologies is driving the market growth in the U.S.

Europe Smart Sensors Market Trends

The smart sensors market in Europe is anticipated to grow at a CAGR of over 19% from 2024 to 2030. This growth is driven by various factors such as the increasing adoption of Internet of Things (IoT) technology, advancements in sensor technologies, rising demand for automation and smart devices, and the push towards digital transformation across industries.

The U.K. smart sensors market is anticipated to grow at a CAGR from 2024 to 2030. In the U.K., there is a growing focus on developing advanced sensor technologies and a shift towards wireless solutions, which is driving the market growth in U.K.

Germany smart sensors market is expected to grow at a CAGR from 2024 to 2030. There is a growing demand for smart sensors in industrial automation, automotive applications, and healthcare sector, which is driving the demand for smart sensors in the country.

The smart sensors market in France is projected to grow at a CAGR from 2024 to 2030. The trend towards integrating AI and machine learning capabilities into sensor systems is notable in France, enhancing data processing efficiency and enabling predictive maintenance strategies.

Asia-Pacific Smart Sensors Market Trends

The smart sensors market in Asia Pacific is expected to grow at the fastest CAGR of over 20% from 2024 to 2030. The proliferation of consumer electronics such as wearables, smart home devices, smartphones and other products is driving the demand for advanced sensor technologies in the Asia Pacific market.

China smart sensors market is projected to grow at a CAGR from 2024 to 2030. The Chinese government’s initiatives to promote smart cities and sustainable development are creating opportunities for smart sensor applications in areas such as environmental monitoring, energy management, and transportation.

The smart sensors market in Japan is expected to grow at a CAGR from 2024 to 2030. Japanese companies are investing heavily in research and development of innovative sensor technologies for diverse applications. The automotive industry in Japan is a key driver of smart sensor adoption, particularly in areas such as autonomous vehicles and driver assistance systems.

India smart sensors market is expected to grow at a CAGR from 2024 to 2030. Smart sensor technologies are being deployed in sectors such as agriculture, healthcare, manufacturing, and smart cities to improve efficiency and productivity, which is boosting the demand for smart sensors in India.

Middle East and Africa Smart Sensors Market Trends

The smart sensors market in the Middle East and Africa is expected to grow at a CAGR of 14% from 2024 to 2030. Industries in the Middle East and Africa are increasingly investing in automation solutions to improve productivity, reduce operational costs, and enhance overall efficiency. Smart sensors are essential components of these automation systems, driving their demand in the region.

Saudi Arabia smart sensors market is anticipated to grow at a CAGR from 2024 to 2030. The growing consumer preferences for convenience, security needs, energy efficiency goals, technological advancements, and government initiatives promoting innovation and sustainability are driving the market expansion in the country.

Key Smart Sensors Company Insights

Some of the key players operating in the global smart sensors market include Honeywell International, Inc., Siemens AG among others.

-

Honeywell International, Inc. is a multinational conglomerate that operates in various industries, including aerospace, building technologies, performance materials, and safety and productivity solutions. The company is known for its innovative technologies and solutions that cater to a wide range of applications, from industrial automation to smart home devices and offers a diverse portfolio of sensor products that are used in industrial automation, HVAC systems, transportation, and more. These sensors play a crucial role in collecting data and enabling automation and control systems to operate efficiently.

-

Siemens AG is a German multinational conglomerate that operates in various sectors such as energy, healthcare, industry, and infrastructure. The company offers a comprehensive range of sensor solutions that are integrated into its automation systems and IoT platforms. These sensors are designed to provide accurate data collection for monitoring and controlling various processes across industries like manufacturing, energy management, and smart buildings.

Analog Devices, Inc. and Omron Corporation are some of the emerging market participants in the smart sensors market.

-

Analog Devices, Inc. is a global semiconductor company specializing in the design and manufacturing of analog, mixed-signal, and digital signal processing integrated circuits. The company’s offerings cater to various applications such as the Internet of Things (IoT), autonomous vehicles, industrial automation, and healthcare. The company’s smart sensor products include accelerometers, gyroscopes, temperature sensors, pressure sensors, and environmental sensors.

-

Omron Corporation is a Japanese multinational electronics company that specializes in industrial automation and healthcare products. The company offers a wide range of sensor products designed for applications such as factory automation, automotive systems, energy management, and healthcare monitoring. The company’s smart sensor solutions leverage cutting-edge technologies such as artificial intelligence (AI), machine learning algorithms, and internet connectivity to enable real-time data collection and analysis for improved decision-making.

Key Smart Sensors Companies:

The following are the leading companies in the smart sensors market. These companies collectively hold the largest market share and dictate industry trends.

- Analog Devices, Inc.

- Honeywell International Inc.

- Siemens AG

- Omron Corporation

- Sensirion AG

- Robert Bosch GmbH

- NXP Semiconductors

- STMicroelectronics

- Infineon Technologies AG

- General Electric

Recent Developments

-

In January 2024, Robert Bosch GmbH. unveiled a cutting-edge smart connected sensors platform for full-body motion tracking. This platform integrates various sensors to provide accurate and detailed motion tracking capabilities for a wide range of applications.

-

In March 2023, Siemens AG launched the Connect Box, a smart IoT solution designed to manage smaller buildings. This innovative solution aims to provide building owners and operators with a comprehensive tool to monitor and control various building systems efficiently.

-

In March 2023, Envision Energy collaborated with Analog Devices Inc. to utilize MEMS sensor technology. This partnership aims to enhance Envision Energy’s wind turbine solutions by integrating Analog Devices’ advanced sensor technology into their systems. By leveraging MEMS sensors, Envision Energy can improve the performance, efficiency, and reliability of their wind turbines.

Smart Sensors Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 59.83 billion |

|

Revenue forecast in 2030 |

USD 169.80 billion |

|

Growth Rate |

CAGR of 19.0% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report Deployment |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Sensors type,technology, component, end use, regional |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; Mexico; Chile; Argentina; South Africa; Saudi Arabia; U.A.E. |

|

Key companies profiled |

Analog Devices, Inc.; Honeywell International Inc., Siemens AG; Omron Corporation; Sensirion AG; Robert Bosch GmbH; NXP Semiconductors; STMicroelectronics; Infineon Technologies AG; General Electric (GE) |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Smart Sensors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart sensors market report based on sensors type, technology, component, end use and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Touch

-

Flow

-

Image

-

Temperature & Humidity

-

Motion

-

Pressure

-

Light

-

Position

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Micro electro-mechanical systems (MEMS)

-

Complementary metal-oxide semiconductors (CMOS)

-

Others

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Analog to Digital Converters (ADC)

-

Digital to Analog Converters (DAC)

-

Transceivers

-

Amplifiers

-

Microcontrollers

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Aerospace & Defense

-

Consumer Electronics

-

Healthcare

-

Transportation & Logistics

-

Automotive

-

Energy & Utilities

-

Renewables

-

Manufacturing

-

Others

-

-

Commercial

-

Retail

-

Hospitality

-

Others

-

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Chile

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global smart sensors market size was estimated at USD 51.42 billion in 2023 and is expected to reach USD 59.83 billion in 2024.

b. The global smart sensors market is expected to grow at a compound annual growth rate of 19.0% from 2024 to 2030 to reach USD 169.80 billion by 2030.

b. North America dominated the smart sensors market with a share of around 34% in 2023. . This dominance is driven by the growing adoption of Industry 4.0 and IoT technologies, the presence of key smart sensor manufacturers such as Analog Devices, Honeywell International, Inc., and the rising demand from the automotive and consumer electronics industries.

b. Some key players operating in the smart sensors market include Analog Devices, Inc., Honeywell International Inc., Siemens AG, Omron Corporation, Sensirion AG, Robert Bosch GmbH, NXP Semiconductors, STMicroelectronics, Infineon Technologies AG, General Electric

b. Key factors that are driving the smart sensors market growth include the proliferation of connected devices, advancements in miniaturization and sensor technology, the rising emphasis on energy efficiency and environmental monitoring.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."