- Home

- »

- Next Generation Technologies

- »

-

Smart Office Market Size, Share And Growth Report, 2030GVR Report cover

![Smart Office Market Size, Share & Trends Report]()

Smart Office Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Type (Retrofit, New Construction), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-302-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Office Market Summary

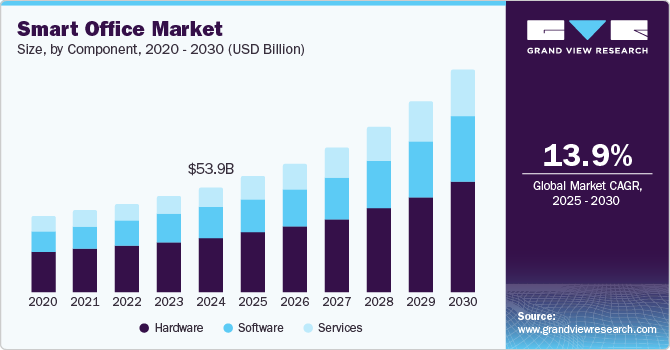

The global smart office market size was estimated at USD 53.9 billion in 2024 and is projected to grow at a CAGR of 13.9% from 2025 to 2030. The rapid pace of digital transformation activities and increasing competition driven by enhanced accessibility and availability of modern technologies have compelled multiple industries to focus on adopting strategies to reduce costs, improve productivity, automate processes, improve internal communication, and attract top talent.

Key Market Trends & Insights

- North America dominated the global smart office market with the largest revenue share of 36.8% in 2024.

- The smart office market in the U.S. led the North America market and held the largest revenue share in 2024.

- By component, the hardware segment led the market, holding the largest revenue share of 52.0% in 2024.

- By type, the new construction segment is expected to grow at the fastest CAGR of 14.3% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 53.9 Billion

- 2030 Projected Market Size: USD 113.8 Billion

- CAGR (2025-2030): 13.9%

- North America: Largest market in 2024

This has resulted in an upsurge in demand for smart office solutions and services.

The emergence of advanced technologies such as cloud computing, the Internet of Things (IoT), Artificial Intelligence (AI), machine learning, sensors, and others have stimulated multiple disruptions in various industries. Companies are proactively adopting strategies to significantly reduce costs, achieve better productivity, and attain operational excellence to address the enormous growth in competition and continuously rising demands and ensure efficiency. Modern technology solutions associated with smart offices are vital in these transitions.

Business innovation, employee well-being, and the adoption of smart technologies have helped industries and businesses establish a high-performance environment within the organization. This includes installing hardware or software solutions related to security systems, smart lighting, energy efficiency, audio-video conferencing, and more. In addition, implementing technologies linked with voice control, intelligent climate control, access control, sensors, connectivity, and advanced analytics assists businesses in reducing operating expenses.

For instance, in 2024, through its planned renovation of the Munich office, NTT DATA, Inc., developed a smarter space with the use of sensors and automation technology. This included developing different workspaces linked to videoconferencing facilities backed by integrated software. The company has developed space connected through its network and sensors to ensure secure data sharing. The dashboard provides insights related to occupancy, space utilization, and building health dynamics, such as humidity or temperature, which analyzes sensor data.

Component Insights

Based on components, the hardware segment dominated the global industry with a revenue share of 52.0% in 2024 attributed to the growing demand for hardware solutions such as sensors, smart lighting products, smart desks, interactive displays, visitor management systems, smart booking systems for efficient internal workflows, and more. Hardware plays a vital role in collecting raw data, including images, voice commands, interactive data, and others, with the help of advanced technology, which organizations utilize through software to ensure desired results.

The services segment is projected to experience the fastest CAGR of 15.3% from 2025 to 2030 mainly driven by the businesses that choose to avail services from other organizations instead of making upfront investments to change the existing office structures. This includes the provision of software, solutions, support, and assistance from service providers in transforming regular workspaces into smart office environments where processes are automated, technology tools assist functions, and multiple parts of daily operations are managed through the use of modern technologies such as IoT, AI, virtual reality, cloud computing, and others.

These services focus on areas such as attendance management, leave & payroll management, device and canteen management, Employee Self-Service applications, data management, digital onboarding, and training. Some user businesses also utilize smart service offerings related to sustainability, crisis management, regulatory compliance, access control, document security, and more.

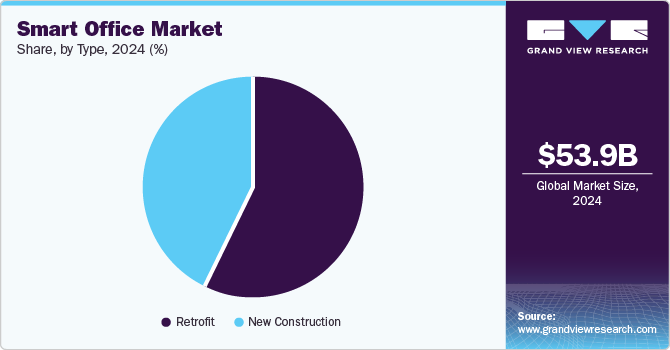

Type Insights

The retrofit segment accounted for the largest revenue share in 2024. Retrofit is a type of office transformation where businesses upgrade or enhance the existing workspace without building a new one. This includes installing technology-driven tools such as sensors, improving network capabilities, adopting smart devices, utilizing unused spaces, and establishing connection devices for purposes such as videoconferencing. Many businesses utilize this type of solutions and services to convert existing offices into more productive and agile workplaces.

The new Construction segment is projected to experience the fastest CAGR from 2025 to 2030. Growth of this segment is mainly driven by factors such as the trend of smart office developments, the availability of technology-equipped spaces, the need to eliminate legacy networks and systems, projections related to enhanced productivity, and the availability of multiple service providers which can assist businesses in the construction of new smart office spaces.

Regional Insights

North America smart office market dominated the global market with a revenue share of 36.8% in 2024, attributed to multiple aspects such as early adoption trends in terms of technology in the region, growing accessibility and availability of modern technologies including sensing, imaging, connected devices, IoT, AI and others, presence of multiple smart office services and solutions providers, and rapid pace of digital transformation.

U.S. Smart Office Market Trends

The U.S. smart office market held the largest revenue share of the regional industry in 2024, mainly driven by factors such as growing demand for intelligent office solutions, multiple businesses' adoption of IoT and other technology tools for enhanced productivity, rise in environmental concerns and regulatory compliance requirements, and increased awareness about workplace safety and employee welfare.

Europe Smart Office Market Trends

Europe smart office market is anticipated to experience significant growth during the forecast period. This market is primarily influenced by the rapid pace of digital transformations, increased focus on energy efficiency, rising demand for safety and security solutions backed by technology, and the presence of multiple key players from the innovation and technology industry in the region.

The UK smart office market held a significant revenue share of the regional industry in 2024, influenced by aspects such as the increasing focus of companies on exploring novel solutions to ensure cost reduction and performance enhancements. Numerous businesses in the country aim to attain energy efficiency by implementing various strategies and using technology tools such as smart lighting or smart access control. Growing awareness regarding employee well-being and the availability of smart office services are expected to fuel the growth of this segment in the approaching years.

Latin America Smart Office Market Trends

Latin America smart office market is projected to experience the fastest CAGR of 16.1% from 2025 to 2030, driven by aspects such as increasing digital transformation activities in the region, growing awareness regarding benefits associated with smart office investments such as enhanced productivity and operational excellence, expansion of internet network, easy availability of innovation-based devices, and increasing use of modern technologies such as AI, IoT, and others.

Brazil held a noteworthy revenue share of the Latin America smart office market attributed to factors such as the growing economy, rising availability of advanced technologies, businesses' increasing focus on technology adoption to reduce operating overheads, and growing awareness regarding employee wellbeing and its significance in achieving enhanced productivity. Increasing urbanization and the availability of smart buildings for office spaces are also contributing to the growth of this market.

Key Smart Office Company Insights

Some of the key companies operating in the smart office market include ABB, Cisco, Schneider Electric, Johnson Controls Inc., Crestron Electronics, Inc., and others. Key market participants are adopting strategies such as enhanced research and development, innovation, new product launches, collaborations, and more to address growing demand and unceasing competition.

-

ABB, one of the prominent companies in the electrification and automation technology industry, provides multiple products for smart offices related to power distribution, lighting and shading control, emergency lighting, HVAC control, electric vehicle charging, motors, drives, and more.

-

Cisco, a major player in innovation and technology, offers Cisco Smart Workplace, a technology-driven solution comprised of the tools and expertise of Cisco's portfolio, which includes Catalyst, Meraki, and Webex.

Key Smart Office Companies:

The following are the leading companies in the smart office market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Cisco Systems, Inc.

- Crestron Electronics, Inc.

- Honeywell International Inc.

- Johnson Controls Inc.

- Lutron Electronics Co., Inc

- Signify Holding

- Schneider Electric

- Siemens

- SensorSuite

Recent Developments

-

In February 2024, Huawei Technologies Co., Ltd., one of the key companies in the technology industry, launched a new series of products, IdeaHub. The series' smart office portfolio includes IdeaPresence LED, IdeaHub ES2 Plus, IdeaHub ES2, IdeaHub 83, and others. Intelligent collaboration of communication technologies and advanced equipment capabilities is expected to enhance the company’s presence in the smart office industry.

Smart Office Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 59.4 billion

Revenue forecast in 2030

USD 113.8 billion

Growth rate

CAGR of 13.9% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, SAUDI ARABIA, UAE, South Africa

Key companies profiled

ABB; Cisco Systems, Inc.; Crestron Electronics, Inc.; Honeywell International Inc.; Johnson Controls Inc.; Lutron Electronics Co., Inc.; Signify Holding; Schneider Electric; Siemens; SensorSuite

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Office Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart office market report based on component, type, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Security Systems & Controls

-

Smart Lighting & Controls

-

Energy Management Systems

-

HVAC Control Systems

-

Audio-Video Conferencing Systems

-

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retrofit

-

New Construction

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.