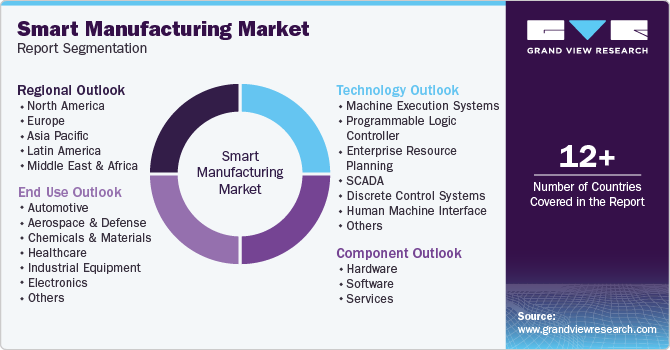

Smart Manufacturing Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Technology (Machine Execution Systems, SCADA, Discrete Control Systems), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-028-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Smart Manufacturing Market Size & Trends

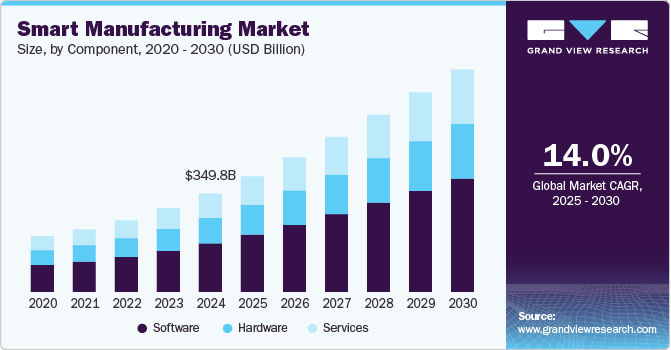

The global smart manufacturing market size was estimated at USD 349.81 billion in 2024 and is projected to grow at a CAGR of 14.0% from 2025 to 2030. The market growth is largely driven by the widespread adoption of Industry 4.0 technologies, including IoT, AI, machine learning, and cloud computing, and the growing demand for automation & cost efficiency. Governments worldwide are promoting smart manufacturing through initiatives focusing on research in technologies such as digital twins and machine condition monitoring. Such programs enhance industrial competitiveness and drive innovation in advanced manufacturing systems. These factors further accelerate the adoption of smart manufacturing solutions across industries, expanding the smart manufacturing industry.

The growing integration of the Industrial Internet of Things (IIoT) in smart manufacturing is another key driver for the industry's expansion. It enables seamless connectivity and data exchange between devices, machines, and systems. By improving visibility into production processes and real-time performance monitoring, IIoT allows manufacturers to increase efficiency, reduce waste, and optimize resource allocation. This shift towards data-driven decision-making fosters productivity gains and cost reductions, encouraging more manufacturers to invest in smart factory technologies, thereby expanding the overall market growth.

In addition, AI and machine learning are driving smart manufacturing industry growth by enabling more intelligent and autonomous production systems. AI algorithms that predict equipment failure optimize production schedules, enhance quality control, reduce operational disruptions, and increase output efficiency. As manufacturers realize the potential of AI in driving operational excellence, more companies are adopting AI-powered solutions, leading to market growth and accelerating the transition to smart, data-driven factories.

Furthermore, advanced robotics and automation are pivotal in expanding the smart manufacturing industry by offering improved production efficiency, cost savings, and labor safety. As robots take over manual, repetitive tasks, they increase productivity, speed up production cycles, and ensure high precision. With the rise of collaborative robots and the ability to automate more complex processes, manufacturers are embracing robotics solutions, resulting in wider industry adoption and contributing significantly to the market’s expansion.

Moreover, digital twins technology is transforming the smart manufacturing industry by enabling manufacturers to create highly accurate virtual representations of physical systems. This capability allows for enhanced simulation, optimization, and proactive maintenance, resulting in lower operational costs and higher product quality. As technology helps companies reduce risks and improve performance before physical implementations, its growing popularity accelerates the expansion of smart manufacturing solutions as more companies incorporate digital twin models to streamline operations.

Component Insights

The software segment accounted for the largest market share of over 49% in 2024, owing to its essential role in enabling data analytics, process optimization, and integration of various manufacturing systems. Software solutions like enterprise resource planning (ERP), manufacturing execution systems (MES), and advanced data analytics tools are critical for real-time monitoring, predictive maintenance, and operational efficiency. As companies increasingly rely on digital tools to optimize their processes, software continues to dominate the market.

The services segment is expected to witness a significant CAGR of over 13% from 2025 to 2030. The growing need for ongoing system integration, maintenance, and real-time support across complex industrial operations drives this rapid growth. As manufacturers increasingly adopt IoT, AI, and cloud-based solutions to optimize productivity and reduce downtime, demand for consulting, implementation, and managed services has surged. Furthermore, the rise of predictive maintenance, remote monitoring, and data-driven decision-making tools is pushing companies to rely more heavily on specialized service providers to ensure seamless integration and scalability of their smart manufacturing ecosystems.

Technology Insights

The discrete control system (DCS) accounted for the largest market share in 2024, owing to its widespread application across industries such as manufacturing, energy, and utilities. DCS systems provide real-time monitoring and control of industrial processes, enhancing operations' efficiency, reliability, and safety. Their ability to manage complex processes and ensure smooth, uninterrupted production is particularly critical in sectors that require high levels of automation and precision, such as chemicals, oil and gas, and energy. This robust demand and the continuous evolution of DCS systems, including advanced analytics and IoT capabilities, contribute to their dominant market position.

The 3D printing segment is expected to witness the fastest CAGR from 2025 to 2030, owing to its growing adoption across industries such as aerospace, automotive, healthcare, and consumer goods. The ability to create complex, customized parts at lower costs and in shorter production cycles makes 3D printing an attractive solution for manufacturers aiming for efficiency and innovation. Moreover, advancements in materials and printing technologies, as well as the increasing need for on-demand production and reduced inventory, are expected to drive the rapid growth of this segment, enabling manufacturers to leverage it for prototyping, spare parts production, and even full-scale manufacturing.

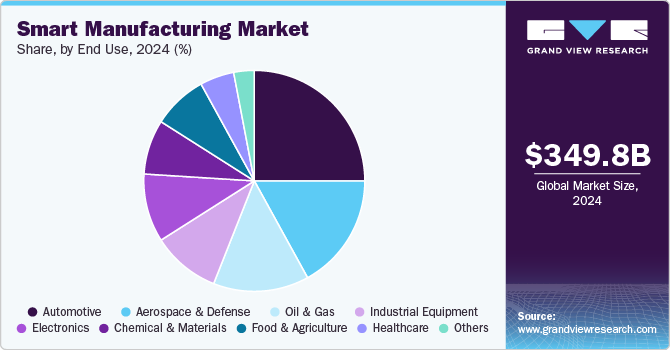

End-use Insights

The automotive industry accounted for the largest market share in 2024, owing to its extensive use of smart manufacturing technologies to improve production efficiency, reduce costs, and enhance vehicle quality. Automotive manufacturers have increasingly adopted advanced robotics, AI, IIoT, and automation to streamline assembly lines, enhance precision in manufacturing, and support mass customization. The rising demand for electric vehicles (EVs) and the push toward sustainable manufacturing practices have also accelerated the industry's investment in smart manufacturing technologies.

The aerospace & defense industry is expected to witness the highest CAGR from 2025 to 2030 as it increasingly adopts advanced manufacturing technologies to meet the growing demand for precision, safety, and innovation in aircraft and defense systems. The industry's need for complex, high-quality components with tight tolerances and the shift towards digital twins, AI-driven predictive maintenance, and advanced robotics is pushing the adoption of smart manufacturing solutions. In addition, increasing government defense spending and the demand for next-generation aircraft and defense systems will further drive investments in smart manufacturing technologies, resulting in the highest growth rate within the market.

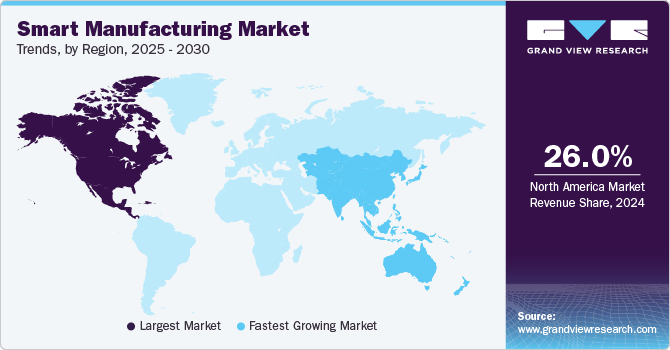

Regional Insights

North America significantly dominated the market with a share of over 26% in 2024, primarily driven by the increasing adoption of Industry 4.0 technologies such as IoT, AI, robotics, and automation. The shift towards sustainable and energy-efficient production processes, along with the growing demand for real-time monitoring and predictive maintenance, further fuels market growth in the region

U.S. Smart Manufacturing Market Trends

The smart manufacturing market in the U.S. dominated in 2024, driven by rapid technological advancements in automation, robotics, AI, and IoT. The U.S. government’s support for advanced manufacturing through initiatives such as "Manufacturing USA" has accelerated the deployment of smart manufacturing solutions. Furthermore, the growing focus on sustainability and energy efficiency, along with the rise of smart factories, is driving manufacturers to adopt innovative solutions for real-time monitoring, predictive maintenance, and improved supply chain management.

Europe Smart Manufacturing Market Trends

The smart manufacturing market in Europe is expected to grow at a CAGR of over 13% from 2025 to 2030. The European Union’s "Industry 4.0" initiative encourages the adoption of smart manufacturing technologies, such as AI, IoT, and robotics, to enhance competitiveness. The region’s emphasis on environmental sustainability drives the demand for energy-efficient and low-emission manufacturing solutions, making smart manufacturing an attractive option.

The UK smart manufacturing market is expected to grow significantly in the coming years, driven by government-backed programs such as the "Made Smarter" initiative and the growing adoption of advanced manufacturing technologies such as IoT, AI, and robotics. Moreover, there is a growing emphasis on sustainable manufacturing practices as the UK works towards its net-zero goals, driving the need for more efficient, resource-conscious manufacturing systems.

The smart manufacturing market in Germany is characterized by its strong industrial base and commitment to Industry 4.0. German brands increasingly use AR/VR to enhance product design and provide virtual product demonstrations. Moreover, Germany’s data protection laws and emphasis on user privacy shape how immersive technologies are deployed, creating a trend toward more secure and transparent customer experiences.

Asia Pacific Smart Manufacturing Market Trends

The smart manufacturing market in Asia Pacific is expected to grow at the highest CAGR of over 15% in 2024, driven by the increasing adoption of advanced technologies in countries. The region’s strong manufacturing base, particularly in electronics, automotive, and consumer goods, has led to the adoption of robotics and digitalization to streamline operations, enhance efficiency, and reduce costs.

Japan smart manufacturing market is gaining traction owing to the country’s high-tech industrial base, particularly in automotive, electronics, and robotics. The Japanese government’s push for advanced manufacturing technologies and the emphasis on innovation for sustainability and energy efficiency further drive the growth of smart manufacturing in the region.

The smart manufacturing market in China is rapidly expanding. The country invests heavily in automation, robotics, AI, and IoT to improve production efficiency, product quality, and competitiveness. China's large-scale manufacturing sector, particularly in electronics, automotive, and consumer goods, increasingly integrates digital technologies to streamline operations and reduce costs while supporting its transition to high-tech industries.

Key Smart Manufacturing Company Insights

Some key players operating in the market are ABB Ltd. and Siemens AG, among others.

-

ABB Ltd. provides innovative solutions that drive digital transformation in the manufacturing, utilities, and transportation industries. ABB specializes in industrial robotics, AI-powered automation, and IoT systems that enhance operational efficiency, reduce costs, and improve sustainability. Its smart manufacturing solutions, including advanced automation and digital services, support manufacturers in optimizing production processes and achieving real-time operational insights, playing a key role in advancing Industry 4.0.

-

Siemens AG is a global technology conglomerate known for its cutting-edge automation, digitalization, and electrification innovations. Siemens AG offers a comprehensive range of smart manufacturing solutions, including industrial automation, AI-driven analytics, digital twins, and IoT platforms. These solutions enable manufacturers to optimize production, improve asset management, and enhance operational efficiency.

FANUC Corporation and Mitsubishi Electric Corporation are some of the emerging market participants.

-

FANUC Corporation specializes in manufacturing computer numerical control (CNC) systems, lasers, industrial robots, and robot machines such as electric injection molding machines and wire electrical discharge machines under brands such as ROBOSHOT and ROBOCUT. With operations spanning Asia, Europe, the Americas, and South Africa, the company is renowned for its innovative automation solutions and robust service support.

-

Mitsubishi Electric Corporation is a multinational company specializing in industrial automation and smart manufacturing technologies. The company offers advanced solutions such as programmable logic controllers (PLCs), industrial robots (MELFA series), and servo motors. The company is committed to Industry 4.0 innovations through strategic investments and partnerships.

Key Smart Manufacturing Companies:

The following are the leading companies in the smart manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Cisco Systems, Inc.

- Siemens AG

- General Electric

- Rockwell Automation Inc.

- Schneider Electric

- Honeywell International Inc.

- Emerson Electric Co.

- FANUC Corporation

- Mitsubishi Electric Corporation

Recent Developments

-

In March 2025, ABB Ltd. expanded its presence in the U.S. and China, strengthening its position in the smart manufacturing industry. The company’s investment in new facilities and technology aims to enhance its production capabilities and support the growing demand for automation and advanced manufacturing solutions.

-

In March 2025, Schneider Electric SE announced a 44 million euro investment in its Dunavecse facility in Hungary to enhance its smart manufacturing capabilities. This investment supports the company's commitment to increasing production capacity for energy management and automation solutions.

-

In January 2025, Siemens AG unveiled groundbreaking innovations in industrial AI and digital twin technology at CES. These advancements are designed to enhance manufacturing processes by integrating AI-driven analytics and virtual representations of physical assets, known as digital twins.

Smart Manufacturing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 410.68 billion |

|

Revenue forecast in 2030 |

USD 790.91 billion |

|

Growth rate |

CAGR of 14.0% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report Product |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, technology, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

ABB Ltd.; Cisco Systems, Inc.; Siemens AG; General Electric; Rockwell Automation Inc.; Schneider Electric; Honeywell International Inc.; Emerson Electric Co.; FANUC Corporation; Mitsubishi Electric Corporation |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet you exact research needs. Explore purchase options |

Global Smart Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart manufacturing market report based on component, technology, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Machine Execution Systems

-

Programmable Logic Controller

-

Enterprise Resource Planning

-

SCADA

-

Discrete Control Systems

-

Human Machine Interface

-

Machine Vision

-

3D Printing

-

Product Lifecycle Management

-

Plant Asset Management

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Chemicals & Materials

-

Healthcare

-

Industrial Equipment

-

Electronics

-

Food & Agriculture

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global smart manufacturing market size was estimated at USD 349.81 billion in 2024 and is expected to reach USD 410.68 billion in 2025.

b. The global smart manufacturing market is expected to witness a compound annual growth rate of 14.0% from 2025 to 2030 to reach USD 790.91 billion by 2030.

b. The automotive segment held the largest share of 25% in 2024 due to the increasing number of IoT devices, connected machinery, and rise in data-driven operations in the auto industry.

b. Some key players operating in the smart manufacturing market include Siemens AG; General Electric; Rockwell Automation Inc.; Schneider Electric; Honeywell International Inc.; and Emerson Electric Co.;

b. Knowledge-based manufacturing, connected supply chains, rising implementation, adoption of Industry 4.0 and increase in the automation are some of the factors driving the smart manufacturing market.

b. The software segment accounted for the largest share of more than 49% in 2024 in the smart manufacturing market and is expected to continue its dominance over the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."