- Home

- »

- Next Generation Technologies

- »

-

Smart Gas Meter Market Size, Share & Growth Report, 2030GVR Report cover

![Smart Gas Meter Market Size, Share & Trends Report]()

Smart Gas Meter Market Size, Share & Trends Analysis Report By Component, By Type (Smart Ultrasonic Gas Meter, Smart Diaphragm Gas Meter), By Technology, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-377-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Smart Gas Meter Market Size & Trends

The global smart gas meter market size was valued at USD 3.24 billion in 2023 and is expected to grow at a CAGR of 6.9% from 2024 to 2030. Efforts to reduce greenhouse gas emissions have emphasized the importance of using natural gas in various applications. Additionally, emerging technologies that enable users to monitor their energy consumption are fueling the growth of the smart gas market. Although this technology is currently new and available only in a few countries, its operational advantages and economic feasibility are expected to facilitate widespread adoption across many countries during the forecast period. Gas pipelines are being installed in many countries to ensure natural gas is available in every home. Gas meters provide several benefits, including accurate readings, eliminating manual involvement, tracking usage data, preventing unaccounted consumption, and assessing monthly tariffs.

Operational advantages such as continuous pipeline monitoring, the elimination of manual monthly readings, real-time data availability, and operational precision drove the adoption of smart gas metering. Additionally, the cost savings and one-time investment in smart meters fueled market growth. Along with the benefits to gas companies, smart gas meters also offer customers advantages such as better control over monthly bills, detailed feedback on energy use, and reduced system failures.

Smart grids are vital technologies that have contemporized gas networks by providing consumers and utilities with the information necessary to manage gas usage efficiently. Energy utilities globally are investing in smart grid technologies, which facilitate the development of new business models, automatic monitoring and control of gas consumption, and a reduction in outages with quicker response spans during natural hazards. At the end-user level, smart grids enable consumer participation and demand flexibility in energy system operations through storage and distributed generation.

According to the U.S. Department of Energy (DOE), a modernized smart grid in the U.S. is expected to help consumers save approximately USD 20 billion on their utility bills by 2025. Smart meters are the fundamental building blocks of smart grid technologies. With a system of smart meters in place, utilities can deliver new efficient and reliable energy products based on customer demand.

Component Insights

The hardware segment led the market in 2023, accounting for over 44.0% share of the global revenue. This high share is attributed to the increasing demand for advanced metering infrastructure that offers precise measurement and real-time data capabilities. Hardware components, including smart meters, sensors, and communication devices, form the backbone of smart gas metering solutions by enabling accurate and reliable gas consumption readings. These devices facilitate automated data collection, reducing the need for manual readings and minimizing human error. Additionally, advancements in hardware technology have significantly enhanced the performance and durability of smart gas meters, making them more attractive to utility companies and consumers alike.

The software segment is predicted to foresee significant growth in the coming years. Software solutions enable utilities to process and analyze vast amounts of data collected by smart meters, providing insights that help in improving operational efficiency, forecasting demand, and implementing dynamic pricing models. These software platforms also facilitate real-time monitoring, allowing for immediate detection of anomalies or inefficiencies in the gas distribution network. Additionally, the integration of software with smart gas meters supports enhanced customer engagement through user-friendly interfaces that offer detailed consumption reports and personalized feedback.

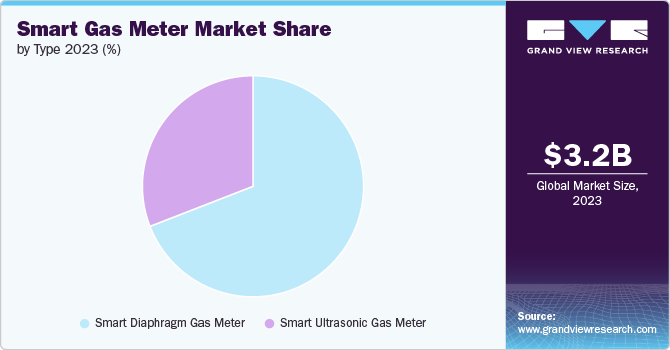

Type Insights

The smart diaphragm gas meter segment accounted for the largest market revenue share in 2023. Smart diaphragm gas meters offer several operational advantages, such as real-time data transmission, remote monitoring, and automated meter reading, which significantly reduce the need for manual interventions and lower operational costs. These meters also provide enhanced diagnostic capabilities, allowing for the early detection of leaks, tampering, or other issues, thereby improving safety and efficiency in gas distribution networks. The scalability and ease of integration of smart diaphragm gas meters into existing infrastructure further contributed to their high market share.

The smart ultrasonic gas meter segment is predicted to foresee significant growth in the coming years. Unlike traditional meters, ultrasonic gas meters use sound waves to measure gas flow, eliminating the need for moving parts. This results in lower maintenance requirements and a longer lifespan, making them highly cost-effective for utilities. The precision of ultrasonic meters in measuring even the slightest changes in gas flow ensures accurate billing and reduces discrepancies, enhancing customer satisfaction.

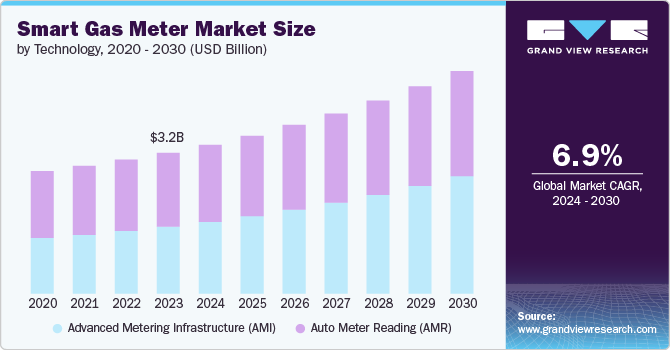

Technology Insights

The Auto Meter Reading (AMR) segment accounted for the largest market revenue share in 2023. AMR technology automates the process of collecting gas usage data, eliminating the need for manual meter readings. This automation not only reduces labor costs but also minimizes human errors, ensuring more accurate and reliable billing. The ability of AMR systems to transmit data remotely allows for real-time monitoring and quicker detection of issues such as leaks or unauthorized usage, enhancing overall safety and operational efficiency.

The Advanced Metering Infrastructure (AMI) segment is anticipated to witness significant growth in the coming years. AMI systems provide an integrated network of smart meters, communication technologies, and data management systems that enable two-way communication between customers and utilities. This connectivity allows for real-time data collection, remote meter reading, and instantaneous monitoring of gas consumption, thereby enhancing the accuracy and reliability of billing and reducing the need for manual interventions. Additionally, the real-time monitoring capabilities of AMI systems enable quicker detection and resolution of issues such as gas leaks, tampering, or outages, thereby improving overall operational efficiency and safety.

End Use Insights

The residential segment accounted for the largest market revenue share in 2023. The growing awareness and demand for energy efficiency among homeowners significantly contributed to this trend. Smart gas meters offer precise real-time monitoring of gas consumption, allowing residents to track their usage closely and make informed decisions to conserve energy and reduce costs. This capability aligns with the increasing consumer focus on sustainability and cost savings. Moreover, government initiatives and regulatory mandates promoting the adoption of smart metering technologies played a crucial role in boosting the residential segment.

The commercial segment is anticipated to exhibit the highest CAGR over the forecast period. Businesses and commercial establishments, which typically have higher and more complex energy demands compared to residential users, found significant value in the advanced capabilities of smart gas meters. The precision and reliability of these meters in monitoring gas consumption enable commercial entities to manage their energy usage more efficiently, directly impacting their operational costs and bottom line. Additionally, many commercial entities are required to comply with stricter energy regulations, which often include the adoption of smart metering technologies. Government incentives and subsidies further encouraged businesses to upgrade their infrastructure to smart meters.

Regional Insights

North America smart gas meter market is anticipated to register rapid growth over the forecast period. Initiatives such as the U.S. Department of Energy's push for smart grid advancements and various state-level mandates encouraged the widespread deployment of smart gas meters. These regulations often included financial incentives and grants for utilities to upgrade their systems, making it economically viable for them to invest in smart metering infrastructure.

U.S. Smart Gas Meter Market Trends

The smart gas meter market in the U.S.is expected to grow at a CAGR of 5.5% from 2024 to 2030. Federal and state initiatives, such as the U.S. Department of Energy's programs, provide financial incentives and regulatory support for the adoption of smart metering technologies. Additionally, advancements in IoT and data analytics enhanced the functionality and reliability of smart gas meters, making them more appealing to utilities and consumers. The combination of these factors drove significant growth in the U.S. smart gas meter market.

Asia Pacific Smart Gas Meter Market Trends

The smart gas meter market in Asia Pacific dominated with a revenue share of over 38.0% in 2023. The region's growing population and expanding urban areas drove a surge in energy demand, prompting utilities and governments to adopt smart gas metering solutions to enhance efficiency and manage resources more effectively. Countries like China, Japan, and South Korea are at the forefront of this trend, implementing large-scale smart grid projects and modernizing their gas distribution networks. Government initiatives and regulations significantly accelerated the adoption of smart gas meters. Many Asia Pacific countries introduced policies and incentives to promote energy efficiency and reduce greenhouse gas emissions. These initiatives often included mandates for the installation of smart metering technologies, providing a significant boost to the market.

Europe Smart Gas Meter Market Trends

The smart gas meter market in the European region is expected to witness significant growth over the forecast period. Initiatives like the EU's Green Deal and Energy Efficiency Directive promote the widespread adoption of smart metering technologies. Additionally, significant investments in modernizing energy infrastructure and the emphasis on reducing carbon emissions spurred growth. Advanced technological capabilities and government incentives further supported the transition to smart gas meters.

Key Smart Gas Meter Company Insights

Key companies include ABB, Honeywell International, Inc., Itron, Inc., and Landis+Gyr. Companies active in the smart gas meter market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in January 2024, Italgas S.p.A announced the fulfillment of the rollout of the initial 20,000 units of its new hydrogen-ready gas smart meters. The installation of these first 20,000 Nimbus units marks a significant step in accelerating the energy transition towards green gas. The widespread adoption of these devices across the Italgas user network will significantly boost the use of renewable gases, paving the way for a new frontier in Italy and globally.

Key Smart Gas Meter Companies:

The following are the leading companies in the smart gas meter market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Apator S.A.

- Eaton

- Hansen Technologies

- Honeywell International, Inc.

- Itron, Inc.

- Landis+Gyr

- Schneider Electric

- Siemens

- Wasion Holdings International

Recent Developments

-

In February 2024, IGL Genesis Technologies announced to the exchanges that it had signed an agreement with Hangzhou Beta Meter Co., Ltd. The deal involves purchasing smart meter manufacturing technology for USD 2.4 million. IGTL has already begun setting up a production facility in India to manufacture smart gas meters, utilizing technical expertise from Hangzhou Beta Meter Co., Ltd.

-

In December 2023, Honeywell International, Inc. announced the European launch of its diaphragm gas meter, capable of operating with 100% hydrogen. This new meter can measure both natural and hydrogen gas, offering versatility throughout Europe. Once deployed, these meters will not need future alternates, even as networks transition to hydrogen, thereby improving operational sustainability and reducing long-term costs.

-

In February 2022, Vikas Lifecare Limited announced that its recent acquisition, GenesisGas, secured orders to supply over 30,000 gas meters to Gujarat Gas Limited, an Indian natural gas distribution company. GenesisGas, a leader in smart water and gas metering in India, holds about 20% of the domestic gas metering market share.

Smart Gas Meter Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.43 billion

Revenue forecast in 2030

USD 5.12 billion

Growth Rate

CAGR of 6.9% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/ billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, type, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, China, India, Japan, Australia, South Korea, Brazil, UAE, South Africa, KSA

Key companies profiled

ABB; Apator S.A.; Eaton; Hansen Technologies; Honeywell International, Inc.; Itron, Inc.; Landis+Gyr; Schneider Electric; Siemens; Wasion Holdings International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Smart Gas Meter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global smart gas meter market report based on component, technology, type, end-use, and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Smart Ultrasonic Gas Meter

-

Smart Diaphragm Gas Meter

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Advanced Metering Infrastructure (AMI)

-

Auto Meter Reading (AMR)

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global smart gas meter size was estimated at USD 3.24 billion in 2023 and is expected to reach USD 3.43 billion in 2024.

b. The global smart gas meter is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 5.12 billion by 2030.

b. North America dominated the market in 2023, accounting for 27.0% of the global revenue. Initiatives such as the U.S. Department of Energy's push for smart grid advancements and various state-level mandates encouraged the widespread deployment of smart gas meters.

b. Some key players operating in the smart gas meter market include ABB, Apator S.A., Eaton, Hansen Technologies, Honeywell International, Inc., Itron, Inc., Landis+Gyr, Schneider Electric, Siemens, Wasion Holdings International.

b. Key factors driving the smart gas meter market growth include increasing emphasis on energy efficiency and conservation, and demand for accurate billing and improved customer service.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."