Smart Glasses Market Size, Share & Trends Analysis Report By Type (Binocular, Audio), By Operating System (Android, Linux), By Glass Tinting Technology, By Application, By Connectivity, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-053-7

- Number of Report Pages: 171

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Smart Glasses Market Size & Trends

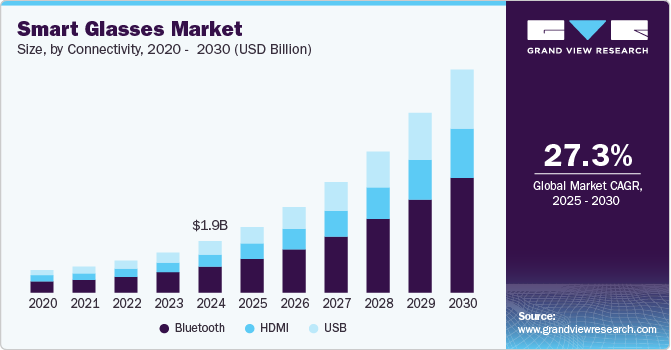

The global smart glasses market size was estimated at USD 1.93 billion in 2024 and is expected to grow at a CAGR of 27.3% from 2025 to 2030. The market is experiencing significant growth driven by a convergence of technological advancements and increasing consumer demand for wearable technology. Factors such as enhanced connectivity through the Internet of Things (IoT) and the rise of augmented reality (AR) applications are propelling the market forward. Consumers are increasingly drawn to smart glasses for their potential to enhance everyday experiences, from navigation and communication to gaming and fitness tracking. In addition, the rising trend of remote work and virtual collaboration tools has created a greater need for devices that facilitate seamless interaction, further boosting the appeal of smart glasses in both personal and professional contexts.

Governments worldwide recognize the potential of smart glasses in various sectors, prompting initiatives to boost their adoption and sales. Many countries are investing in research and development programs to advance AR and VR technologies, which are integral to the smart glasses ecosystem. Moreover, public-private partnerships are emerging to create pilot projects that demonstrate the practical applications of smart glasses in fields such as healthcare, education, and manufacturing. By providing funding and incentives, governments are encouraging innovation and fostering an environment where businesses can thrive, ultimately leading to increased consumer interest and sales in the market.

The market presents a multitude of growth opportunities, particularly in niche segments such as healthcare, education, and industrial applications. In healthcare, smart glasses can facilitate remote surgeries and enhance training through real-time data visualization. In education, they offer immersive learning experiences that can transform traditional teaching methods. Furthermore, as industries increasingly adopt smart glasses for training and maintenance tasks, the demand for specialized applications continues to rise. Emerging markets also present a significant opportunity, as consumer awareness and technology adoption increase in regions previously untapped by smart glasses manufacturers, paving the way for expansive market growth.

Manufacturers in the market are placing a strong emphasis on growth strategies that prioritize innovation and customer engagement. Companies invest heavily in research and development to enhance their products' functionality, design, and user experience. Collaborations with tech firms and research institutions are also becoming commonplace, aiming to leverage expertise and accelerate the development of next-generation smart glasses. Furthermore, manufacturers focus on targeted marketing strategies to reach specific demographics, including healthcare and logistics professionals. By aligning product offerings with market needs and trends, manufacturers are well-positioned to capitalize on the growing demand for smart glasses.

Technological innovation is at the heart of market expansion, driving advancements in display technology, battery life, and connectivity. Recent breakthroughs in micro-display technology have enabled manufacturers to produce lighter and more powerful devices with enhanced visual clarity. Moreover, the integration of artificial intelligence and machine learning is enhancing the functionality of smart glasses, allowing for personalized experiences and smarter interactions. Innovations in battery technology are also extending the usability of these devices, making them more appealing for everyday use. Smart glasses are expected to offer even more features as technology evolves, attracting a broader audience and solidifying their place in the wearable technology landscape.

Type Insights

The audio smart glasses segment registered the largest revenue share of around 26.7% in 2024. The audio segment holds a high market share, driven by the growing demand for hands-free audio experiences. Audio-enabled smart glasses have gained popularity among consumers seeking a seamless blend of entertainment and utility, as these glasses allow users to listen to music, receive calls, and interact with virtual assistants without needing additional accessories. This segment’s market dominance is further bolstered by bone conduction and open-ear audio technology advancements, which improve sound quality while maintaining situational awareness-a key factor for user safety in outdoor settings.

The immersive smart glasses segment is estimated to register the fastest CAGR growth of over 29% during the forecast period, driven by an increasing appetite for augmented reality (AR) and virtual reality (VR) applications. As more industries recognize the benefits of immersive technology, sectors such as retail, education, and healthcare are increasingly adopting smart glasses for enhanced user engagement and interactive training experiences. The expansion of 5G and improvements in graphics rendering have also contributed to the growth of this segment by allowing smoother and more realistic visual experiences, which appeal to both enterprise and consumer markets.

Glass Tinting Technology Insights

Polymer-Dispersed Liquid Crystals (PDLC) hold a substantial share of the smart glass market, primarily due to their effectiveness in controlling light transmission and providing privacy. PDLC technology is widely used in commercial and residential settings where adjustable transparency is essential, such as in conference rooms and vehicle windows. The popularity of PDLC smart glass is supported by its cost-effectiveness and reliability, making it a preferred choice for architectural applications and energy-efficient building designs.

The Electrochromic (EC) smart glass segment is seeing significant market growth, largely due to its dynamic tinting capability, which allows for real-time light transmission adjustment. This technology is highly favored in the automotive and architectural sectors, where it enhances user comfort by reducing glare and heat. EC smart glass is particularly valuable for energy management in buildings, as it can automatically adjust to varying light conditions, reducing reliance on artificial lighting and climate control, making it a promising solution for sustainable building practices.

Connectivity Insights

Bluetooth-enabled smart glasses occupy a high market share due to the technology’s reliability and ease of integration with a wide array of devices. Bluetooth provides users with seamless wireless connectivity for calls, audio, and data transfer, making it a staple in consumer-grade smart glasses and an essential feature in enterprise-grade devices. The widespread adoption of Bluetooth technology in smart glasses is further propelled by its low power consumption, which extends battery life-a critical factor for wearable devices.

The industrial smart glass segment is experiencing significant growth as industries increasingly recognize the benefits of hands-free data access and augmented visualization for workforce efficiency. Smart glasses are used in maintenance, assembly, and logistics applications, where they help improve accuracy, reduce downtime, and provide real-time information for decision-making. With the continued adoption of Industry 4.0 practices and advancements in smart glass technology, the industrial segment is expected to see ongoing expansion, transforming workplace operations across multiple sectors.

Application Insights

The industrial smart glass segment accounted for the largest revenue share of over 27.4% in 2024 and is expected to lead the market throughout the forecast period. This can be attributed to its usage in the production line, as it displays step-by-step assembly instructions in the worker’s field vision, which makes it more convenient to follow instructions and work efficiently with maximum output. This, in turn, is expected to drive the segment growth further.

The healthcare smart glasses segment is expected to register the fastest CAGR over the forecast period. In this segment, smart glasses can offer heads-up, see-through, eye-on Glass Tinting that enables the user to maintain eye contact with the patient while maintaining full situational awareness and providing a clear picture of the patient's area of interest, which is expected to drive the segment's growth further.

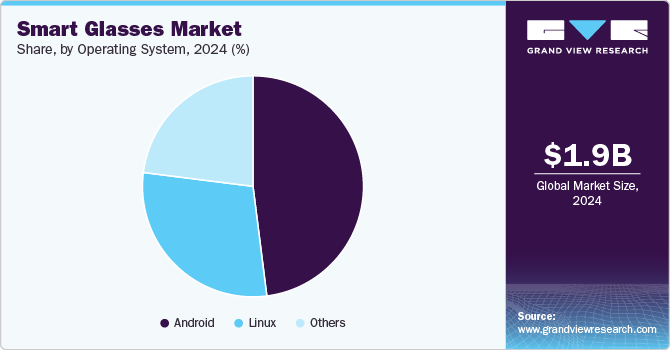

Operating System Insights

Android-powered smart glasses hold a high market share, attributed to the platform’s open-source nature and broad developer support. Android’s adaptability allows manufacturers to customize software for various applications, making it an ideal choice for enterprise solutions and consumer applications. Its extensive app ecosystem and compatibility with existing Android devices also drive its popularity, facilitating seamless user integration and encouraging innovation in smart glasses functionalities across multiple industries.

Linux-based smart glasses are experiencing considerable growth in the market, particularly within the enterprise sector. The Linux platform’s stability, security, and customization options make it appealing for applications requiring high data privacy and operational flexibility. Industries such as manufacturing and healthcare are increasingly adopting Linux-based smart glasses for workflow management, diagnostics, and real-time data sharing, positioning Linux as a rising competitor.

Regional Insights

North America smart glasses market dominated the global market and accounted for the largest revenue share of 35.39% in 2024. The North America smart glasses market is experiencing significant growth, largely driven by the region's technological advancements and high consumer demand for innovative wearable devices. With a robust ecosystem of tech companies and startups focused on augmented reality (AR) and virtual reality (VR), North America serves as a hub for smart glasses development. The increasing integration of smart glasses in sectors such as healthcare, education, and enterprise solutions has further fueled this growth. In addition, the cultural acceptance of wearable technology, coupled with the rise of remote work and digital collaboration tools, has made smart glasses an appealing choice for consumers and businesses alike, solidifying North America's leading position in the market.

The U.S. Smart Glasses Market Trends

The U.S. smart glasses market is witnessing significant growth, driven by a combination of innovation, investment, and consumer adoption. Major tech companies, including Google, Microsoft, and Apple, actively invest in smart glasses technology, resulting in advanced features and improved user experiences. The country's tech-savvy population is eager to embrace new gadgets that enhance productivity and entertainment, contributing to a growing consumer base.

Asia Pacific Smart Glasses Market Trends

The Asia Pacific smart glasses market holds a high share, driven by a surge in technological adoption and a growing interest in wearable devices among consumers. Countries like Japan, South Korea, and China are at the forefront of this trend, investing heavily in research and development for AR applications. The region's young, tech-savvy population increasingly seeks innovative solutions for entertainment, education, and professional use, leading to a robust demand for smart glasses.

China smart glasses market commands a significant share of the Asia Pacific market, propelled by rapid technological advancements and increasing consumer interest in wearable tech. The country’s investments in augmented reality and virtual reality technologies have spurred innovation and development in smart glasses, making them more accessible to a broad audience. Chinese manufacturers are actively creating products that cater to diverse applications, from gaming to industrial use, further boosting market share.

The smart glasses market in India is on a significant growth trajectory, driven by rising disposable incomes, a young demographic, and increased consumer awareness of technology. The growing availability of high-speed internet and improved digital infrastructure have enhanced access to innovative products. As more consumers seek advanced technology for education, entertainment, and professional applications, the demand for smart glasses continues to rise.

Europe Smart Glasses Market Trends

The smart glasses market in Europe is experiencing significant growth, bolstered by rising demand across various industries, including healthcare, automotive, and retail. European companies are increasingly recognizing the potential of smart glasses for enhancing operational efficiency and customer engagement. The region's commitment to research and development, supported by governmental policies to foster innovation, has created a conducive environment for manufacturers of smart glasses.

Key Smart Glasses Company Insights

The major players in the market are concentrating on business strategies like mergers, partnerships, and acquisitions for their businesses, along with developing innovative smart glasses to attract a larger customer base and gain a competitive edge.

-

Vuzix Corporation is an optical technology company specializing in designing, manufacturing, marketing, and selling optical components, waveguides, smart glasses, and Augmented Reality (AR) solutions. The company offers a range of products, including smart glasses, prescription lenses, and accessories, all designed to enhance productivity and user experiences through immersive technology.

-

Amazon.com, Inc. is a multi-technology company in e-commerce and cloud computing known for its vast selection of products, innovative technology, and customer-centric approach. The company provides several smart technology products, including smart glasses, such as Echo Frames, which can integrate Alexa for hands-free assistance, showcasing the company’s commitment to innovative wearable technology that can potentially enhance everyday life and connect users to digital services seamlessly.

Key Smart Glasses Companies:

The following are the leading companies in the smart glasses market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Inc.

- Ampere LLC

- Bose Corporation

- Flows Bandwidth

- Google LLC

- Lenovo

- Lumus Ltd.

- Magic Leap

- Microsoft Corporation

- Razer Inc.

Recent Development

-

In August 2024, Vuzix Corporation launched the M400 Xtreme smart glasses, a new kit incorporating several advantages to its predecessor, the M400, such as the new Xtreme Weather power bank, an IP67-rated, long-lasting, lightweight battery designed to operate at temperatures ranging from -20°C (-4°F) to 45°C (113°F). Plans envisaged the company offering the new M400 Xtreme kit as an out-of-the-box remote support solution, improving upon the M400 All-Weather Kit, particularly with a comfortable headband suitable for long shifts and the harshest working environments and enhanced battery capacity, making it ideal for all-day cold storage warehouse duty and remote field service assignments

-

In April 2023, Magic Leap, Inc. collaborated with NVIDIA Corporation to allow enterprise users to render and stream full-scale, immersive digital twins from the NVIDIA Omniverse platform to Magic Leap 2, a second-generation augmented reality (AR) headset developed by Magic Leap, without compromising visual quality

-

In September 2023, Amazon.com, Inc. introduced the next generation of Echo Frames smart glasses, featuring enhanced audio quality, improved Alexa performance, and fashionable designs by Carrera. The new glasses were designed to offer multiple lens options, including sunglasses with UV protection, prescription lenses, and blue light filters.

Smart Glasses Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.47 billion |

|

Revenue forecast in 2030 |

USD 8.26 billion |

|

Growth rate |

CAGR of 27.3% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in thousand units, revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, glass tinting technology, operating system, application, connectivity, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; ANZ; Brazil; UAE; South Africa; Saudi Arabia |

|

Key companies profiled |

Amazon Inc.; Ampere LLC; Bose Corporation; Flows Bandwidth; Google LLC; Lenovo; Lumus Ltd.; Magic Leap; Razer Inc. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Smart Glasses Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart glasses market report based on type, glass tinting technology, operating system, application, connectivity, and region:

-

Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Monocular Smart Glasses

-

Binocular Smart Glasses

-

Audio Smart Glasses

-

Immersive Smart Glasses

-

Others

-

-

Glass Tinting Technology Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Polymer-Dispersed Liquid Crystals

-

Electrochromic (EC) Smart Glass

-

Photochromic

-

Suspended Particles Device (SPD)

-

Others

-

-

Operating System Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Android

-

Linux

-

Other

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Education

-

Gaming

-

Healthcare

-

Industrial

-

Others

-

-

Connectivity Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Bluetooth

-

HDMI

-

USB

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

ANZ

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart glasses market size was estimated at USD 1.93 billion in 2024 and is expected to reach USD 2.47 billion in 2025.

b. The global smart glasses market is expected to grow at a compound annual growth rate of 27.3% from 2025 to 2030 to reach USD 8.26 billion by 2030.

b. The audio segment holds a high share within the smart glasses market, driven by the growing demand for hands-free audio experiences. Audio-enabled smart glasses have gained popularity among consumers seeking a seamless blend of entertainment and utility, as these glasses allow users to listen to music, receive calls, and interact with virtual assistants without the need for additional accessories. This segment’s market dominance is further bolstered by advancements in bone conduction and open-ear audio technology, which improve sound quality while maintaining situational awareness—a key factor for user safety in outdoor settings.

b. Some of the key players operating in the smart glasses market include Amazon Inc, Ampere LLC, Bose Corporation, Flows Bandwidth, Google LLC, Lenovo, Lumus Ltd., Magic Leap, Microsoft Corporation, Razer Inc.

b. The smart glasses market is experiencing significant growth driven by a convergence of technological advancements and increasing consumer demand for wearable technology. Factors such as enhanced connectivity through the Internet of Things (IoT) and the rise of augmented reality (AR) applications are propelling the market forward. Consumers are increasingly drawn to smart glasses for their potential to enhance everyday experiences, from navigation and communication to gaming and fitness tracking. Additionally, the rising trend of remote work and virtual collaboration tools has created a greater need for devices that facilitate seamless interaction, further boosting the appeal of smart glasses in both personal and professional contexts.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."