- Home

- »

- Medical Devices

- »

-

Smart Orthopedic Implants Market Size, Share Report, 2030GVR Report cover

![Smart Orthopedic Implants Market Size, Share & Trends Report]()

Smart Orthopedic Implants Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Knee, Hip), By Component (Implants, Electronic Components), By Procedure, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-946-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Orthopedic Implants Market Summary

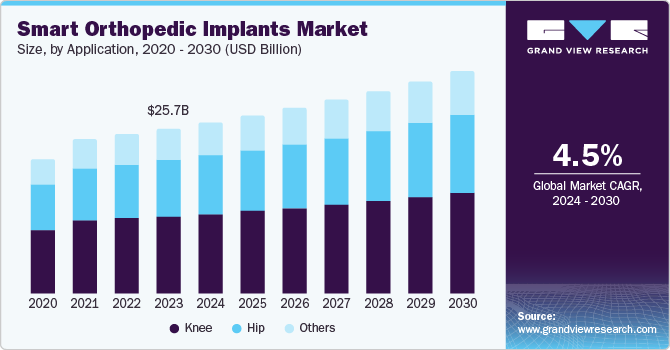

The smart orthopedic implants market was estimated at USD 25.7 billion in 2023 and is projected to grow to USD 34.8 billion by 2030, growing at a CAGR of 4.5% from 2024 to 2030. Factors driving market growth include increased research and development initiatives, advancements in orthopedic procedures, and the adoption of enabling technologies such as robotics and surgical navigation.

Key Market Trends & Insights

- North America dominated the global market with a 41.8% revenue share in 2023.

- Asia Pacific is expected to be the fastest-growing regional market, with a CAGR of 6.1% during the forecast period.

- By application, the knee segment dominated the market in 2023 with a 46.8% revenue share.

- By component, the electronic components segment is projected to have the fastest CAGR of 6.5% over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD USD 25.7 Billion

- 2030 Projected Market Size: USD 34.8 Billion

- CAGR (2024-2030): 4.5%

- North America: Largest market in 2023

Moreover, the efforts of leading companies are also contributing to this growth.

The rising incidence of chronic diseases such as obesity and diabetes, which increase the risk of degenerative joint diseases, is also contributing to higher demand for orthopedic surgeries and smart implants. Furthermore, technological advancements in smart implant technology, including robotic systems and digital enabling technologies, are enhancing surgical outcomes and patient monitoring, making these products more attractive to healthcare providers.

The market is also driven by the growing preference for minimally invasive surgical techniques, which reduce recovery time and discomfort for patients, and the increased availability of advanced orthopedic solutions. Moreover, improved healthcare infrastructure and increased access to surgical procedures are supporting market growth, particularly in developing regions. Efforts by governments and organizations to raise awareness about treatment options for bone injuries are also influencing patient choices towards smart orthopedic implants.

The integration of Internet of Things (IoT) and Artificial Intelligence (AI) technology in orthopedic implants enables close monitoring of patient health, detecting movement, implant condition, and rate of recovery. This allows for prompt initiation of proper treatment. Advances in biomaterial fabrication also enhance the compatibility of implants with the human body, further driving market growth. With the global population aging, orthopedic issues such as osteoarthritis, osteoporosis, and fractures are becoming increasingly common. As a result, there is a growing need for better orthopedic services that facilitate quick healing processes, driving demand for smart orthopedic implants.

Application Insights

The knee segment dominated the market with a revenue share of 46.8% in 2023. The global prevalence of knee disorders, including osteoarthritis, rheumatoid arthritis, and sports injuries, has a significant impact on mobility and overall well-being. According to the World Health Organization (WHO), 73% of osteoarthritis patients are over 55 years old, with 60% being women. This demographic presents a significant market opportunity for knee-related treatments and solutions.

The hip application segment is expected to register the fastest CAGR of 5.1% during the forecast period, driven by the increasing age of the global population. As individuals age, their immune defenses decline, making them more susceptible to hip joint disorders and illnesses, such as osteoarthritis and fractures. With the world’s population projected to reach 2 billion by 2050 by the WHO, the demand for hip-related treatments and solutions is expected to rise.

Component Insights

The implants segment led the market with a revenue share of 82.7% in 2023. The integration of sensors, wireless connectivity, and advanced materials has transformed conventional orthopedic implants into smart devices. This innovation enables real-time patient health monitoring, streamlining post-surgery care and reducing recovery times. The emphasis on optimizing patient outcomes is also driving growth in the implants component segment.

The electronic components segment is expected to register the fastest CAGR of 6.5% during the forecast period. Smart orthopedic implants, equipped with electronic interfaces, are increasingly used in patient rehabilitation. These implants feature alerts, such as notifications for physical therapy exercises, ensuring timely adherence to rehabilitation schedules. Moreover, collected data is analyzed to monitor long-term implant behavior and patient health trends, enabling more informed treatment decisions and improved patient outcomes.

Procedure Insights

Total replacement procedures held the largest revenue share of 56.9% in 2023, owing to the rising prevalence of orthopedic diseases, increased joint replacement surgeries, and technological advancements. With the global total knee replacement market growing, smart implants with embedded sensors offer enhanced post-operative healing, reduced implant failure rates, and improved patient satisfaction.

Partial replacement procedures are expected to register the fastest CAGR of 5.2% during the forecast period. By targeting only the damaged joint area, surgeons can restore healthy tissues and bones, reducing recovery time and pain for patients. Partial replacement procedures are also more cost-effective for healthcare systems and patients compared to total joint replacements, making them a more economical and efficient option.

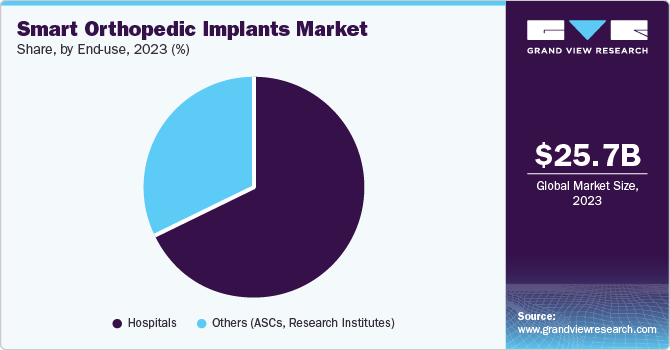

End-use Insights

The hospitals segment dominated the market with a revenue share of 68.0% in 2023, fueled by the growing number of surgical procedures annually. Hospitals, with their advanced infrastructures and skilled personnel, are well-suited to integrate smart implants. Their existing infrastructure and capabilities enable them to seamlessly adopt smart technologies, enhancing patient care and service delivery.

The others (ASCs, Research Institutes) segment is expected to register the fastest CAGR of 5.4% during the forecast period. Ambulatory Surgical Centers (ASCs) have successfully performed orthopedic procedures, demonstrating efficiency and cost-effectiveness. With lower operational costs, ASCs offer competitive pricing, making it accessible to more patients. Meanwhile, research institutions are driving innovation in smart orthopedic implants, developing new technologies and materials that will shape the industry’s future.

Regional Insights

North America smart orthopedic implants market dominated the global smart orthopedic implants market with a revenue share of 41.8% in 2023. The region’s significant share is attributed to the presence of leading companies, such as Zimmer Biomet, and the widespread adoption of digital technologies and robotic systems in healthcare. The growing prevalence of orthopedic disorders is expected to drive regional growth in the coming years, further solidifying the region’s position.

U.S. Smart Orthopedic Implants Market Trends

The smart orthopedic implants market in U.S. dominated the North America smart orthopedic implants market with a revenue share of 81.4% in 2023. The country’s dominance can be attributed to a combination of factors, including technological advancements, healthcare infrastructure, regulatory environment, and market dynamics. In the U.S., arthritis is a prevalent chronic condition, with doctors identifying it as a major cause of disability. By 2040, 78.4 million adults are projected to be affected.

Asia Pacific Smart Orthopedic Implants Market Trends

Asia Pacific smart orthopedic implants market is expected to register the fastest CAGR of 6.1% in the forecast period. The Asia Pacific region is driving innovation in smart orthopedic implants and medical technologies. Countries such as Japan, China, and India have invested heavily in R&D, resulting in the development of advanced products that enhance patient quality of life and position the region as a leader in this space.

The smart orthopedic implants market in Japan dominated the Asia Pacific smart orthopedic implants market with revenue share of 21.5% in 2023. Japan is a prominent global player in technology and engineering, ranking among the top countries in R&D expenditure. This significant investment in various sectors, including healthcare, fosters collaboration between universities, research centers, and private corporations, driving advancements in medical technologies and positioning Japan as a leader in innovation.

Europe Smart Orthopedic Implants Market Trends

Europe smart orthopedic implants market held substantial market share in 2023. Europe is renowned for its exceptional healthcare systems, with countries such as Germany, France, and the UK boasting well-established hospitals that seamlessly integrate modern technologies. This robust infrastructure fosters innovation, driving the development of cutting-edge devices such as smart orthopedic implants.

The smart orthopedic implants market in Germany is expected to grow in the forecast period. Germany’s rapidly growing aging population has created a significant demand for smart orthopedic implants, driving the market’s upward trajectory. The German government actively supports innovation in the medical device sector through targeted funding initiatives and research programs, promoting the development of health technologies and fueling market growth.

Key Smart Orthopedic Implants Company Insights

Some key companies in the smart orthopedic implants market include Zimmer Biomet; Medtronic; Boston Scientific Corporation; and others. In response to intensifying competition, market players have employed strategies such as new product introductions, expanded distribution channels, and geographical expansion to stay ahead.

-

Zimmer Biomet Holdings Inc. specializes in designing, manufacturing, and marketing orthopedic implants. The company prioritizes innovation, leveraging data to drive smarter operations and revolutionize orthopedic surgery.

-

Medtronic offers comprehensive services and solutions. The company has made significant strides in developing cutting-edge smart orthopedic implants, providing real-time status information to clinicians to improve patient outcomes.

Key Smart Orthopedic Implants Companies:

The following are the leading companies in the smart orthopedic implants market. These companies collectively hold the largest market share and dictate industry trends.

- Zimmer Biomet

- Medtronic

- Boston Scientific Corporation

- Abbott.

- Nevro Corp.

- Biotronik.

- Cochlear Ltd.

- Exactech, Inc.

- Stryker

- CONMED Corporation.

Recent Developments

-

In July 2024, Stryker completed the acquisition of Artelon, a strategic move that bolstered its product portfolio and expanded its capabilities in the orthopedic and surgical markets, aligning with its commitment to product excellence.

-

In May 2024, Exactech launched its latest ligament-driven balancing technology, ExactechGPS, with new software and modern alignment philosophies for total knee replacement surgery.

Smart Orthopedic Implants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 26.6 billion

Revenue forecast in 2030

USD 34.8 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, component, procedure, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Zimmer Biomet; Medtronic; Boston Scientific Corporation; Abbott; NEVRO CORP; Biotronik; Cochlear Ltd.; Exactech, Inc.; Stryker; CONMED Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Orthopedic Implants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart orthopedic implants market report based on application, component, procedure, end use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Knee

-

Hip

-

Others

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Implants

-

Electronic Components

-

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Total Replacement

-

Partial Replacement

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Others (ASCs, Research Institutes)

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.