- Home

- »

- Medical Devices

- »

-

Smart Medical Devices Market Size & Share Report, 2030GVR Report cover

![Smart Medical Devices Market Size, Share & Trends Report]()

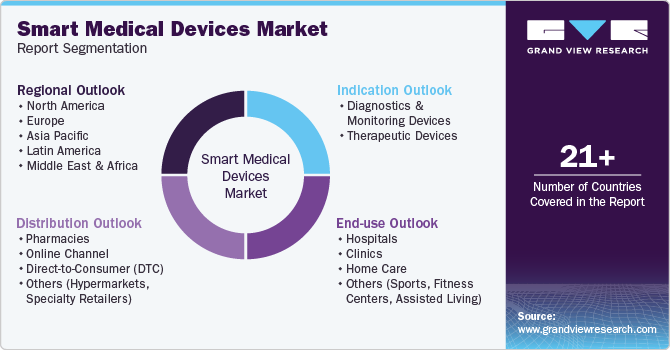

Smart Medical Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Diagnostics & Monitoring Devices, Therapeutic Devices), By Distribution, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-495-6

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Medical Devices Market Summary

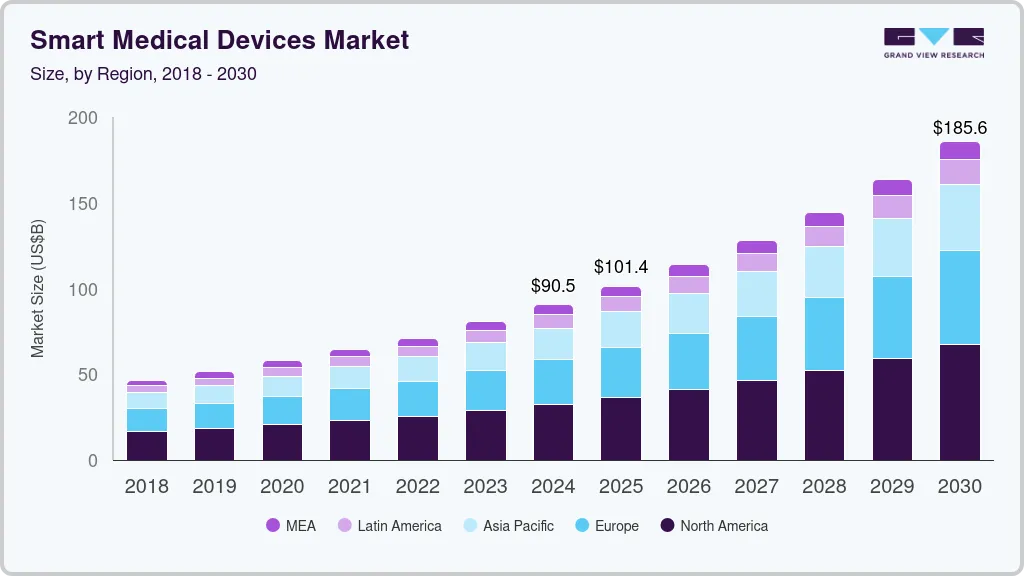

The global smart medical devices market size was estimated at USD 90,546.5 million in 2024 and is projected to reach USD 185,559.9 million by 2030, growing at a CAGR of 12.8% from 2025 to 2030. Technological advancements, the rising prevalence of chronic diseases, and the increasing integration of EHR with medical devices contribute to the market growth.

Key Market Trends & Insights

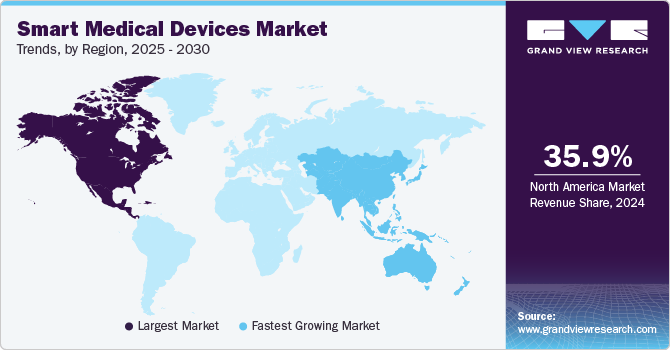

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Sweden is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, therapeutic devices accounted for a revenue of USD 86,571.3 million in 2024.

- Therapeutic Devices is the most lucrative grade segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 90,546.5 million

- 2030 Projected Market Size: USD 185,559.9 million

- CAGR (2025-2030): 12.8%

- North America: Largest market in 2024

In addition, the growing funding from governments and several other institutes is expected to contribute to market growth. For instance, in August 2024, under the U.S. Department of Health and Human Services, the Advanced Research Projects Agency for Health (ARPA-H) launched a new funding initiative through the PRECISE-AI program. This program aims to enhance AI tools in clinical care by detecting misalignments with their training data and auto-correcting them to ensure optimal performance.

Advancements in mobile-based blood pressure monitoring devices are expected to drive significant market growth. Manufacturers are focused on developing innovative, cost-effective, and user-friendly products that cater to the needs of both healthcare providers and patients. Improvements in blood pressure measurement devices, such as digital sphygmomanometers, play a crucial role in this expansion. For instance, in July 2024, Smart Meter introduced its latest innovation-the first cellular-connected blood pressure monitor-specifically designed for cellular remote patient monitoring and chronic care management.

The increase in the prevalence of diabetes due to aging, obesity, and unhealthy lifestyles is one of the factors contributing to the growth of the blood glucose monitoring devices market. Obesity is a major factor leading to diabetes. According to the WHO, in 2022, the number of obese individuals worldwide exceeded 1 billion, including 650 million adults, 340 million adolescents, and 39 million children. This number continues to grow. WHO estimates that if current trends persist, approximately 167 million individuals, including both adults and children, will suffer from deteriorating health conditions related to weight problems by 2025.

In addition to obesity, diabetes is becoming increasingly prevalent globally. The International Diabetes Federation (IDF) estimates that there were 537 million adults (aged 20-79) living with diabetes in 2021, which is expected to increase to 642 million by 2040. The IDF also reports that the prevalence of diabetes is growing globally, with the highest increase witnessed in low- and middle-income countries. In 2021, the regions with the highest number of adults living with diabetes were the Western Pacific (167 million), South Asia (88 million), and Europe (59 million).

Table 1 Global Estimates for Type 1 Diabetes In Children And Adolescents (0-14 Years And 0-19 Years) In 2021

Global population (0-14 years)

1.99 billion

Global population (0-19 years)

2.61 billion

Type 1 diabetes in children and adolescents (0-14 years)

Number of prevalent (existing) cases of type 1 diabetes

651,700

Number of new cases of type 1 diabetes per year

108,300

Type 1 diabetes in children and adolescents (0-19 years)

Number of prevalent (existing) cases of type 1 diabetes

1,211,900

Number of new cases of type 1 diabetes per year

149,500

Furthermore, expanding telemedicine and remote monitoring is expected to drive market growth by enabling continuous patient care outside traditional healthcare settings. Smart devices such as wearable sensors, connected monitors, and mobile health platforms facilitate real-time data collection and transmission to healthcare providers. This improves patient outcomes by allowing early detection of health issues and personalized treatment.

The increasing adoption of telehealth services, driven by advancements in wireless technology and healthcare digitalization, is boosting the demand for smart medical devices in-home care and remote patient management. For instance, in April 2021, Viasat Inc. announced a collaboration to launch an advanced telemedicine and remote patient monitoring solution designed to offer affordable, secure healthcare services, even in remote areas. This enhanced telemedicine platform moved beyond basic video calls by integrating smart diagnostic devices that provide real-time vital data during consultations. This integration enabled healthcare professionals to make more accurate assessments and improve remote patient care quality, creating a more comprehensive clinical experience for patients and providers alike.

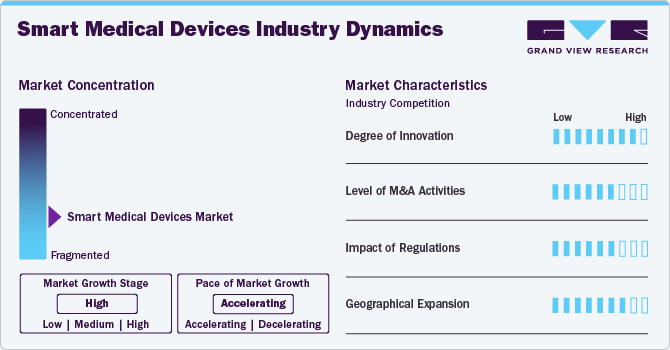

Market Concentration & Characteristics

The degree of innovation in the industry is high. Innovations such as miniaturization, wireless connectivity, and enhanced battery life have enabled the development of smaller, portable, and more user-friendly devices, which improve patient mobility and convenience. Integrating IoT and AI technologies into smart medical devices has allowed real-time data monitoring, remote patient management, and personalized treatment plans, improving diagnostic accuracy and more efficient healthcare delivery. For instance, in May 2024, Smart Meter launched the iGlucose Plus, an advanced version of its cellular-connected glucose meter, improve diabetes management for patients and healthcare providers. This device is designed to facilitate real-time blood glucose monitoring without additional devices such as smartphones or Wi-Fi connections.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance, in November 2023, Nevro Corp. announced the acquisition of Vyrsa Technologies (Vyrsa), a privately held medical technology company specializing in minimally invasive treatment options for patients with chronic sacroiliac joint (SI Joint) pain.

Regulatory trends in the market include increased scrutiny and evolving standards from agencies like the FDA and EMA. Significant developments include introducing a software-as-a-medical device (SaMD) guideline and the integration of real-world evidence into regulatory processes. Moreover, regional regulations aim to facilitate approval, promoting market access for smart medical devices. For instance, in October 2024, Happy Health received FDA clearance for its innovative consumer-oriented platform to deliver clinical-grade healthcare directly to homes. Central to this platform is the Happy Ring, a wearable medical device that combines medical accuracy with all-day comfort. The device monitors vital health metrics, including sleep, heart rate, activity, blood oxygen levels, brain activity, and temperature, all while comfortably worn on the finger.

The industry's regional expansion activities are moderate, driven by an increasing demand for smart medical devices in emerging nations. For instance, in February 2024, Sonova opened a new operations facility in Mexico to expand its cochlear implants and hearing instruments businesses.

“We have been very impressed with the high-quality talent we have been able to bring into our growing team in Mexico, as well as our good collaboration with the local authorities in the run-up to this opening. We will now carefully ramp up the capacity of this important facility, which will allow us to better serve hearing care professionals and people with hearing loss across the Americas region while contributing to our sustainability goals.”

~ Ludger Althoff, Group Vice President Operations of Sonova

Product Insights

Based on product, the therapeutic devices segment dominated the market with a revenue share of 85.18% in 2024 and is expected to witness the fastest growth rate of 12.99% during the forecast period. The rising prevalence of chronic diseases, growing demand for minimally invasive treatments, and advancements in personalized medicine are key drivers of segment growth. These smart medical devices provide precise, targeted therapies, enhancing patient outcomes and reducing the need for hospitalizations. This shift toward more efficient, patient-specific treatments is advancing healthcare delivery and facilitating the adoption of innovative medical technologies.

Diagnostics and monitoring devices is anticipated to grow at a significant CAGR over the forecast period due to the increasing demand for early disease detection and personalized healthcare solutions. Technology advancements in smart hospitals, such as AI and ML, enhance diagnostic accuracy and enable real-time monitoring, allowing healthcare providers to make informed decisions and improve patient outcomes. For instance, in August 2023, Care.ai partnered with Get Well to accelerate the integration of virtual care technologies in smart hospitals. Together, they intend to improve healthcare delivery, enabling seamless virtual patient care experiences while optimizing hospital efficiency, ultimately contributing to the rising demand for the smart diagnostics and monitoring devices market.

Distribution Insights

Based on the distribution, pharmacies dominated the market with the largest revenue share of 39.43% in 2024. Pharmacies have become crucial distribution channels for smart medical devices owing to their enhanced accessibility. As patients increasingly seek convenient solutions for managing chronic conditions at home, pharmacies are well-positioned to fulfill this demand. By integrating smart medical devices into their offerings, pharmacies improve patient engagement and enhance medication adherence & monitoring.

Online channel is expected to grow at the fastest CAGR during the forecast period. Online platforms have made it possible for manufacturers to reach a wider audience and for customers to purchase devices online. In addition, online marketplaces, such as Medtronic's online store, allow customers to browse and purchase devices directly from the manufacturer. This shift towards online distribution has increased accessibility and convenience for customers while reducing costs and improving supply chain efficiency.

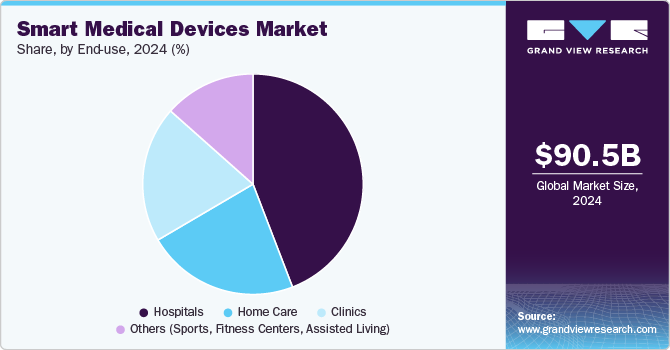

End-use Insights

Hospital dominated the market with the largest revenue share in 2024. The segment's growth can be attributed to the increasing demand for remote patient monitoring, the rising prevalence of chronic diseases, supportive regulatory frameworks for telehealth solutions, and a growing focus on personalized medicine. Moreover, devices such as wearable health monitors, smart infusion pumps, and connected imaging systems allow healthcare hospitals to gather real-time data about patient conditions. Integrating AI into these devices further amplifies their effectiveness by providing predictive analytics to identify potential complications. For instance, Masimo launched a new smart pulse oximeter in 2022 aimed at hospital use, enhancing the ability to monitor oxygen levels remotely for patients in ICUs.

Home healthcare is expected to grow fastest from 2025 to 2030. The rising cost of hospital care, improved technology, an increasing focus on remote patient monitoring, and increasing telehealth integration have significantly shifted patients' preference to get treatment in home care settings rather than hospitals. Furthermore, market players are engaged in collaboration activities to provide advanced technologies for home care settings. For instance, in September 2024, Nonin partnered with Medixine to develop remote digital monitoring services to enhance patient-centric diagnosis of chronic conditions. This collaboration integrates Medixine’s remote patient monitoring digital software platform with Nonin’s pulse oximetry devices in the U.S. market.

Regional Insights

North America dominated the smart medical devices market with the largest revenue share of 35.94% in 2024, owing to the government initiatives to design and implement smart medical devices, such as wearable devices, supportive regulatory bodies enabling the entry of new technologies, and strategic initiatives undertaken by market players. For instance, in August 2024, Stryker announced its acquisition of Care.ai, a startup providing AI-driven solutions for healthcare facilities. Care.ai specializes in patient monitoring, virtual rounding, and AI-powered decision support tools through sensor-based networks. This acquisition is expected to enhance Stryker's expanding health IT and wirelessly connected medical devices portfolio, further strengthening its offerings in the market.

U.S. Smart Medical Devices Market Trends

The smart medical devices market in the U.S. held the largest revenue share in 2024. The growing adoption of advanced healthcare technologies, such as AI and ML, supports the development of innovative, connected devices that enhance patient outcomes. Favorable government initiatives further support adopting and expanding smart medical devices across the healthcare sector. For instance, in April 2023, the U.S. government, through the U.S. Department of Commerce's Economic Development Administration (EDA), designated Minnesota MedTech Hub 3.0 as one of 31 inaugural Tech Hubs. Led by the Minneapolis-Saint Paul Economic Development Partnership, the hub aims to establish Minnesota as a global leader in "Smart MedTech" by integrating AI, ML, and data science into medical technologies.

Europe Smart Medical Devices Market Trends

The smart medical devices market in Europe is poised to grow at the fastest CAGR over the forecast period. The EU is undertaking several initiatives to integrate digital technology with medical devices. It is set to implement a harmonized Health Technology Assessment Regulation (HTAR) in 2025, but it currently excludes digital health technologies. The EDiHTA Project aims to establish a framework for assessing digital health technologies by 2028, addressing the lack of standardized guidance. Moreover, smart hospitals significantly enhance Europe's market by integrating advanced technologies such as IoT, AI, and data analytics into healthcare practices.

The UK smart medical devices market is expected to grow significantly over the forecast period due to government initiatives promoting digital-first primary care. For instance, the NHS Long Term Plan, version 1.2, published in May 2023, highlights integrating digital-first primary care as a new patient option to enhance access to convenient healthcare.

The smart medical devices market in Germany is expected to grow substantially over the forecast period. Strategic initiatives by market players, such as collaborations, research partnerships, and investments in innovative technologies, are significantly advancing the country’s market. For instance, in June 2023, Exo, a company specializing in medical imaging software and devices, partnered with Sana Kliniken AG, a prominent integrated healthcare provider in the German-speaking region with over 120 facilities. This collaboration aims to expand access to Exo's handheld ultrasound platform and AI tools for medical staff, facilitating real-time decision-making that enhances patient outcomes, optimizes workflow, and reduces costs.

Asia Pacific Smart Medical Devices Market Trends

The smart medical devices market in Asia Pacific is expected to grow significantly over the forecast period. The regional growth is driven by rapid advancements in digital healthcare technologies, rising healthcare demands, and the increasing burden of chronic diseases. Furthermore, the launch of smart hospitals in Asia Pacific significantly contributes to the regional market growth by integrating advanced technologies like AI, IoT, and robotics into healthcare operations. For instance, in January 2022, Advantech, in collaboration with Intel, launched Vietnam's first smart hospital project, focusing on integrating advanced medical technologies.

China smart medical devices market is poised to grow substantially over the forecast period. The growth is attributed to advancements in digital healthcare technologies and an increasing demand for personalized care solutions. Innovations like wearable health monitoring devices, AI-driven platforms for chronic disease management, and the integration of data analytics are transforming healthcare delivery, enabling more precise diagnostics and treatment.

The smart medical devices market in India is experiencing significant growth, driven by increasing demand for advanced healthcare solutions, rising chronic disease cases, and government initiatives promoting digital health infrastructure. Innovations in AI, IoT, and wearable technologies are enhancing patient care and diagnostics. Moreover, smart medical rooms contribute significantly to market growth by integrating real-time monitoring, automated systems, and remote access features.

Latin America Smart Medical Devices Market Trends

The smart medical devices market in Latin America is driven by a rising demand for advanced healthcare solutions to manage chronic diseases effectively. Moreover, strategic initiatives undertaken by market players to innovate technologies have contributed to the growing adoption of medical devices in the region. In addition, government initiatives aimed at expanding healthcare access and infrastructure modernization further contribute to market growth. Efforts to integrate digital health solutions and promote telemedicine create a favorable environment for adopting smart medical devices across the region.

Brazil smart medical devices market is experiencing robust growth, driven by several key factors. A significant driver is the increasing prevalence of chronic non-communicable diseases (NCDs), such as diabetes and cardiovascular conditions, which account for approximately 74% of all deaths in the country. This high burden highlights the need for advanced medical technologies that facilitate effective disease management and continuous patient monitoring.

Middle East & Africa Smart Medical Devices Market Trends

The smart medical devices market in the Middle East and Africa (MEA) is witnessing significant growth, driven by increasing healthcare digitization, chronic disease prevalence, and a growing demand for advanced medical technologies. Wearable devices, including fitness trackers and continuous glucose monitors, are gaining popularity as patients and healthcare providers focus on remote monitoring and preventive care. For instance, in February 2024, Dexcom introduced the ONE+, a customizable continuous glucose monitoring solution worn in three different body locations. Dexcom plans to expand the availability of Dexcom ONE+ to the Middle East, Africa, and other European countries in the coming months.

Saudi Arabia smart medical devices market is experiencing rapid growth, driven by significant technological advancements and government initiatives. For instance, in February 2024, Saudi Health launched a new project providing tele-electroencephalogram (EEG) services via the SEHA Virtual Hospital (SVH). This initiative allows medical officers to monitor EEG recordings 24/7 through devices directly connected to the SVH, revolutionizing remote patient care and neurological monitoring. Such developments highlight Saudi Arabia’s commitment to enhancing digital healthcare.

Key Smart Medical Devices Company Insights

The global market is highly competitive, with key players such as Abbott Laboratories, Medtronic, Masimo, and Dexcom, Inc., among others. To gain a competitive edge, key players are involved in new product launches, acquisitions, and partnerships.

Key Smart Medical Devices Companies:

The following are the leading companies in the smart medical devices market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Laboratories

- Medtronic plc

- F. Hoffmann-La Roche Ltd

- Dexcom, Inc.

- Masimo

- Dräger Group (Drägerwerk AG & Co. KGaA)

- Shenzhen Ztsense Hi Tech Co., Ltd

- Smartcardia

- Microlife Corporation

- Beurer GmbH

- Adherium

- Ascensia Diabetes Care Holdings AG

- LifeScan, Inc.

- AgaMatrix, Inc.

- ARKRAY, Inc

- i-SENS, Inc.

- ACON Laboratories, Inc.

- NIPRO CORPORATION

- Garmin

- Fourth Frontier Technologies Private Limited

- Nonin

- Sensoria

- Sonova

- WS Audiology

- Demant A/S

Recent Developments

-

In August 2024, Sonova Holding AG introduced two platforms, Audéo Infinio, and Audéo Sphere Infinio, under the Phonak brand. This marks a new generation of hearing aids developed on a technology platform utilizing real-time AI.

“Solving the speech-in-noise problem is the long-standing goal of modern hearing aid development and essential to improving the quality of life of millions of people with hearing loss. While every user would state we have come a long way in the last 10 years, they will say they still can’t understand conversations as well as they would like to, when background noise is present, like in many crowded places, such as public transport or restaurants. We are convinced that with our new technology, we can make a significant difference for people in need.”

~Arnd Kaldowski, Sonova’s Group CEO

-

In May 2024, Masimo partnered with Medable Inc. to integrate medical-grade wearable devices into clinical research. Medable incorporated Masimo’s MightySat Rx pulse oximeter in its evidence-generation platform for eight large-scale pharmaceutical clinical trials. These trials, involving over 3,000 patients across 25 countries, are focused on two oncology indications: breast and lung cancer.

“Masimo’s SET pulse oximetry is sensitive enough to capture key vitals on the very ill like cancer patients, plus it works on all skin tones, all ages, and is easy to use.”

- Musaddiq Khan, Medable’s Vice President of Digital Outcomes and TA Strategy

-

In May 2024, WS Audiology inaugurated a new R&D center in Hyderabad, India. The hub can accommodate more than 250 engineers and will concentrate on important areas, including the application of AI.

-

In October 2023, Audika, a brand of Demant A/S, acquired the audiology business of Goed Hulpmiddelen and expanded its footprint in Belgium.

Smart Medical Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 101.43 billion

Revenue forecast in 2030

USD 185.56 billion

Growth rate

CAGR of 12.84% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Abbott Laboratories; Medtronic plc; F. Hoffmann-La Roche Ltd; Dexcom, Inc.; Masimo;Dräger Group (Drägerwerk AG & Co. KGaA); Shenzhen Ztsense Hi Tech Co., Ltd; Smartcardia; Microlife Corporation; Beurer GmbH; Adherium; Ascensia Diabetes Care Holdings AG; LifeScan, Inc.; AgaMatrix, Inc.; ARKRAY, Inc; i-SENS, Inc. ; ACON Laboratories, Inc.;NIPRO CORPORATION; Garmin; Fourth Frontier Technologies Private Limited; Nonin; Sensoria; Sonova; WS Audiology; Demant A/S;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Medical Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart medical devices market report based on product, distribution, end-use, and region:

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics and Monitoring Devices

-

Blood Glucose Monitors

-

Pulse Oximeters

-

Breath Analyzers

-

Medical Tricorders

-

Blood Pressure Monitors

-

Smart Thermometers

-

Heart Rate Monitors

-

Smart Contact Lenses

-

Glucose Monitoring

-

Intraocular Pressure Monitoring

-

-

Smart Clothing

-

Embedded Health Sensors

-

Fitness Monitoring

-

-

Wearable ECG Monitors

-

Chest Straps

-

Patches

-

-

-

Therapeutic Devices

-

Portable Oxygen Concentrators & Ventilators

-

Insulin Pumps

-

Hearing Aids

-

Neurostimulation Devices

-

Spinal Cord Stimulation

-

Deep Brain Stimulation

-

Transcranial Magnetic Stimulation

-

-

Smart Inhalers

-

Asthma & COPD Management

-

Connected Inhalers with Data Tracking

-

-

Smart Drug Delivery Systems

-

Wearable Injectors

-

Implantable Drug Delivery Devices

-

-

-

-

Distribution Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmacies

-

Online Channel

-

Direct-to-Consumer (DTC)

-

Others (Hypermarkets, Specialty Retailers)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Home Care

-

Others (Sports, Fitness Centers, Assisted Living)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global smart medical devices market size was estimated at USD 90.55 billion in 2024 and is expected to reach USD 101.43 billion in 2025.

b. The global smart medical devices market is expected to grow at a compound annual growth rate of 12.84% from 2025 to 2030 to reach USD 185.56 billion by 2030.

b. North America dominated the smart medical devices market with a share of 35.94% in 2024. This is attributable to rising government initiatives to design and implement smart medical devices, such as wearable devices, supportive regulatory bodies enabling the entry of new technologies, and strategic initiatives undertaken by market players.

b. Some key players operating in the Smart Medical Devices market include Abbott Laboratories; Medtronic plc; F. Hoffmann-La Roche Ltd; Dexcom, Inc.; Masimo;Dräger Group (Drägerwerk AG & Co. KGaA); Shenzhen Ztsense Hi Tech Co., Ltd; Smartcardia; Microlife Corporation; Beurer GmbH; Adherium; Ascensia Diabetes Care Holdings AG; LifeScan, Inc.; AgaMatrix, Inc.; ARKRAY, Inc; i-SENS, Inc. ; ACON Laboratories, Inc.; NIPRO CORPORATION; Garmin; Fourth Frontier Technologies Private Limited; Nonin; Sensoria; Sonova; WS Audiology; Demant A/S.

b. Key factors that are driving the market growth include technological advancements, the rising prevalence of chronic diseases, and the increasing integration of EHR with medical devices contribute to the market growth. In addition, the growing funding from governments and several other institutes is expected to contribute to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.