- Home

- »

- Electronic Devices

- »

-

Smart Motors Market Size, Share & Growth Report, 2030GVR Report cover

![Smart Motors Market Size, Share & Trends Report]()

Smart Motors Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (18V, 24V, 36V, 48V & Above), By End-use (Industrial, Automotive, Consumer Electronics, Aerospace & Defense), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-190-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Motors Market Size & Trends

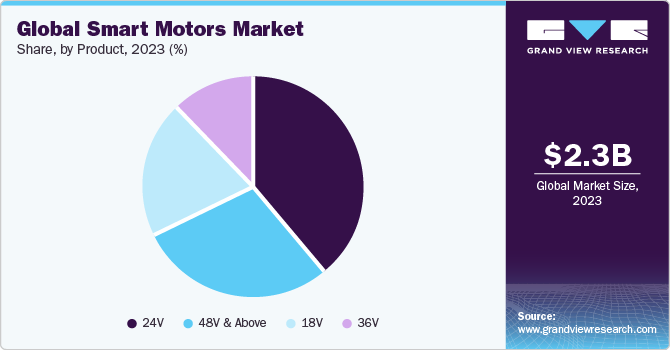

The global smart motors market size was estimated at USD 2.31 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030. The global surge in sales of both passenger and commercial vehicles has led to a substantial increase in the demand for smart motors within the automotive sector. Smart motors are integral components deployed in various automotive applications, including window and electric seat systems. The flexibility and compact nature of these motors provide a significant advantage, allowing for precise control over operations tailored to the vehicle’s specific requirements. This adaptability is a crucial factor attracting vehicle manufacturers, as it enables the seamless integration of these motors’ technology into diverse automotive functionalities.

The automotive industry's growing reliance on smart motors reflects the broader trend toward enhancing vehicle efficiency, automation, and connectivity. As smart motors continue to offer innovative solutions for improved vehicle performance and functionality, manufacturers are increasingly incorporating these advanced technologies into their product offerings to meet the evolving demands of the automotive market. Due to their compact design and superior control capabilities, smart motors have witnessed increased adoption among manufacturers in industries such as wire, fabric, and paper for winding and spooling applications.

In sectors like fabric, wire, and paper manufacturing, manufacturers face challenges related to material tension control, overtravel, and under-travel, as well as issues with excess or inadequate stress on spooling material during winding applications, impacting operational efficiency. Incorporating advanced motors addresses these challenges through closed-loop system control and auto-reversing electronic gearing. This not only enhances operational efficiency but also reduces cabling costs for manufacturers. The rising demand for efficient motor systems in the industrial sector, driven by the need to optimize operational efficiency, is expected to impact the growth of the overall market positively.

As industries increasingly recognize the benefits of these advanced motor technologies in overcoming operational challenges, adopting these motors is likely to expand further, contributing to the growth and advancement of the market. The rise of Industry 4.0 has ushered in a new era of smart manufacturing and robotics within the industrial sector. This transformative trend is forcing manufacturers to adopt advanced robotics for material handling operations. The increased adoption of robots in manufacturing processes is, in turn, fueling the demand for advanced, efficient motors. These motors can provide precise motion control and seamless adaptability to various tasks, making them a pivotal component in the robotics industry. Thus, as the increasing demand for robots intensifies, so does the need for smart motors, contributing to the overall growth of the target market.

Additionally, manufacturers of robots are actively engaging in partnerships with motor manufacturers to develop robust drive systems. These systems are expected to be capable of responding to a high flow of information and empower robots to execute swift turns, stops, brakes, or accelerations. Thus, the development of product-specific smart motors among manufacturers is poised to be a key driver supporting the target market’s expansion.

Market Concentrations & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The target market is characterized by a moderate degree of innovation owing to the technological advancements driven by factors such as the high demand for products integrated with advanced components such as sensors, controllers, and communication systems to enhance operational efficiency and efficient utilization of resources.

The target market is also characterized by a high level of partnerships and collaborations by the leading players. This is due to several factors, including the need to gain access to technology and increase smart motors’ efficiency.

The market faces limited direct substitutes, as alternative products like servo motors and conventional motors are commonly employed for basic control functionalities. However, it is crucial to acknowledge that smart motors offer advanced control and automation capabilities that set them apart from these alternatives. The unique features of smart motors, such as precise control and automation, contribute significantly to their performance and efficiency, differentiating them from conventional options. This distinct set of capabilities positions smart motors as preferred for applications demanding advanced control and automation in various industries.

End-user concentration is one of the significant factors in the market. Various end-user industries are driving demand for these advanced motors. Demand concentration within specific end-user industries, particularly in sectors such as robotics and consumer electronics, offers significant opportunities for companies specializing in smart motor development. This focus on specific industries allows motor manufacturers to cater to these sectors’ the unique needs and requirements, fostering growth and innovation in their applications.

Product Insights

The 24V segment accounted for the highest market share of 39.2% in 2023 and is expected to continue its dominance over the forecast period. The surging demand for 24V smart motors is driven by their capability to deliver high power and optimal speed for various applications. Their inherent energy efficiency makes them particularly suitable for scenarios where power conservation is critical, thereby contributing to overall energy savings. This heightened demand for 24V smart motors is notably prominent among autonomous guided vehicles and agriculture automation vehicle manufacturers. This trend is anticipated to be a key factor supporting the growth and expansion of the 24V segment.

The surge in demand for 48V and above motors within the automotive sector, specifically for applications like power windows, mirrors, and seat adjustments, is a pivotal factor expected to drive the segment's growth. Furthermore, the widespread adoption of 48V motors in material handling equipment and conveyor systems contributes significantly to the segment's expansion. Their adaptability and performance make them a preferred choice, aligning with the evolving needs of industries relying on robust and efficient motion control solutions.

End-use Insights

The industrial segment dominated the market, gaining a share of 37.0% in 2023. The industrial sector is anticipated to account for a significant revenue share in the target segment, primarily attributed to the broad application scope of smart motors in crucial areas such as conveyor systems, material handling equipment, and assembly lines. Manufacturers of advanced motor systems are strategically directing their efforts toward creating tailored solutions that precisely meet the requirements of product manufacturers. Also, substantial investments in developing efficient motors designed to enhance the manufacturing operations’ efficiency are expected to gain traction.

The automotive segment is poised for rapid growth within the target segment, driven by the surging demand for electric vehicles (EVs) worldwide. As the automotive industry shifts towards EVs, manufacturers are increasingly adopting advanced systems, including electric seats and automated mirror systems. These sophisticated systems are integrated with efficient motors, leveraging their high-precision control and responsiveness to enhance the functionality of electric vehicles. This trend underscores the pivotal role of smart motors in the automotive sector, positioning them as essential components for the efficient operation of modern electric vehicles.

Regional Insights

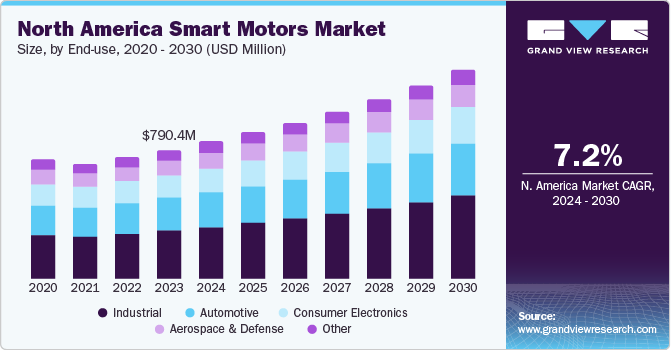

The North America region dominated the market, gaining a share of 34.2% in 2023. The industrial and consumer electronics sectors propel the surge in demand for efficient motors. With a growing preference for smart homes, there is an increased demand for automated products such as motorized blinds, automatic curtains, and intelligent ventilation systems. These products rely on smart motors for their precise control and efficient operation. As the consumer electronics industry continues to innovate, smart motors play a crucial role in enhancing the automation, functionality, and energy efficiency of various devices. This trend is contributing to the overall growth of advanced motors in industrial and consumer applications.

The Asia Pacific region is expected to achieve the fastest CAGR of 8.1% in the market during the forecast period. The remarkable growth in the target market is driven by the rising demand from the automotive sector, particularly in countries like China, India, and South Korea. The surge in sales of both passenger and commercial vehicles has led to an increased need for advanced electronic systems within vehicles, such as electronic seat systems, window controls, and mirror systems. These systems are integrated with smart motors, significantly boosting the overall performance, efficiency, and connectivity features within vehicles.

Key Smart Motors Company Insights

Some of the key players operating in the market include Rockwell Automation, Moog, Inc., Fuji Electric Co., Ltd., ABB Ltd., Siemens AG, Schneider Electric SE, and General Electric, among others.

-

Moog, Inc. is a global manufacturer specializing in precision control components and systems. Leveraging a diverse range of solutions, including electric, hydraulic, and electro-hydrostatic systems, the company excels in assisting product manufacturers to address intricate motion control challenges. Moog serves multiple end-use industries, including oil and gas, construction, industrial machinery, and power generation.

-

Rockwell Automation, a global leader in industrial automation and digital transformation technologies, offers its smart motors to diverse industries, including industrial machinery, automotive, and consumer electronics. The company's innovative solutions contribute to enhancing efficiency and performance across various sectors.

Key Smart Motors Companies:

The following are the leading companies in the smart motors market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these smart motors companies are analyzed to map the supply network.

- Rockwell Automation

- Moog, Inc.

- Fuji Electric Co., Ltd.

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- General Electric

- Dunkermotoren GmbH

- Technosoft SA

- RobotShop, Inc.

- Roboteq, Inc.

Recent Development

-

In October 2023, Applied Motion Products Inc., a manufacturer of components, announced the launch of a new CSM34 Integrated StepSERVO Conveyor Smart Motors. The newly launched product simplifies conveyor control, reduces installation effort, and saves space. This new product launch is expected to help the company enhance its portfolio.

-

In April 2022. Moog Animatics, a global smart motors manufacturer, announced the launch of the new Class 6 D-style SmartMotor range. The newly launched product allows significant reductions in machine development costs and build times. This new product launch is expected to help the company attract new customers.

-

In November 2021, WEG, an electric motor manufacturer, expanded its existing line with the CFW900. CFW900 is a variable-speed drive with a large overload capacity and can handle various applications.

-

In October 2021, ABB, a global component and equipment manufacturer, announced the launch of FusionAir Smart Sensor. The newly launched FusionAir Smart Sensor is integrated with optional room control sensors that aid in tracking humidity, temperature, volatile organic compounds (VOCs), and carbon dioxide (CO2). The newly launched product helped the company attract new customers.

Smart Motors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.45 billion

Revenue forecast in 2030

USD 3.63 billion

Growth rate

CAGR of 6.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Rockwell Automation; Moog, Inc.; Fuji Electric Co., Ltd.; ABB Ltd.; Siemens AG; Schneider Electric SE; General Electric; Dunkermotoren GmbH; Technosoft SA; RobotShop, Inc.; Roboteq, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Motors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the smart motors market report on the basis of product, end-user and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

18V

-

24V

-

36V

-

48V and above

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Automotive

-

Consumer Electronics

-

Aerospace & Defense

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart motors market size was estimated at USD 2.31 billion in 2023 and is expected to reach USD 2.45 billion in 2024.

b. The global smart motors market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 3.63 billion by 2030.

b. North America, led by the U.S., dominated the smart motors market with a revenue share of 34.2% in 2023, driven by increasing demand from consumer electronics and paper manufacturers.

b. Prominent participants in the smart motors market comprise Rockwell Automation, Moog, Inc., Fuji Electric Co., Ltd., ABB Ltd., and Siemens AG

b. Major factor expected to drive the growth of the global smart motors market is increasing demand from automotive and consumer electronic manufacturers for higher precision and control over products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.