Smart Home Security Camera Market Size, Share & Trends Analysis Report By Technology (Wired Camera, Wireless Camera), By Application (Doorbell Camera, Indoor Camera), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-529-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

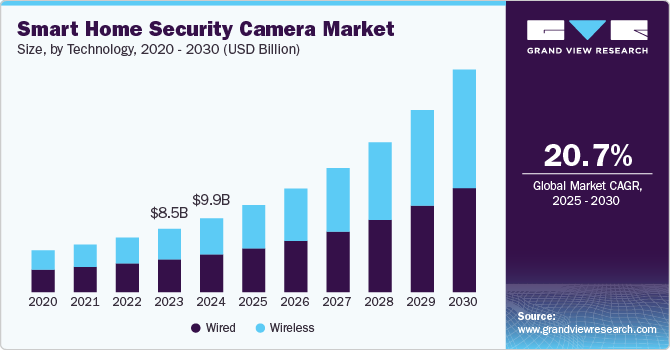

The global smart home security camera market size was estimated at USD 9.98 billion in 2024 and is expected to grow at a CAGR of 20.7% from 2025 to 2030. The increase in smart home security camera usage is attributed to a surge in regional thefts and the cameras' proven ability to prevent burglaries. In addition, integrating these cameras with the expanding smart home ecosystem further propels their popularity and drives the smart home security camera market. Advancements in technology have led to the development of sophisticated AI-powered security cameras that can differentiate between regular activities and potential threats. These intelligent systems enhance the overall efficiency of home security, reducing false alarms and providing more accurate threat detection.

The rising incidence of thefts and break-ins is significantly fueling the demand for advanced home security solutions, particularly smart security cameras. With urban areas experiencing increased property crime, homeowners and businesses increasingly prioritize surveillance and security. As these incidents often lead to costly damage and loss, consumers recognize the need for proactive measures. Smart security cameras provide real-time monitoring, deterrence, and a sense of safety. This heightened security awareness is a primary factor driving the growth of the smart home security camera market.

According to the 2023 Home Security Market Report published by SafeHome, 72% of households across the U.S. are equipped with at least one home security device. Amongst these households, 51 million have opted for video surveillance systems, while 39 million have installed alarm systems.

In addition, according to data from the Office for National Statistics, in the year 2023/2024, there were 181,617 reported home burglaries across England and Wales, averaging 498 burglaries per day, which equates to a house being burgled every 173 seconds. The London Metropolitan area recorded the highest number of burglaries at 37,416, translating to 103 per day or one every 14 minutes. Other regions with significant burglary rates included the West Midlands and Greater Manchester. Notably, 70% of burglaries involved entry through doors, and over 50% occurred while someone was home. The statistics indicate that while no area is completely safe, there are considerable regional differences in burglary frequency, emphasizing the importance of awareness for potential victims. This factor is expected to drive market demand and growth during the forecast period.

Furthermore, technological advancements have significantly driven the smart home security camera industry. Smart cameras that notify users of any movements when no one is at home are gaining traction. An increasing number of younger consumers are buying homes, and this set of homeowners is no longer content with traditional devices. This scenario has driven the penetration of new technologically advanced smart devices such as smart plugs, smart locks, smart light bulbs, and smart home security, among others. The rising construction of smart homes in combination of luxury and convenience-also boosts the demand for smart home security cameras.

Consumers are more inclined to build safe homes and increasingly opt for AI-powered gadgets. A smart home security camera not only helps conserve power and energy but also offers the ultimate convenience through different features such as a motion sensor, window sensor, burglar alarm, glass break sensor, and spotlight camera.

According to 2023 package theft annual research by Security.org, porch pirates stole USD 8 Billion worth of goods, and 44% of Americans experienced package theft at some point; however, with a doorbell camera, consumers are notified as soon as the packages are delivered, and they can even instruct the deliverymen where to place them. Consumers are warned immediately if anyone passes by or attempts to steal the package and can call out to them through the doorbell camera speakers.

Furthermore, these smart home security cameras provide 24-hour real-time alerts when connected to a smartphone or any other device. Some cameras include additional features such as two-way audio, video analytics, motion detection, and high-resolution viewing. All these factors are expected to show notable growth and demand for the smart home security camera market during the forecast period.

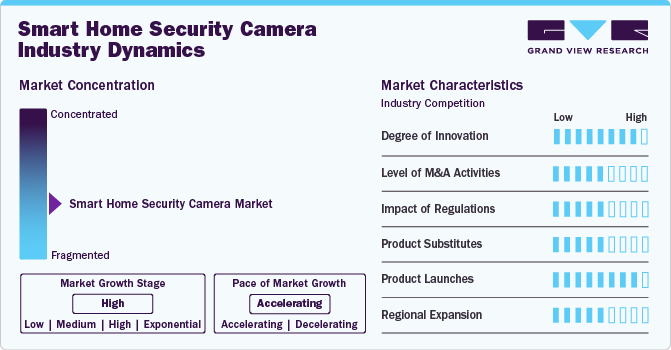

Market Concentration & Characteristics

The global smart home security camera industry is characterized by a high degree of innovation, with new technologies and methods being developed and introduced regularly. Continuous technological advancements, particularly in artificial intelligence (AI), machine learning, and image processing, contribute to smart home security camera innovation. These technologies enable features such as facial recognition, object detection, and improved video analytics, enhancing security cameras' overall capabilities.

Several market players, such as ADT Inc., Brinks Home Security, Wyze Lab, Inc., and SimpliSafe, Inc., are involved in mergers and acquisitions (M&A). Through M&A, these companies can expand their geographic reach and enter new territories.

Regulatory frameworks frequently impose guidelines and requirements pertaining to the privacy of people captured by surveillance devices. To ensure privacy rights are protected, smart home security cameras may be subject to regulations that require features such as facial blurring, user consent mechanisms, or limitations on where cameras can be placed. Compliance with privacy laws is critical for both manufacturers and users to avoid legal consequences and ensure responsible surveillance technology use.

Smart home security cameras are necessary because of their advanced features, such as real-time monitoring and integration with smart home ecosystems, which provide enhanced security and convenience. Traditional security cameras, webcams, DIY surveillance systems, baby monitors, dummy cameras, home automation sensors, smart doorbells without cameras, and outdoor lighting with motion sensors are available as alternatives. These alternatives differ in terms of features and limitations, catering to various needs and preferences in terms of cost, functionality, and ease of use.

Demographic Analysis

According to a 2023 survey by LendingTree, a U.S.-based online lending marketplace, more than 50% of American homeowners utilize home surveillance technology, which includes the deployment of cameras. When integrating electronic surveillance into their homes, younger homeowners show a higher inclination than their older counterparts.

Millennial homeowners aged 27 to 42 lead this trend with an adoption rate of 72%, closely followed by Gen Z homeowners (aged 18 to 26) at 69%. Meanwhile, Gen X homeowners (aged 43 to 58) exhibit a usage rate of 47%, and baby boomer homeowners (aged 59 to 77) follow with a 30% adoption rate.

Technology Insights

Wired smart home security cameras accounted for a revenue share of 51.04% in 2024. With rising thefts, burglaries, and security breaches, homeowners actively seek effective surveillance systems to protect their properties. Wired smart home security cameras provide a stable and consistent connection, ensuring uninterrupted monitoring and prompt alerts for suspicious activities.

Crime rates vary greatly from country to country and are influenced by many factors. Some of the world's lowest crime rates are in Switzerland, Denmark, Norway, Japan, and New Zealand. According to the World Population Review, the 5 countries with the highest crime rate (crimes per 100,000 people), as identified in 2023, are Venezuela, Papua New Guinea, South Africa, Afghanistan, and Honduras. This increase in crime rates in countries shows notable opportunities for the market during the forecast period.

The wireless smart home security camera market is expected to grow at a CAGR of 22.3% from 2025 to 2030. Innovations such as customizable surveillance zones, hybrid connections, floodlight cameras, and differentiation between pets, cars, or animals are increasing the demand for wireless smart home security cameras. In September 2023, Philips Hue launched Philips Hue Secure, marking the brand's entry into the smart home security industry. This self-installation security system features innovative cameras and sensors designed to seamlessly integrate with Philips Hue's intelligent lighting system, deterring potential intruders. In the event of a security alert, the synchronized Hue lights can dynamically flash in red or white, accompanied by an alarm from the connected camera.

Furthermore, wireless smart home security cameras provide a wide range of advantages, including being easier to set up, customize, and use, having advanced features such as machine learning, Making extensive use of cloud storage, offering access to film from any location, and being very flexible in terms of placement. All these factors are expected to further augment the growth of the smart home security camera market during the forecast period.

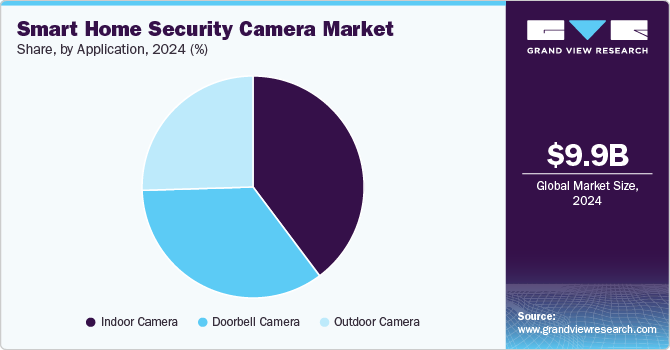

Application Insights

Smart indoor cameras accounted for a revenue share of 39.77% in 2024 in the smart home security camera market. There is an increase in the number of theft and burglary cases, which has raised public awareness about the importance of protecting one's house from criminal activity. Indoor smart cameras offer a variety of capabilities, including instant messaging in the event of a theft, alarm activation, and movement and behavior recognition, which has led to their widespread use in a variety of applications. Furthermore, An indoor security camera is an economical alternative to a full security system for consumers who live in a small apartment and want to keep an eye on their belongings when they are not at home. Nearly all freestanding security cameras link to a customer's home Wi-Fi so they can check on things from their cell phone or tablet. A majority of these cameras include built-in motion and sound sensors that send push and email notifications when those sensors are triggered.

The smart doorbell security camera market is expected to grow with a CAGR of 21.3% from 2025 to 2030. According to 2023 package theft annual research by Security.org, porch pirates stole $8 Billion worth of goods, and 44% of Americans experienced package theft at some point; however, with a doorbell camera, consumers are notified as soon as the packages are delivered, and they can even instruct the deliverymen where to place them. Consumers are warned immediately if anyone passes by or attempts to steal the package and can call out to them through the doorbell camera speakers. These factors are expected to augment the demand and growth of the world's smart doorbell security camera market during the forecast period.

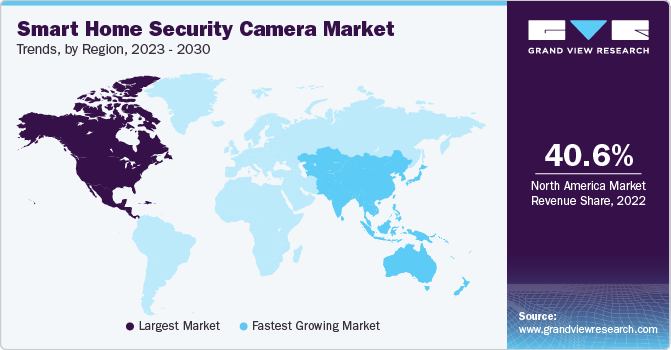

Regional Insights

The North America smart home security camera market led the industry and accounted for a revenue share of 41.06% in 2024. In North America, the demand for smart home security cameras is primarily driven by heightened safety concerns and rising crime rates in urban areas. As homeowners seek effective solutions to protect their properties and families, smart security cameras have emerged as a popular choice due to their ability to provide real-time monitoring, alerts, and remote access. The integration of advanced features such as high-definition video, night vision, and motion detection has made these cameras more appealing, allowing users to feel more secure and informed about their surroundings.

In addition, the growing trend of home automation plays a significant role in the increasing adoption of smart security cameras. As more consumers invest in smart home ecosystems that include devices like smart locks, lights, and voice assistants, the demand for security cameras seamlessly integrating with these systems has surged.

U.S. Smart Home Security Camera Market Trends

The U.S. smart home security camera market is expected to grow at a CAGR of 21.5% from 2025 to 2030. According to Parks Associates, the ownership of video doorbells in U.S. internet households has surged to 20% in 2023, up from 4% in 2017, reflecting increased consumer adoption of smart home security devices. In addition, as per the 2023 Home Security Market Report published by SafeHome, a significant 72% of households across the U.S. are equipped with at least one home security device. Among these households, 51 million have opted for video surveillance systems, while 39 million have installed alarm systems. These statistics show high demand for the smart home security camera market in the U.S. during the forecast period.

Europe Smart Home Security Camera Market Trends

The Europe smart home security camera market is expected to grow at a CAGR of 20.2% from 2025 to 2030.Emerging technologies and applications such as multi-dimensional perception, UHD, low-light imaging, artificial intelligence, and cloud technology open new possibilities for the security industry. At the same time, millions of cameras and other security devices are being connected to networks, making the security industry in Europe an important part of the future European IoT world.

Moreover, video doorbell cameras are becoming very popular in different parts of Europe. The biggest reason for choosing these cameras is that they can be operated both as rechargeable batteries or wired, driving the growth and demand for the region's smart home security camera market during the forecast period.

Asia Pacific Smart Home Security Camera Market Trends

The smart home security camera market in Asia Pacific is expected to grow at a CAGR of 21.9% from 2025 to 2030.Countries in the Asia Pacific are heavily surveilled, and China is one of the countries covered the most. Globally, there are already 770 million cameras in use, with 54% of these being in China. According to a survey by Comparitech in 2023, 16 out of the top 20 most surveilled cities (based on the number of cameras per 1,000 people) are in China.Indore, Hyderabad, and Delhi (all in India) were the only cities outside China to make the top 20, taking the fourth, twelfth, and sixteenth places, respectively. Delhi, Chennai, Singapore, Seoul, and Mumbai are all featured in the top 20. Delhi and Chennai (India) have more cameras per square mile than any Chinese city. These figures prove that Asia Pacific is a highly lucrative market for smart home security cameras, which is expected to drive the regional market during the forecast period.

Key Smart Home Security Camera Company Insights

ADT Inc., Vivint Smart Home, Inc., Nest Labs, and Samsung Electronics Co, Ltd. are some of the market's dominant players.

-

Vivint Smart Home, Inc. provides a range of smart home devices, including locks, lights, cameras, thermostats, smoke and carbon monoxide detectors, garage door control, car protection, and security sensors. Furthermore, they offer comprehensive home systems featuring in-home consultations, professional installations, and ongoing support services.

-

ADT Inc. operates and markets across three reportable segments such as operates: Commercial, Consumer, Small Business, and Solar segments.

-

Samsung Electronics Co, Ltd. operates at several facilities across the U.S., Asia, Europe, and Central & South America and has reached more than 74 markets through direct sales and distributors.

Wyze Lab, Inc., Blink, Skylinkhome, Frontpoint Security Solution, LLC, and Xiaomi Inc. are some of the emerging market players in the smart home security camera sector. Wyze Labs, Inc., known simply as Wyze, specializes in smart home products and wireless cameras. Xiaomi Inc.’s product range is diverse, extending from smartphones to televisions, wearable items, and a variety of smart home products within its Internet of Things and Xiaomi Smart Home ecosystems.

Key Smart Home Security Camera Companies:

The following are the leading companies in the smart home security camera market. These companies collectively hold the largest market share and dictate industry trends.

- Vivint Smart Home, Inc.

- ADT Inc.

- SimpliSafe, Inc.

- Brinks Home Security

- Xiaomi Inc.

- Skylinkhome

- Samsung Electronics Co, Ltd.

- Frontpoint Security Solution, LLC

- Arlo Technologies, Inc.

- Wyze Lab, Inc.

- blink

- eufy (Anker Innovations)

- Ring LLC

Recent Developments

-

In November 2024, Sensormatic Solutions, a leading global retail brand under Johnson Controls, partnered with Thruvision, a pioneer in walk-through security screening technology, to enhance people screening in retail environments. This collaboration aims to provide retailers with advanced passive terahertz camera technology that complements Sensormatic's loss-prevention solutions. The technology enables efficient detection of concealed items, such as weapons and stolen goods, from a distance of up to seven meters without emitting radiation or compromising individual privacy.

-

In October 2024, Ring LLC added 24/7 recordings in its security cameras. This will allow a camera to record continuously rather than just when it detects motion, which is how Ring’s cameras and video doorbells normally operate.

-

In May 2024, Eufy introduced the Eufy S330, which is a fully autonomous LTE surveillance camera featuring a 360-degree field of vision and a solar panel for continuous power. This innovative camera not only delivers high image quality but also moves on its own, utilizing AI tracking to easily monitor expansive areas. Now available, the Eufy S330 redefines home security with its advanced technology and reliable performance.

Smart Home Security Camera Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 11.77 billion |

|

Revenue forecast in 2030 |

USD 30.10 billion |

|

Growth rate (revenue) |

CAGR of 20.7% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa |

|

Key companies profiled |

Vivint Smart Home, Inc.; ADT Inc.; SimpliSafe, Inc.; Brinks Home Security; Xiaomi Inc.; Skylinkhome; Samsung Electronics Co, Ltd.; Frontpoint Security Solution, LLC; Arlo Technologies, Inc.; Wyze Lab, Inc.; blink; eufy (Anker Innovations); Ring LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Smart Home Security Camera Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart home security camera market report based on technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Doorbell Camera

-

Indoor Camera

-

Outdoor Camera

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include the growing penetration of smart homes, particularly in developing as well as developed states, and rising prominence for security devices through the home automation process in order to access security 24/7.

b. The global smart home security camera market size was estimated at USD 9.98 billion in 2024 and is expected to reach USD 11.77 billion in 2025.

b. The global smart home security camera market is expected to grow at a compound annual growth rate of 20.7% from 2025 to 2030 to reach USD 30.10 billion by 2030.

b. North America region dominated the global smart home security camera market with a share of 41.06% in 2024. This is attributable to the increasing trend towards small sized households in American countries such as the U.S., Canada, and Mexico that have urged consumers to invest in household security devices in the absence of residents.

b. Some key players operating in the global smart home security camera market include Vivint Smart Home, Inc.; ADT Inc.; SimpliSafe, Inc.; Brinks Home Security; Xiaomi Inc.; Skylinkhome; Samsung Electronics Co, Ltd.; Frontpoint Security Solution, LLC; Arlo Technologies, Inc.; Wyze Lab, Inc.; blink; eufy (Anker Innovations); and Ring LLC.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."