- Home

- »

- Electronic & Electrical

- »

-

Smart Rings Market Size And Share, Industry Report, 2030GVR Report cover

![Smart Rings Market Size, Share & Trends Report]()

Smart Rings Market Size, Share & Trends Analysis Report By Technology (Bluetooth-enabled Smart Rings, NFC-enabled Smart Rings), By Application, By Distribution, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-490-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Smart Rings Market Size & Trends

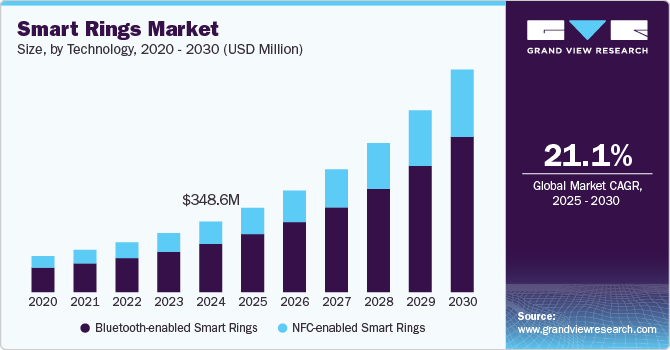

The global smart rings market size was estimated at USD 348.56 million in 2024 and is projected to grow at a CAGR of 21.1% from 2025 to 2030. One of the primary drivers of the market is the growing adoption of smartphones globally. As smartphones become ubiquitous, they facilitate the integration of smart rings with other devices, enhancing their functionality. The tech-savvy population, particularly among younger demographics, is increasingly inclined towards wearable technology that offers convenience and connectivity. This trend fosters a favorable environment for adopting smart rings as they provide seamless access to notifications and applications directly from the user's finger.

The evolution of microelectronics and sensor technology has significantly contributed to the market growth. Innovations in miniaturization enable manufacturers to incorporate advanced features into these compact devices without compromising performance or comfort. This technological progress allows smart rings to offer functionalities such as health monitoring, contactless payments, and data transfer, making them attractive to many consumers. Furthermore, advancements in artificial intelligence are enhancing user experiences by enabling personalized interactions with these devices.

There is a notable shift towards health consciousness among consumers, driving demand for wearable devices that facilitate health tracking. Smart rings are increasingly being recognized for their ability to monitor vital health metrics such as heart rate, sleep patterns, and physical activity levels.

This growing awareness of personal health management aligns with the rising popularity of fitness tracking technologies, making smart rings an appealing choice for health-conscious individuals. The convenience of continuous health monitoring offered by these devices supports the trend toward preventive healthcare. The trend towards contactless payment systems has emerged as a significant market driver for smart rings. As consumers seek more convenient and secure payment methods, smart rings equipped with Near Field Communication (NFC) technology are gaining traction. This functionality not only simplifies transactions but also aligns with the increasing demand for contactless solutions in various retail environments. The integration of payment capabilities into smart rings positions them as versatile tools that enhance everyday transaction.

The fusion of technology with fashion is another critical factor propelling the market growth. Manufacturers are increasingly focusing on creating stylish designs that appeal to consumers looking for fashionable yet functional accessories. This emphasis on aesthetics allows smart rings to attract a broader audience beyond traditional tech enthusiasts, positioning them as trendy wearable devices suitable for various occasions. The growing acceptance of wearable technology as fashion statements further fuels market growth.

One of the most significant challenges for the smart rings industry is the technological limitations imposed by their compact size. Smart rings must balance advanced functionalities-such as health monitoring, NFC payments, and notifications-within a small form factor. This constraint often compromises battery life and processing power, as the limited space restricts the inclusion of robust hardware like larger batteries and sensors. Consequently, users may experience frequent charging needs, which can negatively impact satisfaction and usability. Moreover, ensuring accurate functionality across diverse features can be difficult, potentially limiting the overall appeal of smart rings.

Despite advancements in technology, market acceptance remains a hurdle for smart rings. Many consumers still need to become more familiar with the capabilities and benefits of smart rings compared to more established wearables like smartwatches or fitness trackers. This lack of awareness can hinder adoption rates as potential users may need to understand how smart rings can enhance their daily lives fully. In addition, fashion preferences play a crucial role; if the design does not align with consumer aesthetics or lacks customization options, it may deter users who seek both functionality and style.

Technology Insights

Based on technology, the Bluetooth-enabled segment led the market with the largest revenue share of 68.51% in 2024. Bluetooth technology facilitates seamless integration with various devices, including smartphones, tablets, and smart home systems. This capability allows users to receive notifications for calls, messages, and social media alerts directly on their rings, enhancing user experience by keeping them connected without the need to check their phones frequently. Furthermore, Bluetooth's ability to maintain stable connections over longer distances compared to NFC makes it more practical for everyday use, as users can interact with their devices from a greater range, thereby increasing the functionality and appeal of Bluetooth-enabled smart rings.

In addition to connectivity advantages, Bluetooth-enabled smart rings offer enhanced functionalities that cater to diverse consumer needs. These rings can serve as remote controls for various smart devices, allowing users to adjust settings for music playback, control lighting, or even take photos with their smartphones. The integration of health monitoring features-such as heart rate tracking activity levels-also benefits from Bluetooth's data exchange capabilities, enabling real-time updates and insights when paired with smartphone health apps. As Bluetooth technology continues to evolve, incorporating advancements like low energy consumption and improved data transfer rates, the potential for Bluetooth-enabled smart rings to deliver sophisticated features will likely outpace that of NFC-enabled rings, solidifying their position in the wearable technology market.

The NFC-enabled smart rings segment is anticipated to grow at the fastest CAGR during the forecast period. It gaining momentum in the wearable technology market primarily due to its convenience and security in contactless payments. As consumers increasingly seek efficient and hygienic payment methods, NFC technology allows users to make transactions simply by tapping their rings against compatible payment terminals. This functionality aligns with the growing trend towards contactless payments, accelerated by the COVID-19 pandemic, which has heightened awareness and demand for touchless solutions. The ease of use associated with NFC-enabled smart rings, which can function without needing a smartphone or additional apps, makes them an appealing choice for consumers looking for a seamless payment experience.

Another significant driver for NFC-enabled smart rings is their versatility beyond payments, which enhances their appeal across various applications. NFC technology is not limited to financial transactions; it can also facilitate access control, data sharing, and interaction with other NFC-enabled devices. For instance, users can unlock doors, share contact information, or connect with smart devices effortlessly. This multi-functionality broadens the market for NFC-enabled smart rings, attracting consumers interested in a comprehensive wearable solution that integrates into their daily lives.

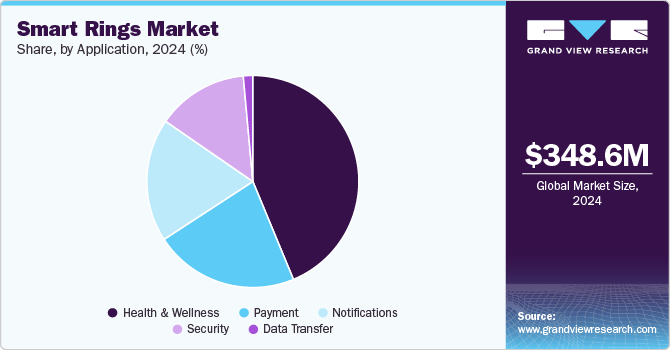

Application Insights

Based on application, the health & wellness segment led the market with the largest revenue share of 43.73% in 2024. The primary driver for smart rings in the health and wellness application sector is the increasing consumer focus on personal health management and fitness tracking. Smart rings are equipped with advanced sensors that allow for continuous monitoring of vital health metrics such as heart rate, sleep patterns, and physical activity levels. This capability appeals to health-conscious individuals who seek non-intrusive ways to track their well-being throughout the day. The discreet nature of smart rings makes them an attractive alternative to bulkier wearables like smartwatches, allowing users to monitor their health without compromising on style or comfort. As awareness of preventive healthcare grows, consumers are increasingly looking for devices that provide real-time insights into their health, further driving the demand for smart rings in this application.

Another significant factor contributing to the popularity of smart rings in health and wellness is their integration with mobile applications and IoT technologies. Many smart rings come with companion apps that analyze collected data, offering personalized recommendations based on users' activity and sleep patterns. This functionality not only enhances user engagement but also empowers individuals to make informed lifestyle choices to improve their overall health. In addition, advancements in technology have led to the development of features such as stress level monitoring and body temperature tracking, making smart rings versatile tools for holistic health management. As telemedicine and remote patient monitoring become more prevalent, smart rings are positioned as valuable assets for both consumers and healthcare providers, facilitating continuous health tracking and timely interventions when necessary.

The payment segment is expected to grow at a robust CAGR of 21.8% from 2024 to 2030. The primary driver for smart rings in contactless payments is the growing consumer demand for convenience and efficiency in financial transactions. As consumers increasingly seek quick and hygienic payment methods, NFC-enabled smart rings provide a seamless solution by allowing users to make purchases with a simple tap at compatible payment terminals. This functionality aligns with the broader trend of contactless payments, which has gained traction due to the COVID-19 pandemic, prompting many individuals to prefer touchless solutions over traditional cash or card payments. The compact design of smart rings makes them an attractive alternative to bulky wallets or smartphones, offering a discreet and stylish way to manage transactions.

The security features associated with NFC technology significantly enhance the appeal of smart rings for contactless payments. Many smart rings incorporate advanced cryptographic measures to protect sensitive data during transactions, ensuring user information remains secure. This focus on security is crucial in building consumer trust as concerns about data breaches and fraud continue to rise. Furthermore, the ability to program NFC smart rings for multiple functions-such as unlocking devices or sharing information-adds versatility, making them more than just payment tools. As technology continues to advance and consumer preferences evolve, the integration of NFC capabilities in smart rings is expected to drive substantial growth in this application area, solidifying their role as essential accessories in modern financial interactions.

Distribution Insights

Based on distribution channel, the online segment led the market with the largest revenue share of 37.12% in 2024. The online sales of smart rings are driven by several key factors that enhance consumer engagement and purchasing convenience. One of the most significant drivers is the expansive reach and accessibility provided by e-commerce platforms. Online retail allows consumers from various geographical locations to explore a wide range of smart ring options without the limitations of physical store inventories. This convenience enables consumers to browse, compare features, and make informed decisions from the comfort of their homes. In addition, online platforms often offer competitive pricing and promotional discounts, further incentivizing purchases and attracting a broader audience.

Another crucial factor influencing online sales is the targeted marketing and promotional strategies employed by retailers. Digital marketing techniques, including social media advertising, influencer partnerships, and tailored promotions, effectively capture the attention of tech-savvy consumers interested in wearable technology. These strategies not only raise awareness about smart rings but also highlight their functionalities, such as health monitoring and contactless payments, appealing to the growing consumer interest in health and wellness. Moreover, the ability to read reviews and access customer support online enhances the overall shopping experience, fostering trust and encouraging more consumers to opt for online purchases of smart rings. As consumer behavior continues to shift towards digital shopping, these drivers are expected to boost online sales in the smart rings industry significantly.

Regional Insights

The smart rings market in North America is anticipated to grow at the fastest CAGR during the forecast period. The dominance is driven by a high adoption rate of advanced wearable technologies, a tech-savvy population, and robust infrastructure that supports Internet of Things (IoT) devices. The presence of leading market players and continuous innovation in health monitoring features further propel growth in this region, making it a key player in the North America market landscape.

U.S. Smart Rings Market Trends

The smart rings market in the U.S. accounted for the largest market share in North America in 2024. The U.S. market growth is due to its robust consumer electronics industry, increasing health consciousness among consumers, and the integration of smart rings with health monitoring systems. As the market continues to evolve, the U.S. is expected to maintain its leading position, supported by ongoing technological advancements and consumer demand for wearable devices that enhance daily life.

Asia Pacific Smart Rings Market Trends

Asia Pacific dominated the smart rings market with the largest revenue share of 27.03% in 2024. This growth is attributed to a large consumer base eager to adopt new technologies, rising disposable incomes, and increasing urbanization. Countries like China and India are particularly influential due to the growing popularity of wearable technology and government initiatives promoting digitalization.

Key Smart Rings Company Insights

The company landscape for the smart rings industry is characterized by a mix of established players and emerging startups, each striving to capture a share of this rapidly growing segment. Key market players include Oura, which dominates the market primarily due to its focus on health and wellness features, such as sleep tracking and fitness monitoring. Other notable companies include Ultrahuman and several smaller brands like McLear, Logbar, and Ringly. These companies are innovating with various functionalities, including biometric tracking, contactless payments, and customizable designs, catering to diverse consumer preferences.

Key Smart Rings Companies:

The following are the leading companies in the smart rings market. These companies collectively hold the largest market share and dictate industry trends.

- Oura Health

- Ultrahuman

- McLear Ltd.

- Ringly Inc.

- Circular

- Motiv

- Bellabeat

- Sky Labs

- Tokenize Inc.

- Jakcom Technology Co. Ltd.

- Nimb Inc.

- Wellnesys Inc.

- E SENSES

- Fujitsu Ltd.

- Guangdong Jiu Zhi Technology Co. Ltd.

Recent Developments

-

In July 2024, Samsung introduced its first smart ring, the Galaxy Ring. The Galaxy Ring features AI-powered health and fitness tracking capabilities, including sleep analysis, heart rate monitoring, and workout detection, all housed in a compact design with a battery life of up to seven days.

-

In February 2024, Oura introduced a new feature designed to assess users' resilience to stress and their recovery patterns throughout the day and night, especially during sleep. This feature categorizes resilience into five distinct types: Limited, Adequate, Solid, Strong, and Exceptional. This nuanced approach provides users with a comprehensive understanding of their stress responses and recovery capabilities, enhancing the overall functionality of the Oura Ring

Smart Rings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 417.54 million

Revenue forecast in 2030

USD 1,101.60 million

Growth rate

CAGR of 21.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, distribution, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Oura Health; Ultrahuman; McLear Ltd.; Ringly Inc.; Circular; Motiv; Bellabeat; Sky Labs; Tokenize Inc.; Jakcom Technology Co. Ltd.; Nimb Inc.; Wellnesys Inc.; E SENSES; Fujitsu Ltd.; Guangdong Jiu Zhi Technology Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Rings Market Report Segmentation

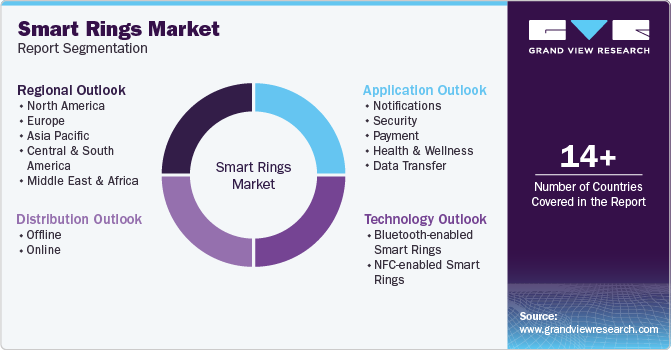

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart rings market report based on the technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Bluetooth-enabled Smart Rings

-

NFC-enabled Smart Rings

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Notifications

-

Security

-

Payment

-

Health and wellness

-

Data transfer

-

-

Distribution Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart rings market was valued at USD 348.56 million in 2024 and is expected to reach USD 417.54 million in 2025.

b. The global smart rings market is expected to grow at a CAGR of 21.1% from 2025 to 2030 to reach USD 1,101.60 million by 2030.

b. Bluetooth-enabled smart rings were the most popular technology used, accounting for a market revenue of USD 199.64 million in 2023. Bluetooth technology facilitates seamless integration with various devices, including smartphones, tablets, and smart home systems. This capability allows users to receive notifications for calls, messages, and social media alerts directly on their rings, enhancing user experience by keeping them connected without the need to check their phones frequently.

b. Some key players operating in the smart rings market include Oura Health; Ultrahuman; McLear Ltd.; Ringly Inc.; Circular; Motiv; Bellabeat; Sky Labs; Tokenize Inc.; Jakcom Technology Co. Ltd.; Nimb Inc.; Wellnesys Inc.; E SENSES; Fujitsu Ltd.; Guangdong Jiu Zhi Technology Co. Ltd.

b. One of the primary drivers of the smart rings market is the growing adoption of smartphones globally. As smartphones become ubiquitous, they facilitate the integration of smart rings with other devices, enhancing their functionality. The tech-savvy population, particularly among younger demographics, is increasingly inclined towards wearable technology that offers convenience and connectivity. This trend fosters a favorable environment for adopting smart rings as they provide seamless access to notifications and applications directly from the user's finger.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."