- Home

- »

- Animal Health

- »

-

Smart Pet Feeder Market Size, Share, Industry Report, 2030GVR Report cover

![Smart Pet Feeder Market Size, Share & Trends Report]()

Smart Pet Feeder Market (2025 - 2030) Size, Share & Trends Analysis Report By Pet (Dogs, Cats), By Connectivity (Wi-Fi, Others), By Capacity, By Sales Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-497-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Pet Feeder Market Summary

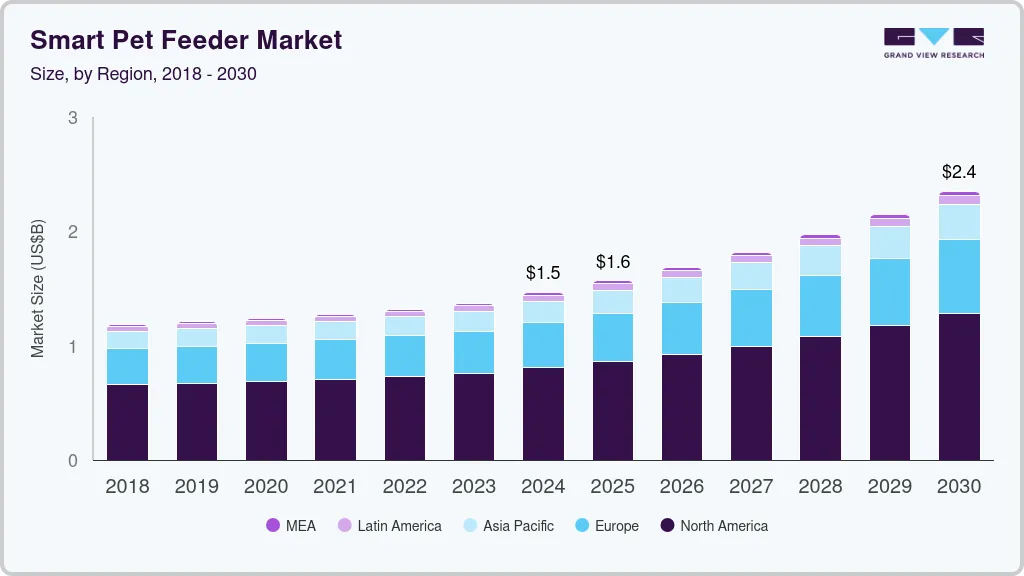

The global smart pet feeder market size was estimated at USD 1,465.7 million in 2024 and is projected to reach USD 2,352.0 million by 2030, growing at a CAGR of 8.5% from 2025 to 2030. The market has witnessed robust growth driven by the increasing prevalence of digitized homes.

Key Market Trends & Insights

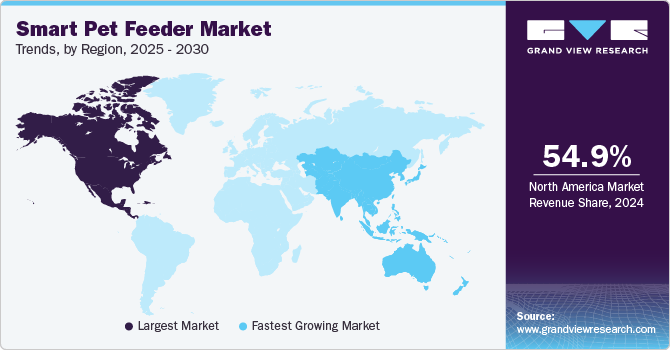

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Denmark is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, dogs accounted for a revenue of USD 1,092.7 million in 2024.

- Cats is the most lucrative pet type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,465.7 Million

- 2030 Projected Market Size: USD 2,352.0 Million

- CAGR (2025-2030): 8.5%

- North America: Largest market in 2024

Feeders with connectivity features, controllable via smartphones, are gaining traction due to their ability to let owners monitor and manage pet activities remotely, offering unparalleled convenience. A notable trend is the integration of these feeders with digital voice assistants like Amazon Alexa.

For example, Petnet Inc.'s Smart Feeder supports voice commands, enabling hands-free operation. Such innovations enhance user experience and are key contributors to the market's expansion.

With the growing need for convenient pet care solutions among busy pet owners, modern lifestyles, characterized by hectic work schedules and frequent travel, often make it difficult for owners to maintain consistent feeding routines. Smart pet feeders address this challenge by offering remote meal scheduling and monitoring, ensuring pets are fed on time even when owners are away. In addition, rising awareness about pet health and nutrition has amplified demand for these devices, which feature portion control and customized feeding schedules. These capabilities help prevent overfeeding and support balanced diets, aligning with the increasing focus on pet wellness and care.

In addition, the rising trend of pet ownership and demand for innovative pet care solutions also contribute to the market growth. These feeders incorporate advanced technologies such as AI-powered feeding algorithms, biometric identification, and voice control, enabling personalized feeding experiences for pets. Integration with smart home ecosystems, pet activity trackers, and cameras enhances convenience and usability. Wi-Fi-enabled and camera-equipped models allow owners to monitor their pets remotely, providing peace of mind. Popular brands such as PetSafe, Arf Pets, and Roffie lead the market with features like scheduled feeding, health tracking, and app-based controls. Widely adopted by pet daycares, rehabilitation centers, and online retailers, these feeders offer convenience, nutrition management, and health monitoring, meeting the needs of tech-savvy pet owners worldwide.

Pet Insights

Dog segment accounted for 69.83% of revenue share in 2024, driven by the high global population of pet dogs and their significant share in veterinary healthcare services. According to the American Pet Products Association, the United States alone was home to over 65.1 million pet dogs in 2023, reflecting the widespread adoption of dogs as companion animals. This large population creates a substantial demand for innovative feeding solutions that cater to dog owners' needs. Features such as portion control, health monitoring, and remote feeding capabilities offered by smart pet feeders align with the nutritional and care requirements of dogs, further solidifying their position as the leading segment in this growing market.

The cat segment is expected to grow at a CAGR of 8.95% from 2025 to 2030. This growth is attributed to the high number of cat owners seeking convenient and tailored feeding solutions. According to the American Veterinary Medical Association's November 2024 report, cats are the second most popular pet in the United States, with over 73.8 million pet cats. This large population highlights the growing demand for technologies designed to meet cats' specific feeding habits, such as portion control and scheduled meals. Smart feeders cater to these needs while offering features like app-based controls and remote monitoring, which are particularly appealing to cat owners prioritize convenience and pet wellness.

Capacity Insights

Smart pet feeders with a capacity of 3L to 5L held the largest market share in 2024, due to their ability to cater to the needs of larger pets and multi-pet households. These feeders are especially popular among dog owners, as they can store significant amounts of food, reducing the need for frequent refills. Products such as the Xiaomi Mijia Smart Pet Feeder 2 exemplify this trend, offering several features like a 5L storage capacity for sufficient food supply and an HD screen for user-friendly operation. Additional functionalities like food shortage reminders and backup power systems ensure uninterrupted feeding schedules, even during power outages. These advanced capabilities make larger-capacity feeders a preferred choice for busy households and multi-pet owners, driving their dominance in the market.

Moreover, the segment is expected to grow at the fastest CAGR of 8.64% during the forecast period. This segment is poised for the fastest CAGR during the forecast period due to its balanced size, versatility, and ability to cater to a broad spectrum of pet owners. These feeders, such as the TESLA Smart Pet Feeder, offer practical solutions for single-pet households or smaller pets, with a 4L capacity that ensures fresh food is available without requiring frequent refills. Features such as precise portion control (e.g., 10g per serving), Wi-Fi connectivity, and app-based operation enhance their appeal to tech-savvy consumers. In addition, their compact dimensions and mid-range capacity make them ideal for urban pet owners with limited space, fueling their rapid adoption and market growth.

Connectivity Insights

The Wi-Fi segment held the largest market share in 2024 and dominated the smart pet feeder industry due to its advanced features and seamless remote management capabilities. These feeders allow pet owners to control feeding schedules, monitor food levels, and receive real-time notifications through smartphone apps. The integration of Wi-Fi enhances convenience, enabling users to manage feeding routines from anywhere. In addition, features like video monitoring, health tracking, and voice interaction through smart home ecosystems further boost their popularity. The widespread availability of Wi-Fi infrastructure and increasing adoption of IoT devices in households have solidified the dominance of Wi-Fi-based feeders in the market.

Other segments, including cellular-based or Bluetooth-based smart pet feeders, are expected to grow at the fastest CAGR over the forecast period, driven by their affordability, energy efficiency, and reliability in areas with limited Wi-Fi access. These feeders appeal to pet owners who prioritize straightforward and stable connections without relying on continuous internet connectivity. Bluetooth-enabled feeders are ideal for short-range control, offering seamless setup and operation, while cellular-connected feeders provide robust remote management capabilities in areas with poor or no Wi-Fi infrastructure. Their growing adoption in rural and semi-urban regions and by users seeking cost-effective alternatives is fueling their rapid growth within the connectivity segment.

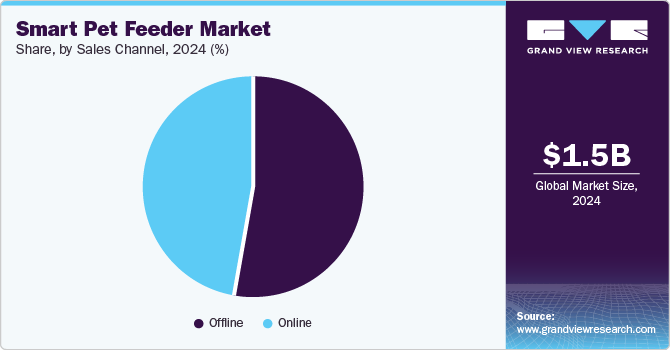

Sales Channel Insights

The offline segment dominated the market in 2024, driven by consumers’ preference for in-store purchases that allow them to physically evaluate the products before buying. Pet specialty stores, retail chains, and supermarkets offer hands-on demonstrations and expert guidance, which build trust among buyers. The opportunity to assess the quality, features, and usability of smart pet feeders in person is a significant driver for this segment's dominance. In addition, promotional activities, attractive offers, and customer service available in offline stores further enhance their appeal. This channel is especially favored in regions where online shopping penetration is limited, or consumer trust in e-commerce is still developing.

The online segment is projected to grow at the fastest CAGR over the forecast period, fueled by the increasing penetration of e-commerce platforms and the convenience of online shopping. Consumers are drawn to the vast product variety, competitive pricing, and ease of comparing features and reviews available on platforms like Amazon, Chewy, and specialized pet care websites. The rise of mobile shopping apps and the availability of exclusive online discounts and promotions further drive this growth. In addition, the integration of advanced delivery systems and the growing trust in secure payment gateways make online shopping a preferred choice, especially among tech-savvy and urban consumers. This shift is supported by the increasing digitalization and expanding internet user base globally.

Regional Insights

North America smart pet feeder market held the largest global revenue share of 54.90% in 2024. Busy lifestyles in the developed countries in the region often demand convenience for pet care, which is a key driver for the smart pet feeders industry, as pet owners increasingly seek convenient solutions to manage their pets' feeding routines amidst demanding lifestyles. According to a study by the U.S. Bureau of Labor Statistics published in April 2024, over 60% of households have at least one family member working full-time, contributing to limited availability for regular pet care. Smart pet feeders address this challenge by offering automated feeding schedules and remote monitoring via different applications. The high adoption rate of technology in North America further accelerates the demand for these devices, allowing pet owners to ensure consistent care even during long work hours or frequent travel.

U.S. Smart Pet Feeder Market Trends

The U.S. market for smart pet feeders is driven by the high prevalence of pet ownership, with over 70% of U.S. households owning pets, according to the American Pet Products Association (APPA). This widespread adoption of pets fuels the demand for innovative pet care solutions, including automated feeding systems. The increasing emphasis on pet health and convenience, coupled with the integration of technology into everyday life, makes smart feeders an attractive option for U.S. pet owners. This strong pet ownership culture and demand for advanced care solutions position the country as a key growth market for smart pet feeders.

Europe Smart Pet Feeder Market Trends

Europe smart pet feeder market was identified as a lucrative region in 2024. The European market is driven by increasing e-commerce penetration and the growing focus on pet health and well-being. Companies like New Pet in Town, operating in six European countries, including Germany, France, and Italy, emphasize quality and innovation in pet care products, fostering market growth. The presence of brands like Pawbo, supported by Acer's global expertise in IoT solutions, is a key driver, offering advanced hardware and software-integrated feeders that enable remote pet care. This combination of technological innovation and a strong e-commerce infrastructure caters to Europe’s tech-savvy pet owners, enhancing the adoption of smart feeders across the region.

The UK market for smart pet feeders is driven by growing consumer demand for advanced pet care solutions, as exemplified by the launch of products like Pawbo Crunchy. Designed for cats and small to medium-sized dogs, this feeder offers precise portion control, scheduling capabilities, and health monitoring, addressing the rising concerns over pet nutrition and obesity. With features such as dual high-precision scales, app-based monitoring, and a 6L capacity, it caters to the needs of busy pet owners seeking convenience and reliability. The ability to operate seamlessly during power outages further enhances its appeal. These innovations reflect the increasing investment in smart pet care technologies in the UK, making the market a hotspot for growth in this segment.

Asia Pacific Smart Pet Feeder Market Trends

The Asia Pacific smart pet feeder market is anticipated to grow at the fastest CAGR of 9.10% during the forecast period, driven by the growing adoption of advanced pet care technologies, as exemplified by products like Furspark's Big Eye. This innovative feeder, launched in Hong Kong, integrates AI pet care features and high-definition monitoring, addressing the increasing demand for tech-savvy solutions among pet owners. The feeder's unique privacy protection measures, including bionic lens covers and encrypted communication, appeal to consumers concerned about data security. In addition, its AI-driven monitoring of pet behavior and 2K imaging capabilities ensure precise feeding and health tracking. As urbanization and pet ownership rise across Asia, such advanced, multifunctional products are driving market growth in the region.

The smart pet feeder market in Japan is significantly driven by the ongoing trend of pet humanization, where pet owners increasingly treat their animals as cherished family members. This cultural shift has led to a premiumization of pet care products, including high-quality food and advanced feeding solutions. Japanese pet owners are particularly focused on providing the best care for their pets, which includes the adoption of smart pet feeders, health monitoring, and convenience. Additionally, there is a growing emphasis on sustainability, with market players adopting eco-friendly practices to align with consumers' environmental concerns. These factors collectively contribute to the rising demand for innovative, premium smart pet feeders in Japan.

Latin America Smart Pet Feeder Market Trends

The smart pet feeder market in Latin America is experiencing growth driven by increasing pet ownership and the rising adoption of technology for pet care. As pet humanization trends continue to spread across the region, Latin American consumers are seeking more advanced solutions to manage their pets' feeding schedules and health. With the growing availability of e-commerce platforms and the entry of global brands and local players, consumers can now access smart pet feeders that offer features such as portion control, remote monitoring, and automated feeding. Additionally, the region’s expanding middle class and greater disposable income are contributing to a higher demand for premium pet products, including innovative pet feeders that provide convenience and enhanced care.

The smart pet feeder market in Brazil is driven by the increasing availability of innovative products from global companies like Xiaomi and Ubuy Co., which have expanded their presence in the region. As Brazilian consumers embrace the convenience of smart technologies, these companies offer affordable yet advanced smart pet feeders equipped with features like remote feeding, volume control, and mobile app integration, thereby contributing to market growth.

MEA Smart Pet Feeder Market Insights

The smart pet feeder market in the Middle East and Africa (MEA) region is being driven by growing pet ownership and increasing demand for convenience and technology-driven pet care solutions. As urbanization rises and disposable income improves, pet owners in MEA are more willing to invest in advanced products that enhance their pets' health and well-being.

The smart pet feeder market in Saudi Arabia is being fueled by the growing pet culture and increasing affluence among pet owners. As pets are increasingly treated as family members, Saudi consumers are investing in high-tech solutions to ensure their pets receive the best care. Smart pet feeders that offer features such as customizable feeding schedules, portion control, and the ability to monitor pets remotely are in high demand. Moreover, the rise in online shopping, coupled with greater exposure to global trends through social media, is encouraging Saudi pet owners to adopt innovative pet care products. The growing focus on pet health, coupled with busy lifestyles, further drives the demand for smart pet feeders in the region.

Key Smart Pet Feeder Company Insights

The market is relatively competitive and fragmented due to multiple small and large companies. Moreover, companies are increasingly adopting various strategies, such as mergers and acquisitions, geographic expansions, and product launches, to expand their market share. Owing to constant research initiatives, this industry can be seen as moderate to high in innovation.

Key Smart Pet Feeder Companies:

The following are the leading companies in the smart pet feeder market. These companies collectively hold the largest market share and dictate industry trends.

- Dogness Group

- Dokoo

- Faroro

- PETKIT Australia

- Sure Pet care (Allflex group)

- Xiaomi

- TESLA Solar, s.r.o.

- Skymee

- Aqara (Lumi United Technology)

- Pet Marvel Ltd.

Recent Developments

-

In February 2024, Penthouse Paws launched the Automatic Cat Feeder, a programmable device designed to ensure cats receive timely meals, even in the owner's absence. With a 6-liter capacity, food-grade plastic construction, and backup battery mode, it guarantees safety and convenience. Notable features include a 10-second voice message for comfort and a bite-proof cable for safety, making it a must-have for responsible cat owners.

Smart Pet Feeder Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.56 billion

Revenue forecast in 2030

USD 2.35 billion

Growth rate

CAGR of 8.46% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet, capacity, connectivity, sales channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Saudi Arabia, UAE, South Africa and Kuwait

Key companies profiled

Dogness Group, Dokoo, Faroro, PETKIT Australia, Sure Pet Care (Allflex group), Xiaomi, TESLA Solar, s.r.o., Skymee, Aqara (Lumi United Technology), Pet Marvel Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Pet Feeder Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart pet feeder market report based on pet capacity, connectivity, sales channel, and region:

-

Pet Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Upto 3L

-

3L to 5L

-

More than 5L

-

-

Connectivity Outlook (Revenue, USD Million, 2018 - 2030)

-

Wi-Fi

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LATAM

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global smart pet feeder market size was estimated at USD 1.46 billion in 2024 and is expected to reach USD 1.56 billion in 2025.

b. The global smart pet feeder market is expected to grow at a compound annual growth rate of 8.46% from 2025 to 2030 to reach USD 2.35 billion by 2030.

b. North America dominated the smart pet feeder market with a share of 54.90% in 2024. This is attributable to the busy lifestyles in the region's developed countries often demand convenience for pet care. Pet owners increasingly seek convenient solutions to manage their pets' feeding routines amidst demanding lifestyles.

b. Some key players operating in the smart pet feeder market include Dogness Group, Dokoo, Faroro, PETKIT Australia, Sure Pet care (Allflex group), Xiaomi, TESLA Solar, s.r.o., Skymee, Aqara (Lumi United Technology), Pet Marvel Ltd.

b. Key factors that are driving the market growth include increasing pet ownership and expenditure, busy lifestyles and rising demand for convenience, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.