Smart Home Gym Equipment Market Size, Share & Trends Analysis Report By Product (Cardiovascular Equipment, Strength Training Equipment), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-445-1

- Number of Report Pages: 108

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Smart Home Gym Equipment Market Trends

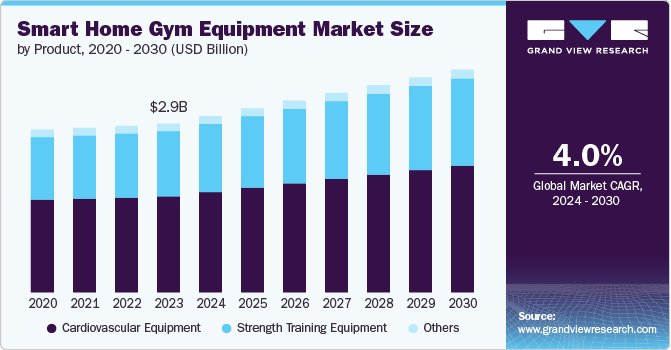

The global smart home gym equipment market size was estimated at USD 2,890.4 million in 2023 and is expected to grow at a CAGR of 4.0% from 2024 to 2030. The integration of advanced technologies like artificial intelligence (AI), virtual reality (VR), and connected fitness apps has made smart home gym equipment more attractive. These technologies offer personalized workouts, real-time feedback, and engaging fitness experiences. Smart home gym equipment offers the convenience of working out at home without time constraints. This flexibility appeals to busy professionals and individuals who prefer private workout spaces.

The trend toward creating a connected fitness ecosystem where equipment, wearables, and apps work together is growing. This ecosystem allows users to track their progress, set goals, and stay motivated through a comprehensive fitness experience. A combination of in-person and virtual fitness experiences is emerging, with smart home gym equipment playing a central role. Consumers are blending home workouts with occasional gym visits, driven by the hybrid work environment.

There is a growing emphasis on sustainability in product design and manufacturing. Consumers are increasingly seeking eco-friendly equipment, prompting manufacturers to adopt greener practices. Continuous innovation in product design, functionality, and technology integration presents opportunities for manufacturers to differentiate themselves and capture a larger market share.

Younger generations, particularly millennials and Gen Z, are the primary consumers, driven by their familiarity with technology and preference for convenient, on-demand services. Manufacturers are expanding their product portfolios to include a wide range of equipment, from smart treadmills and stationary bikes to strength training machines and interactive mirrors. Manufacturers are heavily investing in research and development to stay ahead of the competition by introducing innovative products that meet evolving consumer needs.

The market for smart home gym equipment is set for sustained growth, driven by innovations in product formulations, strategic marketing efforts, and expanding distribution networks. Manufacturers and stakeholders in this sector have significant opportunities to capitalize on changing consumer trends and strengthen their positions in the global market.

Many manufacturers are adopting subscription-based models, offering access to online classes, personalized coaching, and community engagement. This recurring revenue model is becoming increasingly popular.

Product Insights

The cardiovascular equipment segment accounted for a share of 56.93% of the global revenue in 2023. Cardiovascular exercises are among the most popular forms of workouts due to their effectiveness in improving heart health, burning calories, and enhancing overall fitness. Many consumers prioritize cardio exercises as part of their fitness routines, leading to strong demand for equipment such as treadmills, stationary bikes, and rowing machines. These types of equipment are generally more compact and space-efficient compared to other types of fitness equipment. This makes it ideal for home use, especially in urban areas where living spaces might be limited. Consumers are more likely to invest in equipment that can easily fit into their homes.

Strength training equipment segment is expected to grow at a CAGR of 4.2% from 2024 to 2030. The development of compact, versatile, and smart strength training equipment has made it easier for consumers to set up effective home gyms. Innovations such as adjustable dumbbells, all-in-one strength stations, and connected weight systems with digital tracking are attracting more consumers to invest in strength training equipment for their homes. Many consumers are seeking personalized fitness solutions that cater to their specific goals, whether it's building muscle, toning, or rehabilitating from injuries. Smart strength training equipment offers customized workout programs and real-time feedback, making it more appealing to a broader audience.

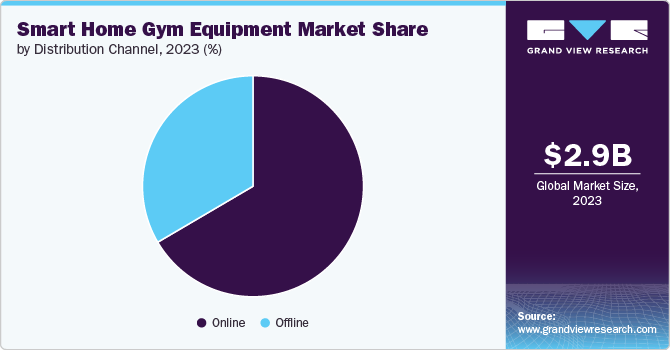

Distribution Channel Insights

The sales of smart home gym equipment through online accounted for a revenue share of 66.55% in 2023. Consumers increasingly prefer the convenience and ease of online shopping, particularly for larger purchases like home gym equipment. Online platforms offer a wide variety of products, detailed descriptions, customer reviews, and the ability to compare prices, making it easier for consumers to make informed purchasing decisions from the comfort of their homes. Online platforms often carry a broader range of smart home gym equipment than physical retail stores. This extensive selection allows consumers to find specific brands, models, and features that may not be available locally, driving more sales through online channels.

The sales of smart home gym equipment offline are expected to grow at a CAGR of 3.8% from 2024 to 2030. Consumers often prefer to physically see, touch physically, and try out smart home gym equipment before making a purchase. Offline retail stores, particularly specialty fitness stores, provide an opportunity for consumers to experience the equipment firsthand, which can build confidence in their buying decisions. Retailers often run exclusive in-store promotions, discounts, or bundle deals that may not be available online. These offers can attract customers to purchase smart home gym equipment from brick-and-mortar stores, driving growth in offline sales

Regional Insights

The smart home gym equipment market in North America captured a revenue share of over 46.17% in the market. The region is at the forefront of technological innovation, with consumers eager to adopt new and advanced fitness technologies. The integration of AI, machine learning, and IoT in fitness equipment is a significant driver for market growth. There is a growing trend toward building connected fitness ecosystems, where equipment, fitness apps, and wearables are integrated to offer a comprehensive and personalized workout experience. Companies like Peloton, NordicTrack, and Mirror are leading this trend in the region.

U.S. Smart Home Gym Equipment Market Trends

The smart home gym equipment market in the U.S. is projected to grow at a significant CAGR from 2024 to 2030.The U.S. population places significant emphasis on health and fitness, with a strong culture of regular exercise. This health-conscious attitude drives demand for convenient, home-based fitness solutions. Consumers are increasingly drawn to smart home gym equipment that offers advanced features such as virtual coaching, interactive displays, and real-time performance tracking. Higher disposable incomes allow U.S. consumers to invest in premium home gym equipment. In addition, the availability of financing options makes it easier for consumers to purchase high-end products.

Europe Smart Home Gym Equipment Market Trends

The smart home gym equipment market in Europe is anticipated to grow at a CAGR of 4.0% from 2024 to 2030. European consumers are increasingly seeking fitness equipment that integrates with apps, wearables, and online platforms. The ability to track progress, participate in virtual classes, and connect with fitness communities online is driving demand for smart home gym equipment that offers these features. The popularity of subscription-based fitness services is rising in Europe, with consumers subscribing to platforms that offer live and on-demand workout classes. Smart home gym equipment manufacturers are capitalizing on this trend by offering integrated subscriptions that provide access to exclusive content and personalized training programs.

Asia Pacific Smart Home Gym Equipment Market Trends

The smart home gym equipment market in Asia Pacific is anticipated to witness a CAGR of 4.7% from 2024 to 2030. The rising disposable income in many Asia Pacific countries is enabling consumers to spend more on high-quality, advanced fitness equipment. As economic conditions improve, more people are willing to invest in premium smart home gym products. The expanding middle-class population in the Asia Pacific is contributing to increased spending on fitness and wellness. As more people enter the middle class, there is a growing market for smart home gym equipment that caters to diverse fitness needs and preferences.

Key Smart Home Gym Equipment Company Insights

The smart home gym equipment market is characterized by competitive dynamics shaped by a combination of factors, including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Key manufacturers in the smart home gym equipment industry utilize their expansive distribution networks and robust brand recognition to sustain a substantial market presence.

Key Smart Home Gym Equipment Companies:

The following are the leading companies in the smart home gym equipment market. These companies collectively hold the largest market share and dictate industry trends.

- AOPEN Inc.

- Aroleap Fitness Private Limited

- Beyond Power Inc.

- Flexnest Gym Accessories

- INNODIGYM

- Life Fitness

- Nordic Track

- Peloton Interactive Inc.

- Precor

- TECHNOGYM S.p.A

Recent Developments

-

In March 2024, EGYM introduced the EGYM Hip Thrust, a revolutionary piece of equipment aimed at enhancing and strengthening the lower body musculature, with a particular focus on the glutes and hamstrings. This cutting-edge device is the first of its kind globally, featuring a fully electronic hip thrust mechanism that utilizes smart weights instead of conventional physical weights or resistance bands.

-

In March 2024, Precor partnered with Glutebuilder, a groundbreaking innovator known for its biomechanically advanced designs. This collaboration aims to launch a revolutionary line of patent-pending glute training equipment that redefines the standards in the plate-loaded glute equipment sector. Featuring distinctive and unmatched biomechanics, these Glutebuilder machines provide remarkable adjustability, establishing a new benchmark for glute training within the fitness industry.

Smart Home Gym Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3,021.6 million |

|

Revenue forecast in 2030 |

USD 3,815.5 million |

|

Growth rate |

CAGR of 4.0% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; South Africa |

|

Key companies profiled |

AOPEN Inc.; Aroleap Fitness Private Limited; Beyond Power Inc.; Flexnest Gym Accessories; INNODIGYM; Life Fitness; Nordic Track; Peloton Interactive Inc.; Precor; TECHNOGYM S.p.A |

|

Customization scope |

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options. |

Global Smart Home Gym Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart home gym equipment market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Equipment

-

Strength Training Equipment

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The smart home gym equipment market size was estimated at USD 2,890.4 million in 2023 and is expected to reach USD 3,021.6 million in 2024.

b. The smart home gym equipment market is expected to grow at a compounded growth rate of 4.0% from 2024 to 2030 to reach USD 3,815.5 million by 2030.

b. The cardiovascular equipment segment dominated the smart home gym equipment market with a share of 56.93% in 2023. Cardiovascular exercises are among the most popular forms of workouts due to their effectiveness in improving heart health, burning calories, and enhancing overall fitness. Many consumers prioritize cardio exercises as part of their fitness routines, leading to strong demand for equipment like treadmills, stationary bikes, and rowing machines.

b. Some key players operating in the smart home gym equipment market include AOPEN Inc.; Aroleap Fitness Private Limited; Beyond Power Inc.; Flexnest Gym Accessories; INNODIGYM; Life Fitness; and Nordic Track

b. Key factors that are driving the market growth include the integration of advanced technologies like artificial intelligence (AI), virtual reality (VR), and connected fitness apps. Also, the trend toward creating a connected fitness ecosystem, where equipment, wearables, and apps work together.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."