Smart Fitness Market Size, Share & Trends Analysis By Product (Smartwatch, Smart Band, Smart Clothing, Fitness App, Others), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-650-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Smart Fitness Market Size & Trends

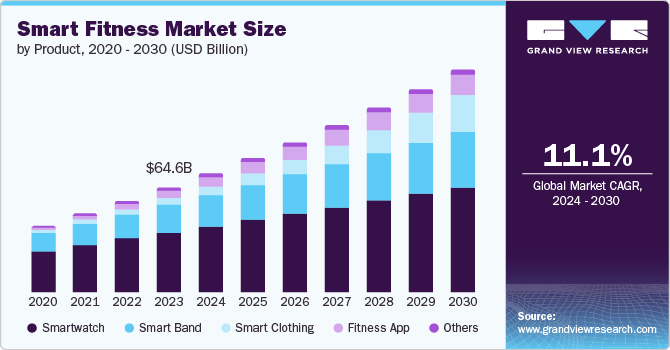

The global smart fitness market size was valued at USD 64.60 billion in 2023 and is projected to grow at a CAGR of 11.1% from 2024 to 2030. The growing demand for features such as workout time monitoring, distance covered, and calorie burn tracking in smart fitness watches and trackers is driving the market. The use of data-driven methods and advanced capabilities in smart fitness devices, including integration with artificial intelligence, the Internet of Things, and big data analysis is driving the growth of the fitness technology market.

There is a growing global awareness of the importance of maintaining a healthy lifestyle, driven by increasing rates of chronic diseases such as obesity, diabetes, and cardiovascular conditions. In 2021, the adult population from 20 to 79 years had diabetes, and in 2022, 2.5 billion adults above 18 were overweight. Governments, health organizations, and influencers actively promote the benefits of regular physical activity and healthy eating habits. This heightened awareness has led to a surge in demand for fitness solutions that are convenient, accessible, and effective. Smart fitness devices and applications cater to this demand by providing users with tools to monitor their health and set fitness goals.

Modern consumer preferences are shifting towards more personalized and tech-driven fitness experiences. Consumers are increasingly pursuing workouts that fit their busy schedules and are able to perform anywhere, whether at home, in the park, or while traveling. Smart fitness technologies, such as virtual trainers, interactive fitness apps, and online workout classes, cater to these preferences by providing a wide range of options that are customized according to individual needs. For instance, in February 2024, Samsung launched a fitness band, Galaxy Fit 3, in the Philippines market. It is available in aluminum frames and color options such as grey, silver, and pink-gold. It offers features such as blood oxygen level monitoring, sleep monitoring, and tracking sleep patterns. It supports over 100 workout modes, including running, elliptical, rowing machine, and pool swim.

The COVID-19 pandemic accelerated the adoption of digital fitness solutions as gyms and fitness studios were closed or operated at reduced capacity. This shift led to the rise of hybrid fitness models that combine in-person and online workouts. Many fitness brands and studios have developed digital platforms offering live-streamed classes, on-demand workouts, and virtual coaching. This hybrid approach allows users to choose between physical and digital fitness experiences. This convenience of working has led to an increase in demand for the smart fitness market.

Product Insights

The smartwatch segment dominated the market and accounted for a market revenue share of 56.9% in 2023. Modern smartwatches have advanced sensors, including accelerometers, gyroscopes, heart rate monitors, GPS, and electrocardiogram (ECG) capabilities. These technologies allow for precise tracking of various fitness metrics such as steps taken, calories burned, distance traveled, heart rate, and sleep quality. Improvements in battery life, display quality, and connectivity options, such as Bluetooth and Wi-Fi, enhance the user experience, making smartwatches more reliable and attractive to consumers. For instance, in July 2024, Samsung launched the Galaxy Watch 7 and Galaxy Watch Ultra. The Galaxy Watch 7 features a BioActive sensor, offers more accurate measurement of existing metrics, and enables more advanced features. It includes a dual-frequency GPS for precise location tracking capabilities. The Galaxy Watch Ultra features a 10ATM water resistance and Titanium Grade 4 frame for durability. It includes a Functional Threshold Power (FTP) metric that allows users to track their cycling more accurately and in a more personalized manner.

The smart clothing segment is expected to witness the fastest CAGR over the forecast period. Smart clothing directly integrates sensors and biometric tracking capabilities into the fabric, eliminating the need for separate wearable devices. This integration enhances user comfort and convenience while providing continuous monitoring during physical activities. Sensors detect movement patterns, monitor posture, and analyze biomechanical metrics, offering valuable feedback to optimize training routines, prevent injuries, and improve overall performance. Biometric data collected from smart clothing is synced with mobile apps or cloud platforms for detailed analysis and personalized coaching.

Regional Insights & Trends

The North America smart fitness market dominated the market with a revenue share of 36.7% in 2023. Social media platforms such as Instagram, YouTube, and TikTok significantly promote fitness culture and smart fitness products in North America. Fitness influencers and celebrities frequently share their workout routines, fitness tips, and personal health journeys, often featuring smart fitness devices and apps. These influencers have substantial followings, and their endorsements significantly impact consumer behavior.

U.S. Smart Fitness Market Trends

The U.S. smart fitness accounted for the largest revenue share in 2023. The U.S. has a well-developed fitness infrastructure, including extensive retail networks, online marketplaces, and efficient logistics systems that facilitate the distribution and accessibility of smart fitness products. Consumers are able to easily purchase fitness devices and apps through various channels, including physical stores, e-commerce platforms, and consumer websites. For instance, in September 2023, Apple introduced the Apple Watch Series 9 with S9 SiP, a double tap gesture, a brighter display, Precision Finding for the iPhone, and others. It includes Smart Stack, cycling and hiking features, and tools to support mental health. It is available on the official Apple website and other authorized retailers. The presence of numerous fitness centers, sports facilities, and wellness clinics that integrate smart fitness technologies enhances the overall ecosystem, making it easier for consumers to adopt and benefit from these solutions.

The Canada smart fitness market is expected to witness significant growth over the forecast period. Many smart fitness devices and apps include guided meditation, breathing exercises, and stress management techniques. These tools aid users in improving their mental well-being alongside their physical fitness. As awareness of mental health issues increases, consumers seek comprehensive wellness solutions that support their overall health, making smart fitness products more attractive. These advanced features play an essential role in busy lifestyle users, driving demand in the Canada market.

Asia Pacific Smart Fitness Market Trends

Asia Pacific smart fitness market is expected to witness the fastest CAGR over the forecast period. The diverse demographic landscape of the Asia Pacific region necessitates customized fitness solutions catering to different age groups, fitness levels, and health conditions. Smart fitness products offer personalized experiences for seniors, children, athletes, and individuals with specific health needs. This customization ensures that users from different age groups benefit from smart fitness technologies, expanding the market.

The China smart fitness market is expected to witness significant growth over the forecast period. Rapid urbanization and consumer's increasingly busy lifestyles contribute to the growing demand for convenient fitness solutions. Many citizens have limited time for gym visits and seek alternatives that fit into their busy schedules. Smart fitness products provide the flexibility to work out anytime and anywhere, whether at home, in the office, or while traveling. Features such as quick workout routines, personalized coaching, and progress tracking aid users stay active despite their busy lives, driving the adoption of smart fitness technologies in China.

The India smart fitness market is expected to witness significant growth over the forecast period. Innovations in wearable technology, AI, machine learning, and IoT have created sophisticated fitness trackers, smartwatches, and fitness apps that offer personalized health monitoring and fitness coaching. The widespread availability of affordable smartphones and high-speed internet further supports the growth of digital fitness solutions, driving the smart fitness market in India. Many companies are entering the Indian smart fitness market, capitalizing on the growing demand for health and wellness solutions. The companies leverage e-commerce platforms to launch their products. For instance, Amazfit launched the Amazfit BIP 5 Unity smartwatch in India on Amazfit India's official website and Amazon India. The smartwatch includes a health-centric operating system, Zepp OS 3.0, including an AI-powered wellness assistant that provides insights into sleeping patterns, soundscapes, and health reports.

Europe Smart Fitness Market Trends

The Europe smart fitness market is expected to witness significant growth over the forecast period. Education and awareness campaigns by the government and private sector play a crucial role in promoting the benefits of smart fitness products. These campaigns highlight the importance of physical activity, the advantages of using technology for fitness, and the features of smart fitness products that aid in achieving health goals. These campaigns drive market adoption and growth by educating the public about the practical uses and benefits of smart fitness devices and apps.

The UK smart fitness market is expected to witness significant growth over the forecast period. There is a rise in fitness startups that offer innovative products and services. These startups leverage technology to provide unique fitness solutions, such as AI-based fitness coaching, virtual workout classes, and personalized nutrition plans. These drive the continuous development of advanced fitness devices and applications. Additionally, the UK has a well-established retail and e-commerce infrastructure that facilitates the distribution and accessibility of smart fitness products. Consumers are able to easily purchase fitness devices and apps through various channels, including physical stores, online marketplaces, and direct-to-consumer websites. The convenience of online shopping and efficient logistics networks ensure that smart fitness products are readily available to consumers nationwide, driving their adoption.

Key Smart Fitness Company Insights

Some key companies in the smart fitness market include SAMSUNG, Xiaomi, Under Armour, Inc., Apple Inc., and Noise.

-

Samsung is a prominent player in technology and consumer electronics. It offers a diverse range of innovative products, such as smartphones, tablets, televisions, home appliances, and more. Samsung offers advanced wearable devices such as the Galaxy Watch series, which feature fitness tracking, heart rate monitoring, sleep analysis, and ECG capabilities.

-

Apple Inc., headquartered in California, is a global technology company that offers products such as the iPhone, iPad, Mac computers, Apple Watch, and others. In the smart fitness market, Apple's offerings include the Apple Watch, which is integrated with advanced sensors for fitness tracking, heart rate monitoring, ECG readings, and blood oxygen levels.

Key Smart Fitness Companies:

The following are the leading companies in the smart fitness market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Zauba Technologies Private Limited

- Fitbit Inc.

- Garmin Ltd.

- Noise

- Pebble

- Polar Electro

- SAMSUNG

- Under Armour, Inc.

- Xiaomi

Recent Developments

-

In March 2024, Airtel Payments Bank partnered with Noise and MasterCard to introduce its first smartwatch in India. The smartwatch allows users to make contactless payments of up to Rs. 25,000 daily. The smartwatch is equipped with an NFC chip that enables users to conduct contactless Tap and Pay transactions

-

In May 2024, Pebble launched the Pebble Mega smartwatch in India. It has a 2.06" AMOLED display and a metallic finish. It includes features such as a built-in AI voice assistant, Bluetooth calling, SpO2 tracking, and seven days of battery life on a single charge.

Smart Fitness Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 73.21 billion |

|

Revenue forecast in 2030 |

USD 137.33 billion |

|

Growth Rate |

CAGR of 11.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product and Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Japan China, India, Australia, South Korea, Brazil, South Africa, South Arabia, and UAE |

|

Key companies profiled |

Apple Inc., Zauba Technologies Private Limited, Fitbit Inc., Garmin Ltd., Noise, Pebble, Polar Electro, SAMSUNG, Under Armour, Inc. and Xiaomi |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Smart Fitness Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the smart fitness market report based on product and region.

-

Product Outlook (Revenue, USD Million; 2017 - 2030)

-

Smartwatch

-

Smart Band

-

Smart Clothing

-

Fitness App

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

South Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."