- Home

- »

- Next Generation Technologies

- »

-

Smart Highway Market Size, Share And Growth Report, 2030GVR Report cover

![Smart Highway Market Size, Share & Trend Report]()

Smart Highway Market (2024 - 2030) Size, Share & Trend Analysis Report By Technology (Intelligent Transport Management System, Monitoring System), By Displays (Variable Message Signs, Digital Signage), By Deployment, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-406-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Highway Market Size & Trends

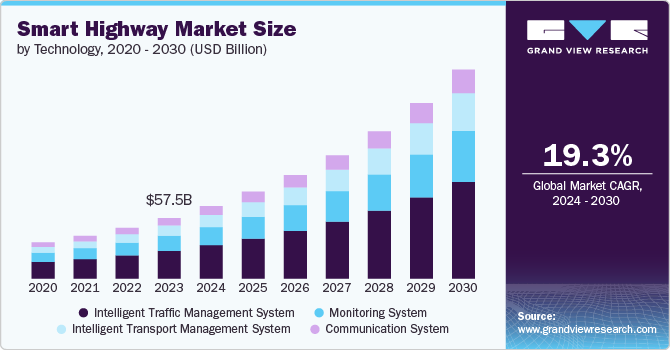

The global smart highways market size was estimated at USD 57.45 billion in 2023 and is projected to grow at a CAGR of 19.3% from 2024 to 2030. This growth is driven by technological advancements, including IoT integration for improved traffic monitoring and management, government initiatives to modernize transportation infrastructure, and solutions to combat urbanization-induced traffic congestion. Environmental concerns are also promoting smart highways, which feature energy-efficient lighting, EV charging stations, and smart grids. Enhanced safety features, such as automated incident detection and real-time alerts, further drive the adoption of smart highway technologies.

The growth of the smart highways market is significantly influenced by economic growth and infrastructure development, mainly in emerging economies, where investments in smart highways are essential for enhancing connectivity and supporting economic activities. Public-private partnerships (PPPs) are playing a vital role in accelerating the implementation of smart highway projects, leveraging private sector expertise and funding for quicker project completion and innovation. The global push towards developing smart cities is creating a demand for integrated transportation systems, with smart highways being vital components that offer efficient and sustainable mobility solutions. Additionally, advanced data analytics and AI are enhancing smart highway capabilities, enabling predictive maintenance, optimized traffic flows, and personalized user experiences.

The rise of autonomous vehicles (AVs) is further driving the need for smart highway infrastructure, which supports AV operations through advanced communication networks and real-time data exchange. Consumer demand for improved travel experiences, including safer, more efficient, and more convenient journeys, is being met by smart highways with dynamic toll pricing, real-time traffic updates, and smart parking solutions. Global competitiveness is another factor, as countries invest in smart highway technologies to attract businesses, tourism, and investments by offering modern transportation infrastructure. Moreover, smart highways enhance disaster management and resilience with technologies that provide real-time monitoring and automated response systems to ensure quicker recovery and minimize disruptions during emergencies.

Technology Insights

The intelligent traffic management system (ITMS) segment led the market and accounted for over 45.0% of the global revenue in 2023. ITMS solutions are crucial for enhancing traffic flow, reducing congestion, and improving road efficiency through real-time data management. They also significantly boost road safety with automated incident detection and emergency response coordination, reducing vehicle emissions and promoting environmental sustainability. Government investments and policies, technological advancements in AI and IoT, and the challenges of rising urbanization are driving the adoption of ITMS solutions, which offer economic benefits by lowering fuel consumption and travel times, thus supporting both individual and business cost savings.

The intelligent transport management system (ITMS) segment within the smart highway market is experiencing significant growth due to the increasing demand for efficient transportation networks amid rising urbanization and vehicle numbers. Technological advancements in AI, IoT, and big data analytics have enhanced ITMS capabilities, enabling real-time monitoring, predictive analytics, and automated decision-making. Government investments and policies supporting smart infrastructure modernization, coupled with a focus on improving road safety and environmental sustainability, are driving the adoption of ITMS solutions. Additionally, integration with smart city initiatives and rising consumer expectations for more efficient travel experiences further fuel the segment's expansion.

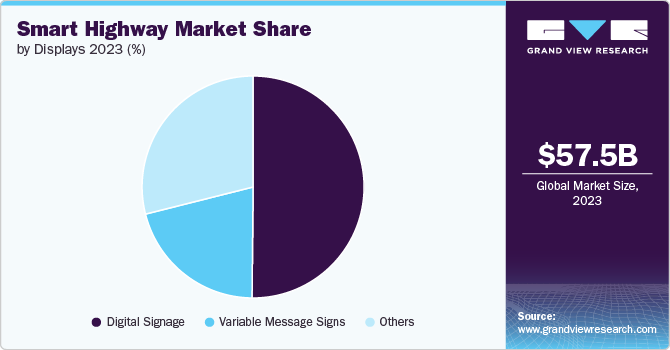

Displays Insights

The digital signage segment led the smart highways market in 2023 due to its essential role in providing real-time traffic information, including updates on road conditions and incidents. Its versatility and adaptability for various applications, such as variable message signs, advertising, and public announcements, enhance road safety and traffic management. Technological advancements in display technology and integration with intelligent traffic management systems have increased the effectiveness and adoption of digital signage. Additionally, opportunities for advertising revenue and the growing demand for smart infrastructure further drive the deployment of digital signage, which improves user experience by offering engaging and interactive content.

The variable message signs (VMS) segment is experiencing significant growth due to its ability to provide real-time updates on traffic conditions, road closures, and incidents, which help alleviate congestion and improve road safety. VMS systems offer enhanced driver information by displaying essential details such as speed limits and detour routes, aiding in effective navigation. Their flexibility and adaptability, coupled with integration with intelligent transportation systems, allow for dynamic updates and improved traffic management. Increased government investment in smart infrastructure, along with technological advancements in display technology, further drive the adoption and effectiveness of VMS solutions.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2023, due to its ability to provide scalable and flexible infrastructure, which efficiently manages large volumes of traffic data and real-time information for smart highway systems. Cloud solutions offer cost efficiency by reducing the need for significant upfront investments and utilizing pay-as-you-go models. They also enable centralized data integration and management, real-time processing and analytics, and enhanced collaboration among stakeholders. Additionally, robust security features and backup solutions offered by cloud providers ensure the protection and reliability of critical data, supporting the effective operation of smart highway systems.

The on-premises segment is expected to grow significantly due to its advantages in data security, control, and compliance, mainly for essential infrastructure such as smart highways. These solutions offer greater customization and integration with existing systems, high performance, and reliability, especially for mission-critical applications. On-premises systems are more cost-effective in the long term and reduce issues related to network latency and bandwidth. Additionally, they facilitate the integration of legacy systems and ensure compliance with stringent regulatory requirements by keeping data within the local infrastructure.

Regional Insights

North America represented a significant market share of over 43.0% in 2023, driven by its advanced infrastructure, substantial investment in technology, and proactive government initiatives. The region's well-developed transportation network and technological leadership provide a strong foundation for integrating smart highway solutions, supported by significant funding and collaboration between the public and private sectors. North America faces urbanization and traffic challenges, making smart highway technologies essential for improving traffic management and safety. Additionally, the region's focus on sustainability, consumer demand for enhanced mobility, and efforts to reduce environmental impact further drive the adoption of smart highway solution.

U.S. Smart Highway Market Trends

The smart highway market in the U.S. is expected to grow significantly over the forecast period, fueled by substantial government investment in infrastructure modernization and smart transportation projects, such as those supported by the Infrastructure Investment and Jobs Act (IIJA) and state-level initiatives. High urbanization and traffic congestion in major cities drive the need for smart highway solutions, including intelligent traffic management and real-time updates. Technological advancements in IoT, AI, and data analytics enhance these solutions, focusing on improving road safety and efficiency. Additionally, the U.S. emphasis on integrating smart highway infrastructure with autonomous vehicle operations supports developing and deploying these technologies.

Europe Smart Highway Market Trends

The smart highway market in Europe is gaining significant traction due to government initiatives and funding from the EU and national governments, which support smart transportation infrastructure and align with broader smart city and green energy goals. Europe's stringent environmental regulations and sustainability targets drive the adoption of smart highway technologies that reduce carbon emissions and promote energy efficiency. Urbanization and traffic congestion in many cities are addressed through smart solutions such as real-time traffic monitoring and adaptive signals. Technological advancements in IoT, AI, and big data analytics enhance these solutions, while a strong focus on road safety and integration with autonomous vehicle infrastructure further drives the segment's growth in the region.

Asia Pacific Smart Highway Market Trends

Smart highway market in Asia Pacific is poised for significant growth, driven by rapid urbanization, population growth, and increased demand for efficient transportation infrastructure. Governments across the region are heavily investing in smart transportation projects through initiatives such as China's "Smart City" program and infrastructure plans in India, Japan, and South Korea. Economic growth and a focus on sustainability further support the adoption of smart highways in the region.

Key Smart Highway Company Insights

Key players in the industry have strengthened their market presence through a strategic mix of product launches, expansions, mergers and acquisitions, contracts, partnerships, and collaborations. These initiatives serve as vital tools for enhancing market penetration and strengthening their competitive edge within the industry. For instance, in June 2024, Dubai's Roads and Transport Authority (RTA) launched the next stage of its intelligent traffic systems initiative, expanding coverage to 100% of the emirate's main roads. This phase enhances road management with upgraded technologies, including new traffic surveillance cameras, incident monitoring devices, Variable Message Signs (VMS), travel time and speed measurement tools, weather sensor stations, and extensive electric power and fiber optic networks.

Key Smart Highway Companies:

The following are the leading companies in the smart highway market. These companies collectively hold the largest market share and dictate industry trends.

- ALE International

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Indra

- Infineon Technologies AG

- Kapsch TrafficCom AG

- LG CNS

- Schneider Electric

- Siemens

Recent Developments

-

In July 2024, Michigan will begin construction on the world's first "smart highway," a section of I-94 between Ann Arbor and Detroit. This highway will use sensors and towers to enable vehicles to communicate with each other, allowing for more efficient operation without driver input. The new technology leverages existing sensors in most newer vehicles to create a connected network along the highway.

-

In July 2024, the European Union invested a record USD 7.6 billion into 134 projects aimed at developing sustainable, safe, and smart transport infrastructure. These projects will enhance roads, railways, waterways, inland roads, and short-sea shipping routes and will connect to ports, airports, and multimodal terminals. For road transport, the deployment of cooperative Intelligent Transport Systems (ITS) and the construction of safe and secure parking areas will improve safety and journeys across the European road network.

-

In July 2024, the Pune Expressway in India will implement Maharashtra's first AI-powered Intelligent Traffic Management System (ITMS). This system uses artificial intelligence and data analytics to improve vehicle flow and enhance road safety. It will automatically detect traffic violations, providing a safer and more efficient driving experience for commuters.

Smart Highway Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 68.77 billion

Revenue forecast in 2030

USD 198.25 billion

Growth rate

CAGR of 19.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered Application

Technology, displays, deployment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA; South Africa

Key companies profiled

ALE International; Cisco Systems, Inc.; Huawei Technologies Co., Ltd.; IBM Corporation; Indra; Infineon Technologies AG; Kapsch TrafficCom AG; LG CNS; Schneider Electric; Siemens

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Highway Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global smart highway market report based on technology, displays, deployment, and region:

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Intelligent Transport Management System

-

Lane Departure Warning System (LDW)

-

Automatic Number Plate Recognition (ANPR)

-

Incident Detection System

-

Radio Frequency Identification (RFID)

-

-

Intelligent Traffic Management System

-

Electronic Toll Collection System

-

Global Navigation Satellite System (GNSS)/Global Positioning System (GPS)

-

Real-Time Traffic Management

-

-

Communication System

-

Radio Network

-

Emergency Network

-

Data Network

-

-

Monitoring System

-

Traffic Measurement

-

Weather Management

-

Video Surveillance

-

-

-

Displays Outlook (Revenue, USD Million, 2017 - 2030)

-

Variable Message Signs

-

Digital Signage

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global smart highway market size was estimated at USD 57.45 billion in 2023 and is expected to reach USD 68.77 billion in 2024.

b. The global smart highway market is expected to grow at a compound annual growth rate of 19.3% from 2024 to 2030 to reach USD 198.25 billion by 2030.

b. North America dominated the market in 2023, accounting for over 43% share of the global revenue, driven by its advanced infrastructure, substantial investment in technology, and proactive government initiatives.

b. Some key players operating in the smart highway market include ALE International, Cisco Systems, Inc., Huawei Technologies Co., Ltd., IBM Corporation, Indra, Infineon Technologies AG, Kapsch TrafficCom AG, LG CNS, Schneider Electric, and Siemens.

b. Key factors driving the smart highway market growth include growing investment in infrastructure developments and an increase in the deployment of advanced technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.