- Home

- »

- Healthcare IT

- »

-

Smart Jewelry Market Size, Share & Growth Report, 2030GVR Report cover

![Smart Jewelry Market Size, Share & Trends Report]()

Smart Jewelry Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Activity Tracking, Heart Rate Monitoring), By Operation System (Android, IOS), By Product, By Age Group, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-977-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Jewelry Market Summary

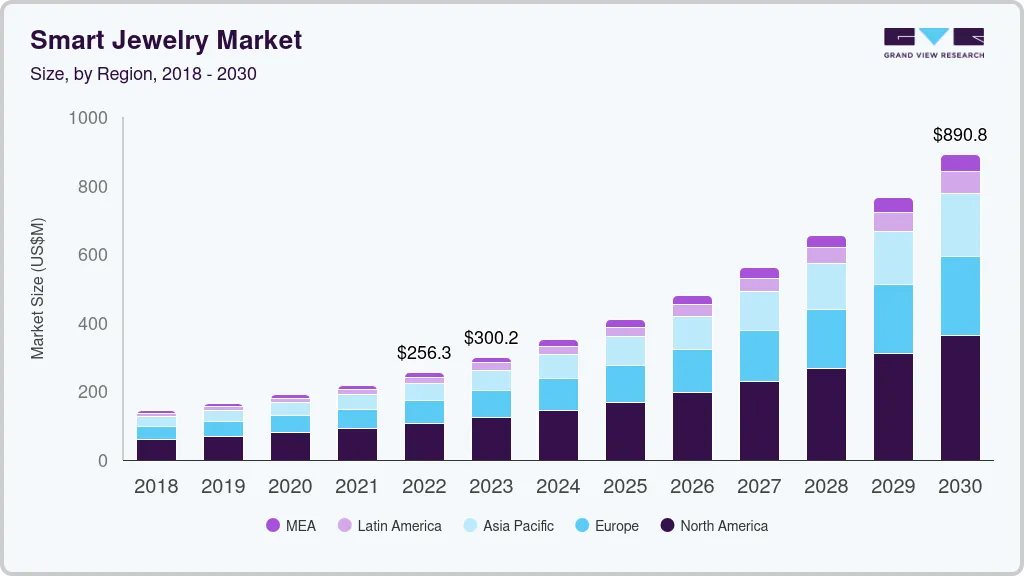

The global smart jewelry market size was estimated at USD 256.3 million in 2022 and is projected to reach USD 890.8 million by 2030, growing at a CAGR of 16.8% from 2023 to 2030. Growing innovation strategies and rising acceptance of smart jewelry particularly among female consumers are some of the key growth drivers.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2022.

- Country-wise, Germany is expected to register the highest CAGR from 2023 to 2030.

- In terms of segment, activity tracking accounted for a revenue of USD 95.1 million in 2022.

- Activity tracking is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 256.3 Million

- 2030 Projected Market Size: USD 890.8 Million

- CAGR (2023-2030): 16.8%

- North America: Largest market in 2022

A variety of rings, bracelets, necklaces, and earrings are referred to as "smart jewelry," which is a subgenre of wearable technology.

The category attempts to increase a person’s life' productivity, communications, and health. In India, Pebble introduced its new Iris smart ring in September 2024. The wearable boasts a stainless-steel construction and smart touch controls. It comes equipped with Advanced Sleep Monitoring, which tracks HRV continuously and offers Sleep Management for deep sleep and light naps. In addition, it keeps tabs on body temperature, heart rate variability, caloric expenditure, and blood oxygen levels.

In addition, it is projected that during the projection timeframe, demand for wellness and fitness items will increase due to the growing popularity of these gadgets among amateur and professional athletes. Additionally, the industry is anticipated to profit from expanding smartphone penetration, increasing disposable incomes, and growing public awareness of the advantages of wearable electronics. The growth opportunities are further aided by the R&D efforts of several market participants.

Moreover, the entry of new market players in the market will further drive the demand for smart jewelry. In August 2024, several reports stated that Apple filed patents for several smart rings, each with unique features but intended to be used in conjunction. According to the patent paperwork, Apple could be developing three individual ring devices with specific functions including health monitoring, voice-activated assistance, and gesture manipulation.

The demand for smart jewelry is projected to increase due to the growing popularity of connected devices and the Internet of Things (IoT), as well as the rapidly expanding worldwide population of technologically knowledgeable individuals. Additionally, the adoption of wearable gadgets like activity trackers and body monitors that offer real-time data on the user's general welfare, such as obesity and chronic diseases, has been influenced by their rising prevalence. These wearables also provide data on daily activities and physiological information, including sleep quality, heart rate, blood oxygen saturation, blood pressure, cholesterol level, and calories burned:

Moreover, increasing product launches and approvals are fostering market expansion. In June 2023, Teltonika, a high-tech company group based in Lithuania, initiated the manufacturing of TeltoHeart, a versatile smart medical wristband created to assist individuals with heart rhythm issues.

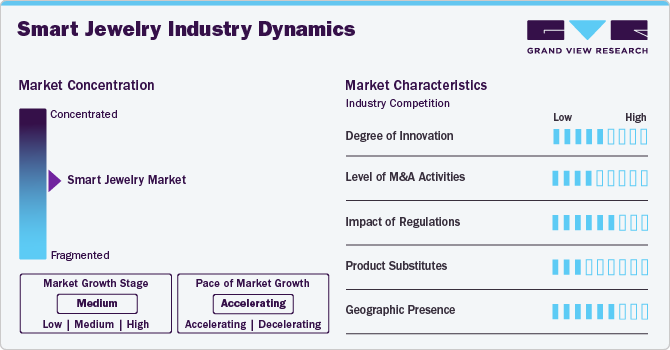

Market Concentration & Characteristics

The market is witnessing a remarkable degree of innovation, driven by advancements in technology and evolving consumer preferences. This sector is increasingly merging aesthetics with functionality, as designers incorporate health monitoring features, notifications, and even payment systems into stylish accessories. Companies are leveraging materials like advanced polymers and precious metals, integrating sensors that track fitness metrics or provide alerts discreetly. Moreover, the rise of customizable and modular designs allows users to tailor their smart jewelry to their personal style and functional needs.

The market is characterized by a medium level of merger and acquisition (M&A) activity. These M&A activities enable access to complementary expertise, technologies, and various distribution channels, enabling companies to enhance operational efficiency, accelerate product development, and capture a larger market share. For instance, in September 2024, Oura, a manufacturer of smart rings, purchases Veri, a company specializing in metabolic health. This acquisition will enable Oura to introduce Meals, a metabolic health service that enables users to monitor how the timing of their meals impacts sleep, recovery, and stress measurements.

As the number of connected devices increases, regulations are being updated to ensure that data collected by smart jewelry, including health metrics and location information, is handled securely and ethically. Manufacturers must comply with standards such as GDPR in Europe or other data protection laws in different regions, which means implementing strong data security measures. This can impact the design and development timelines of the products.

Traditional accessories like watches and bracelets often compete with smart jewelry for consumer attention, especially among those who prioritize aesthetics over functionality. Additionally, fitness trackers and smartwatches, which offer similar health monitoring features, can be viable alternatives for tech-savvy individuals.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Moreover, increasing investment in the development of smart jewelry will supplement its demand. For instance, in March 2024, Ultrahuman, a company that produces wearable technology such as a continuous glucose monitor (CGM), a habit-tracking ring, and a forthcoming home health device, has secured USD35 million in a Series B funding round that includes both equity and debt. This funding will be used to support the company's growth and to finance advanced research in health monitoring.

Application Insights

The activity tracking segment dominated the market and accounted for the largest revenue share of 37.7% in 2024. Increased consumer disposable income levels, growing internet and smartphone penetration, and growing awareness of health and fitness are all major contributors to the market growth. The target market for fitness trackers includes younger adults and working-class members. There is growing awareness of fitness and health among these groups, leading to an increase in fitness activities. This trend is driving research and development efforts to create more advanced products.

In a study released in the journal Science Advances in July 2022, a group from The Ohio State University showcased a wireless biochemical sensor that operates without a battery. This sensor can detect the glucose, or blood sugar, that humans release through their skin during physical activity. The Ohio State team created a "smart necklace" with a fully functional clasp and pendant. When worn around the neck, this necklace was utilized to track the glucose levels of the research participants as they engaged in physical exercise.

The heart rate monitoring segment is anticipated to witness the fastest CAGR from 2025 to 2030. Growing adoption of strategic initiatives by key market players is driving the industry growth. In February 2024, the Samsung Galaxy Ring was revealed at MWC 2024. This wearable gadget provides functions such as pulse monitoring, body temperature tracking, and potential blood pressure monitoring. Moreover, the Covid-19 pandemic has significantly increased awareness about these devices. The rising adoption has led to an increase in device development & innovation as more market players race in to deliver the growing demand and capture a higher revenue share.

Operating System Insights

Android segment dominated the smart jewelry market in 2024 and accounted for the largest revenue share of 54.7%. The key factor contributing to this share includes the rising adoption of android smartphones across the globe. For instance, according to a report by Techjury, the number of Android smartphone users in the US reached 144.01 million in 2023, marking a rise of 10.61 million from the previous year. With a growing number of consumers using Android smartphones, developers are motivated to create innovative applications tailored for smart jewelry, expanding functionality in areas like health monitoring, notifications, and personalized settings.

The IOS segment is anticipated to witness the fastest CAGR from 2025 to 2030 due to its strong user base and the premium positioning of Apple products. With iPhones and Apple Watches leading the market, smart jewelry that seamlessly integrates with iOS devices can leverage this established ecosystem to offer enhanced functionality, thereby supplementing segmental growth. Additionally, the App Store provides a robust platform for developers to create innovative applications specifically tailored for smart jewelry.

Product Insights

The smart bracelets segment dominated the market and accounted for the largest revenue share of 35.4% in 2024. Increasing research and development activities for advancing the function of smart bracelets is boosting segmental growth. For instance, in August 2023, Corsano Health, a prominent MedTech company engaged in the development, manufacturing, and promotion of medical-grade continuous health monitoring, announced the incorporation of Cuffless Blood Pressure measurements into its advanced smart bracelet. The CardioWatch 287-2 is a wireless remote monitoring system certified under EU-MDR, designed for the continuous gathering of physiological data in both home and healthcare environments. This encompasses monitoring of sleep, heart rate, respiration rate, heart rate variability (R-R interval), activity, SpO2, ECG, Blood Pressure, and Body Temperature.

The ring segment is anticipated to witness the fastest CAGR from 2025 to 2030 due to the strong customer preference for smart rings. In October 2024, Oura unveils an updated design and new sensors for USD 349 in their latest smart ring. The rings from this company monitor exercise, sleep, heart health, stress, and other metrics, empowering users to gain insights about their bodies and adopt healthier habits. The Oura Ring 4 features a more streamlined design, new sensors, and a battery life of up to eight days.

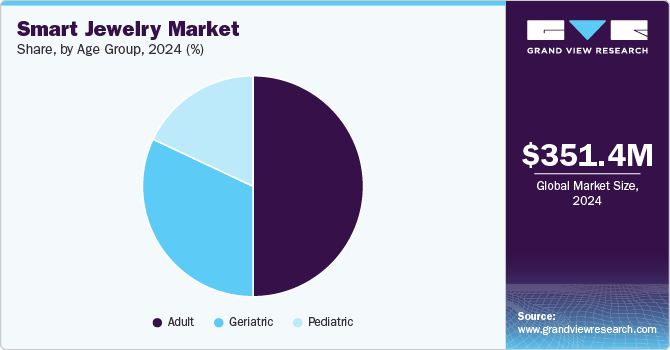

Age Group Insights

The adult segment dominated the market and accounted for the largest revenue share of 49.6% in 2024. The awareness regarding fitness and health is growing especially in the younger adults and working-class population. In 2023, approximately 40 percent of adults in the U.S. are utilizing healthcare-related apps, while 35 percent are making use of wearable healthcare gadgets, as per a Morning Consult survey. Similarly, according to a 2023 article, nearly 33% of Americans employ a wearable gadget, like a smartwatch or fitness band, to monitor their health and physical activity. This information is based on the responses of thousands of adults who took part in the Health Information National Trends Survey.

The pediatric segment in the market is anticipated to witness the fastest CAGR from 2025 to 2030 due to the increasing emphasis on health and safety for children. In November 2023, Munich-based startup Leevi Health developed "Lilio", a smart bracelet containing small sensors to monitor crucial health metrics of infants and transmit the information to their parents' smartphones. Leevi Health, the company, has finished a prosperous initial funding phase, raising USD 2.4 million. This funding is used to launch the groundbreaking product "Lilio" in the market.

Regional Insights

The North America smart jewelry market dominated the global market and accounted for the largest revenue share of 41.2% in 2024. High disposable incomes and a tech-savvy population eager to adopt wearable technology are driving regional growth. The presence of major tech hubs and a culture of innovation further stimulate research and development, thereby supplementing industry growth.

U.S. Smart Jewelry Market Trends

The smart jewelry market in U.S. held the largest revenue share of 77.6% in 2024. Growing research and development activities in the U.S. are driving the demand for smart jewelry. In March 2024, the University of Washington revealed the Thermal Earring, a wireless wearable device with the potential to transform personal health monitoring. This groundbreaking gadget constantly tracks the temperature of the user's earlobe and could have various uses such as monitoring ovulation, stress levels, eating habits, and physical activity.

Europe Smart Jewelry Market Trends

Europe smart jewelry market is anticipated to register a significant growth rate during the forecast period. The increasing adoption of smartphones and wearable devices are accelerating regional growth. Moreover, as European regulations regarding data protection and privacy become more stringent, consumers are gaining increased trust in the security of smart devices, leading to broader adoption.

The smart jewelry market in Germany is anticipated to register a considerable growth rate during the forecast period. The market is growing due to the existence of high-end department stores and boutiques in the area. Additionally, the rising prevalence of chronic illnesses is contributing to the expansion of the market.

UK smart jewelry market is anticipated to register a considerable growth rate during the forecast period. The increasing availability of smart jewelry in the country is escalating market growth. The company ŌURA, known for its smart ring that provides personalized health information, advice, and daily guidance, revealed its initial retail collaboration in the UK with John Lewis in May 2024. As of May 2024, the Oura Ring can be purchased on JohnLewis.com and will be gradually introduced in all 34 John Lewis department stores across the country.

Asia Pacific Smart Jewelry Market Trends

The smart jewelry market in Asia Pacific is expected to witness the fastest growth over the forecast period. Increasing adoption of fitness trackers and growing awareness regarding overall health &fitness among the working-class population are propelling regional growth. In addition, a rise in consumer disposable income levels, easy availability of advanced products of various brands, and the growing e-commerce penetration in Asia Pacific will drive the regional market over the coming years

India smart jewelry market is anticipated to register the fastest growth rate during the forecast period. Surging product launches in the country are fostering market growth. In India, boAt, a prominent wearable brand, unveiled its inaugural smart ring in July 2023. The smart ring is a fashionable and lightweight accessory designed to monitor health and fitness metrics such as heart rate, sleep patterns, and menstrual cycles.

Latin America Smart Jewelry Market Trends

The smart jewelry market in Latin America is anticipated to register a considerable growth rate during the forecast period. Advancements in technology, such as miniaturization of sensors and improved battery life, are enabling the creation of more sophisticated and comfortable smart jewelry, thereby fostering market growth.

Brazil smart jewelry market is anticipated to register a considerable growth rate during the forecast period. Entry of key market players in the region is driving market growth. Samsung revealed in September 2024 that the Galaxy Ring would be introduced to additional global markets. Most recently, the ring has been made accessible in Brazil and Mexico.

Middle East And Africa Smart Jewelry Market Trends

The smart jewelry market in the Middle East and Africa region is experiencing lucrative growth in the smart jewelry market. Rising disposable incomes and increasing smartphone penetration are fostering regional growth.

South Africa smart jewelry market is anticipated to register a considerable growth rate during the forecast period. Factors such as increasing healthcare spending in the country and the growing prevalence of chronic diseases are likely to contribute to market growth over the forecast period.

Key Smart Jewelry Company Insights

Key participants in the market focus on developing innovative business growth strategies through mergers and acquisitions, partnerships and collaborations, product portfolio expansions, and business footprint expansions.

Key Smart Jewelry Companies:

The following are the leading companies in the smart jewelry market. These companies collectively hold the largest market share and dictate industry trends.

- Bellabeat

- Oura Health Oy.

- RINGLY

- Samsung

- Motiv, Inc.

- Ultrahuman

- Corsano Health

- Wellue

- Pebble

Recent Developments

-

In August 2024, RingConn introduced its second-generation Smart Ring on Kickstarter, which includes built-in sleep apnea monitoring. This product provides 10 to 12 days of battery life, a small form factor, and extensive health tracking capabilities.

-

In June 2024, Incora Health, a startup that focuses on smart earrings, secures funding from XRC Ventures. With the financial backing from XRC Ventures, the Incora Health team intends to carry out clinical trials and introduce the product to the market.

-

In November 2023, a Munich-based startup called Leevi Health developed "Lilio", a smart bracelet containing tiny sensors that monitor crucial health indicators of infants and transmit the information straight to their parents' smartphones.

Smart Jewelry Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 411.1 million

Revenue forecast in 2030

USD 890.8 million

Growth rate

CAGR of 16.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, age group, operating system, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Bellabeat; Oura Health Oy.; RINGLY; Samsung; Motiv, Inc.; Ultrahuman; Corsano Health; Wellue; Pebble

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Jewelry Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global smart jewelry market report based on the application, product, age group, operating system, and region:

-

Application Outlook (Revenue USD Million, 2018 - 2030)

-

Activity tracking

-

Heart rate monitoring

-

Sleep tracking

-

-

Operating System Outlook (Revenue USD Million, 2018 - 2030)

-

Android

-

IOS

-

-

Product Outlook (Revenue USD Million, 2018 - 2030)

-

Pendent

-

Smart Bracelets

-

Ring

-

Others

-

-

Age Group Outlook (Revenue USD Million, 2018 - 2030)

-

Pediatric

-

Adult

-

Geriatric

-

-

Regional Outlook Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global smart jewelry market size was estimated at USD 351.4 million in 2024 and is expected to reach USD 411.1 million in 2025.

b. The global smart jewelry market is expected to grow at a compound annual growth rate of 16.7% from 2025 to 2030 to reach USD 890.8 million by 2030.

b. North America dominated the smart jewelry market with a share of 41.2% in 2024. This is attributable to rising cases of health issues related to sedentary lifestyles, the advent of innovative products by key market players, and the growing penetration of smartphones and the internet.

b. Some key players operating in the smart jewelry market include Misfit (Fossil Group), Bellabeat, InvisaWear, Ringly, Fitbit (Google LLC), Oura Health Oy, Totwoo Smart Jewelry, Wellue, Motiv, Capri Holdings

b. Key factors that are driving the smart jewelry market growth include rising acceptance of smart jewelry particularly among female consumers, the growing popularity of connected devices and the Internet of Things, growing awareness of health and fitness with the respective fashion trend

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.